Insiders Back Fujian Apex SoftwareLTD And 2 More Leading Growth Stocks

Reviewed by Simply Wall St

As global markets experience broad-based gains, with U.S. indexes approaching record highs and smaller-cap indexes outperforming large-caps, investor sentiment remains cautiously optimistic amid geopolitical tensions and policy uncertainties. In this environment of mixed macroeconomic signals, growth companies with high insider ownership often attract attention due to the confidence they inspire among investors who value management's vested interest in the company's success.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Pharma Mar (BME:PHM) | 11.8% | 56.9% |

| CD Projekt (WSE:CDR) | 29.7% | 29.6% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 103.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 95% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Let's dive into some prime choices out of the screener.

Fujian Apex SoftwareLTD (SHSE:603383)

Simply Wall St Growth Rating: ★★★★☆☆

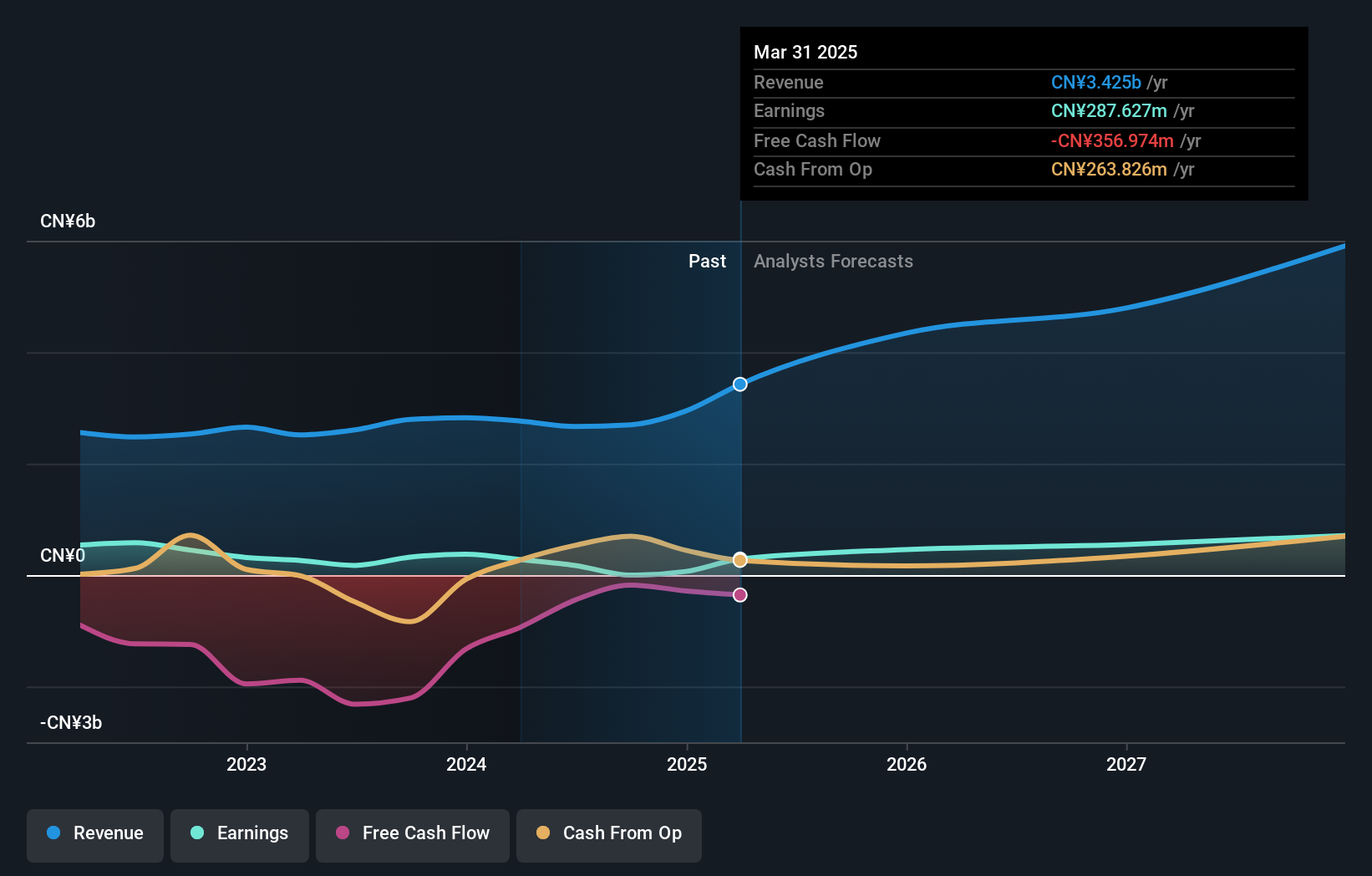

Overview: Fujian Apex Software Co., LTD is a professional platform software and information service provider in China with a market cap of CN¥7.90 billion.

Operations: The company generates revenue of CN¥707.34 million from its application software service industry segment.

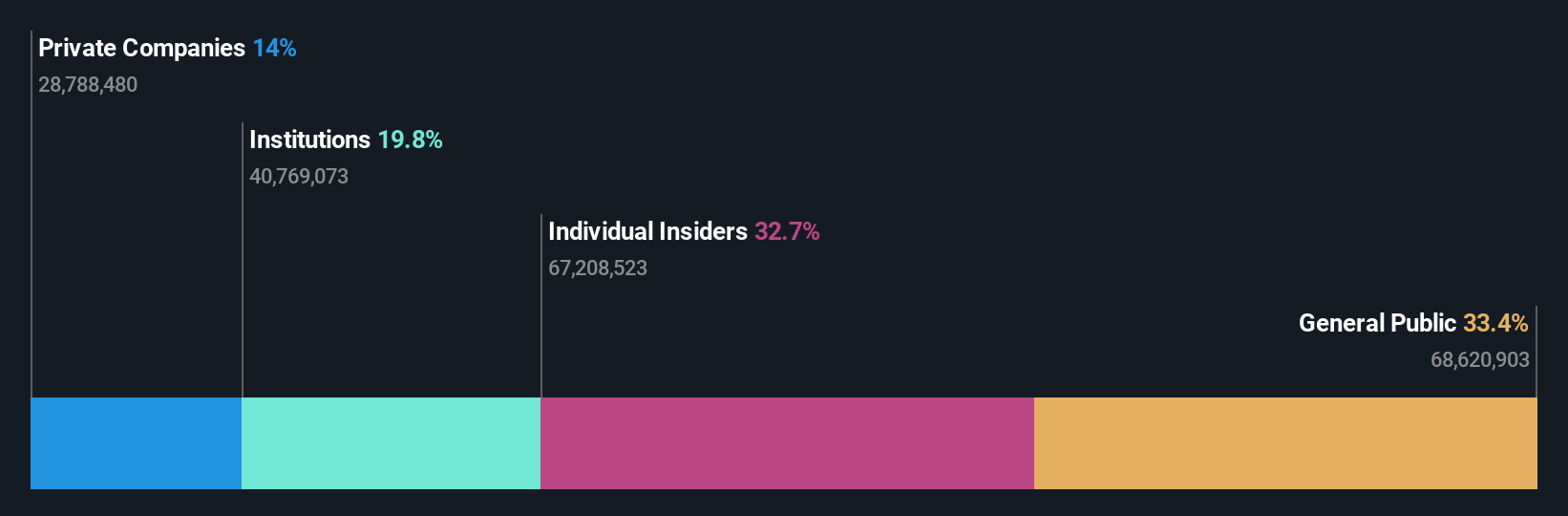

Insider Ownership: 32.7%

Earnings Growth Forecast: 24.1% p.a.

Fujian Apex SoftwareLTD, with substantial insider ownership, is trading at a good value compared to peers and industry. Despite recent earnings decline to CNY 101.24 million for the nine months ended September 2024, its revenue growth forecast of 19% per year outpaces the CN market. However, its dividend yield of 2.75% isn't well covered by earnings or cash flows. The company's earnings are projected to grow significantly at 24.1% annually over the next three years despite high share price volatility recently.

- Click here to discover the nuances of Fujian Apex SoftwareLTD with our detailed analytical future growth report.

- The analysis detailed in our Fujian Apex SoftwareLTD valuation report hints at an deflated share price compared to its estimated value.

Naruida Technology (SHSE:688522)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Naruida Technology Co., Ltd. manufactures and sells polarized multifunctional active phased array radars in China, with a market cap of CN¥12.16 billion.

Operations: The company's revenue is primarily derived from its Scientific & Technical Instruments segment, totaling CN¥235.19 million.

Insider Ownership: 17.8%

Earnings Growth Forecast: 72.3% p.a.

Naruida Technology, with significant insider ownership, shows promising growth potential despite recent earnings declines. Its earnings are forecasted to grow at a robust 72.3% annually, outpacing the CN market's average. Revenue is also expected to increase rapidly by 60.8% per year. However, net profit margins have decreased from last year and share price volatility remains high. Recent inclusion in the S&P Global BMI Index and ongoing share buybacks reflect strategic positioning for future growth.

- Delve into the full analysis future growth report here for a deeper understanding of Naruida Technology.

- Our valuation report unveils the possibility Naruida Technology's shares may be trading at a premium.

Luoyang Xinqianglian Slewing Bearing (SZSE:300850)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Luoyang Xinqianglian Slewing Bearing Co., Ltd. operates in the manufacturing sector, specializing in the production of slewing bearings, and has a market capitalization of CN¥8.86 billion.

Operations: Revenue segments for the company include various components related to its core manufacturing operations, though specific figures are not provided in the text.

Insider Ownership: 36.3%

Earnings Growth Forecast: 106.3% p.a.

Luoyang Xinqianglian Slewing Bearing, despite recent earnings challenges, is projected to experience significant growth with expected annual revenue increases of 34.1%, surpassing the CN market average. The company forecasts becoming profitable within three years, highlighting strong growth potential. However, recent financial results show a net loss of CNY 36.09 million for the nine months ended September 2024, compared to a profit last year, and share price volatility remains high.

- Dive into the specifics of Luoyang Xinqianglian Slewing Bearing here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Luoyang Xinqianglian Slewing Bearing is trading beyond its estimated value.

Key Takeaways

- Click this link to deep-dive into the 1508 companies within our Fast Growing Companies With High Insider Ownership screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300850

Luoyang Xinqianglian Slewing Bearing

Luoyang Xinqianglian Slewing Bearing Co., Ltd.

High growth potential with adequate balance sheet.