Asian Growth Stocks With High Insider Ownership December 2025

Reviewed by Simply Wall St

As Asian markets navigate a complex landscape marked by technological enthusiasm and economic uncertainties, investor interest in growth companies with high insider ownership has intensified. In this environment, stocks characterized by strong insider ownership can offer insights into management confidence and alignment of interests, making them compelling considerations for those looking to understand market dynamics.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25.2% | 120.7% |

| SungEel HiTech (KOSDAQ:A365340) | 37.5% | 110.8% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 34.1% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Here we highlight a subset of our preferred stocks from the screener.

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

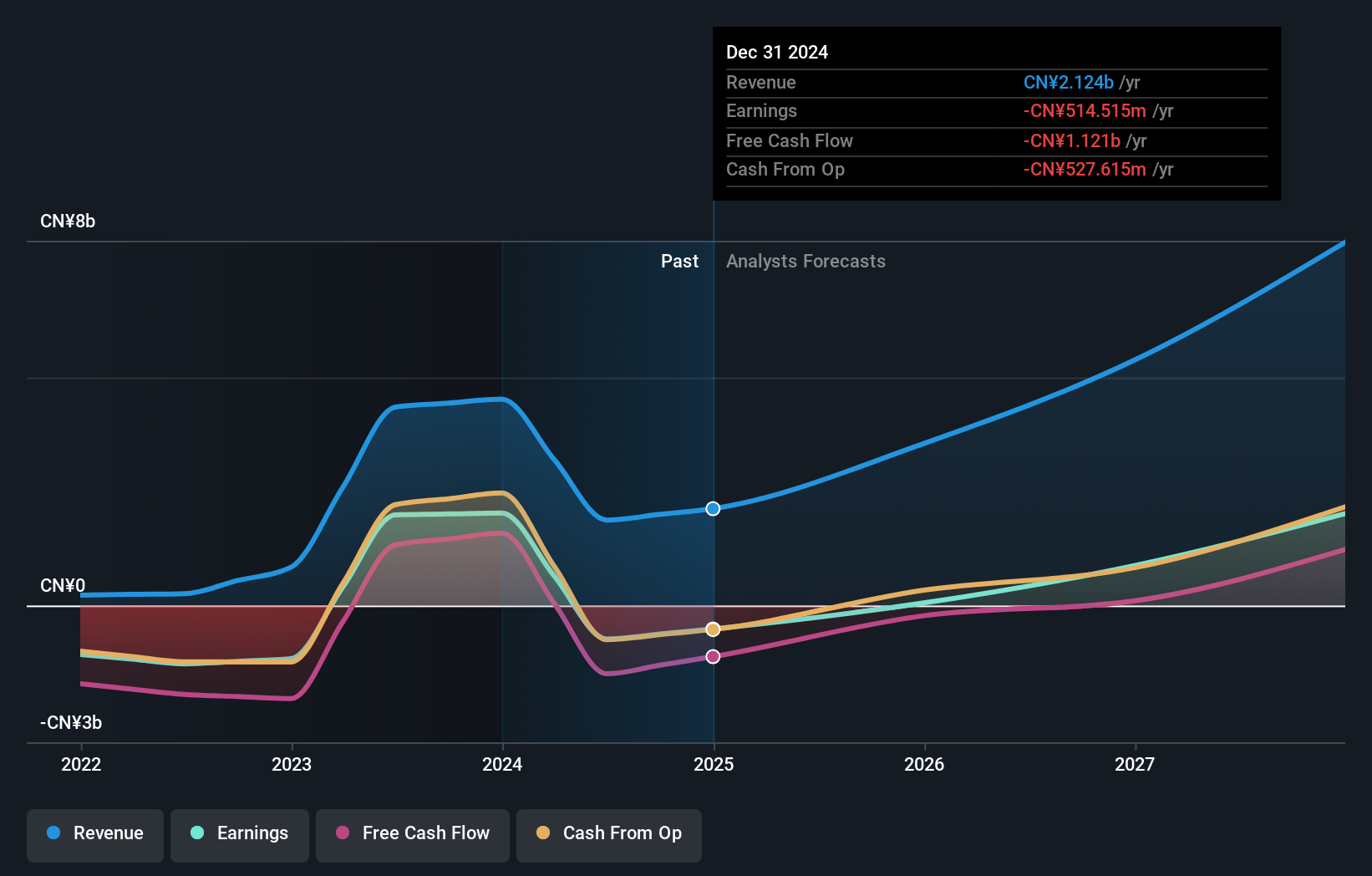

Overview: Akeso, Inc. is a biopharmaceutical company focused on the research, development, manufacture, and commercialization of antibody drugs globally, with a market cap of HK$111.09 billion.

Operations: The company's revenue segment is derived from the research, development, production, and sale of biopharmaceutical products, totaling CN¥2.51 billion.

Insider Ownership: 18.1%

Akeso demonstrates strong growth potential with high insider ownership, supported by forecasts of revenue and earnings growth surpassing market averages. Trading below estimated fair value, it is positioned for profitability within three years. Recent advancements include clinical trial approvals for AK152 in Alzheimer's and significant progress with ivonescimab in cancer therapy, underscoring its innovative pipeline. Despite no recent insider trading activity, Akeso's strategic developments highlight its commitment to addressing critical unmet medical needs across various diseases.

- Dive into the specifics of Akeso here with our thorough growth forecast report.

- Our valuation report here indicates Akeso may be overvalued.

Do-Fluoride New Materials (SZSE:002407)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Do-Fluoride New Materials Co., Ltd. develops, produces, and sells inorganic fluorides, electronic chemicals, lithium-ion batteries, and related materials both in China and internationally with a market cap of CN¥39.88 billion.

Operations: The company's revenue is derived from its activities in inorganic fluorides, electronic chemicals, and lithium-ion batteries along with related materials across domestic and international markets.

Insider Ownership: 13.3%

Do-Fluoride New Materials is poised for substantial growth, with revenue expected to outpace the market at 30.2% annually and earnings projected to grow significantly. Despite a volatile share price and low forecasted return on equity, the company is on track to become profitable within three years. Recent earnings showed improved net income of CNY 78.05 million, indicating positive momentum. However, its dividend yield of 0.58% lacks coverage by earnings or free cash flow.

- Take a closer look at Do-Fluoride New Materials' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Do-Fluoride New Materials is trading beyond its estimated value.

Guangzhou Great Power Energy and Technology (SZSE:300438)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Great Power Energy and Technology Co., Ltd focuses on the research, development, production, and sale of battery products in China with a market capitalization of approximately CN¥29.12 billion.

Operations: The company generates its revenue primarily from the electronic component manufacturing segment, which amounts to CN¥9.89 billion.

Insider Ownership: 34.4%

Guangzhou Great Power Energy and Technology is positioned for strong growth, with revenue expected to increase by 36.2% annually, surpassing the market average. Earnings are projected to grow significantly at 93.16% per year, indicating a path to profitability within three years despite a low forecasted return on equity of 17.7%. Recent earnings reports show improved sales and net income, reflecting positive financial momentum amidst high share price volatility and recent amendments in company bylaws.

- Navigate through the intricacies of Guangzhou Great Power Energy and Technology with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Guangzhou Great Power Energy and Technology is trading behind its estimated value.

Where To Now?

- Investigate our full lineup of 637 Fast Growing Asian Companies With High Insider Ownership right here.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9926

Akeso

A biopharmaceutical company, engages in the research, development, manufacture, and commercialization of antibody drugs worldwide.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026