- China

- /

- Metals and Mining

- /

- SZSE:000612

JiaoZuo WanFang Aluminum Manufacturing (SZSE:000612) delivers shareholders notable 12% CAGR over 5 years, surging 6.4% in the last week alone

Stock pickers are generally looking for stocks that will outperform the broader market. Buying under-rated businesses is one path to excess returns. For example, long term JiaoZuo WanFang Aluminum Manufacturing Co., Ltd (SZSE:000612) shareholders have enjoyed a 68% share price rise over the last half decade, well in excess of the market return of around 16% (not including dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 31%, including dividends.

Since the stock has added CN¥513m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for JiaoZuo WanFang Aluminum Manufacturing

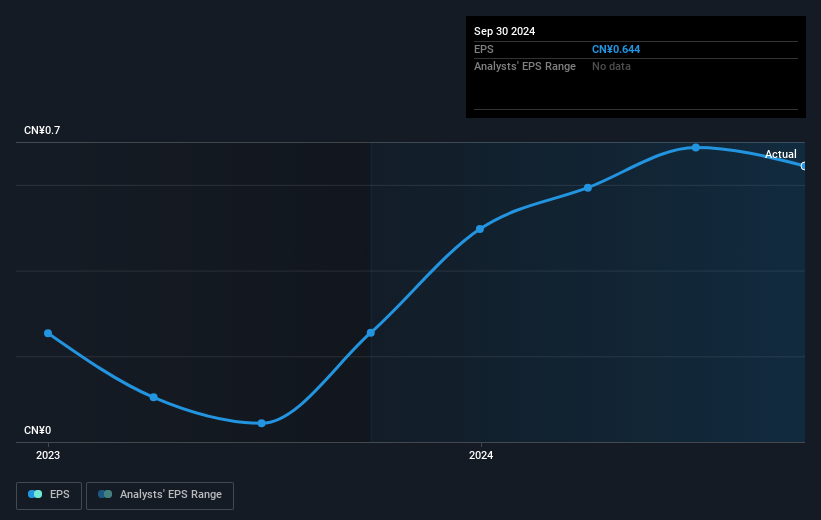

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last half decade, JiaoZuo WanFang Aluminum Manufacturing became profitable. That would generally be considered a positive, so we'd hope to see the share price to rise. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. In fact, the JiaoZuo WanFang Aluminum Manufacturing stock price is 3.8% lower in the last three years. Meanwhile, EPS is up 1.9% per year. It would appear there's a real mismatch between the increasing EPS and the share price, which has declined -1.3% a year for three years.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on JiaoZuo WanFang Aluminum Manufacturing's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of JiaoZuo WanFang Aluminum Manufacturing, it has a TSR of 79% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's good to see that JiaoZuo WanFang Aluminum Manufacturing has rewarded shareholders with a total shareholder return of 31% in the last twelve months. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 12% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand JiaoZuo WanFang Aluminum Manufacturing better, we need to consider many other factors. Take risks, for example - JiaoZuo WanFang Aluminum Manufacturing has 1 warning sign we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000612

JiaoZuo WanFang Aluminum Manufacturing

Engages in smelting and processing aluminum products in China.

Flawless balance sheet with solid track record and pays a dividend.