- China

- /

- Construction

- /

- SZSE:002941

3 Undiscovered Gems in Global Markets with Promising Potential

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating interest rates and mixed economic signals, global markets have shown resilience with many indices posting gains despite concerns over labor market weaknesses. In this environment, smaller-cap stocks have demonstrated sensitivity to these changes, presenting unique opportunities for investors seeking potential growth. Identifying promising stocks often involves looking for companies that can thrive in uncertain conditions by leveraging innovative strategies or occupying niche markets.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Saha-Union | 0.74% | 0.97% | 18.05% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| Yibin City Commercial Bank | 82.57% | -1.19% | 15.94% | ★★★★★★ |

| YuanShengTai Dairy Farm | 15.09% | 11.64% | -31.87% | ★★★★★☆ |

| Hospital Corporation of China | 137.48% | 28.23% | 50.23% | ★★★★★☆ |

| Billion Industrial Holdings | 33.11% | 16.86% | -16.10% | ★★★★★☆ |

| Uju Holding | 34.04% | 5.58% | -25.17% | ★★★★★☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

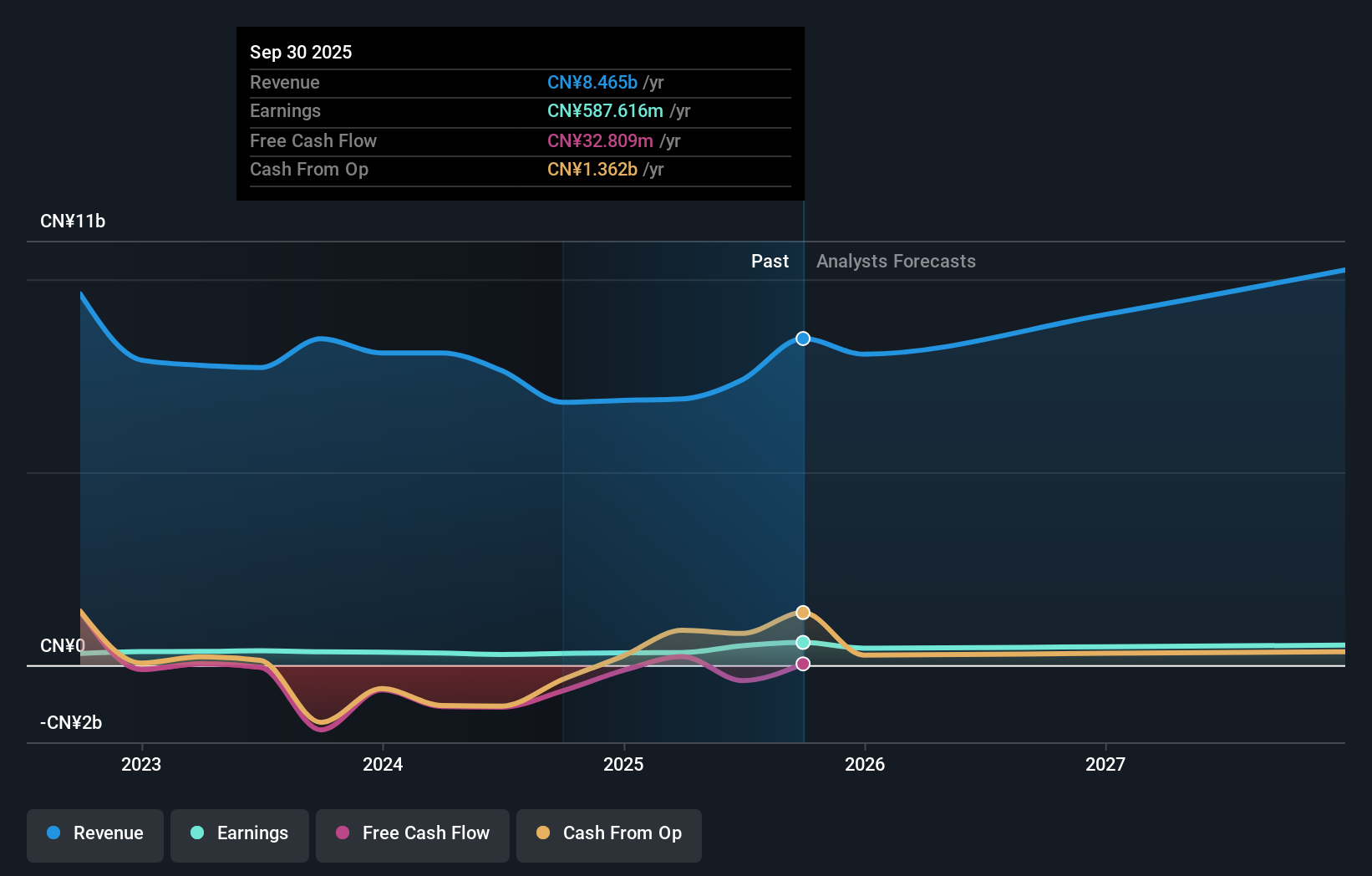

Xinyu Iron & Steel (SHSE:600782)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Xinyu Iron & Steel Co., Ltd is a company engaged in the production and sale of steel products in China, with a market capitalization of approximately CN¥13.24 billion.

Operations: The company generates revenue primarily from the production and sale of steel products in China. It has a market capitalization of approximately CN¥13.24 billion.

Xinyu Iron & Steel shows a mixed financial picture with recent earnings growth of 72.5%, outpacing the Metals and Mining industry, which saw a -1.5% change. The company reported net income of CN¥111 million for the half-year ending June 2025, marking an improvement from a net loss of CN¥75 million in the previous year. Despite this, revenue decreased to CN¥17.51 billion from CN¥21.44 billion year-on-year, likely due to market conditions or operational challenges. Notably, Xinyu trades at 21.6% below its estimated fair value and has reduced its debt-to-equity ratio from 15.9% to 13.3% over five years, indicating prudent financial management despite past one-off gains affecting results by CN¥92 million.

- Click to explore a detailed breakdown of our findings in Xinyu Iron & Steel's health report.

Evaluate Xinyu Iron & Steel's historical performance by accessing our past performance report.

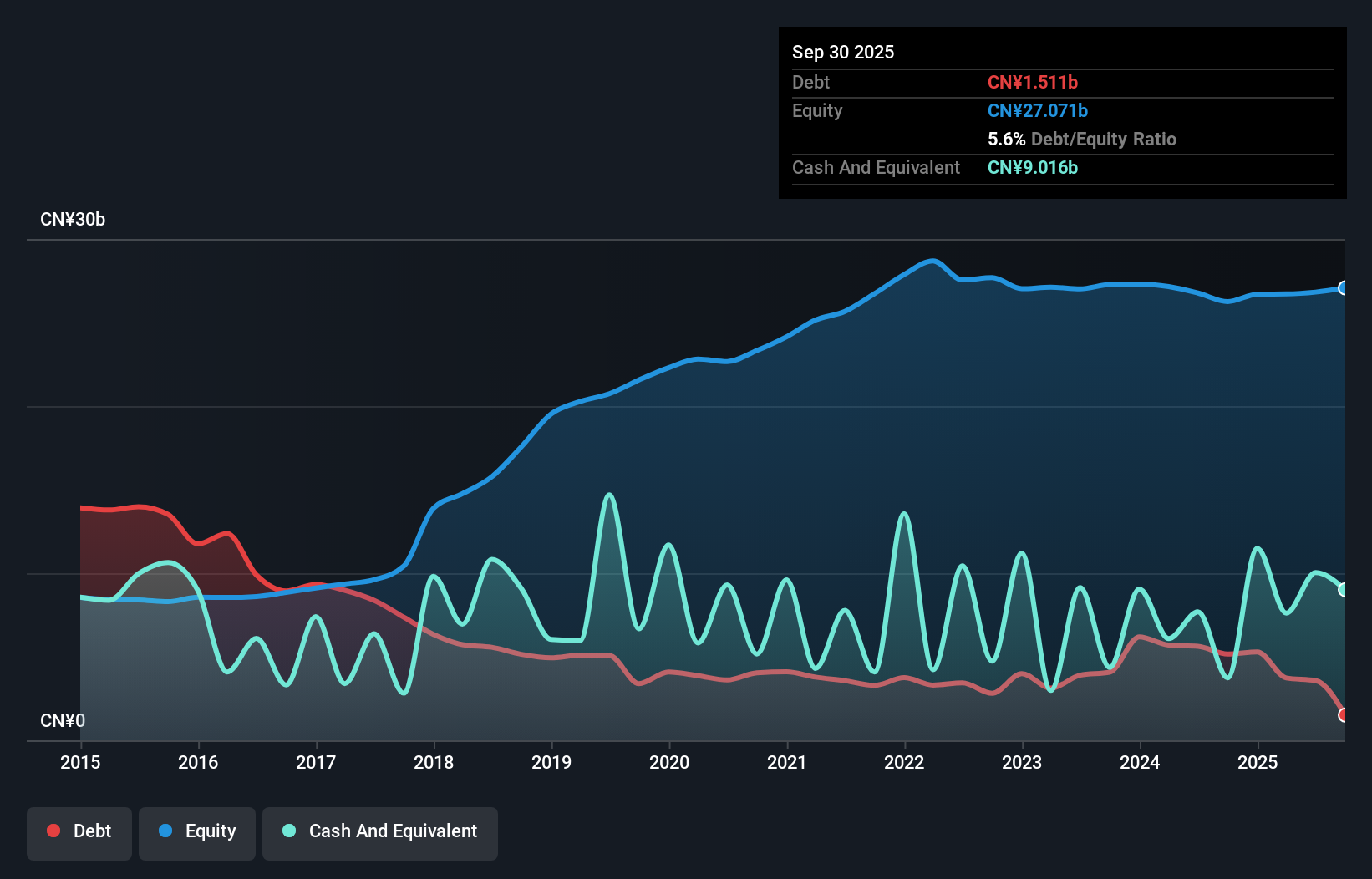

Xinjiang Communications Construction Group (SZSE:002941)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Xinjiang Communications Construction Group Co., Ltd. operates in the construction industry, focusing on infrastructure projects, with a market cap of CN¥11.43 billion.

Operations: Xinjiang Communications Construction Group generates revenue primarily from infrastructure construction projects. The company's cost structure is heavily influenced by material and labor expenses, impacting its profitability. Its gross profit margin has shown variability, reflecting fluctuations in project costs and pricing strategies.

Xinjiang Communications Construction Group, a notable player in the construction sector, has demonstrated significant growth with earnings surging by 81.6% over the past year, outpacing the industry's -8.2%. The company's debt to equity ratio improved from 153.3% to 140.6% over five years, yet its net debt to equity remains high at 73.6%. Recent financials reveal sales climbing to CNY 2.53 billion from CNY 1.99 billion and net income jumping to CNY 254 million from CNY 72 million year-over-year, reflecting robust performance despite a volatile share price environment recently observed in the market.

- Click here to discover the nuances of Xinjiang Communications Construction Group with our detailed analytical health report.

Learn about Xinjiang Communications Construction Group's historical performance.

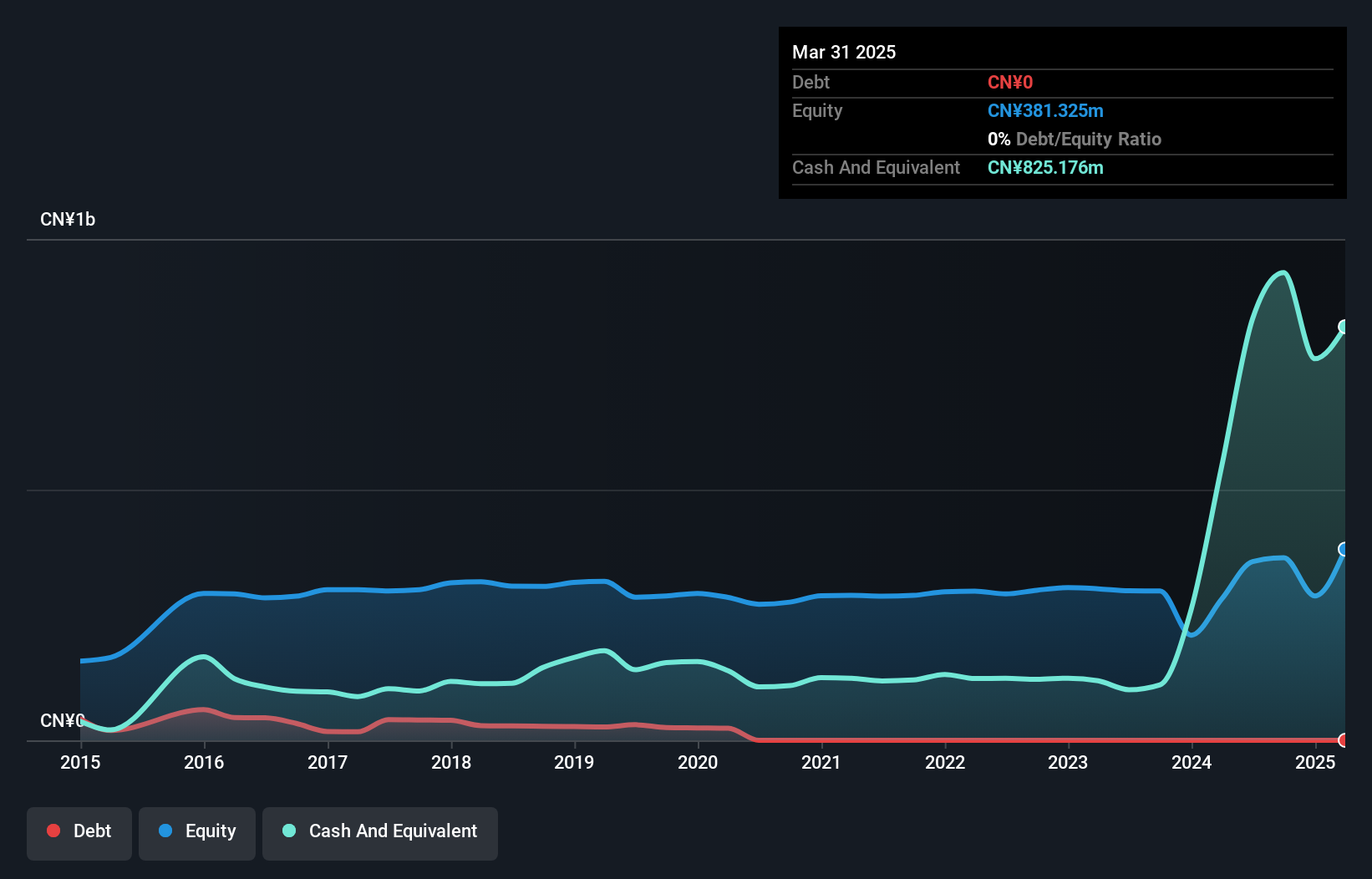

Huatu Cendes (SZSE:300492)

Simply Wall St Value Rating: ★★★★★☆

Overview: Huatu Cendes Co., Ltd. is an architectural design company offering professional design, consulting, and engineering services to a diverse clientele including state-owned enterprises, multinational corporations, private companies, and government agencies in China with a market cap of CN¥13.63 billion.

Operations: Huatu Cendes derives its revenue primarily from providing architectural design, consulting, and engineering services. The company's financial performance is influenced by its ability to manage costs associated with delivering these professional services. Its net profit margin reflects the efficiency of converting revenue into actual profit after accounting for all expenses.

Huatu Cendes showcases a compelling narrative with its earnings growth of 330.5% over the past year, far surpassing the Professional Services industry's 3.6%. The company reported half-year revenue of ¥1.72 billion, up from ¥1.51 billion the previous year, and net income rose to ¥212.91 million from ¥121.6 million a year ago, reflecting robust financial health. Additionally, Huatu Cendes has strategically repurchased 3.82 million shares for ¥260.23 million this year alone, indicating strong confidence in its future prospects and shareholder value enhancement strategies while maintaining more cash than total debt for stability.

- Click here and access our complete health analysis report to understand the dynamics of Huatu Cendes.

Gain insights into Huatu Cendes' historical performance by reviewing our past performance report.

Seize The Opportunity

- Navigate through the entire inventory of 2950 Global Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002941

Xinjiang Communications Construction Group

Xinjiang Communications Construction Group Co., Ltd.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives