Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SHSE:688627

Meituan And 2 Top Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

In a week marked by busy earnings reports and economic data, global markets experienced a mixed performance, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating. Amidst this volatility, growth stocks generally lagged behind value shares as cautious earnings from major tech companies influenced market sentiment. In such an environment, identifying growth companies with strong insider ownership can be advantageous; it suggests confidence in the company's future prospects by those who know it best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Brightstar Resources (ASX:BTR) | 14.8% | 84.6% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Underneath we present a selection of stocks filtered out by our screen.

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meituan is a technology retail company operating in the People's Republic of China with a market cap of HK$1.12 trillion.

Operations: The company's revenue is derived from two main segments: Core Local Commerce, contributing CN¥228.13 billion, and New Initiatives, generating CN¥77.56 billion.

Insider Ownership: 11.9%

Meituan demonstrates strong growth potential with earnings forecasted to grow significantly at 26.3% annually, outpacing the Hong Kong market. Recent financial results show substantial improvement, with net income more than doubling year-over-year. Despite no substantial insider buying recently, insider selling has been limited. The company completed significant share buybacks totaling $2 billion and issued $1.2 billion in fixed-income offerings, indicating strategic capital management amidst trading below estimated fair value by 46.8%.

- Dive into the specifics of Meituan here with our thorough growth forecast report.

- According our valuation report, there's an indication that Meituan's share price might be on the expensive side.

Shenzhen SEICHI Technologies (SHSE:688627)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen SEICHI Technologies Co., Ltd. specializes in the research, development, production, and sale of new display device testing equipment in China, with a market cap of CN¥7.57 billion.

Operations: The company's revenue primarily comes from the research, development, production, and sale of new display device testing equipment in China.

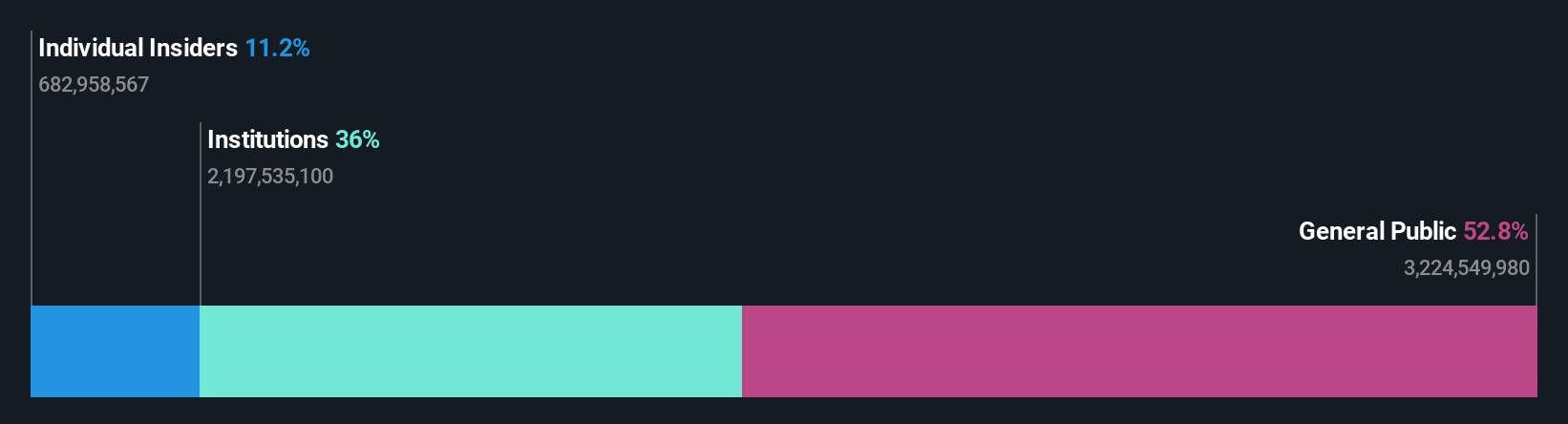

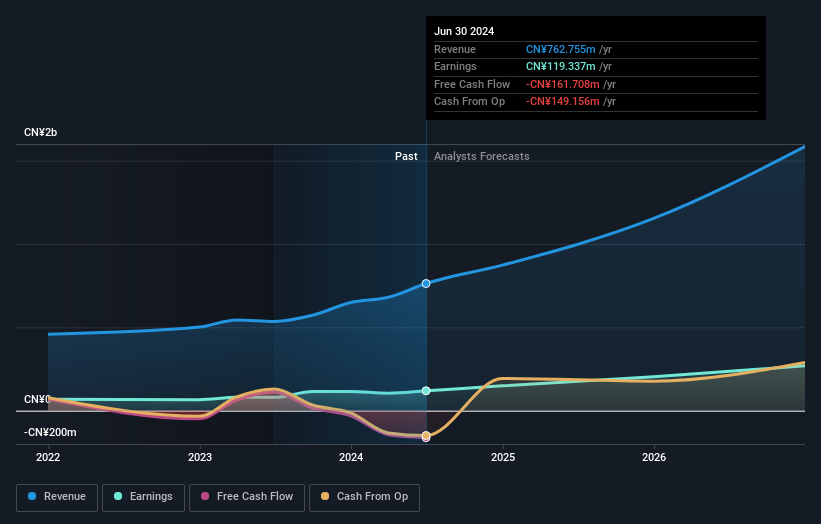

Insider Ownership: 18.6%

Shenzhen SEICHI Technologies is poised for significant growth, with earnings projected to increase by 35.75% annually, surpassing the Chinese market average. Despite a decline in net profit margin from last year and volatile share prices, revenue is expected to grow at 29.1% annually, outpacing the market significantly. Recent earnings reports show increased sales but slightly lower net income compared to last year. The company completed a share buyback of 1 million shares worth CNY 44.76 million, reflecting strategic capital management efforts.

- Take a closer look at Shenzhen SEICHI Technologies' potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Shenzhen SEICHI Technologies' share price might be too optimistic.

Shenzhen Zhaowei Machinery & Electronics (SZSE:003021)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Zhaowei Machinery & Electronics Co., Ltd. operates in the machinery and electronics sector with a market cap of CN¥13.36 billion.

Operations: Shenzhen Zhaowei Machinery & Electronics Co., Ltd. generates revenue from its operations in the machinery and electronics sector.

Insider Ownership: 18.2%

Shenzhen Zhaowei Machinery & Electronics is set for robust growth, with revenue expected to grow at 25.8% annually, outpacing the Chinese market. Recent earnings show a strong performance with CNY 1.06 billion in sales and net income of CNY 159.16 million for the first nine months of 2024. Earnings are projected to rise by 29.84% annually over the next three years, despite a low future return on equity forecast of 10.2%.

- Unlock comprehensive insights into our analysis of Shenzhen Zhaowei Machinery & Electronics stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Shenzhen Zhaowei Machinery & Electronics shares in the market.

Key Takeaways

- Dive into all 1522 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688627

Shenzhen SEICHI Technologies

Engages in the research and development, production, and sale of new display device testing equipment in China.