As global markets navigate through a period of heightened volatility, with U.S. consumer sentiment hitting near-record lows and concerns about elevated valuations impacting tech stocks, the Asian market presents a unique landscape for investors seeking opportunities in lesser-known equities. In this dynamic environment, identifying promising stocks often involves looking for companies that demonstrate resilience and adaptability to shifting economic conditions while maintaining robust growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tsubakimoto Kogyo | NA | 7.85% | 12.88% | ★★★★★★ |

| Cresco | 4.98% | 9.33% | 11.61% | ★★★★★★ |

| Kyoritsu Electric | 3.87% | 6.01% | 17.16% | ★★★★★★ |

| Yashima Denki | 2.28% | 2.70% | 25.81% | ★★★★★★ |

| DoshishaLtd | NA | 3.17% | 3.20% | ★★★★★★ |

| Hyakugo Bank | 172.81% | 6.28% | 7.46% | ★★★★★☆ |

| KinjiroLtd | 20.72% | 11.66% | 24.80% | ★★★★★☆ |

| Nippon Ski Resort DevelopmentLtd | 38.68% | 15.71% | 60.81% | ★★★★★☆ |

| Li Ming Development Construction | 170.96% | 14.13% | 22.83% | ★★★★☆☆ |

| Iljin DiamondLtd | 2.18% | -3.74% | 9.21% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Jiangxi Jiangnan New Material Technology (SHSE:603124)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiangxi Jiangnan New Material Technology Co., Ltd. operates in the new materials industry and has a market capitalization of CN¥12.08 billion.

Operations: The company generates revenue primarily from its operations in the new materials industry. It focuses on specific segments within this sector, contributing to its financial performance.

Jiangxi Jiangnan New Material Technology, a small cap player in the industry, has demonstrated notable growth with earnings rising 22.9% over the past year, outpacing the broader electronic sector's 9%. The company reported sales of CNY 7.57 billion for the first nine months of 2025, compared to CNY 6.40 billion a year earlier, with net income also improving from CNY 135.49 million to CNY 165.24 million during this period. Despite its volatile share price recently and negative free cash flow trends, it maintains a solid financial position with more cash than total debt and robust interest coverage at 7.9 times EBIT.

Anhui Guangxin Agrochemical (SHSE:603599)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Anhui Guangxin Agrochemical Co., Ltd. is engaged in the research, development, production, and sale of pesticides and phosgene products in China with a market cap of CN¥11.64 billion.

Operations: Anhui Guangxin Agrochemical generates revenue primarily from the sale of pesticides and phosgene products. The company's financial performance is reflected in its market capitalization of CN¥11.64 billion.

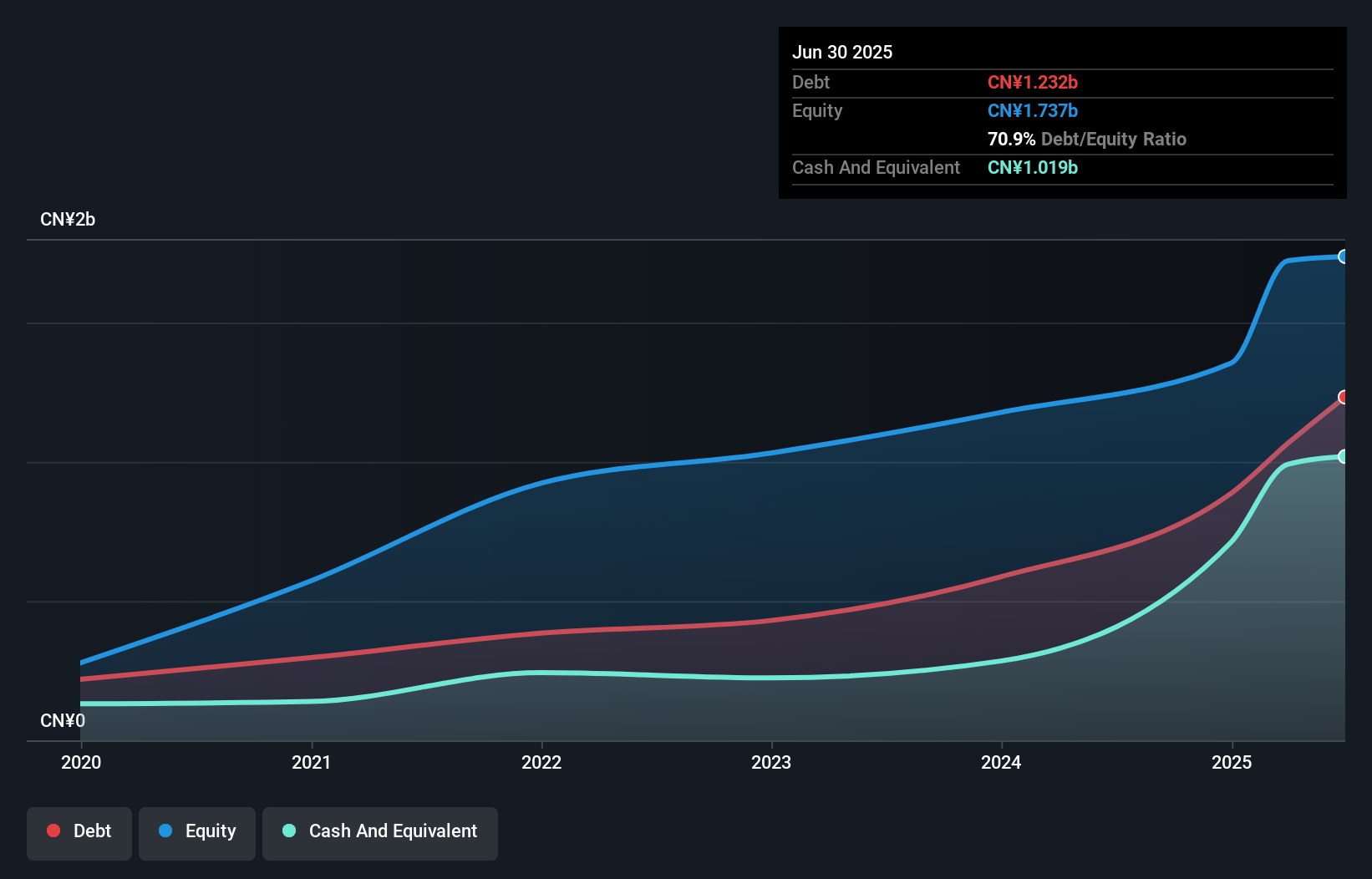

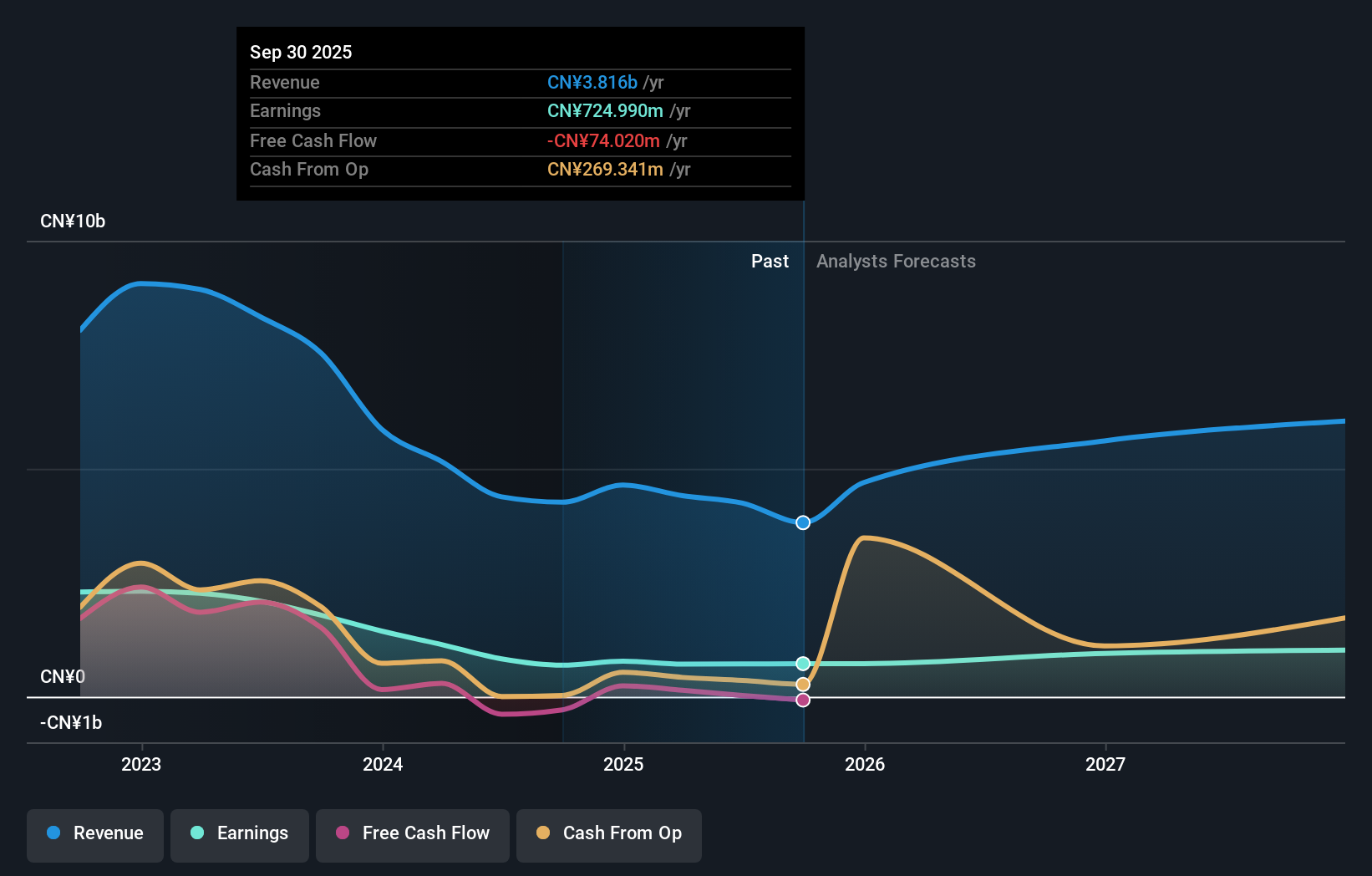

Anhui Guangxin Agrochemical, a notable player in the agrochemical sector, has demonstrated a solid financial footing despite recent challenges. The company's sales for the nine months ended September 2025 were CNY 2.66 billion, down from CNY 3.49 billion the previous year, with net income at CNY 520.43 million compared to last year's CNY 574.18 million. With a price-to-earnings ratio of 16x, it trades favorably against the broader CN market's average of 45x. Although its earnings growth of 5% lagged behind the chemical industry's average of 6%, its debt-to-equity ratio has risen to a manageable level of approximately 33%.

Kunming Chuan Jin Nuo Chemical (SZSE:300505)

Simply Wall St Value Rating: ★★★★★★

Overview: Kunming Chuan Jin Nuo Chemical Co., Ltd. is engaged in the development, production, and sale of phosphate chemicals in China with a market capitalization of CN¥6.78 billion.

Operations: Kunming Chuan Jin Nuo Chemical generates revenue primarily from the sale of phosphate chemicals. The company's net profit margin has shown fluctuations, reflecting changes in cost management and pricing strategies.

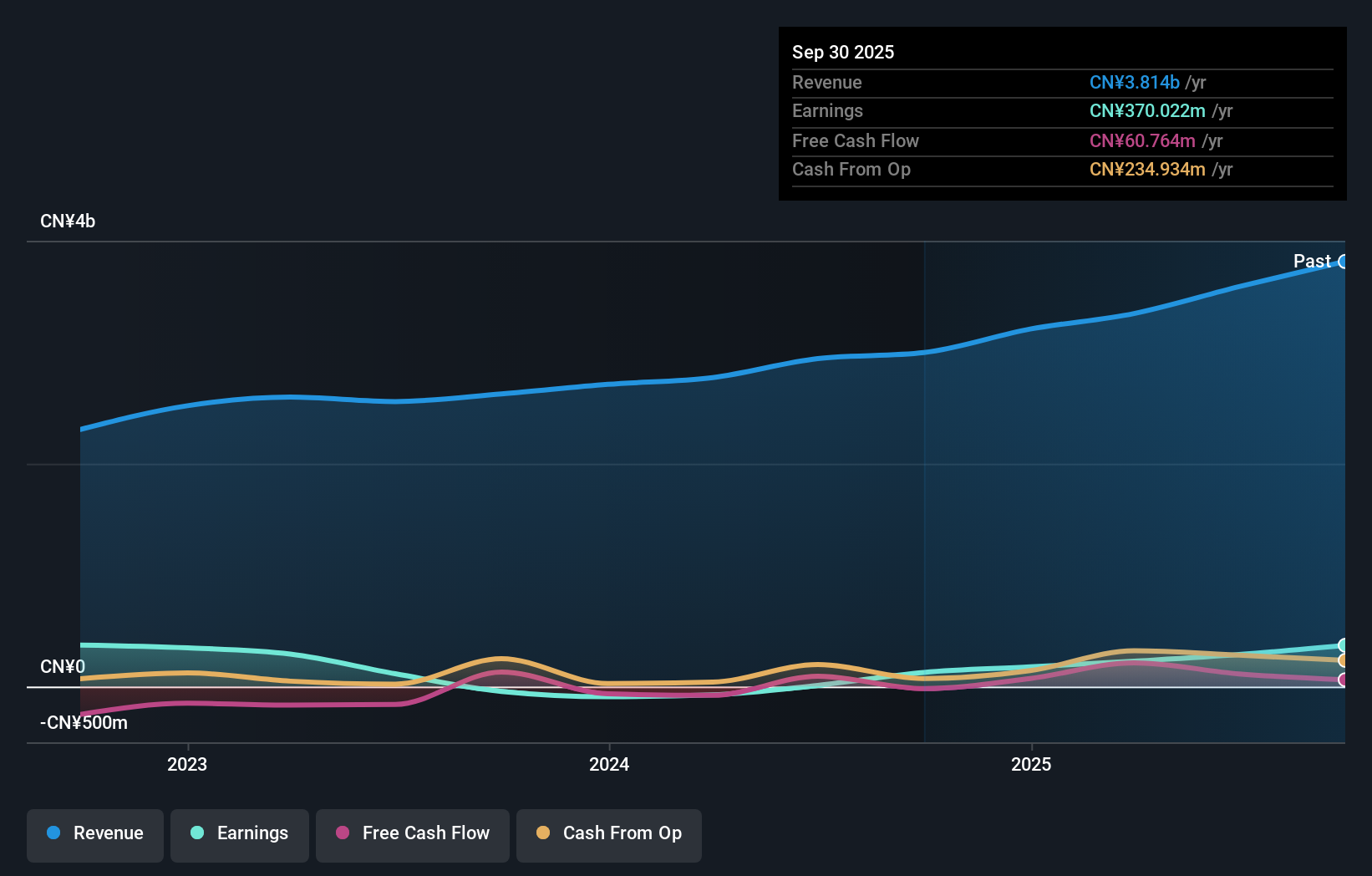

Kunming Chuan Jin Nuo Chemical, a small player in the chemical industry, has shown impressive growth with earnings surging 191.2% over the past year, outpacing industry averages. The company's debt to equity ratio improved from 31.9 to 23.1 over five years, highlighting effective financial management. Its price-to-earnings ratio of 18.3x is attractive compared to the broader CN market's 45x, suggesting potential value for investors. Recent financial results showed sales reaching CNY 2.81 billion and net income at CNY 304 million for nine months ending September 2025, reflecting strong operational performance and strategic direction adjustments through bylaw changes.

- Navigate through the intricacies of Kunming Chuan Jin Nuo Chemical with our comprehensive health report here.

Understand Kunming Chuan Jin Nuo Chemical's track record by examining our Past report.

Summing It All Up

- Gain an insight into the universe of 2431 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603599

Anhui Guangxin Agrochemical

Researches, develops, produces, and sells pesticides and phosgene products in China.

Adequate balance sheet and fair value.

Market Insights

Community Narratives