- Japan

- /

- Professional Services

- /

- TSE:7088

Exploring Undiscovered Gems in Asia for November 2025

Reviewed by Simply Wall St

As global markets face volatility, with U.S. consumer sentiment nearing record lows and technology stocks experiencing a sell-off, investors are increasingly turning their attention to Asia's burgeoning opportunities. In this environment, identifying promising small-cap stocks in Asia requires a keen eye for companies that demonstrate resilience and potential for growth despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| ITE Tech | NA | 5.32% | 8.89% | ★★★★★★ |

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| TCM Biotech International | 2.84% | 2.11% | 5.25% | ★★★★★★ |

| Cota | NA | 3.97% | 1.24% | ★★★★★★ |

| Shenyang Yuanda Intellectual Industry GroupLtd | NA | 9.86% | 33.52% | ★★★★★★ |

| Ogaki Kyoritsu Bank | 96.00% | 3.20% | 12.40% | ★★★★★☆ |

| MNtech | 66.79% | 12.39% | -12.13% | ★★★★★☆ |

| OUG Holdings | 80.81% | 3.52% | 34.81% | ★★★★☆☆ |

| Nippon Sharyo | 48.57% | -0.32% | -3.31% | ★★★★☆☆ |

| Aurora OptoelectronicsLtd | 4.59% | -12.12% | 20.63% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Kuaijishan Shaoxing Rice Wine (SHSE:601579)

Simply Wall St Value Rating: ★★★★★★

Overview: Kuaijishan Shaoxing Rice Wine Co., Ltd. is engaged in the production, processing, and sale of rice wine both in China and internationally, with a market capitalization of CN¥11.17 billion.

Operations: Kuaijishan Shaoxing Rice Wine generates revenue primarily through the production and sale of rice wine in both domestic and international markets. The company has a market capitalization of CN¥11.17 billion.

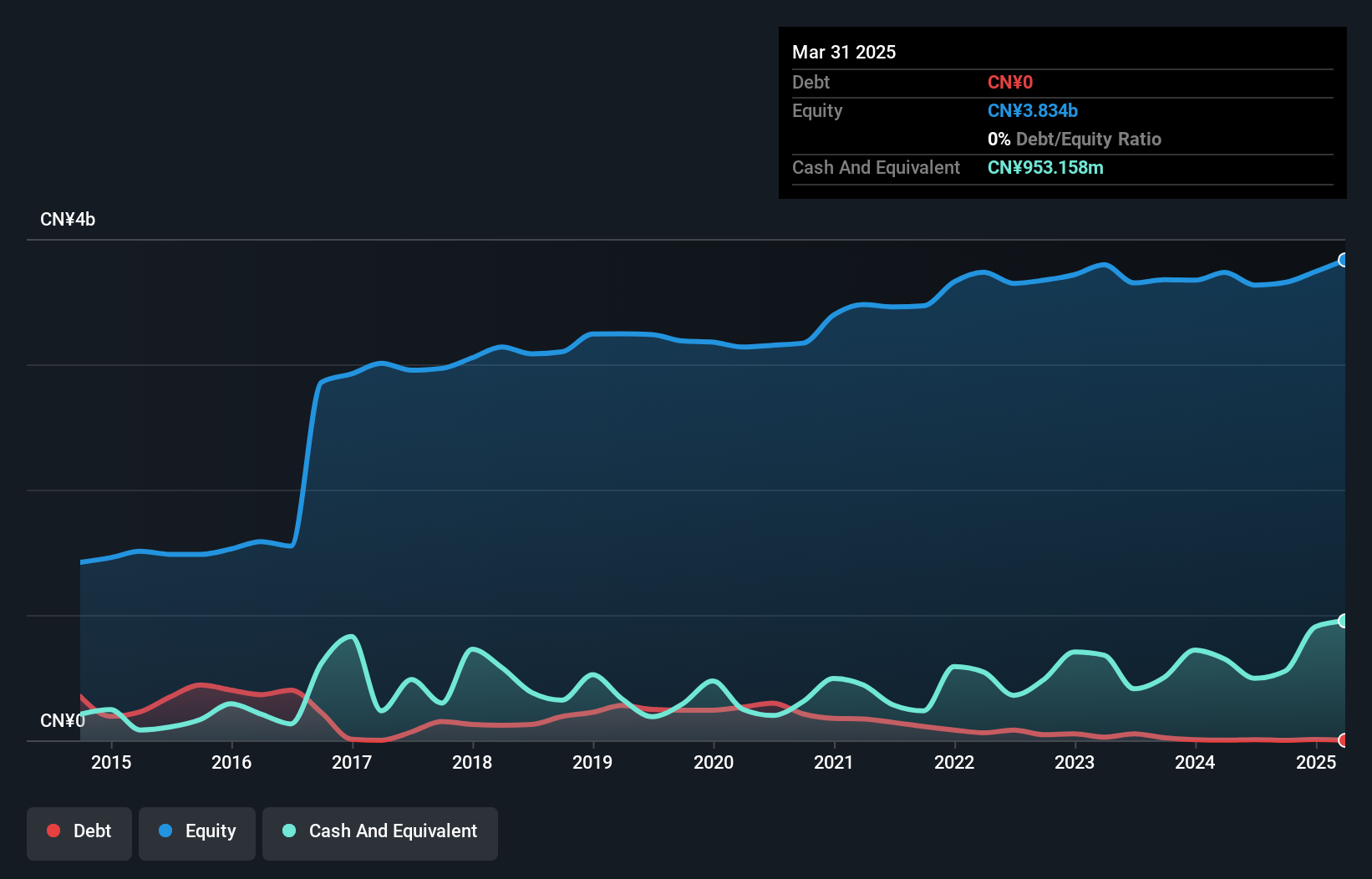

Kuaijishan Shaoxing Rice Wine, a niche player in the beverage industry, has shown promising growth despite market volatility. The company reported sales of ¥1.21 billion for the first nine months of 2025, up from ¥1.06 billion in the prior year. Net income reached ¥116 million compared to last year's ¥113 million, reflecting its resilience and strong market position. With no debt on its books now versus a 6.6% debt-to-equity ratio five years ago, it seems financially robust and poised for future growth as earnings are expected to grow by 30% annually based on forecasts.

Jiangyin Haida Rubber And Plastic (SZSE:300320)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangyin Haida Rubber And Plastic Co., Ltd. operates in the rubber and plastic industry with a market capitalization of CN¥6.54 billion.

Operations: The company generates revenue primarily from its rubber and plastic segments. It has a market capitalization of CN¥6.54 billion, reflecting its position in the industry.

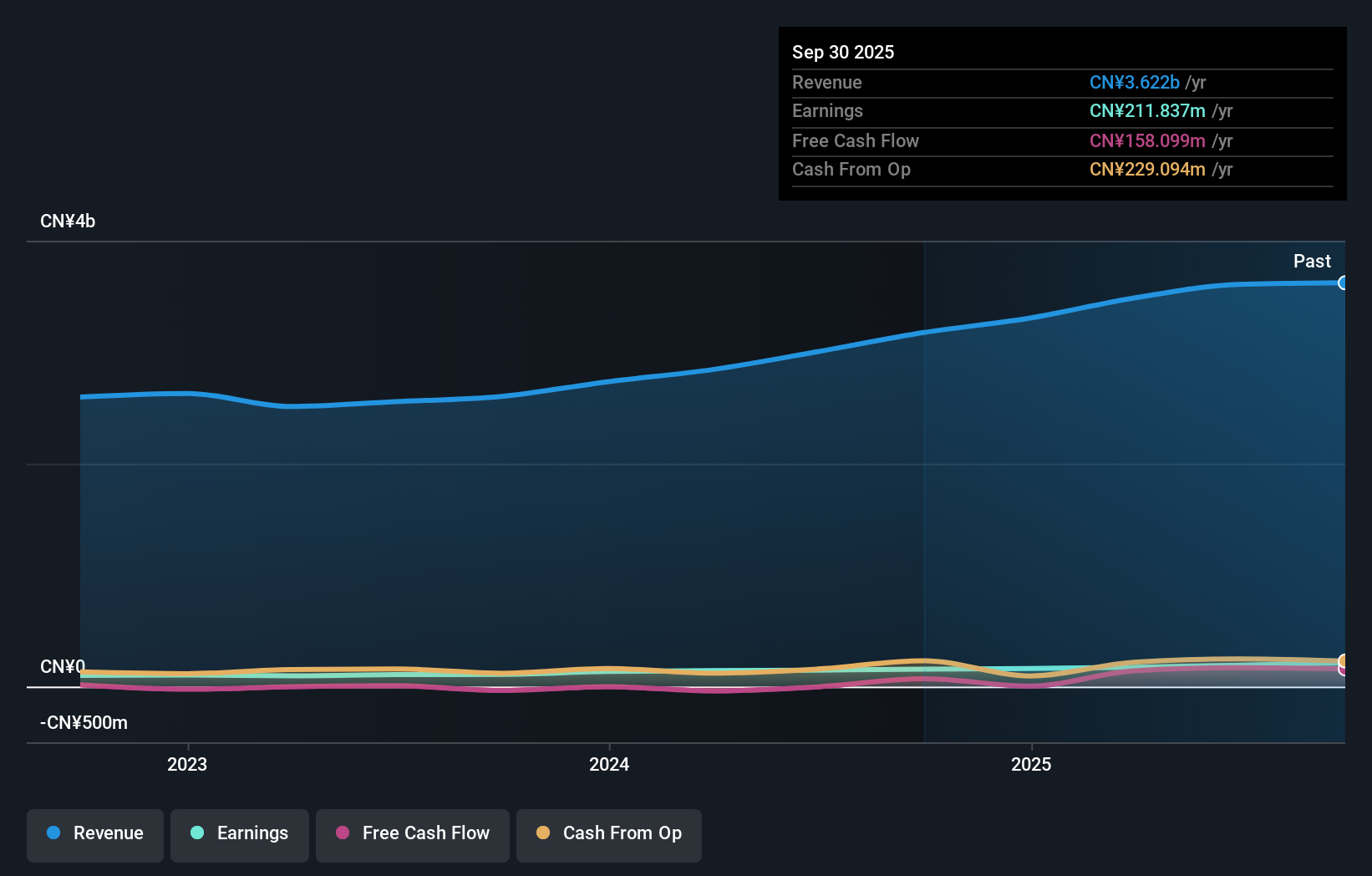

Jiangyin Haida Rubber And Plastic, a nimble player in the rubber and plastic industry, has shown resilience with its debt to equity ratio dropping from 18.1% to 11.9% over five years. The company delivered impressive earnings growth of 36.2% last year, outpacing the chemicals sector's average of 6.2%. With a price-to-earnings ratio at 30.9x, it offers better value compared to China's market average of 45x. Recent earnings for nine months ended September showed sales climbing to CNY 2.67 billion from CNY 2.35 billion last year, while net income rose sharply to CNY 166 million from CNY 117 million previously.

Forum Engineering (TSE:7088)

Simply Wall St Value Rating: ★★★★★★

Overview: Forum Engineering Inc. specializes in the dispatch and introduction of engineers, offering a variety of services to engineers, science and engineering students, and others in Japan, with a market cap of ¥83.66 billion.

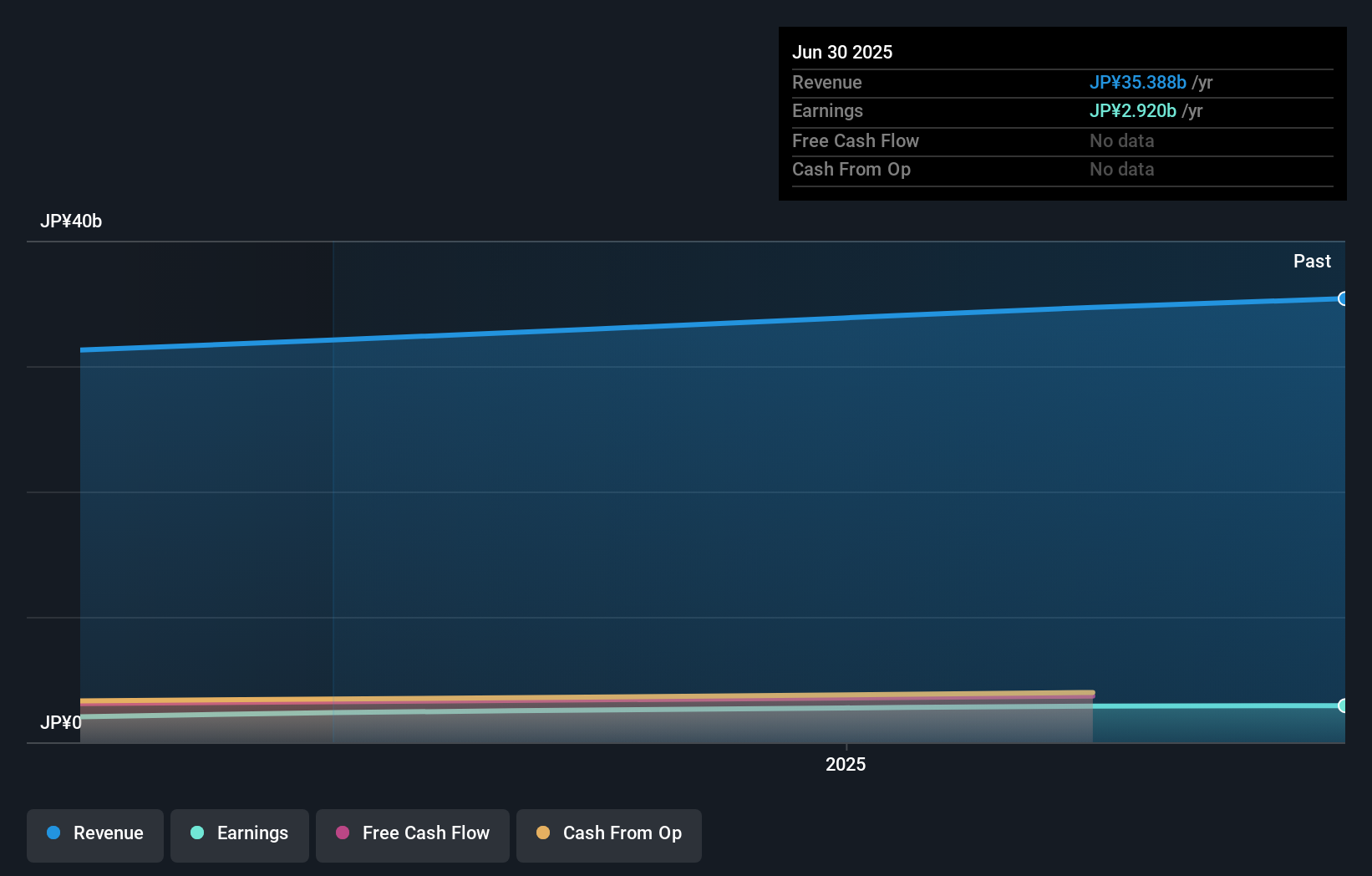

Operations: Forum Engineering generates its revenue primarily from Engineer Staffing Service and Engineer Referral Service, totaling ¥35.39 billion. The company's market cap stands at ¥83.66 billion.

Forum Engineering, a small yet promising player in the professional services sector, has shown robust earnings growth of 23% over the past year, outpacing the industry average of 17%. With no debt on its books for five years and trading at an attractive 18% below fair value estimates, it seems well-positioned financially. However, its share price has been highly volatile recently. In a significant development, KKR & Co. Inc. plans to acquire Forum for ¥90 billion at ¥1,710 per share as part of a tender offer that could make Forum a wholly-owned subsidiary by December 2025.

- Navigate through the intricacies of Forum Engineering with our comprehensive health report here.

Explore historical data to track Forum Engineering's performance over time in our Past section.

Taking Advantage

- Discover the full array of 2435 Asian Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7088

Forum Engineering

Provides dispatch and introduction of engineers, and a wide range of services to engineers, science and engineering students, and other people in Japan.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives