- Singapore

- /

- Hotel and Resort REITs

- /

- SGX:Q5T

3 Asian Penny Stocks With Market Caps Under US$3B

Reviewed by Simply Wall St

As global markets grapple with trade uncertainties and economic concerns, investors are increasingly looking to diverse regions like Asia for potential opportunities. Penny stocks, often associated with smaller or newer companies, remain a compelling area of interest due to their affordability and growth potential. Despite being considered a throwback term, penny stocks can offer significant value when backed by strong financials and clear growth prospects.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$4.23 | HK$48.48B | ★★★★★★ |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.29 | SGD9.05B | ★★★★★☆ |

| Lever Style (SEHK:1346) | HK$1.31 | HK$831.57M | ★★★★★★ |

| Beng Kuang Marine (SGX:BEZ) | SGD0.205 | SGD40.84M | ★★★★★★ |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.09 | CN¥3.58B | ★★★★★★ |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.48 | SGD457.62M | ★★★★★★ |

| Interlink Telecom (SET:ITEL) | THB1.43 | THB1.99B | ★★★★☆☆ |

| Jiumaojiu International Holdings (SEHK:9922) | HK$3.38 | HK$4.72B | ★★★★★★ |

| China Zheshang Bank (SEHK:2016) | HK$2.42 | HK$81.2B | ★★★★★★ |

| China Lilang (SEHK:1234) | HK$4.19 | HK$5.02B | ★★★★★☆ |

Click here to see the full list of 1,159 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Far East Hospitality Trust (SGX:Q5T)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Far East Hospitality Trust is a Singapore-focused hotel and serviced residence hospitality trust listed on the SGX-ST, with a market cap of SGD1.15 billion.

Operations: The trust generates revenue primarily from Hotels and Serviced Residences, contributing SGD91.36 million, and Retail Units, Offices, and Others, which add SGD17.34 million.

Market Cap: SGD1.15B

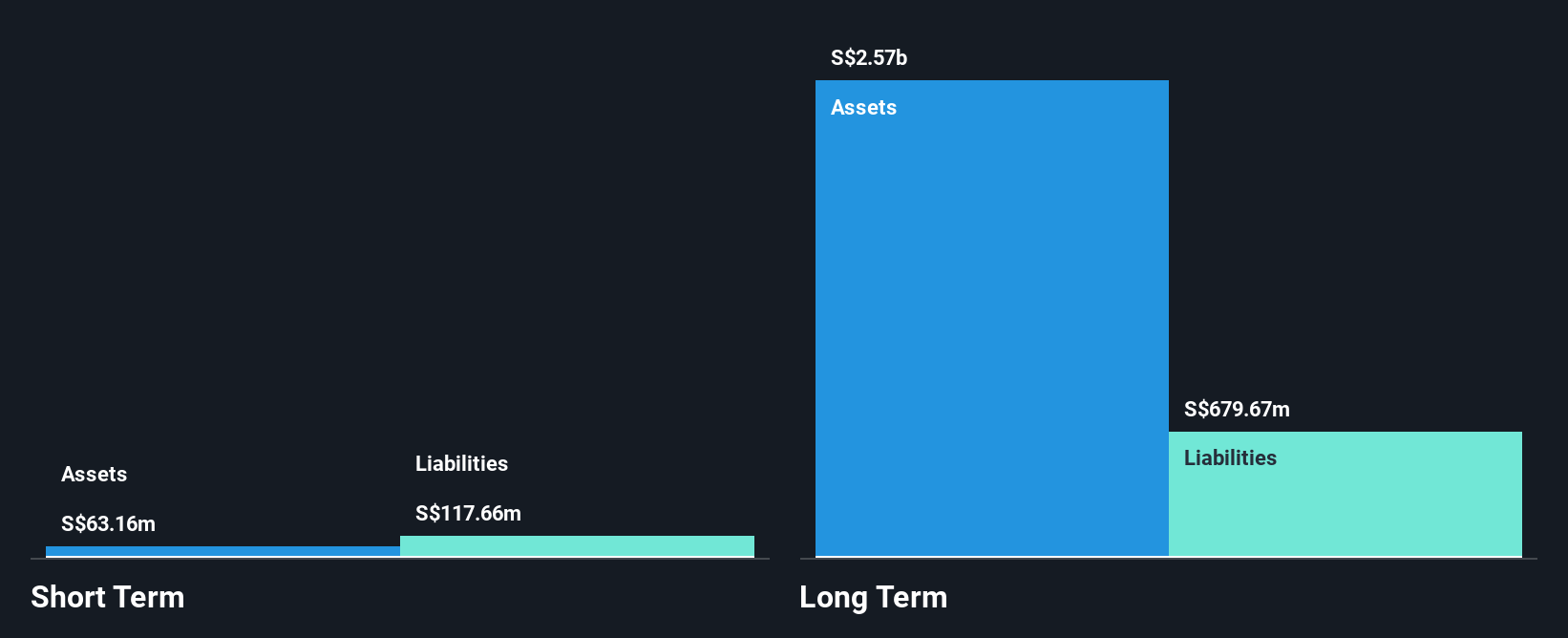

Far East Hospitality Trust, listed on the SGX-ST with a market cap of SGD 1.15 billion, has seen significant developments recently. Despite negative earnings growth last year and low return on equity at 2.5%, it maintains a satisfactory net debt to equity ratio of 37.6%. The trust's recent acquisition of an upscale hotel in Japan for JPY 6 billion (SGD 52.8 million) marks its first overseas expansion, potentially diversifying risks and enhancing long-term growth prospects. Trading below fair value estimates and analysts' price targets, the trust also declared a distribution increase to stapled securityholders for late 2024.

- Navigate through the intricacies of Far East Hospitality Trust with our comprehensive balance sheet health report here.

- Explore Far East Hospitality Trust's analyst forecasts in our growth report.

Sichuan Hebang Biotechnology (SHSE:603077)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sichuan Hebang Biotechnology Corporation Limited operates in the agricultural, chemical, and new material sectors with a market cap of CN¥14.93 billion.

Operations: No specific revenue segments are reported for this company.

Market Cap: CN¥14.93B

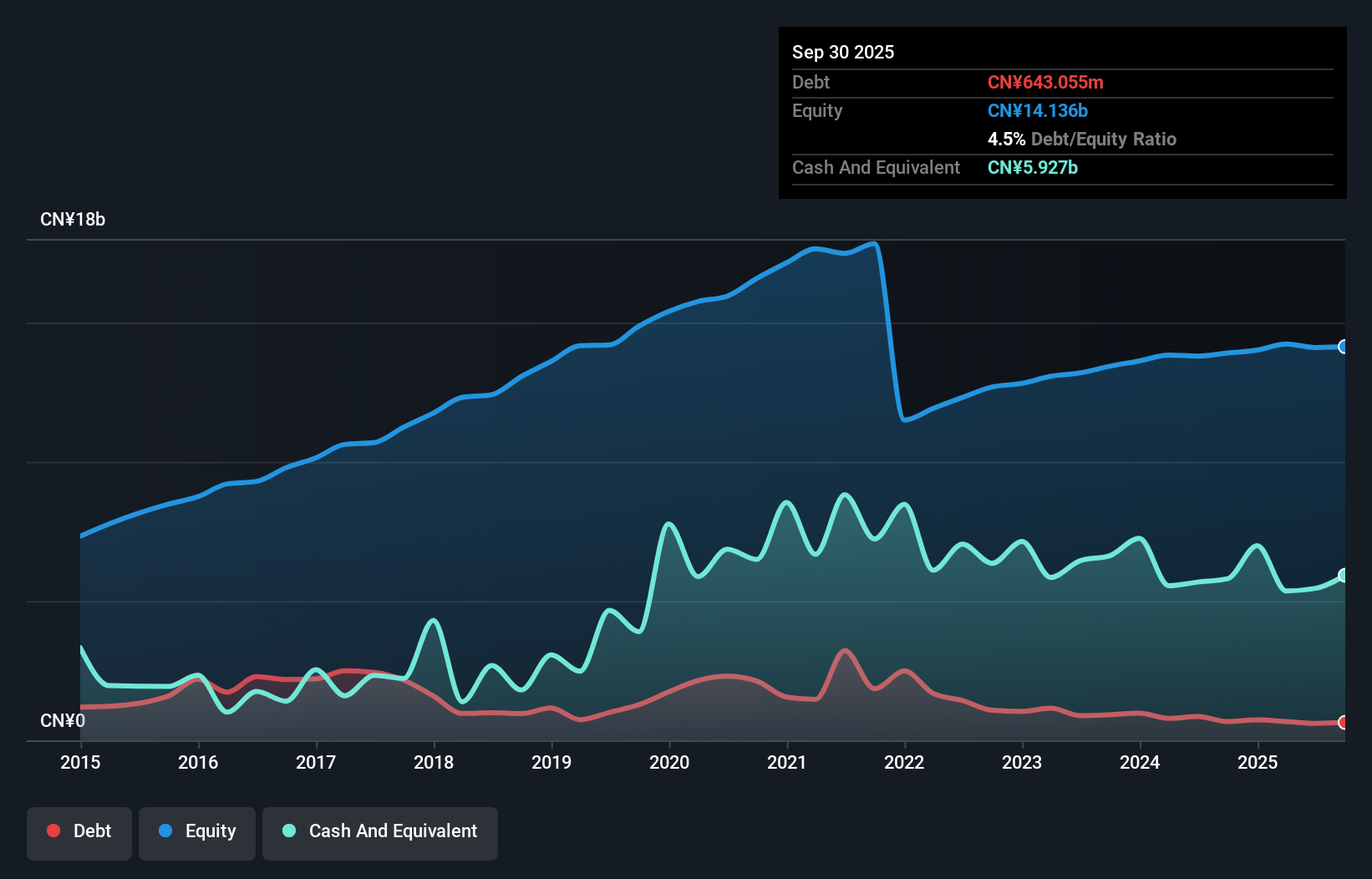

Sichuan Hebang Biotechnology Corporation Limited, with a market cap of CN¥14.93 billion, recently completed a share buyback program, repurchasing 51.84 million shares for CN¥100 million. Despite its low return on equity at 2.4% and a significant decline in earnings growth last year (-65.3%), the company maintains satisfactory debt levels with net debt to equity at 4.4%. Its short-term assets (CN¥10.8 billion) comfortably cover both short- and long-term liabilities, though negative operating cash flow raises concerns about debt coverage sustainability in the future.

- Click here to discover the nuances of Sichuan Hebang Biotechnology with our detailed analytical financial health report.

- Assess Sichuan Hebang Biotechnology's previous results with our detailed historical performance reports.

Suzhou Gold Mantis Construction Decoration (SZSE:002081)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Suzhou Gold Mantis Construction Decoration Co., Ltd. operates in China, focusing on interior decoration, curtain walls, furniture, and landscape design and construction, with a market cap of CN¥9.29 billion.

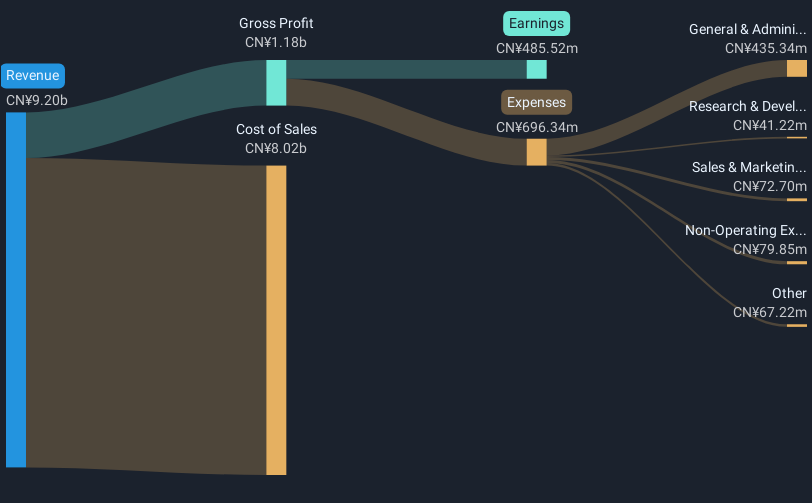

Operations: The company generates CN¥18.33 billion in revenue from its operations within China.

Market Cap: CN¥9.29B

Suzhou Gold Mantis Construction Decoration Co., Ltd. maintains a solid financial position with short-term assets of CN¥30.2 billion exceeding both its short- and long-term liabilities. Despite having more cash than total debt, the company's earnings have declined significantly, with negative growth over the past year and a forecasted decline of 1.3% annually for the next three years. Its return on equity is low at 4.8%, and profit margins have decreased from last year, raising concerns about profitability sustainability. The dividend yield is not well covered by free cash flows, indicating potential challenges in maintaining payouts without improved earnings performance.

- Click here and access our complete financial health analysis report to understand the dynamics of Suzhou Gold Mantis Construction Decoration.

- Evaluate Suzhou Gold Mantis Construction Decoration's prospects by accessing our earnings growth report.

Taking Advantage

- Get an in-depth perspective on all 1,159 Asian Penny Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:Q5T

Far East Hospitality Trust

Far East H-Trust is a Singapore-Focused Hotel and Serviced Residence Hospitality Trust listed on the Main Board of The Singapore Exchange Securities Trading Limited (“SGX-ST”).

Reasonable growth potential average dividend payer.

Market Insights

Community Narratives