- China

- /

- Diversified Financial

- /

- SZSE:300773

Asian Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

Amidst a backdrop of global economic shifts, Asian markets have shown resilience, with Chinese stock indices rising due to robust export data and Japan's markets buoyed by strong corporate earnings. In this context, growth companies with substantial insider ownership can be particularly appealing as they often indicate confidence in the company's future potential and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.7% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Techwing (KOSDAQ:A089030) | 19.1% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 25.8% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 24.3% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| Laopu Gold (SEHK:6181) | 35.5% | 43% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 32.8% |

| Fulin Precision (SZSE:300432) | 12.8% | 43.7% |

Let's explore several standout options from the results in the screener.

BIWIN Storage Technology (SHSE:688525)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BIWIN Storage Technology Co., Ltd. engages in the research, development, design, packaging, testing, production, and sale of semiconductor memories with a market cap of CN¥30.50 billion.

Operations: The company generates revenue of CN¥6.51 billion from its semiconductor segment.

Insider Ownership: 17.7%

Earnings Growth Forecast: 57.7% p.a.

BIWIN Storage Technology is poised for robust growth, with revenue projected to increase over 20% annually, outpacing the broader Chinese market. Despite a low forecasted return on equity of 16%, the company is expected to achieve profitability within three years, surpassing average market growth rates. Recent events include an upcoming earnings release and a special shareholders meeting. There has been no significant insider trading activity in recent months, reflecting stable insider confidence.

- Click here to discover the nuances of BIWIN Storage Technology with our detailed analytical future growth report.

- The valuation report we've compiled suggests that BIWIN Storage Technology's current price could be inflated.

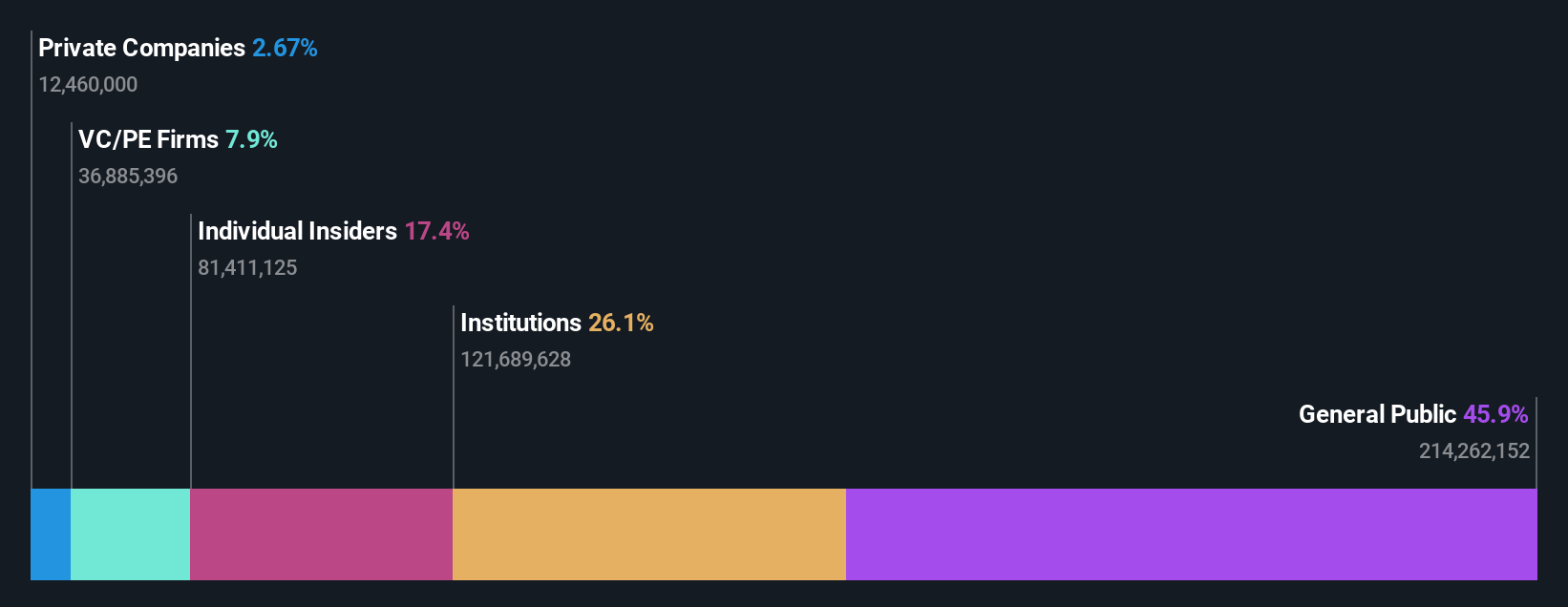

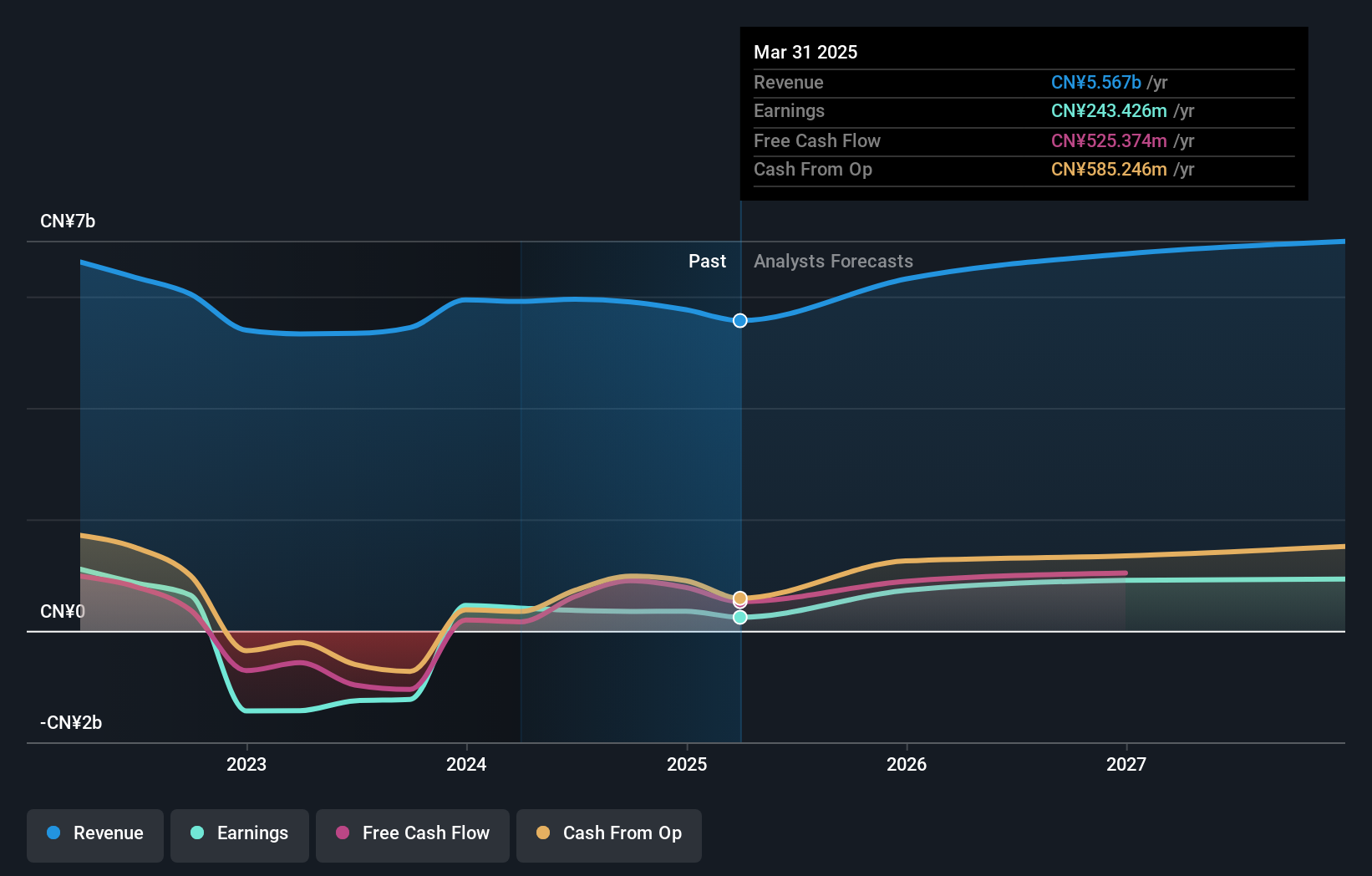

Lakala Payment (SZSE:300773)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lakala Payment Co., Ltd. operates in the digital payment and technology service sector in China, with a market cap of CN¥22.11 billion.

Operations: Lakala Payment Co., Ltd. generates revenue through its digital payment and technology services in China.

Insider Ownership: 12.5%

Earnings Growth Forecast: 28.6% p.a.

Lakala Payment is set for substantial earnings growth at 28.6% annually, outpacing the Chinese market, though revenue growth lags behind. Profit margins have declined from last year, and the dividend yield of 2.14% is not well covered by earnings or cash flows. Recent amendments to company bylaws were approved at the AGM alongside a cash dividend declaration for 2024. The company's share price has been highly volatile recently with no significant insider trading activity noted in three months.

- Dive into the specifics of Lakala Payment here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Lakala Payment shares in the market.

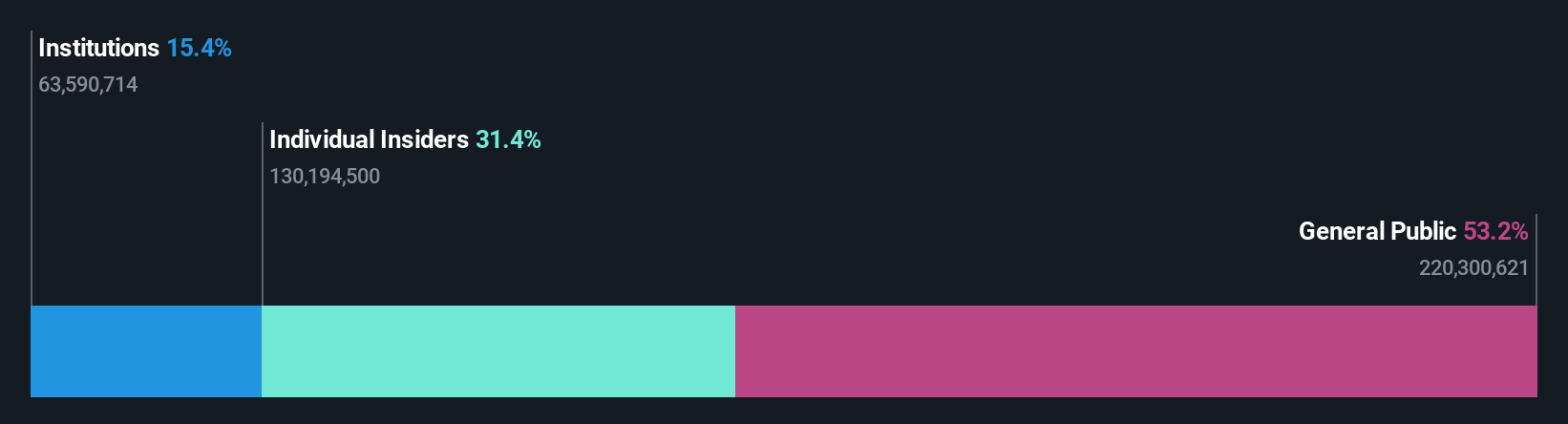

Luoyang Xinqianglian Slewing Bearing (SZSE:300850)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Luoyang Xinqianglian Slewing Bearing Co., Ltd. (SZSE:300850) specializes in the production and sale of slewing bearings, with a market cap of approximately CN¥14.76 billion.

Operations: Luoyang Xinqianglian Slewing Bearing Co., Ltd. generates its revenue primarily from the production and sale of slewing bearings.

Insider Ownership: 34.2%

Earnings Growth Forecast: 29.6% p.a.

Luoyang Xinqianglian Slewing Bearing's earnings are projected to grow significantly at 29.61% annually, surpassing the broader Chinese market. However, revenue growth is expected to be slower than 20% per year. The company announced a reduced cash dividend for 2024 at its recent AGM, reflecting potential strategic reinvestment or financial adjustments. Return on Equity is forecasted to remain low at 9.3%, and there has been no significant insider trading activity in the past three months.

- Click here and access our complete growth analysis report to understand the dynamics of Luoyang Xinqianglian Slewing Bearing.

- Our valuation report unveils the possibility Luoyang Xinqianglian Slewing Bearing's shares may be trading at a premium.

Next Steps

- Take a closer look at our Fast Growing Asian Companies With High Insider Ownership list of 590 companies by clicking here.

- Seeking Other Investments? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300773

Lakala Payment

Engages in digital payment and technology service business in China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives