- China

- /

- Aerospace & Defense

- /

- SZSE:301050

Undiscovered Gems Promising Stocks To Explore In November 2024

Reviewed by Simply Wall St

In the current global market landscape, smaller-cap indexes have been outperforming their larger counterparts, with U.S. indices nearing record highs amid broad-based gains and a robust labor market driving positive sentiment. As investors navigate this environment marked by geopolitical tensions and economic optimism, identifying promising stocks often involves looking for those with strong fundamentals and growth potential that might be overlooked in the broader market rally.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Standard Chartered Bank Kenya | 40.67% | 12.22% | 22.08% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We'll examine a selection from our screener results.

J.S. Corrugating Machinery (SZSE:000821)

Simply Wall St Value Rating: ★★★★☆☆

Overview: J.S. Corrugating Machinery Co., Ltd. specializes in the R&D, design, production, and sale of non-standard smart equipment for photovoltaics and corrugated packaging industries both domestically in China and internationally, with a market cap of CN¥8.71 billion.

Operations: The company's primary revenue streams are derived from the sale of non-standard smart equipment for photovoltaics and corrugated packaging. A notable financial metric is its gross profit margin, which stands at 28.5%.

J.S. Corrugating Machinery, a notable player in the machinery sector, has shown impressive financial performance with earnings growth of 18% over the past year, outpacing the industry average of -0.4%. The company reported sales of CNY 6.66 billion for nine months ending September 2024, up from CNY 4.95 billion a year earlier, while net income rose to CNY 432.95 million from CNY 298.43 million. Trading at a price-to-earnings ratio of 18.6x—below the CN market average—the firm offers good value and maintains positive free cash flow despite an increased debt-to-equity ratio from 23.8% to 31.8% over five years.

Ruida FuturesLtd (SZSE:002961)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ruida Futures Co., Ltd. operates as a futures company in China, with a market cap of CN¥6.77 billion.

Operations: Ruida generates revenue primarily through its futures trading operations. The company's financial performance is characterized by a net profit margin of 15%.

Ruida Futures, a promising player in the financial sector, has demonstrated impressive growth with earnings surging by 42% over the past year, outpacing the Capital Markets industry's -12.6%. The company's price-to-earnings ratio stands at 20.6x, which is favorable compared to the CN market's 35.5x. Despite an increase in its debt-to-equity ratio from 24% to 28% over five years, Ruida maintains a healthy balance with more cash than total debt and high-quality earnings. Recent reports show revenue of CNY 1.67 billion for nine months ending September 2024 and net income of CNY 271 million, reflecting robust performance amidst industry challenges.

Chengdu RML Technology (SZSE:301050)

Simply Wall St Value Rating: ★★★★★★

Overview: Chengdu RML Technology Co., Ltd. specializes in the research, development, manufacture, and testing of millimeter-wave microsystems and has a market cap of CN¥12.72 billion.

Operations: RML Technology generates revenue primarily from its millimeter-wave microsystems. The company's cost structure is influenced by research and development expenses, along with manufacturing costs. It has a market capitalization of CN¥12.72 billion, reflecting its position in the industry.

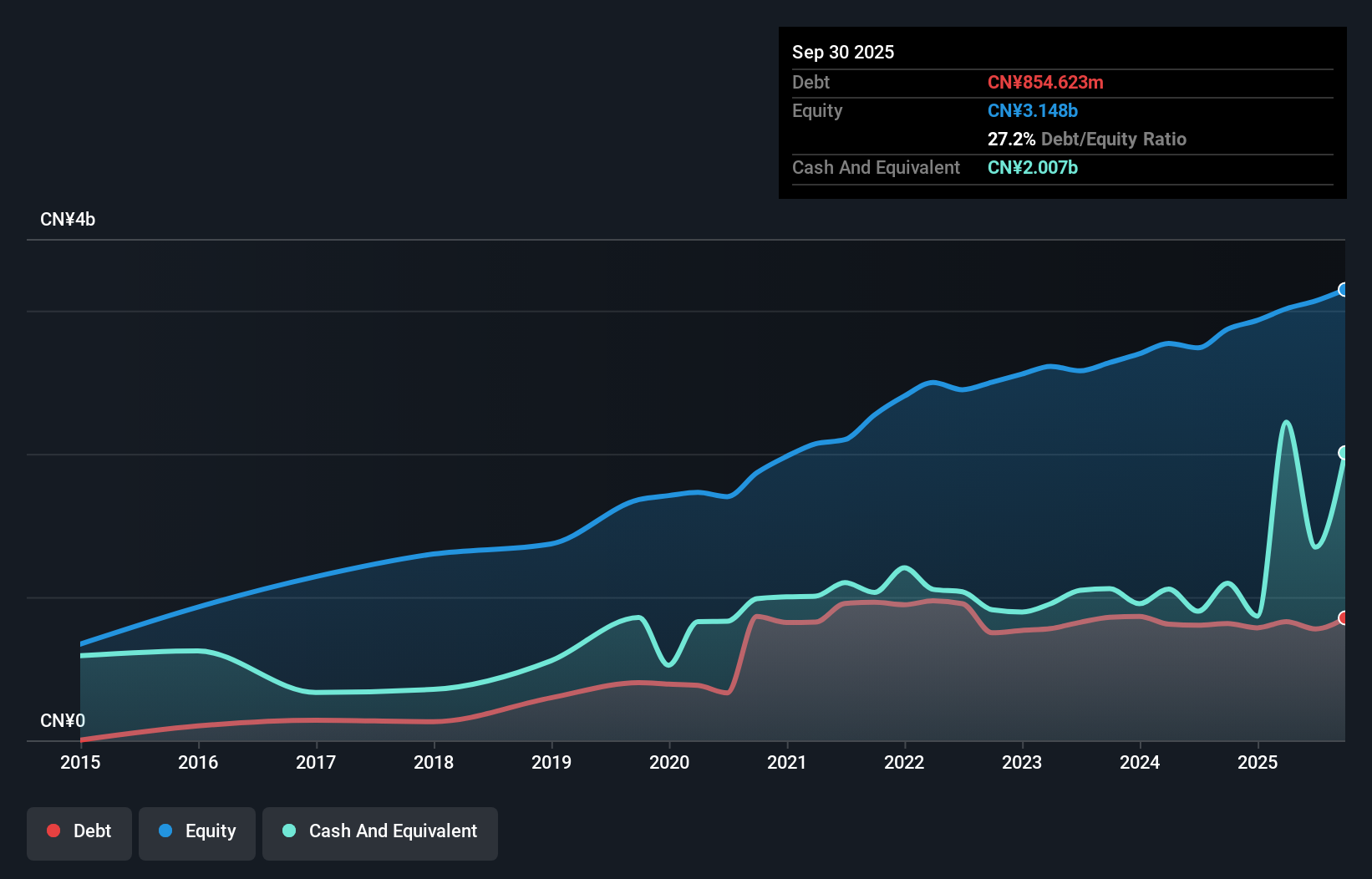

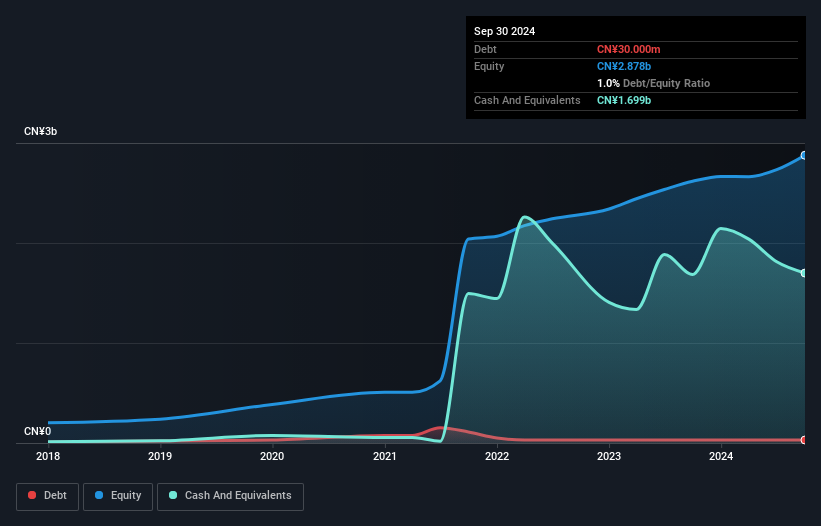

RML Technology has shown robust performance with its earnings surging 41% over the past year, outpacing the Aerospace & Defense industry. The company's net income for the first nine months of 2024 was CNY 373.8 million, up from CNY 264.28 million a year earlier, reflecting strong operational momentum. Its debt-to-equity ratio impressively decreased from 7.9% to just 1% over five years, indicating prudent financial management. Despite a volatile share price recently, RML maintains high-quality earnings and offers good value with a price-to-earnings ratio of 31.1x below the CN market average of 35.5x.

- Unlock comprehensive insights into our analysis of Chengdu RML Technology stock in this health report.

Gain insights into Chengdu RML Technology's past trends and performance with our Past report.

Next Steps

- Explore the 4622 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301050

Chengdu RML Technology

Engages in the research, development, manufacture, and testing of millimeter-wave microsystems.

Flawless balance sheet with proven track record.