- China

- /

- Hospitality

- /

- SHSE:603099

Undiscovered Gems In Asia November 2025

Reviewed by Simply Wall St

As global markets face headwinds from U.S. consumer sentiment lows and a tech sell-off, Asian markets have shown resilience with easing trade tensions between the U.S. and China boosting investor confidence. In this environment, identifying promising small-cap stocks in Asia requires a keen eye for companies that can capitalize on regional growth dynamics and adapt to shifting economic landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Soliton Systems K.K | 0.47% | 2.84% | 2.40% | ★★★★★★ |

| Anpec Electronics | NA | 0.97% | 1.03% | ★★★★★★ |

| YagiLtd | 27.83% | -6.06% | 32.03% | ★★★★★★ |

| Saison Technology | NA | 1.32% | -10.74% | ★★★★★★ |

| Shangri-La Hotel | NA | 33.29% | 66.13% | ★★★★★★ |

| Taiyo KagakuLtd | 0.66% | 6.12% | 4.54% | ★★★★★☆ |

| CHANGE HoldingsInc | 63.47% | 29.29% | 14.76% | ★★★★★☆ |

| Zhejiang Wanfeng ChemicalLtd | 12.30% | 0.64% | -19.71% | ★★★★★☆ |

| Nippon Care Supply | 12.39% | 10.40% | 1.75% | ★★★★☆☆ |

| Pizu Group Holdings | 41.45% | -2.37% | -15.01% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Daehan Shipbuilding (KOSE:A439260)

Simply Wall St Value Rating: ★★★★★☆

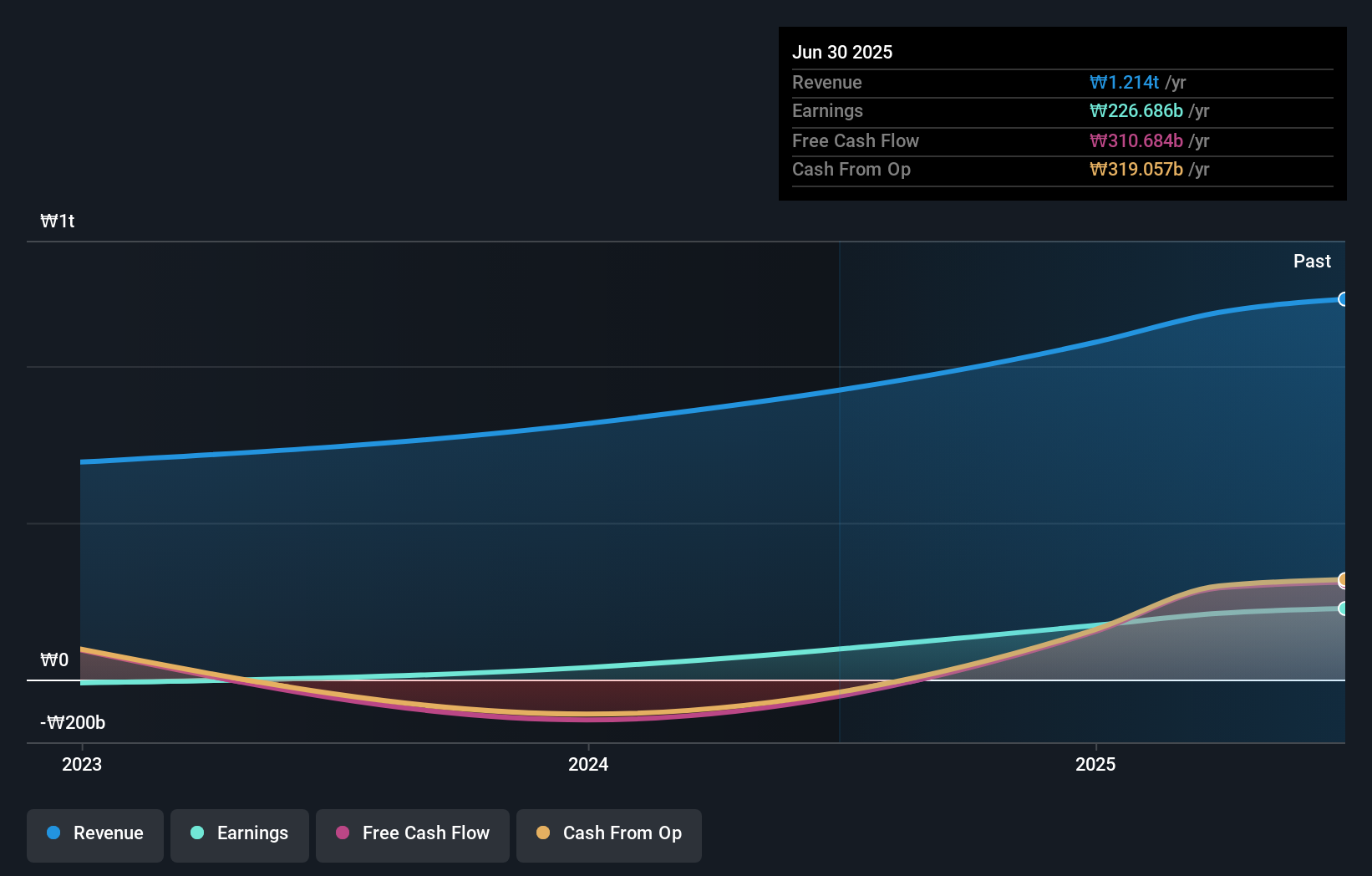

Overview: Daehan Shipbuilding Co., Ltd. specializes in ship construction and repair services, with a market capitalization of ₩2.50 trillion.

Operations: Daehan Shipbuilding generates revenue primarily from its shipbuilding segment, amounting to ₩1.21 trillion.

Daehan Shipbuilding, a nimble player in the shipbuilding sector, has been making waves with its financial performance. The company is trading at 95.6% below its estimated fair value, indicating potential undervaluation. Over the past year, earnings surged by 115%, significantly outpacing the industry's growth of 3%. This performance is backed by high-quality earnings and robust debt management; interest payments are well covered with an EBIT coverage of 27 times. Additionally, Daehan boasts more cash than total debt and has maintained positive free cash flow recently, suggesting strong operational health and potential resilience in future market conditions.

- Navigate through the intricacies of Daehan Shipbuilding with our comprehensive health report here.

Gain insights into Daehan Shipbuilding's past trends and performance with our Past report.

Changbai Mountain Tourism (SHSE:603099)

Simply Wall St Value Rating: ★★★★★★

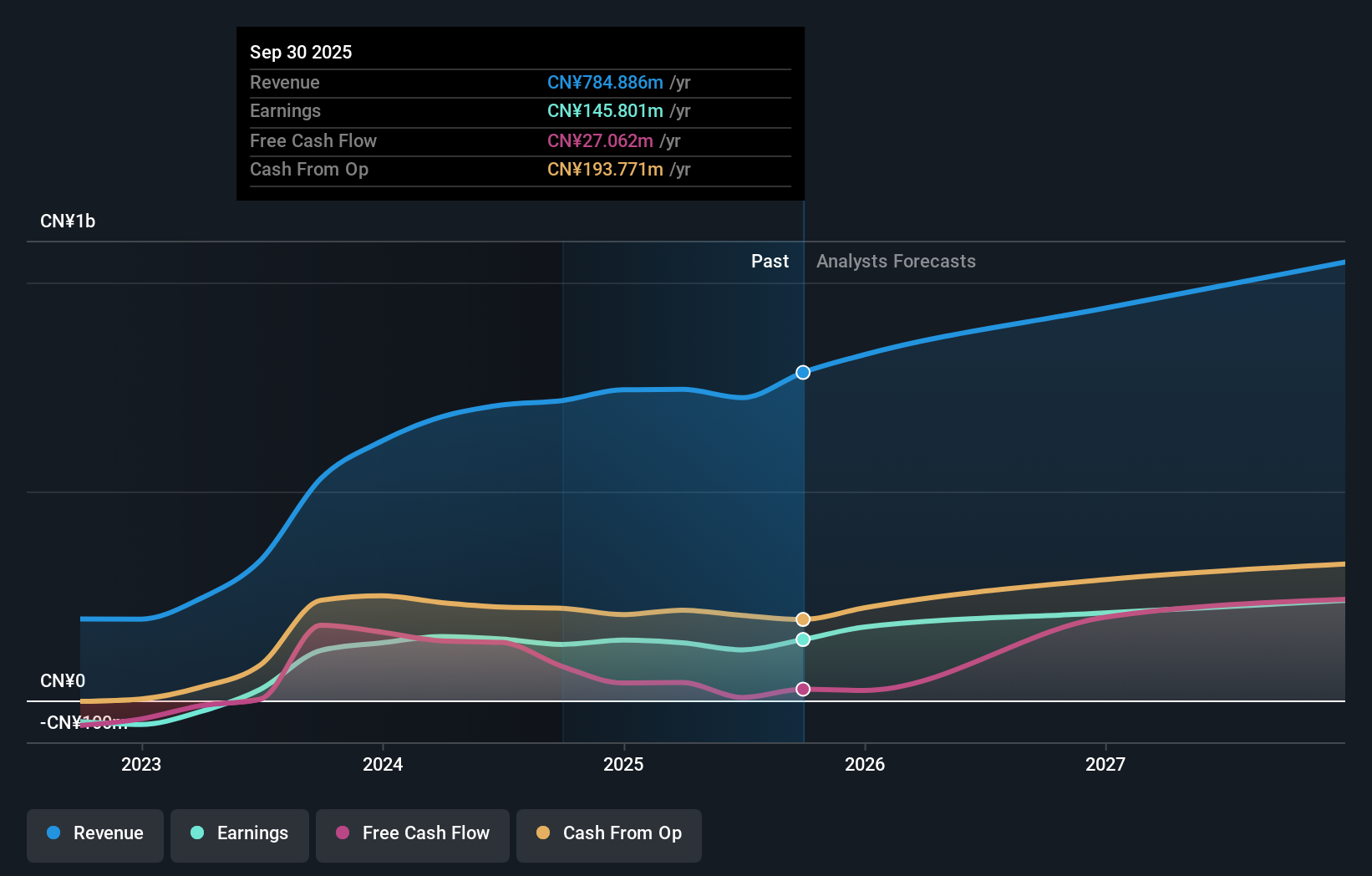

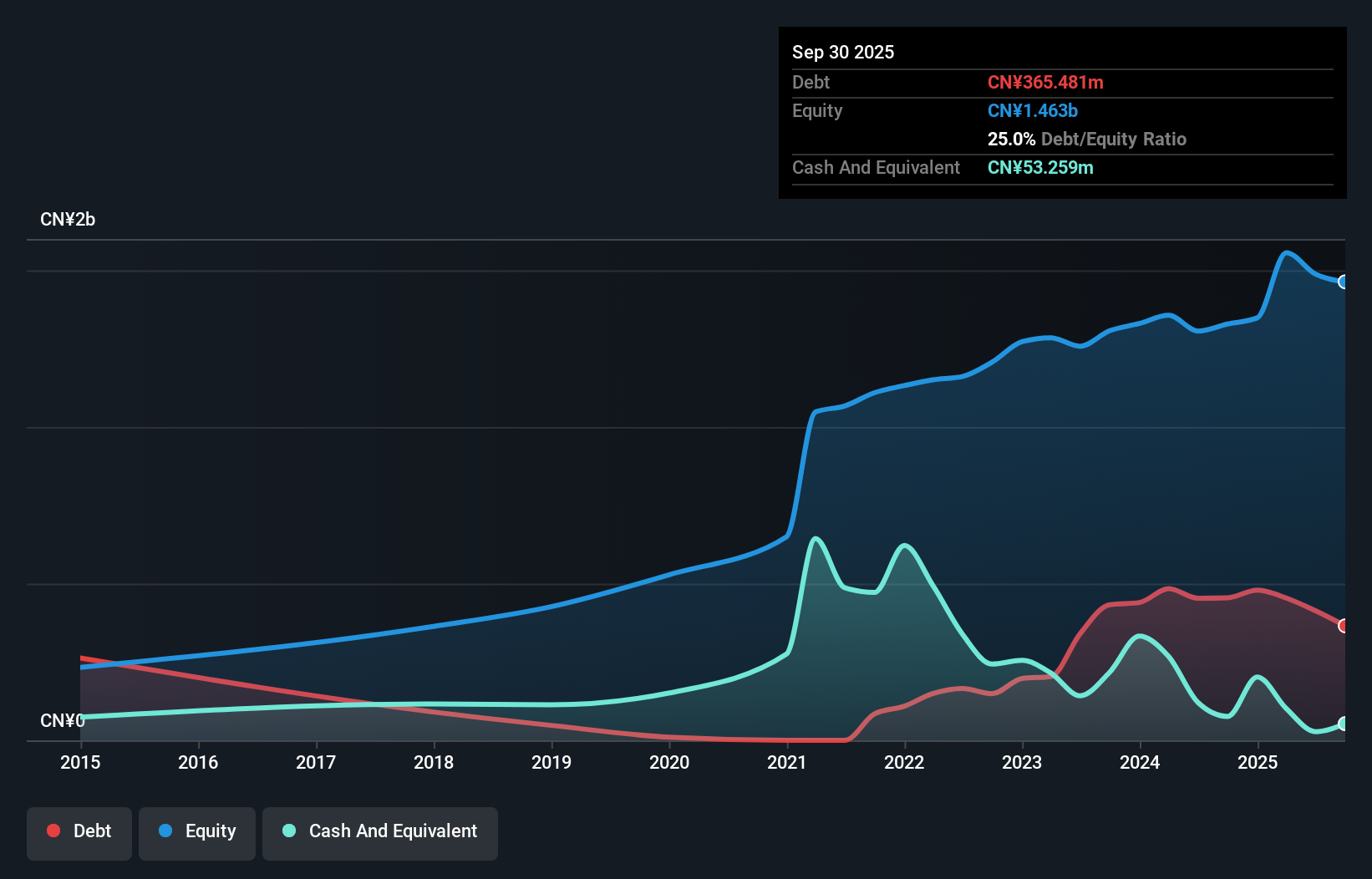

Overview: Changbai Mountain Tourism Co., Ltd. operates in the tourism industry in China with a market cap of CN¥13.59 billion.

Operations: Changbai Mountain Tourism generates revenue primarily through its tourism-related activities in China. The company has a market cap of CN¥13.59 billion, reflecting its significant presence in the industry.

Changbai Mountain Tourism, a smaller player in the hospitality sector, has shown resilience with earnings growing 8.6% last year, outpacing the industry average of -5.4%. Despite recent volatility in its share price over three months, the company boasts high-quality earnings and maintains a strong financial position with more cash than total debt. Its debt-to-equity ratio improved from 12.5 to 10.1 over five years, indicating prudent financial management. Recent reports show sales reaching CNY 636 million for nine months ended September 2025 compared to CNY 595 million last year, reflecting steady revenue growth amidst challenges.

- Click here to discover the nuances of Changbai Mountain Tourism with our detailed analytical health report.

Learn about Changbai Mountain Tourism's historical performance.

Zhejiang Truelove Vogue (SZSE:003041)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Truelove Vogue Co., Ltd. engages in the research and development, design, manufacture, and sale of blankets in China with a market capitalization of CN¥5.37 billion.

Operations: Zhejiang Truelove Vogue generates its revenue primarily through the sale of blankets, with a focus on research and development, design, and manufacturing. The company's financial performance is influenced by its cost structure related to these activities.

Zhejiang Truelove Vogue, a smaller player in the luxury sector, has demonstrated impressive earnings growth of 216% over the past year, outpacing its industry significantly. However, this performance was bolstered by a one-off gain of CN¥215 million. The company's price-to-earnings ratio stands at 21.5x, which is attractively lower than the broader CN market's 44.6x. Despite an increase in its debt to equity ratio from 0.4% to 25% over five years, it remains within satisfactory levels with interest coverage not being a concern. Future earnings are expected to decline by nearly half annually for the next three years, presenting potential challenges ahead.

Taking Advantage

- Take a closer look at our Asian Undiscovered Gems With Strong Fundamentals list of 2426 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603099

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives