As global markets navigate a complex landscape marked by geopolitical tensions and economic uncertainties, major indices like the S&P 500 have experienced fluctuations, reflecting investor concerns over consumer spending and inflationary pressures. Amidst these challenges, small-cap stocks often present unique opportunities for growth due to their potential for innovation and agility in adapting to changing market conditions. Identifying such undiscovered gems requires a keen understanding of market dynamics and an eye for companies with strong fundamentals poised to thrive despite broader economic headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 21.07% | 27.94% | ★★★★★★ |

| Shangri-La Hotel | NA | 15.26% | 23.20% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Taiyo KagakuLtd | 0.73% | 4.83% | -2.64% | ★★★★★☆ |

| Tai Sin Electric | 28.69% | 9.56% | 4.66% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

| Time Interconnect Technology | 212.50% | 18.13% | 93.08% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Shanghai Zijiang Enterprise Group (SHSE:600210)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Zijiang Enterprise Group Co., Ltd. operates as a diversified company involved in various industries, with a market cap of approximately CN¥9.71 billion.

Operations: The company generates revenue through its diversified operations across multiple industries. It has a market capitalization of approximately CN¥9.71 billion, indicating its substantial presence in the market.

Shanghai Zijiang Enterprise Group, a notable player in the packaging sector, is trading at a significant discount of 97.5% below its estimated fair value. Over the past year, earnings grew by 2.3%, which lags behind the industry average of 18.4%. However, there's optimism with forecasts suggesting annual growth of 10.42%. The company's net debt to equity ratio stands satisfactorily at 19.6%, and interest payments are well-covered by EBIT with a coverage ratio of 45.5x. Notably, over five years, they've reduced their debt to equity from 79% to an improved 56.4%.

- Get an in-depth perspective on Shanghai Zijiang Enterprise Group's performance by reading our health report here.

Understand Shanghai Zijiang Enterprise Group's track record by examining our Past report.

Wuxi Chipown Micro-electronics (SHSE:688508)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wuxi Chipown Micro-electronics Limited focuses on the research, development, and sale of semiconductor products in China with a market cap of CN¥7.38 billion.

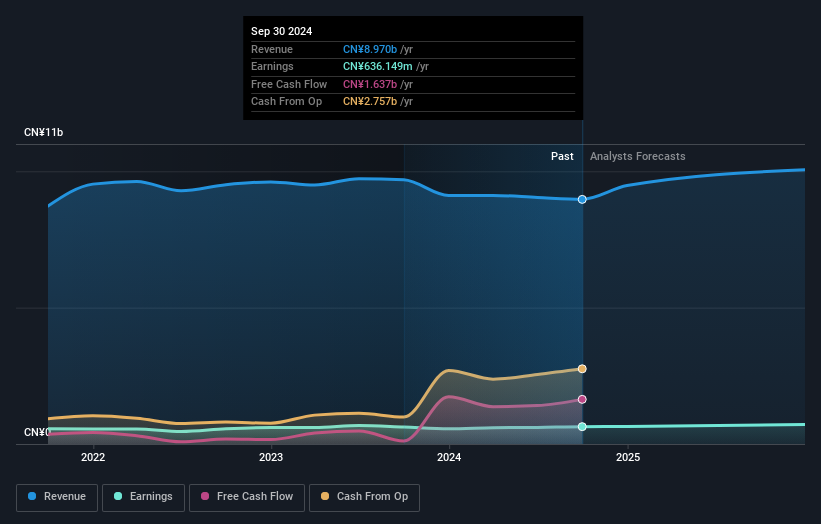

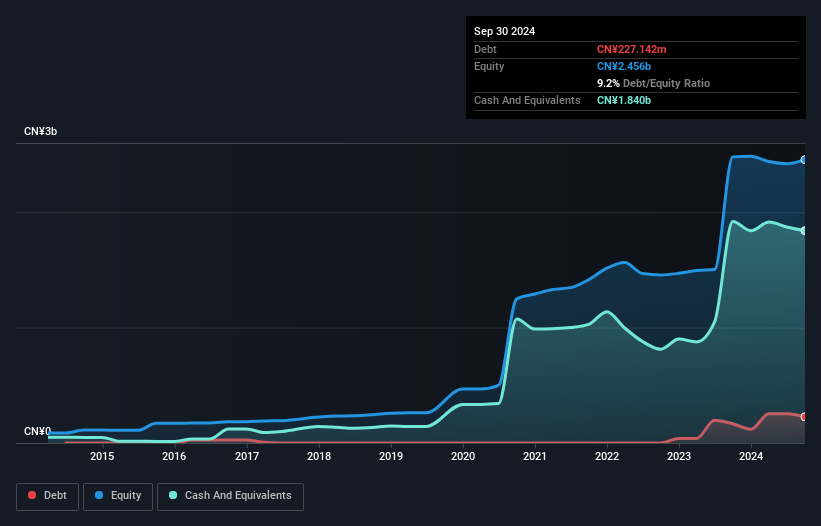

Operations: The company generates revenue primarily from semiconductor product sales, with a notable gross profit margin of 45.6%. Operating expenses are a significant component of its cost structure, impacting overall profitability.

Wuxi Chipown Micro-electronics has demonstrated impressive growth, with earnings increasing 87.2% over the past year, outpacing the Semiconductor industry's 13.9%. The company's sales reached CNY 964.6 million for the year ending December 2024, up from CNY 780.38 million previously, while net income improved to CNY 111.34 million from CNY 59.48 million a year ago. Its price-to-earnings ratio of 65.7 is below the industry average of 70.4, suggesting potential value in its stock price despite a debt-to-equity ratio rising to just over nine percent in five years, indicating manageable leverage levels amidst strong earnings performance and high-quality profits.

Suzhou Nanomicro Technology (SHSE:688690)

Simply Wall St Value Rating: ★★★★★★

Overview: Suzhou Nanomicro Technology Co., Ltd. specializes in the production and supply of spherical, mono-disperse particles for diverse industries globally, with a market capitalization of CN¥7.84 billion.

Operations: Nanomicro Technology generates revenue through the production and supply of spherical, mono-disperse particles for various global industries. The company's financial performance is reflected in its market capitalization of CN¥7.84 billion.

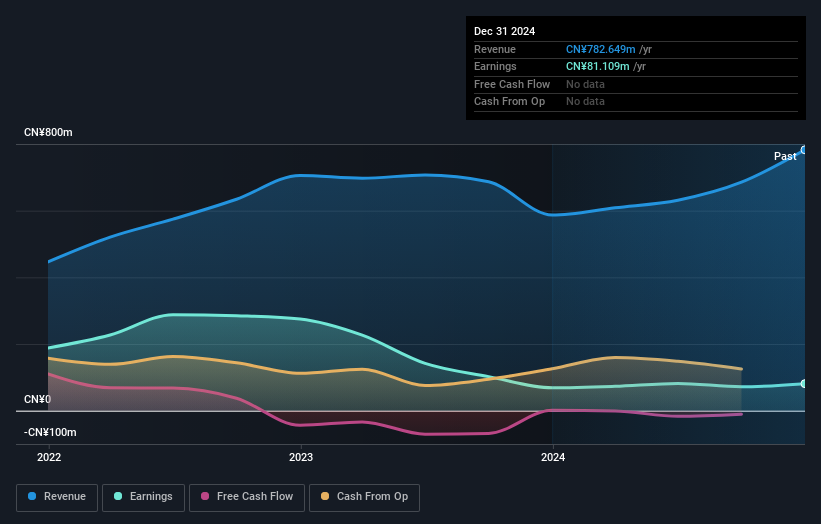

Suzhou Nanomicro Technology, a notable player in the chemicals sector, has shown impressive earnings growth of 18.3% over the past year, outpacing the industry's -5.4%. The company's debt management is commendable, with its debt-to-equity ratio decreasing from 10.8% to 6.3% over five years and interest payments well-covered by EBIT at an astounding 33,787x coverage. Despite not being free cash flow positive recently, it reported sales of CNY 782.65 million for 2024 compared to CNY 586.87 million in the previous year and net income increased to CNY 81.11 million from CNY 68.57 million last year, reflecting robust financial health and operational efficiency amidst industry challenges.

- Take a closer look at Suzhou Nanomicro Technology's potential here in our health report.

Gain insights into Suzhou Nanomicro Technology's past trends and performance with our Past report.

Summing It All Up

- Get an in-depth perspective on all 3184 Global Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600210

Shanghai Zijiang Enterprise Group

Shanghai Zijiang Enterprise Group Co., Ltd.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives