- China

- /

- Construction

- /

- SZSE:301027

Undiscovered Gems With Strong Fundamentals None November 2024

Reviewed by Simply Wall St

In a week marked by mixed signals from the labor market and cautious earnings reports, small-cap stocks have demonstrated resilience compared to their larger counterparts. As global markets navigate these complexities, identifying stocks with robust fundamentals becomes crucial for investors seeking stability amidst volatility. In this context, undiscovered gems can offer compelling opportunities when they exhibit strong financial health and growth potential despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Hermes Transportes Blindados | 58.80% | 4.29% | 2.04% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Lanzhou Lishang Guochao Industrial GroupLtd (SHSE:600738)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Lanzhou Lishang Guochao Industrial Group Co., Ltd operates department stores in China and internationally, with a market cap of CN¥3.40 billion.

Operations: The company generates its revenue primarily through the operation of department stores both domestically and internationally. The financial data does not provide specific revenue or cost breakdowns, making it challenging to analyze detailed financial trends.

Lanzhou Lishang Guochao Industrial Group, a smaller player in the market, has shown notable financial resilience. Over the past year, its earnings surged by 166.5%, outpacing the broader Multiline Retail sector's -5.9%. The company's debt to equity ratio improved from 52.3% to 33.4% over five years, reflecting stronger financial health and quality earnings with interest payments well covered by EBIT at a robust 50.3x coverage. Recent results for nine months ending September show net income of CNY107 million compared to CNY78 million last year, despite sales dipping from CNY695 million to CNY516 million, suggesting efficient cost management amidst revenue challenges.

- Navigate through the intricacies of Lanzhou Lishang Guochao Industrial GroupLtd with our comprehensive health report here.

Understand Lanzhou Lishang Guochao Industrial GroupLtd's track record by examining our Past report.

New Huadu Technology (SZSE:002264)

Simply Wall St Value Rating: ★★★★★★

Overview: New Huadu Technology Co., Ltd. operates in the Internet marketing sector in China with a market capitalization of CN¥4.30 billion.

Operations: The company generates revenue primarily from its Internet marketing services in China. With a market capitalization of CN¥4.30 billion, it focuses on leveraging digital platforms to drive sales and engagement.

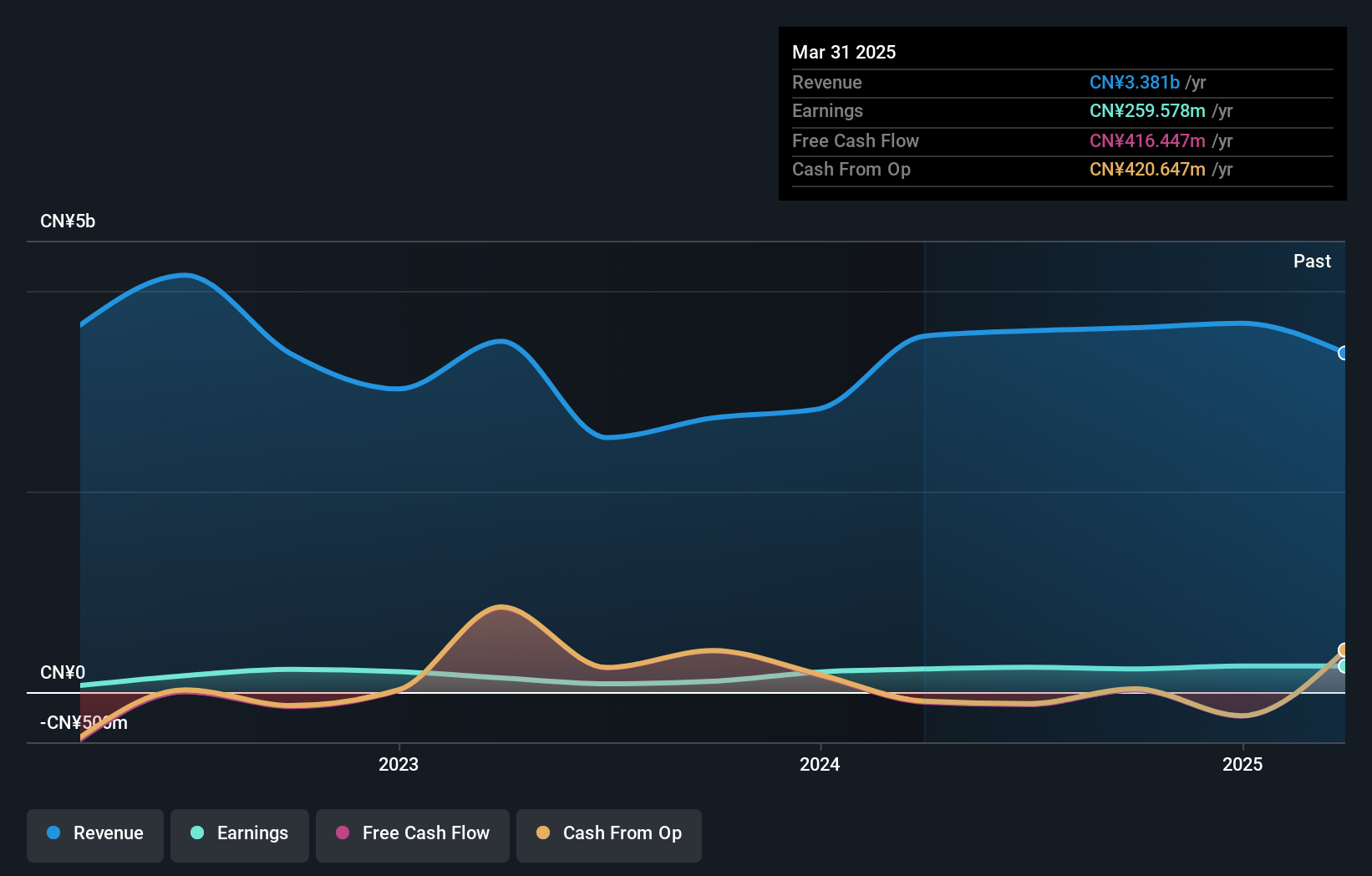

New Huadu Technology, a dynamic player in its field, has shown impressive growth with earnings up 115.7% over the past year, significantly outpacing the Consumer Retailing industry’s 6%. The company is trading at a favorable price-to-earnings ratio of 18.5x compared to the broader CN market's 35.4x, suggesting good relative value. Financially robust, it holds more cash than its total debt and enjoys positive free cash flow. Recent earnings reports highlight revenue climbing to CNY 2.77 billion from CNY 1.97 billion last year and net income rising to CNY 190 million from CNY 159 million, reflecting strong operational performance and profitability improvements.

- Delve into the full analysis health report here for a deeper understanding of New Huadu Technology.

Evaluate New Huadu Technology's historical performance by accessing our past performance report.

Hualan Group (SZSE:301027)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hualan Group Co., Ltd. offers integrated services for urban and rural construction in China, with a market capitalization of CN¥1.91 billion.

Operations: Hualan Group generates revenue through its integrated services in urban and rural construction. The company has a market capitalization of CN¥1.91 billion, reflecting its financial position within the industry.

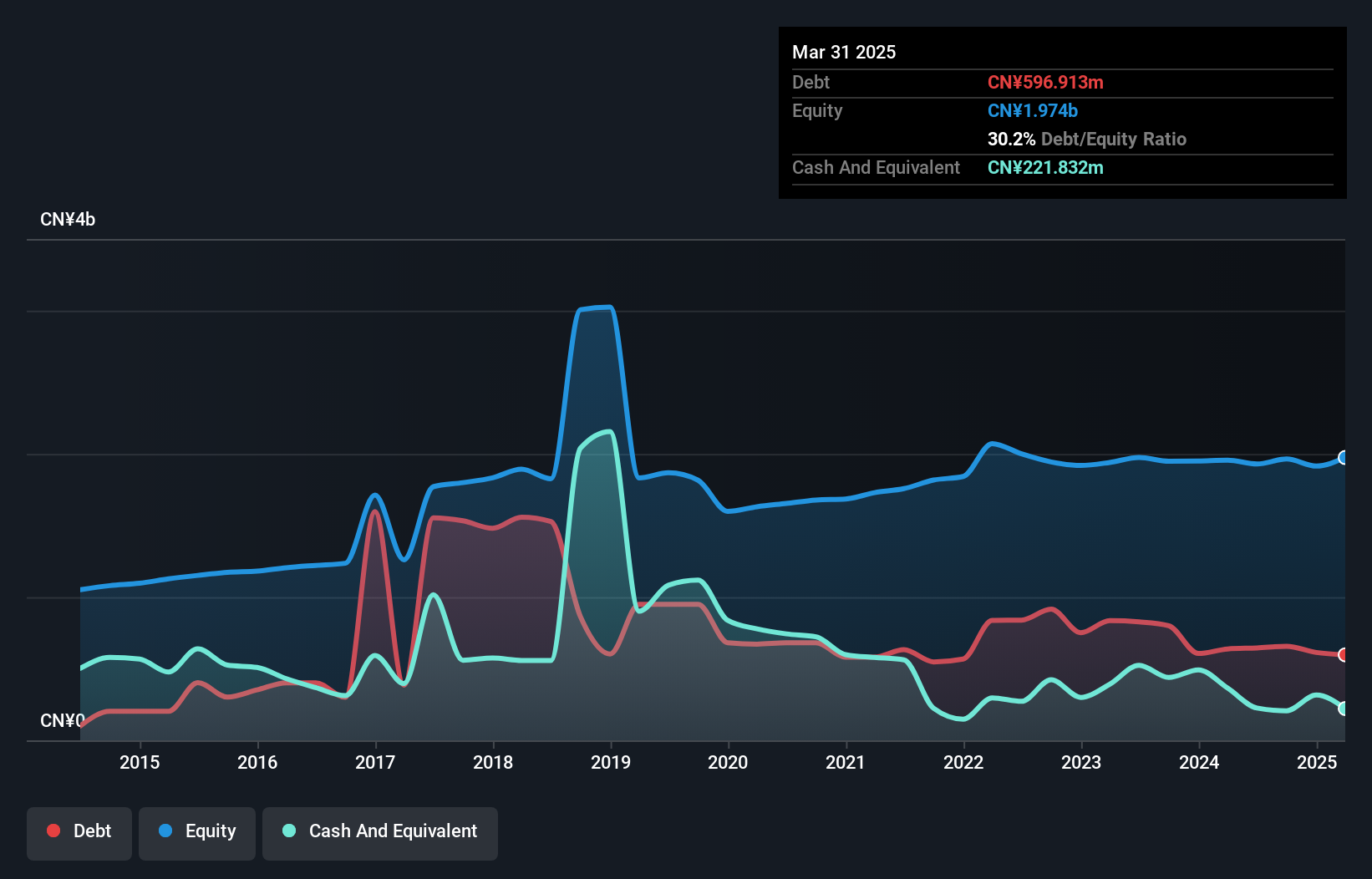

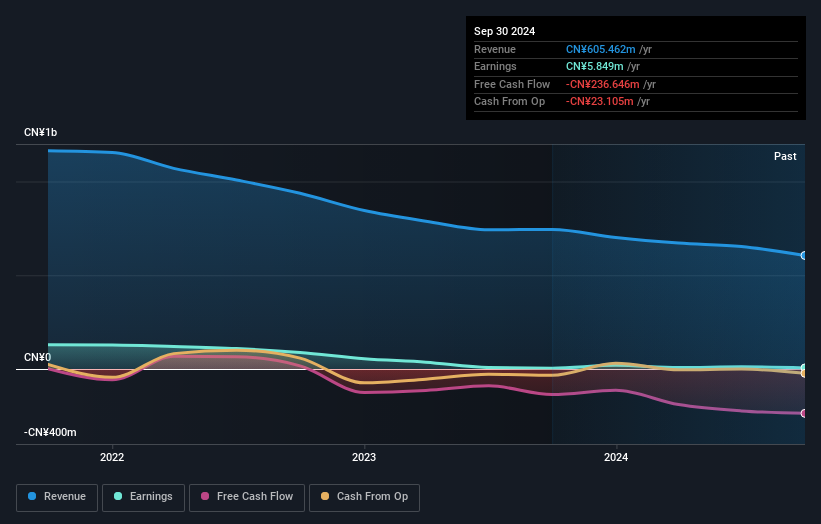

Hualan Group, a smaller player in its sector, has faced challenging times with earnings declining by 47.7% annually over the last five years. However, recent figures show a 26.6% growth in earnings this past year, outpacing the broader construction industry's -4.3%. Despite reporting a net loss of CNY 23.47 million for the nine months ending September 2024 compared to CNY 9.55 million previously, their interest payments are well covered at an EBIT ratio of 4.6x. The company's debt-to-equity ratio has improved from 36.5% to 31.1%, indicating better financial management amidst volatility and losses per share increasing to CNY 0.16 from CNY 0.06 last year.

- Click here to discover the nuances of Hualan Group with our detailed analytical health report.

Gain insights into Hualan Group's past trends and performance with our Past report.

Make It Happen

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4701 more companies for you to explore.Click here to unveil our expertly curated list of 4704 Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hualan Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301027

Hualan Group

Provides integrated services in the field of urban and rural construction in China.

Excellent balance sheet with acceptable track record.