As global markets navigate a complex landscape of earnings reports and economic data, small-cap stocks have shown resilience, outperforming their larger counterparts amid cautious investor sentiment. In this environment, identifying undiscovered gems requires a keen eye for companies with strong fundamentals and growth potential that can weather market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Changshu Fengfan Power Equipment | 91.61% | 6.89% | 31.92% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

WuXi Xinje ElectricLtd (SHSE:603416)

Simply Wall St Value Rating: ★★★★★☆

Overview: WuXi Xinje Electric Co., Ltd. focuses on the development, production, and sale of industrial automation products both in China and internationally, with a market cap of CN¥5.22 billion.

Operations: WuXi Xinje Electric Co., Ltd. generates revenue primarily from the sale of industrial automation products. The company focuses on both domestic and international markets, contributing to its financial performance.

WuXi Xinje Electric, a smaller player in the electronics industry, has reported notable financial growth with earnings up by 12.8% over the past year, outpacing the industry's 1.7% increase. The company seems to be trading at a favorable value, approximately 12.7% below its estimated fair value, and it boasts high-quality past earnings. Recent figures show sales for nine months reached ¥1.21 billion (up from ¥1.08 billion), while net income rose to ¥174 million from ¥155 million last year; basic EPS climbed to ¥1.25 from ¥1.10, suggesting robust operational performance and potential for continued growth.

Xiamen Kingdomway Group (SZSE:002626)

Simply Wall St Value Rating: ★★★★★★

Overview: Xiamen Kingdomway Group Company is involved in the manufacturing and sale of nutrition and health products both in China and internationally, with a market capitalization of CN¥10.34 billion.

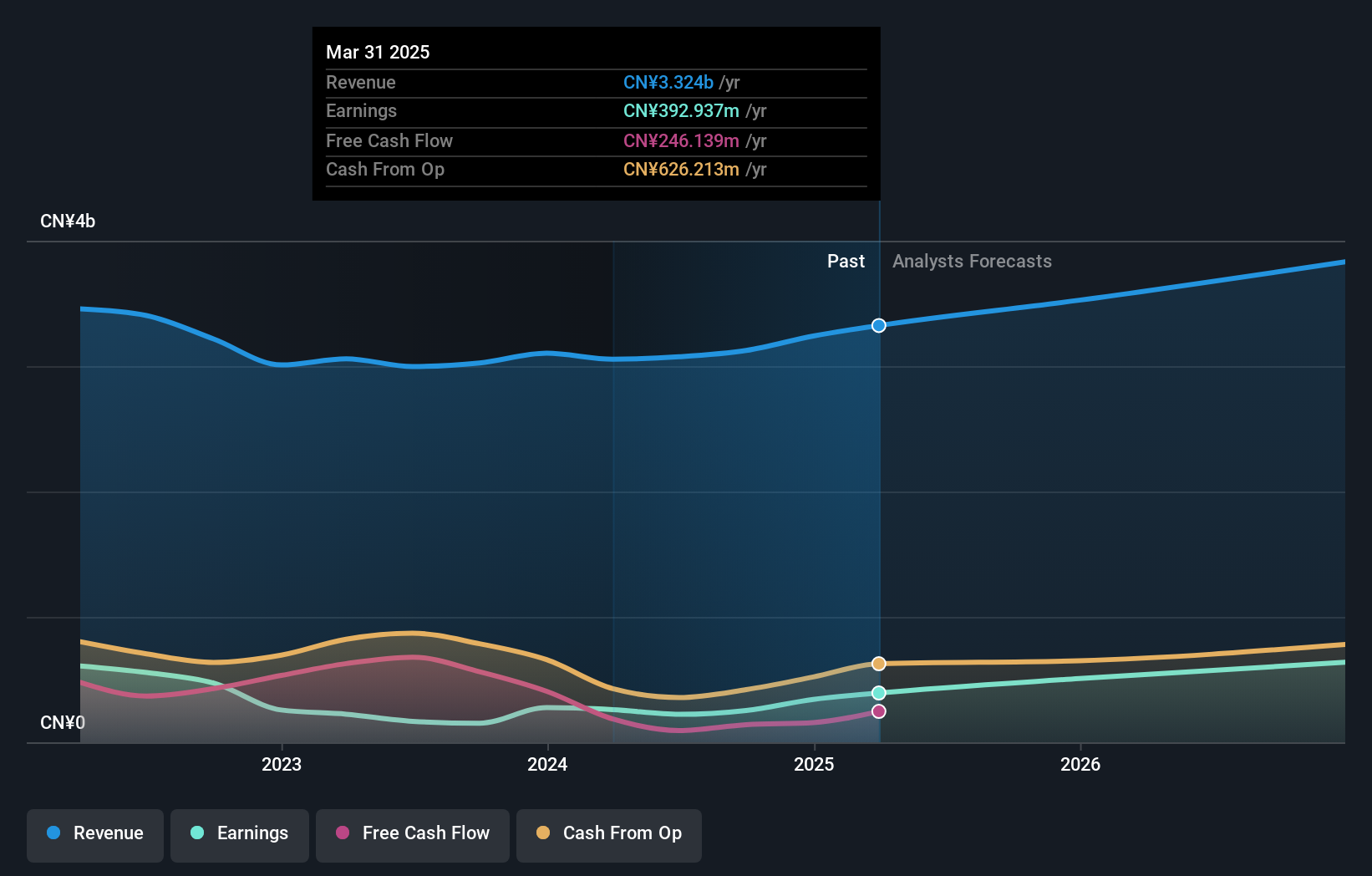

Operations: Xiamen Kingdomway Group generates revenue primarily from the sale of nutrition and health products. The company focuses on cost management within its production processes to optimize profitability. It has reported a net profit margin of 15% in recent periods, reflecting its efficiency in converting sales into actual profit.

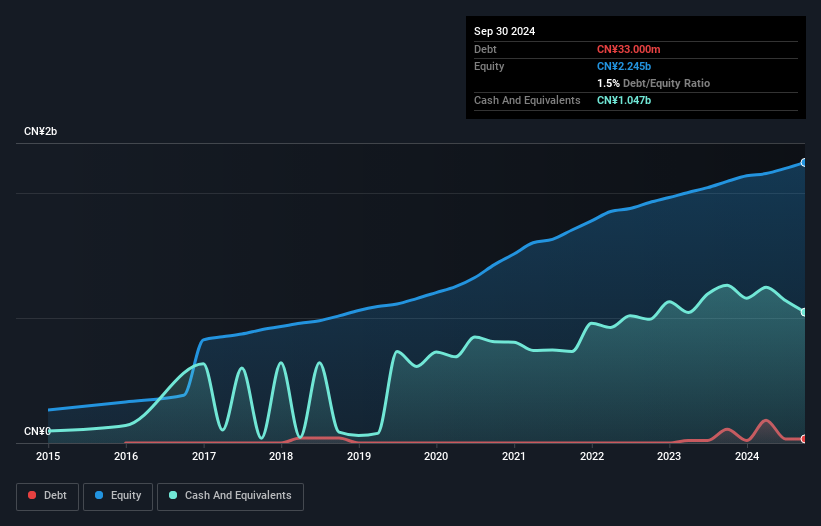

Kingdomway, a nimble player in the health supplements sector, has shown resilience despite industry challenges. Its earnings surged by 66.9% last year, outpacing the broader pharmaceuticals sector which saw a -1.2% change. With sales reaching CNY 2,342 million for the nine months ending September 2024, revenue grew slightly from CNY 2,321 million in the previous period. Net income was CNY 220 million compared to CNY 243 million previously; however, Kingdomway's debt-to-equity ratio improved significantly from 44.4% to 26.8% over five years and it holds more cash than total debt, indicating financial prudence amidst fluctuating earnings per share at CNY 0.36 from continuing operations.

Yangzhou Seashine New MaterialsLtd (SZSE:300885)

Simply Wall St Value Rating: ★★★★★★

Overview: Yangzhou Seashine New Materials Co., Ltd. specializes in the design, production, and marketing of powder metallurgy structural parts in China, with a market cap of CN¥3.11 billion.

Operations: Yangzhou Seashine generates revenue primarily from the sale of powder metallurgy structural parts. The company reported a gross profit margin of 35% in its latest financial period.

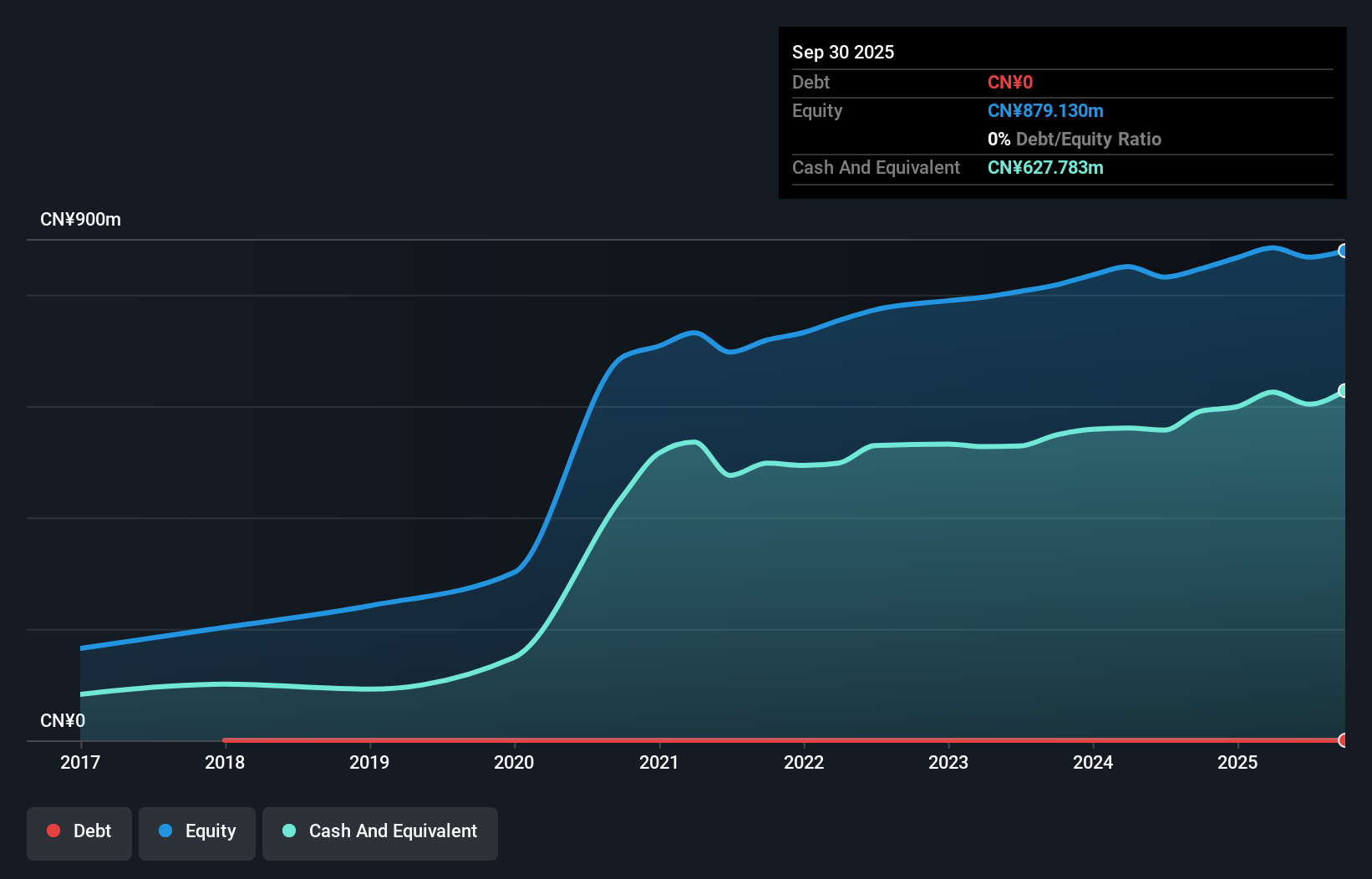

Yangzhou Seashine New Materials Co., Ltd. showcases a robust financial profile, with impressive earnings growth of 84% over the past year, outpacing the Consumer Durables industry average of -2.1%. The company reported CNY 217.17 million in revenue for the nine months ending September 2024, up from CNY 159.59 million during the same period last year, while net income rose to CNY 45.73 million from CNY 28.02 million previously. Notably debt-free for five years and consistently generating positive free cash flow, Yangzhou Seashine's high-quality earnings reflect its solid operational efficiency and strategic positioning within its sector.

Key Takeaways

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4703 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002626

Xiamen Kingdomway Group

Engages in the manufacturing and sale of the nutrition and health products in China and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.