As global markets navigate a mix of geopolitical tensions and economic optimism, U.S. indexes are nearing record highs, buoyed by broad-based gains and positive labor market data. In this context of economic growth and stabilizing conditions, dividend stocks present an appealing option for investors seeking steady income streams; their potential to provide consistent returns becomes particularly attractive amid fluctuating market dynamics.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.87% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.60% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.73% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.45% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Beijing Tong Ren Tang Chinese Medicine (SEHK:3613)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beijing Tong Ren Tang Chinese Medicine Company Limited, along with its subsidiaries, is involved in the manufacture, retail, and wholesale of healthcare products and Chinese medicine to both wholesalers and individuals, with a market cap of HK$6.67 billion.

Operations: Beijing Tong Ren Tang Chinese Medicine Company Limited generates revenue from several segments, including Overseas (HK$429.03 million), Hong Kong (HK$979.91 million), and Mainland China (HK$240.56 million).

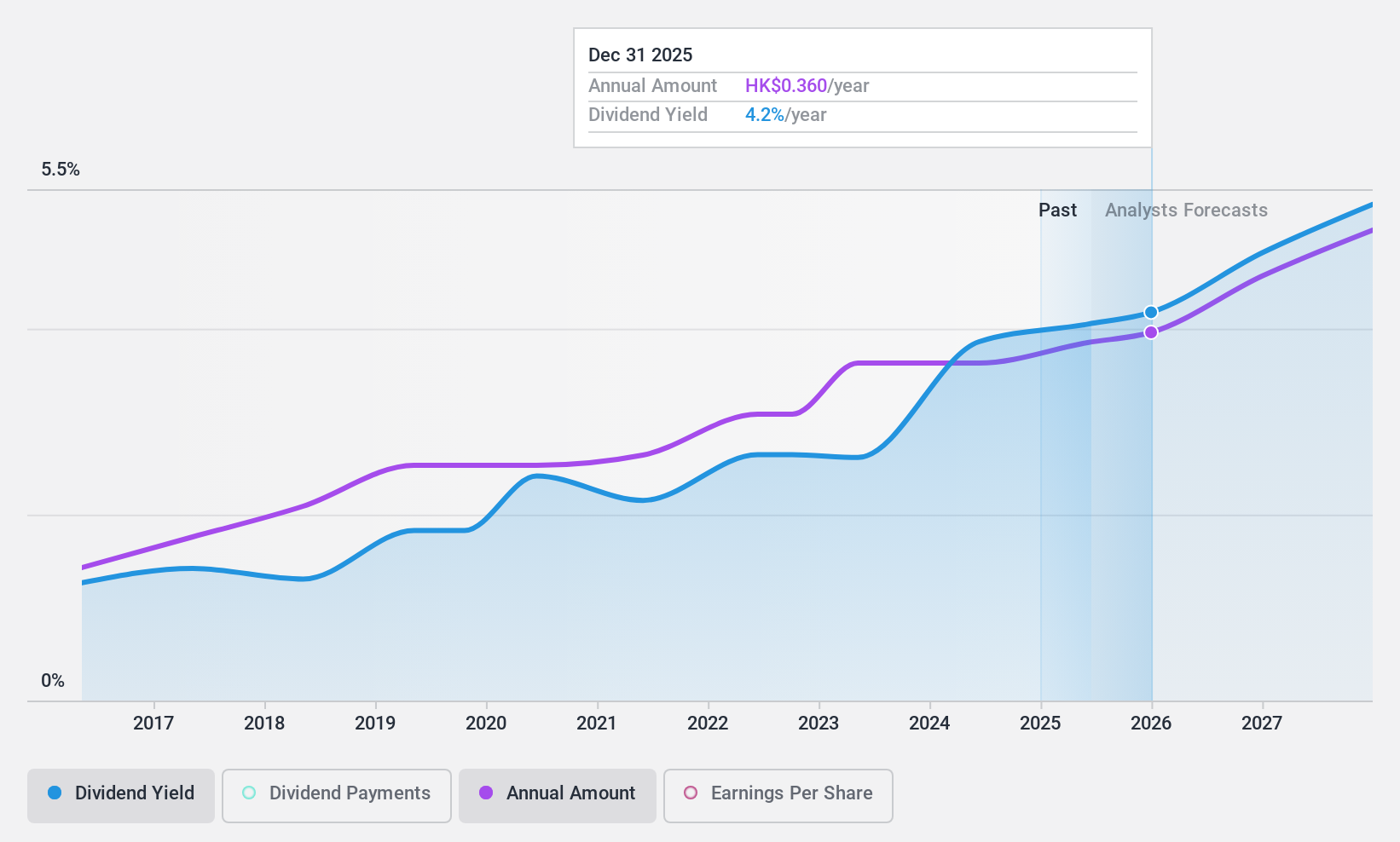

Dividend Yield: 4%

Beijing Tong Ren Tang Chinese Medicine offers a dividend yield of 4.01%, which is stable and has grown over the past decade, yet it is not covered by free cash flows, indicating potential sustainability concerns. The payout ratio of 55.9% suggests dividends are covered by earnings, but recent financials show declining sales and net income for H1 2024, with sales at HK$664.52 million and net income at HK$219.78 million compared to the previous year.

- Unlock comprehensive insights into our analysis of Beijing Tong Ren Tang Chinese Medicine stock in this dividend report.

- Our expertly prepared valuation report Beijing Tong Ren Tang Chinese Medicine implies its share price may be too high.

Cisen Pharmaceutical (SHSE:603367)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cisen Pharmaceutical Co., Ltd. manufactures and sells chemical drug preparations and healthcare products in China and internationally, with a market cap of CN¥6.51 billion.

Operations: Cisen Pharmaceutical Co., Ltd. generates revenue primarily from its pharmaceutical manufacturing segment, which amounts to CN¥4.25 billion.

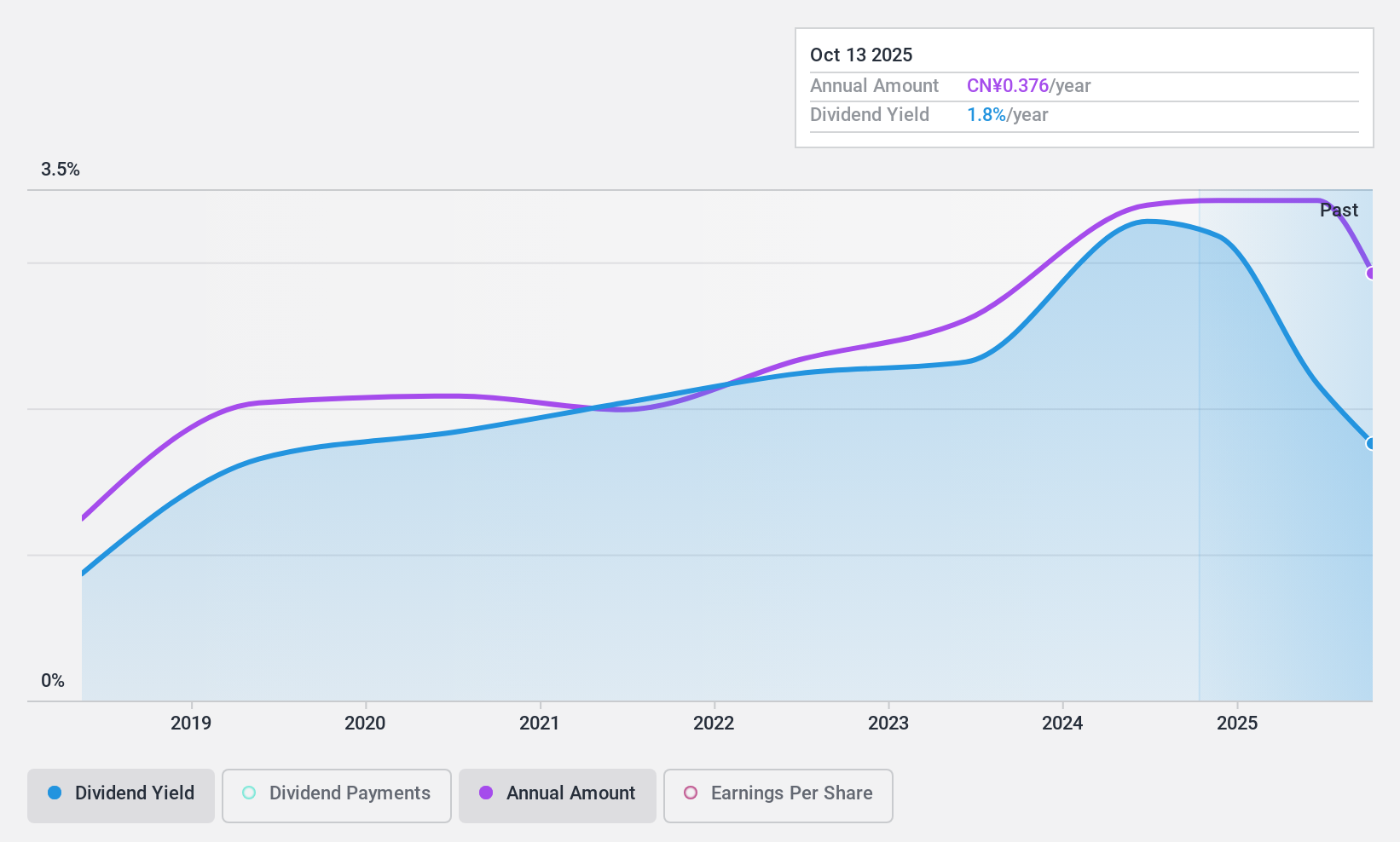

Dividend Yield: 3%

Cisen Pharmaceutical's dividend yield of 3.03% ranks in the top 25% of the CN market, supported by a payout ratio of 56.1%, indicating earnings coverage, and a cash payout ratio of 54.4%, showing cash flow support. Despite only seven years of dividend history, payments have been stable and growing with minimal volatility. Recent financials reveal slight revenue decline but net income growth for the first nine months of 2024, suggesting potential resilience in earnings capacity.

- Click here to discover the nuances of Cisen Pharmaceutical with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Cisen Pharmaceutical's share price might be too pessimistic.

Chacha Food Company (SZSE:002557)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Chacha Food Company, Limited focuses on the production and sale of fresh nuts in China, with a market cap of CN¥14.92 billion.

Operations: Chacha Food Company's revenue from leisure food amounts to CN¥7.08 billion.

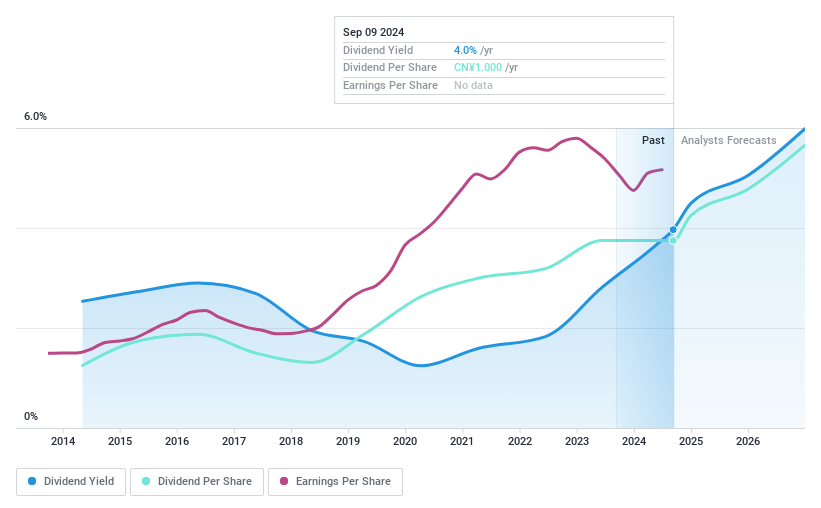

Dividend Yield: 3.3%

Chacha Food Company's dividend yield of 3.26% places it in the top quartile of CN market payers, with dividends well-supported by a 55.2% payout ratio and a cash payout ratio of 74.5%. Over the past decade, dividends have been stable and growing, reflecting reliability. Recent financials show increased earnings and revenue for the first nine months of 2024. A share repurchase plan worth CNY 80 million may further enhance shareholder value through equity incentives or employee stock ownership plans.

- Navigate through the intricacies of Chacha Food Company with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Chacha Food Company is trading behind its estimated value.

Turning Ideas Into Actions

- Embark on your investment journey to our 1960 Top Dividend Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Tong Ren Tang Chinese Medicine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3613

Beijing Tong Ren Tang Chinese Medicine

Engages in the manufacture, retail, and wholesale of healthcare products and Chinese medicine to wholesalers and individuals.

Excellent balance sheet average dividend payer.