3 Growth Companies Insiders Are Backing With Up To 52% Earnings Growth

Reviewed by Simply Wall St

In a week marked by the U.S. Federal Reserve's first rate cut in over four years, global markets have shown mixed reactions, with U.S. stocks reaching new highs while European indices displayed caution. Amid this backdrop of economic shifts and investor optimism, identifying growth companies with high insider ownership can be particularly compelling as insiders often have unique insights into their company's potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 33.7% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 29.9% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.7% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.3% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

We're going to check out a few of the best picks from our screener tool.

Vietnam International Commercial Bank (HOSE:VIB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vietnam International Commercial Joint Stock Bank (HOSE:VIB) offers banking products and services to organizations and individuals, with a market cap of ₫55.11 trillion.

Operations: Vietnam International Commercial Joint Stock Bank's primary revenue segment is Banking Activities, generating ₫16.83 billion.

Insider Ownership: 15.8%

Earnings Growth Forecast: 14.8% p.a.

Vietnam International Commercial Bank (VIB) exhibits high insider ownership and is forecasted to achieve substantial revenue growth of 25.8% per year, outpacing the VN market. However, recent earnings reports show a decline in net income and basic earnings per share compared to last year. Despite this, VIB's return on equity is projected to be strong at 23.2% in three years. The bank also trades at a good value relative to peers but has a high level of bad loans (3.1%).

- Dive into the specifics of Vietnam International Commercial Bank here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Vietnam International Commercial Bank's current price could be quite moderate.

Darbond Technology (SHSE:688035)

Simply Wall St Growth Rating: ★★★★☆☆

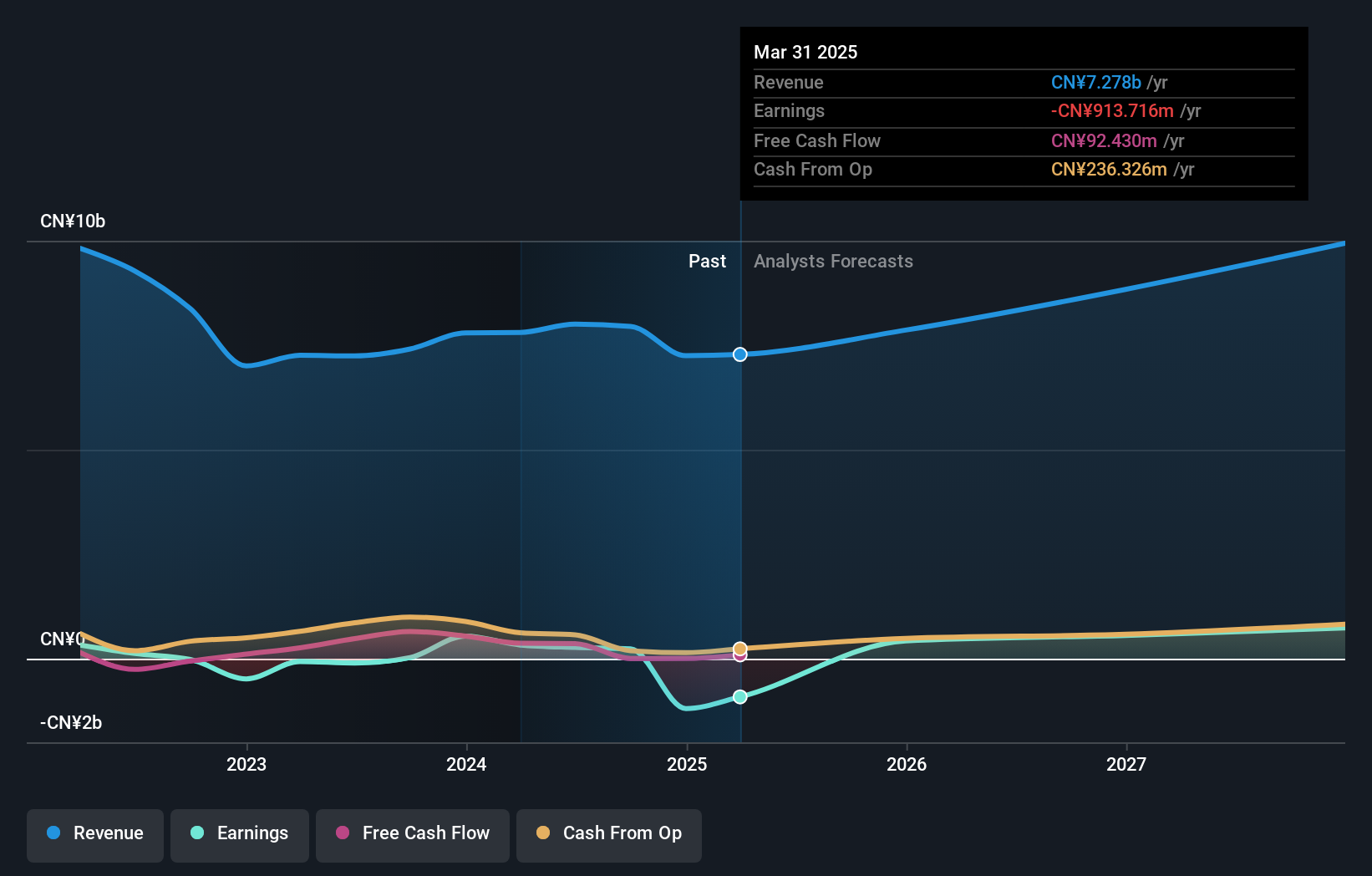

Overview: Darbond Technology Co., Ltd focuses on the research, development, production, and sale of polymer engineering and interface materials in China with a market cap of CN¥4.11 billion.

Operations: Darbond Technology generates revenue from the research, development, production, and sale of polymer engineering and interface materials in China.

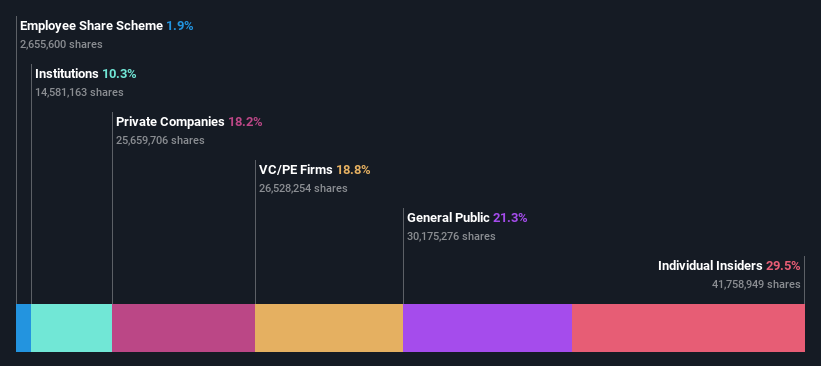

Insider Ownership: 29.5%

Earnings Growth Forecast: 52.7% p.a.

Darbond Technology shows high insider ownership and is forecasted to achieve significant earnings growth of 52.66% per year, outpacing the CN market. However, its recent earnings report revealed a decline in net income and basic earnings per share compared to last year. The company was recently added to the S&P Global BMI Index and completed a share buyback program. Despite revenue growth, profit margins have decreased from 13.7% to 8.6%.

- Click here and access our complete growth analysis report to understand the dynamics of Darbond Technology.

- Our comprehensive valuation report raises the possibility that Darbond Technology is priced higher than what may be justified by its financials.

China Transinfo Technology (SZSE:002373)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Transinfo Technology Co., Ltd. operates in the transportation and IoT sectors, with a market cap of CN¥11.99 billion.

Operations: The company's revenue segments include Intelligent Transportation, generating CN¥3.12 billion, and Intelligent Internet of Things, contributing CN¥4.88 billion.

Insider Ownership: 17.2%

Earnings Growth Forecast: 44.6% p.a.

China Transinfo Technology demonstrates substantial insider ownership and is expected to see significant earnings growth of 44.59% per year, surpassing the CN market's average. However, its recent earnings report showed a sharp decline in net income from CNY 285.09 million to CNY 12.24 million year-over-year, despite an increase in revenue. The company also completed a share buyback program repurchasing 8,475,000 shares for CNY 79.77 million earlier this year.

- Take a closer look at China Transinfo Technology's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that China Transinfo Technology is trading behind its estimated value.

Make It Happen

- Click this link to deep-dive into the 1524 companies within our Fast Growing Companies With High Insider Ownership screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688035

Darbond Technology

Engages in the research and development, production, and sale of polymer engineering and interface materials in China.

Flawless balance sheet with reasonable growth potential.