Asian Equities Priced Below Estimated Value In September 2025

Reviewed by Simply Wall St

As global markets react to the Federal Reserve's recent interest rate cut and ongoing trade discussions between the U.S. and China, Asian equities are navigating a complex landscape marked by varying economic signals from major economies like Japan and China. In this environment, identifying undervalued stocks requires careful consideration of factors such as economic resilience, growth potential, and market positioning amidst these shifting dynamics.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥83.66 | CN¥165.09 | 49.3% |

| Takara Bio (TSE:4974) | ¥938.00 | ¥1829.46 | 48.7% |

| Pansoft (SZSE:300996) | CN¥17.23 | CN¥33.78 | 49% |

| Meitu (SEHK:1357) | HK$9.06 | HK$18.02 | 49.7% |

| Kolmar Korea (KOSE:A161890) | ₩78300.00 | ₩155815.46 | 49.7% |

| Hugel (KOSDAQ:A145020) | ₩295500.00 | ₩580178.41 | 49.1% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥39.81 | CN¥78.15 | 49.1% |

| FP Partner (TSE:7388) | ¥2244.00 | ¥4425.25 | 49.3% |

| Bloomberry Resorts (PSE:BLOOM) | ₱3.91 | ₱7.66 | 49% |

| Anhui Ronds Science & Technology (SHSE:688768) | CN¥49.86 | CN¥97.19 | 48.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

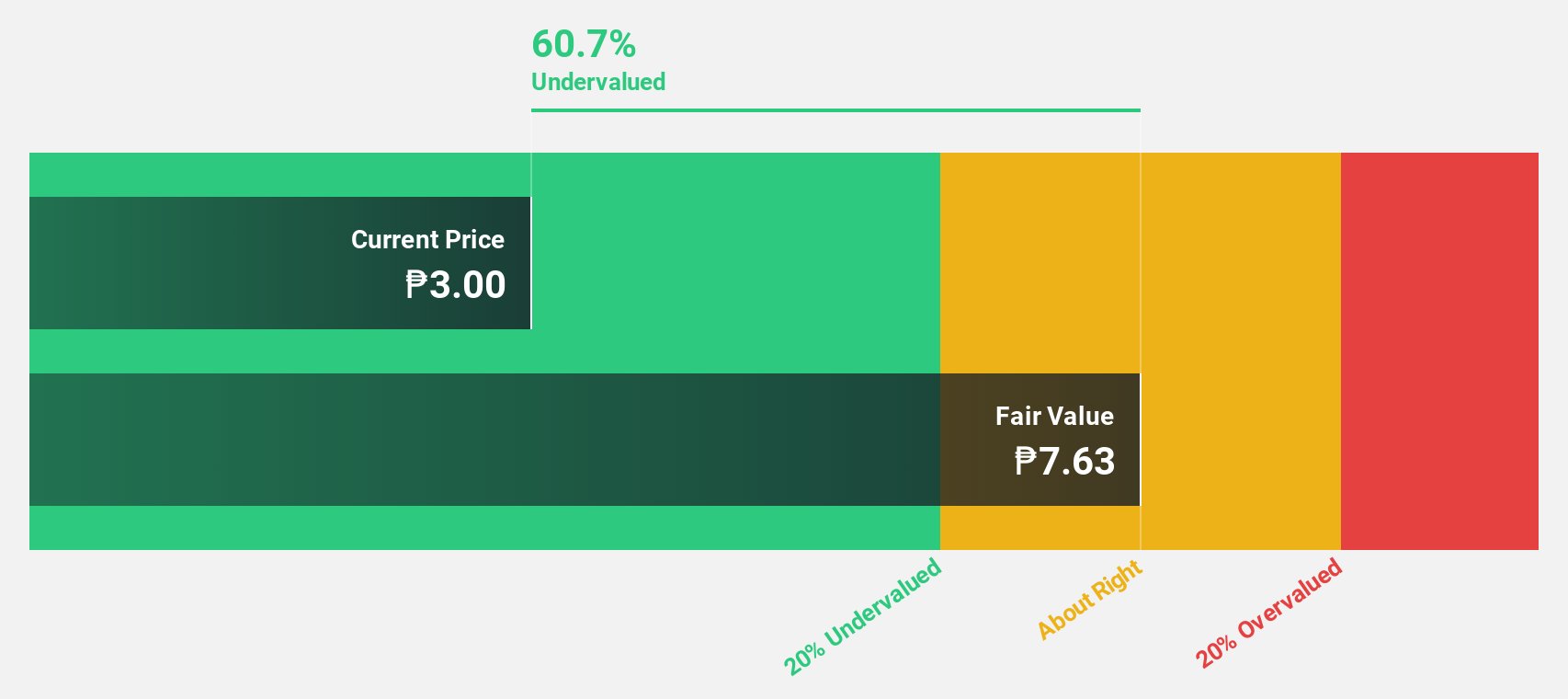

Bloomberry Resorts (PSE:BLOOM)

Overview: Bloomberry Resorts Corporation, with a market cap of ₱44.92 billion, develops, owns, and operates hotels, casinos, and integrated resorts in the Philippines and Korea through its subsidiaries.

Operations: The company generates revenue primarily from its integrated resort facility segment, amounting to ₱55.10 billion.

Estimated Discount To Fair Value: 49%

Bloomberry Resorts, trading at ₱3.91, is significantly undervalued against its fair value of ₱7.66, offering potential for investors focused on cash flow valuation. Despite a volatile share price and recent removal from the Philippines PSE Composite Index, earnings are forecast to grow substantially at 60.9% annually, outpacing the market's 10.6%. However, challenges include low profit margins and insufficient earnings coverage for interest payments, with a forecasted low return on equity of 5.1%.

- The analysis detailed in our Bloomberry Resorts growth report hints at robust future financial performance.

- Dive into the specifics of Bloomberry Resorts here with our thorough financial health report.

Mobvista (SEHK:1860)

Overview: Mobvista Inc., along with its subsidiaries, provides advertising and marketing technology services to support the mobile internet ecosystem globally, with a market cap of HK$31.41 billion.

Operations: Mobvista's revenue is primarily derived from its Advertising Technology Services segment, which generated $1.79 billion, complemented by its Marketing Technology Business contributing $17.61 million.

Estimated Discount To Fair Value: 45.8%

Mobvista Inc., trading significantly below its fair value of HK$37.81, presents an opportunity for investors focused on cash flow valuation, with shares currently at HK$20.5. Recent earnings showed a strong performance, with net income rising to US$32.28 million from US$9.27 million year-over-year, driven by robust revenue growth in its core advertising platform Mintegral and improved operating leverage. However, the stock's high volatility and significant insider selling may pose risks for potential investors.

- Our growth report here indicates Mobvista may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Mobvista.

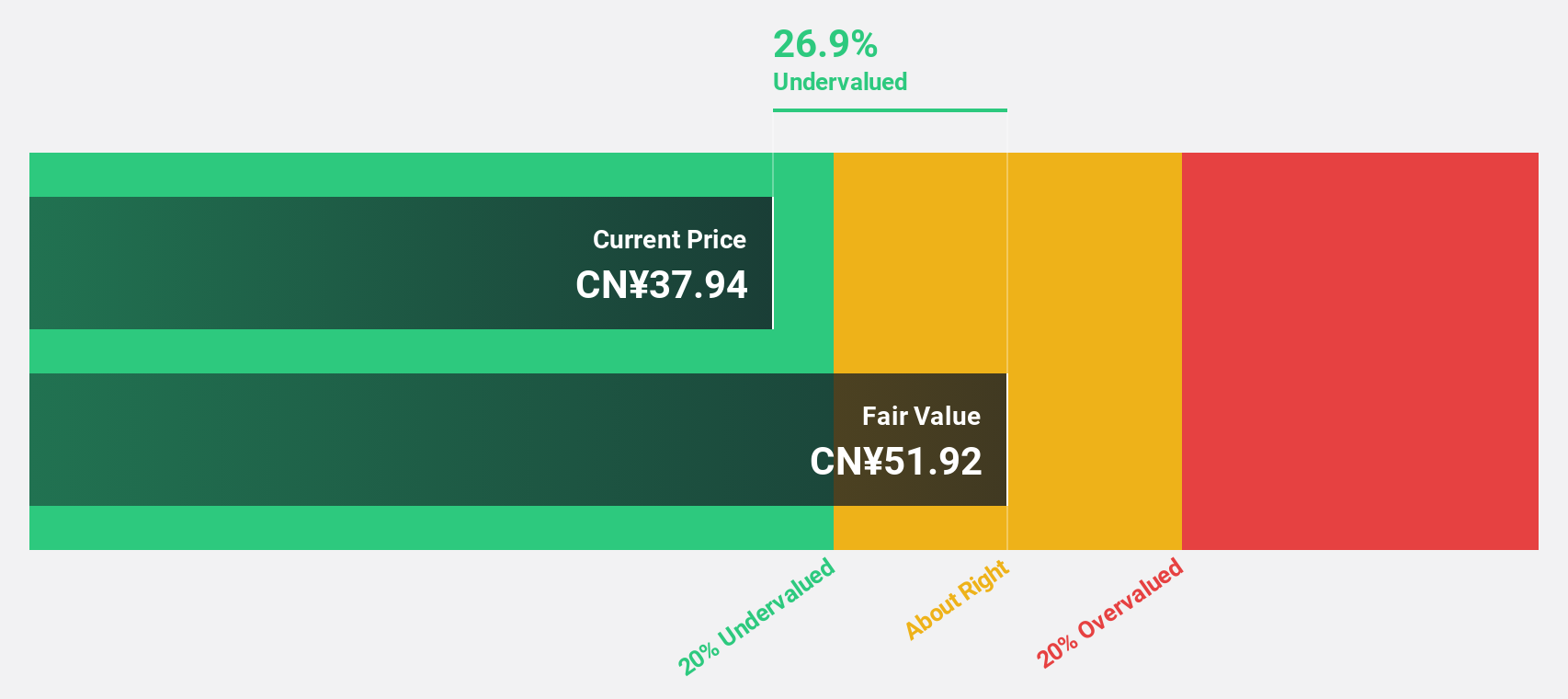

SKSHU PaintLtd (SHSE:603737)

Overview: SKSHU Paint Co.,Ltd. operates in China under the 3trees brand, focusing on the production and sale of paints, coatings, and building materials, with a market cap of CN¥34.60 billion.

Operations: The company generates revenue from the production and sale of paints, coatings, and building materials under the 3trees brand in China.

Estimated Discount To Fair Value: 28.5%

SKSHU Paint Ltd. is trading at CNY 46.9, below its estimated fair value of CNY 65.6, indicating potential undervaluation based on cash flows. The company reported a significant net income increase to CNY 435.83 million from last year's CNY 210.01 million, despite high debt levels and slower revenue growth compared to the market average. Forecasts suggest substantial annual earnings growth of over 20%, although large one-off items have impacted recent financial results.

- The growth report we've compiled suggests that SKSHU PaintLtd's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of SKSHU PaintLtd.

Taking Advantage

- Navigate through the entire inventory of 284 Undervalued Asian Stocks Based On Cash Flows here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603737

SKSHU PaintLtd

Produces and sells paints, coatings, and building materials under the 3trees brand in China.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives