- Hong Kong

- /

- Medical Equipment

- /

- SEHK:1302

Asian Growth Stocks With Strong Insider Confidence

Reviewed by Simply Wall St

As global markets navigate geopolitical tensions and economic uncertainties, Asian indices have shown resilience, bolstered by strong performances in specific sectors like technology. In this environment, growth companies with high insider ownership often stand out as they signal confidence from those who understand the business best, making them an intriguing focus for investors seeking stability and potential in a fluctuating market.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Jiayou International LogisticsLtd (SHSE:603871) | 19.3% | 27.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Sineng ElectricLtd (SZSE:300827) | 36.3% | 41.4% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.2% | 35.6% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 92.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 43.2% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| BIWIN Storage Technology (SHSE:688525) | 18.9% | 88.8% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.2% | 60% |

Let's uncover some gems from our specialized screener.

LifeTech Scientific (SEHK:1302)

Simply Wall St Growth Rating: ★★★★★☆

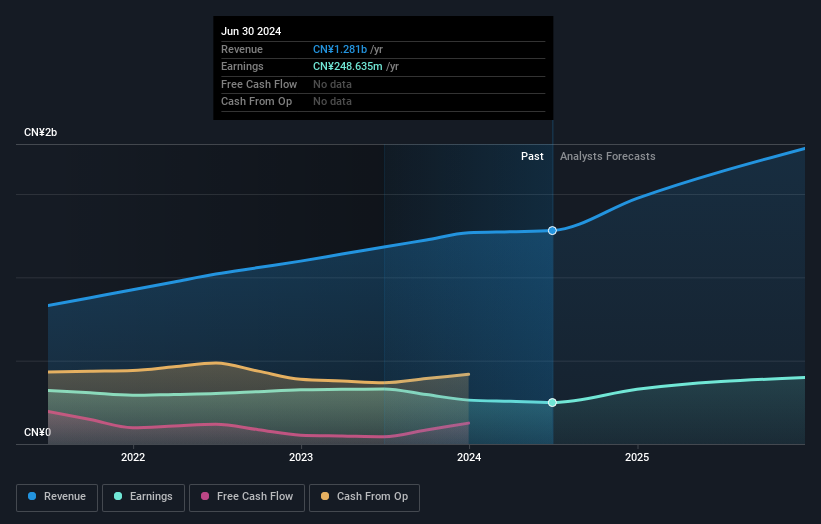

Overview: LifeTech Scientific Corporation is an investment holding company that develops, manufactures, and trades interventional medical devices for cardiovascular and peripheral vascular diseases globally, with a market cap of HK$7.87 billion.

Operations: The company's revenue segments include CN¥523.01 million from the Structural Heart Diseases Business, CN¥725.13 million from the Peripheral Vascular Diseases Business, and CN¥32.36 million from the Cardiac Pacing and Electrophysiology Business.

Insider Ownership: 16%

LifeTech Scientific is experiencing significant growth, with revenue projected to increase by 21.5% annually, surpassing the Hong Kong market's growth rate. Earnings are expected to grow at 29.5% per year, driven by innovative products like the recently approved Ankura Aortic Stent Graft System in China. Despite lower profit margins compared to last year, the company's strategic focus on medical device development and recent leadership changes support its expansion trajectory in Asia's competitive healthcare sector.

- Unlock comprehensive insights into our analysis of LifeTech Scientific stock in this growth report.

- Upon reviewing our latest valuation report, LifeTech Scientific's share price might be too optimistic.

Ningxia Baofeng Energy Group (SHSE:600989)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ningxia Baofeng Energy Group Co., Ltd. engages in the production, processing, and sale of coal mining and chemical products with a market cap of CN¥118.80 billion.

Operations: The company generates revenue through its operations in coal mining, washing, coking, coal tar, crude benzene, C4 deep-processing, methanol, and olefin products.

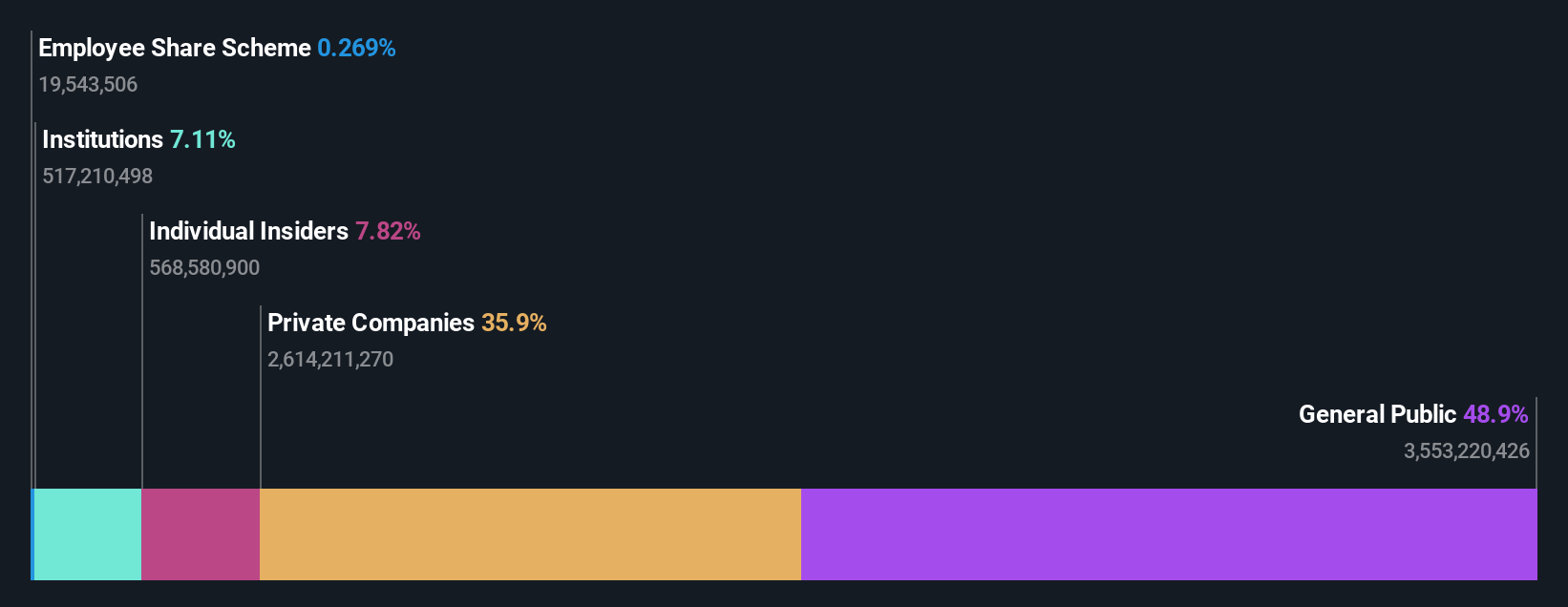

Insider Ownership: 35%

Ningxia Baofeng Energy Group is poised for substantial growth, with revenue expected to rise by 27.5% annually, outpacing the broader Chinese market. Earnings are set to grow significantly at 38.5% per year, indicating strong potential despite a high debt level and a dividend not fully covered by free cash flows. The stock trades at a good value, 33.9% below its fair value estimate, suggesting upside potential as analysts anticipate a price increase of 34.2%.

- Navigate through the intricacies of Ningxia Baofeng Energy Group with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Ningxia Baofeng Energy Group shares in the market.

Guo Tai Epoint SoftwareLtd (SHSE:688232)

Simply Wall St Growth Rating: ★★★★☆☆

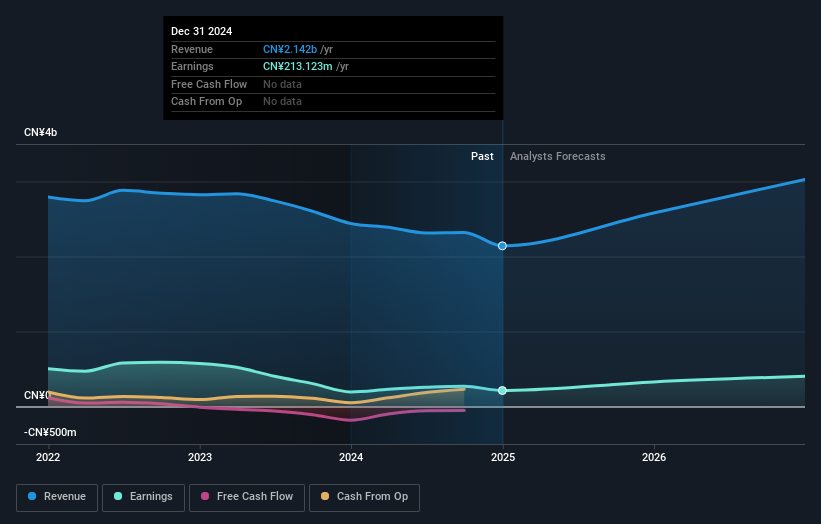

Overview: Guo Tai Epoint Software Co., Ltd provides software and information technology solutions in China, with a market cap of CN¥13.33 billion.

Operations: Guo Tai Epoint Software Co., Ltd's revenue primarily stems from its software and information technology solutions offered within China.

Insider Ownership: 30%

Guo Tai Epoint Software Ltd shows promising growth potential, with earnings projected to increase significantly at 30.5% annually, surpassing the Chinese market average. Despite a decline in sales to CNY 2.14 billion for 2024, net income rose to CNY 213.12 million, reflecting operational improvements. The recent completion of a share buyback program underscores management's confidence in the company's prospects. However, its return on equity forecast remains low at 6.4%, and dividends are not well covered by free cash flows.

- Get an in-depth perspective on Guo Tai Epoint SoftwareLtd's performance by reading our analyst estimates report here.

- The analysis detailed in our Guo Tai Epoint SoftwareLtd valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Get an in-depth perspective on all 638 Fast Growing Asian Companies With High Insider Ownership by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1302

LifeTech Scientific

An investment holding company, develops, manufactures, and trades in interventional medical devices for cardiovascular and peripheral vascular diseases and disorders worldwide.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives