- Japan

- /

- Trade Distributors

- /

- TSE:8089

3 Dividend Stocks To Consider With Yields Up To 7.1%

Reviewed by Simply Wall St

In a week marked by heightened economic activity and mixed signals from the labor market, global indices have mostly trended lower, reflecting investor caution amid busy earnings reports and ongoing geopolitical concerns. As growth stocks lagged behind value shares, particularly in the U.S., investors are increasingly looking towards stable dividend-paying stocks as a potential source of income amidst market volatility. In this context, dividend stocks can offer a reliable income stream and may provide some insulation against broader market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.29% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.96% | ★★★★★★ |

| Innotech (TSE:9880) | 4.82% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.18% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.10% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.36% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.94% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.94% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.63% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.00% | ★★★★★★ |

Click here to see the full list of 2022 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

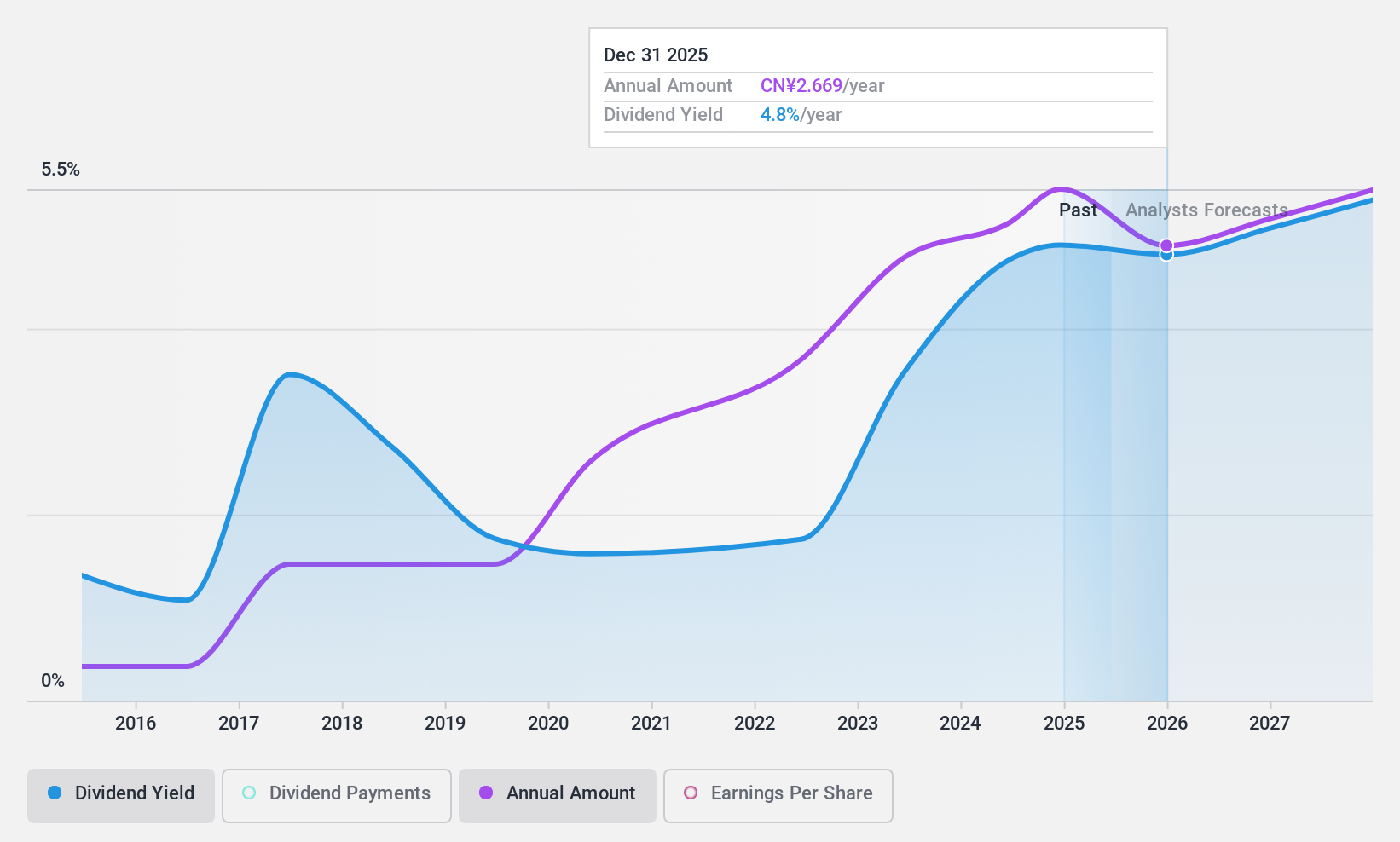

Chongqing Brewery (SHSE:600132)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chongqing Brewery Co., Ltd. is a company that produces and sells beers and non-alcoholic beverages in China, with a market cap of CN¥30 billion.

Operations: Chongqing Brewery Co., Ltd. generates its revenue primarily from the beer segment, amounting to CN¥14.85 billion.

Dividend Yield: 4.5%

Chongqing Brewery's dividend yield of 4.52% ranks in the top 25% within the Chinese market, yet its reliability is questionable due to volatility over the past decade. The company's current cash payout ratio of 79.5% suggests dividends are covered by cash flow, but a high payout ratio of 102.5% indicates they aren't well-covered by earnings. Despite some growth in dividends over ten years, sustainability concerns persist due to inconsistent earnings coverage and historical volatility.

- Take a closer look at Chongqing Brewery's potential here in our dividend report.

- The valuation report we've compiled suggests that Chongqing Brewery's current price could be quite moderate.

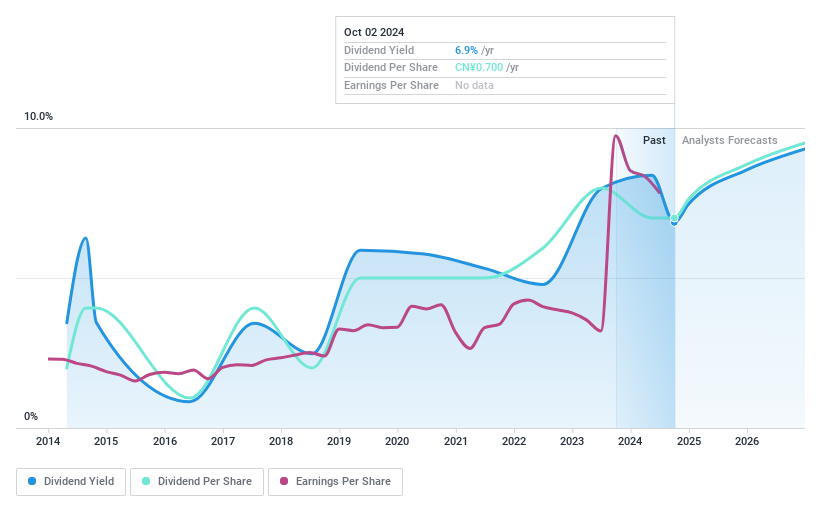

Xiamen C&D (SHSE:600153)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xiamen C&D Inc. operates in the supply chain and real estate development sectors both within China and internationally, with a market cap of CN¥28.91 billion.

Operations: Xiamen C&D Inc.'s revenue is primarily derived from its Supply Chain Operations Division, which accounts for CN¥474.91 billion, followed by the Real Estate Business Segment at CN¥183.26 billion and the Home Furnishing Shopping Mall Operation Business Segment contributing CN¥8.94 billion.

Dividend Yield: 7.1%

Xiamen C&D's dividend yield of 7.14% ranks among the top 25% in China, but its reliability is undermined by a history of volatility and lack of free cash flow coverage. Despite an earnings payout ratio of 88%, suggesting dividends are covered by earnings, recent financials show declining net income and profit margins. While the company trades at a favorable price-to-earnings ratio compared to peers, concerns about dividend sustainability persist due to inconsistent earnings coverage.

- Click to explore a detailed breakdown of our findings in Xiamen C&D's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Xiamen C&D shares in the market.

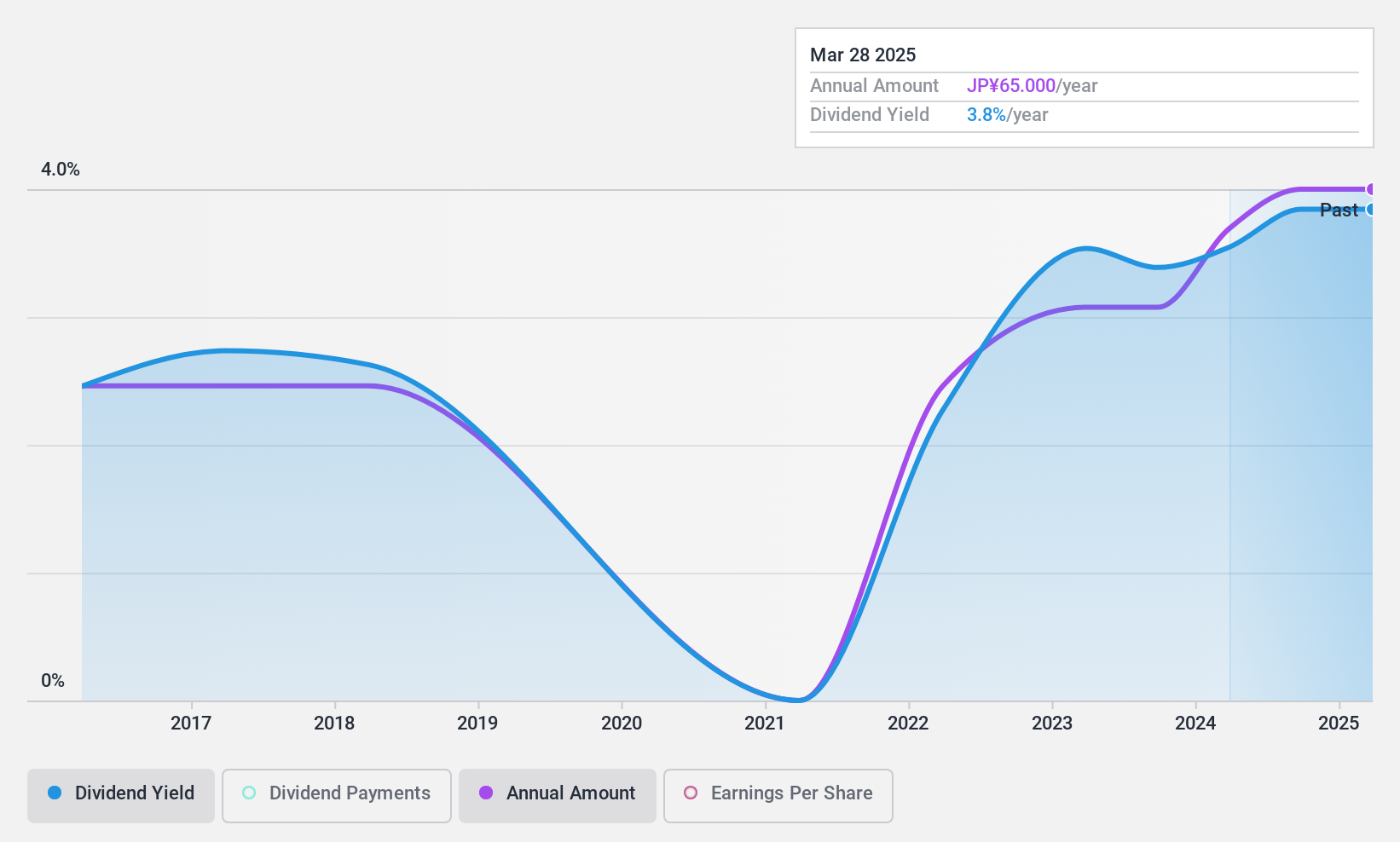

Nice (TSE:8089)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nice Corporation imports, distributes, and sells building materials for housing in Japan and internationally, with a market cap of ¥19.52 billion.

Operations: Nice Corporation's revenue segments include importing, distributing, and selling building materials for housing both domestically in Japan and on an international scale.

Dividend Yield: 3.9%

Nice Corporation's dividend yield of 3.93% is among the top 25% in Japan, supported by a low cash payout ratio of 11.1%, indicating strong coverage by free cash flow. However, the dividend track record has been unstable and volatile over the past decade. Recent guidance suggests a ¥40 per share annual dividend for fiscal year ending March 2025, though large one-off items have impacted financial results and profit margins have declined from last year.

- Click here and access our complete dividend analysis report to understand the dynamics of Nice.

- Our comprehensive valuation report raises the possibility that Nice is priced lower than what may be justified by its financials.

Key Takeaways

- Investigate our full lineup of 2022 Top Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nice might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8089

Nice

Imports, distributes, and sells building materials for housing in Japan and internationally.

Excellent balance sheet average dividend payer.