- China

- /

- Electronic Equipment and Components

- /

- SZSE:300684

3 Undiscovered Gems in Global Markets with Strong Fundamentals

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by dovish Federal Reserve signals and subdued economic data, small-cap stocks have emerged as notable outperformers, with the Russell 2000 Index surging by over 5% in recent weeks. In this environment, identifying stocks with strong fundamentals becomes crucial for investors seeking to capitalize on growth opportunities while managing risks effectively.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Creative & Innovative System | 0.72% | 37.76% | 64.55% | ★★★★★★ |

| Xinya Electronic | 51.57% | 28.63% | 3.77% | ★★★★★☆ |

| JiaXing Gas Group | 49.18% | 19.35% | 19.32% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| TSTE | 37.68% | 4.91% | -5.78% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Suzhou Fengbei Biotech Stock | 42.33% | 18.50% | 13.12% | ★★★★☆☆ |

| Grupo Gigante S. A. B. de C. V | 34.19% | 6.87% | 32.94% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

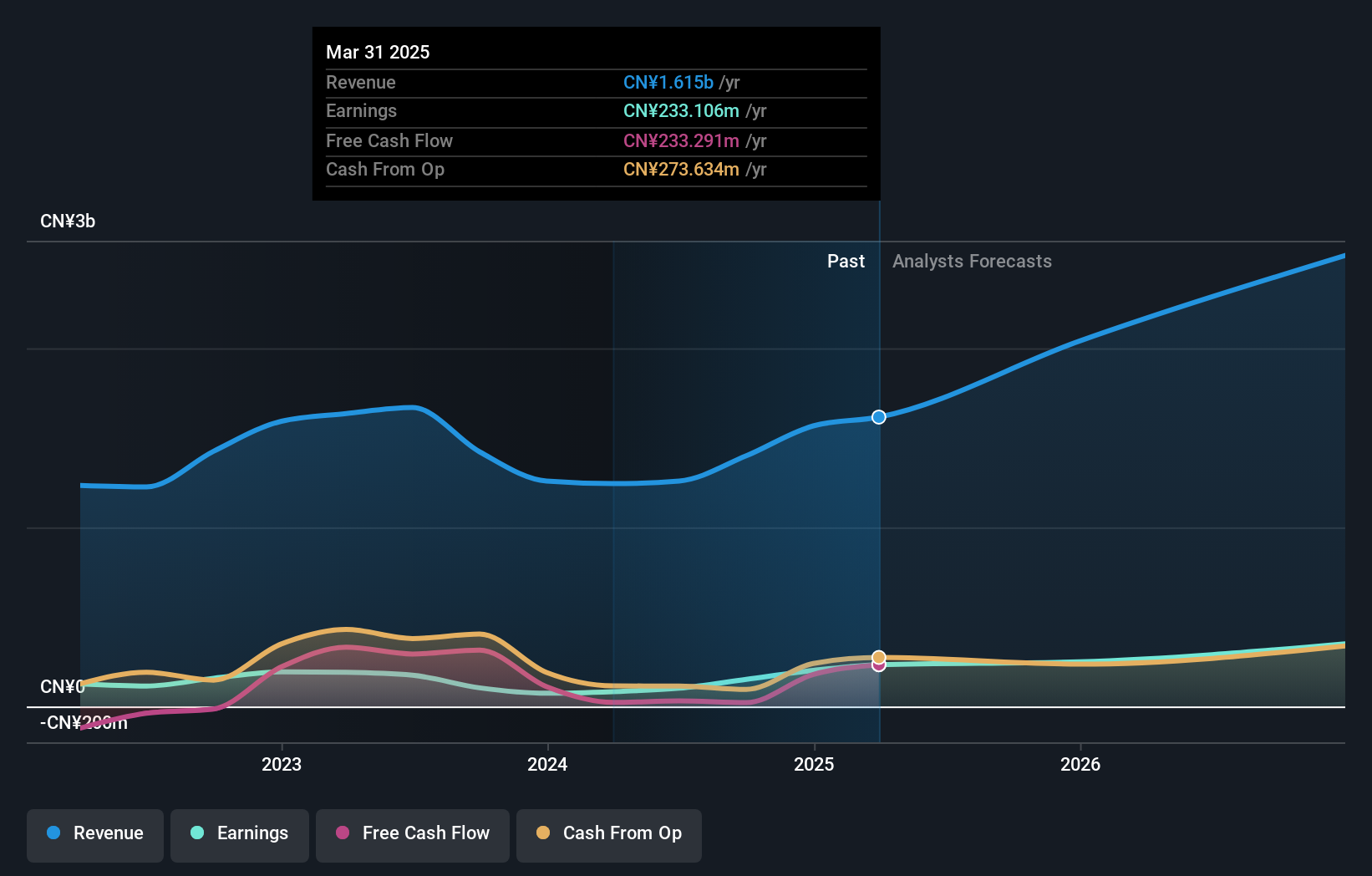

Anhui Coreach TechnologyLtd (SZSE:002983)

Simply Wall St Value Rating: ★★★★★☆

Overview: Anhui Coreach Technology Co., Ltd specializes in the design, development, production, and sale of display materials, modules, and terminals with a market capitalization of CN¥5.33 billion.

Operations: The company generates revenue primarily through the sale of display materials, modules, and terminals. It has a market capitalization of CN¥5.33 billion.

Anhui Coreach Technology, a compact player in its sector, reported a net income of CNY 94.27 million for the first nine months of 2025, up from CNY 74.97 million the previous year. With earnings per share rising to CNY 0.42 from CNY 0.34, it shows robust performance despite sales dipping to CNY 732.72 million from last year's CNY 764.13 million. Its financial health is underscored by interest payments covered well by EBIT at a ratio of 37 times and an earnings growth rate that outpaces the industry standard significantly at 30%. The company also repurchased shares worth CNY 3.72 million recently, reflecting confidence in its value proposition amidst evolving market dynamics.

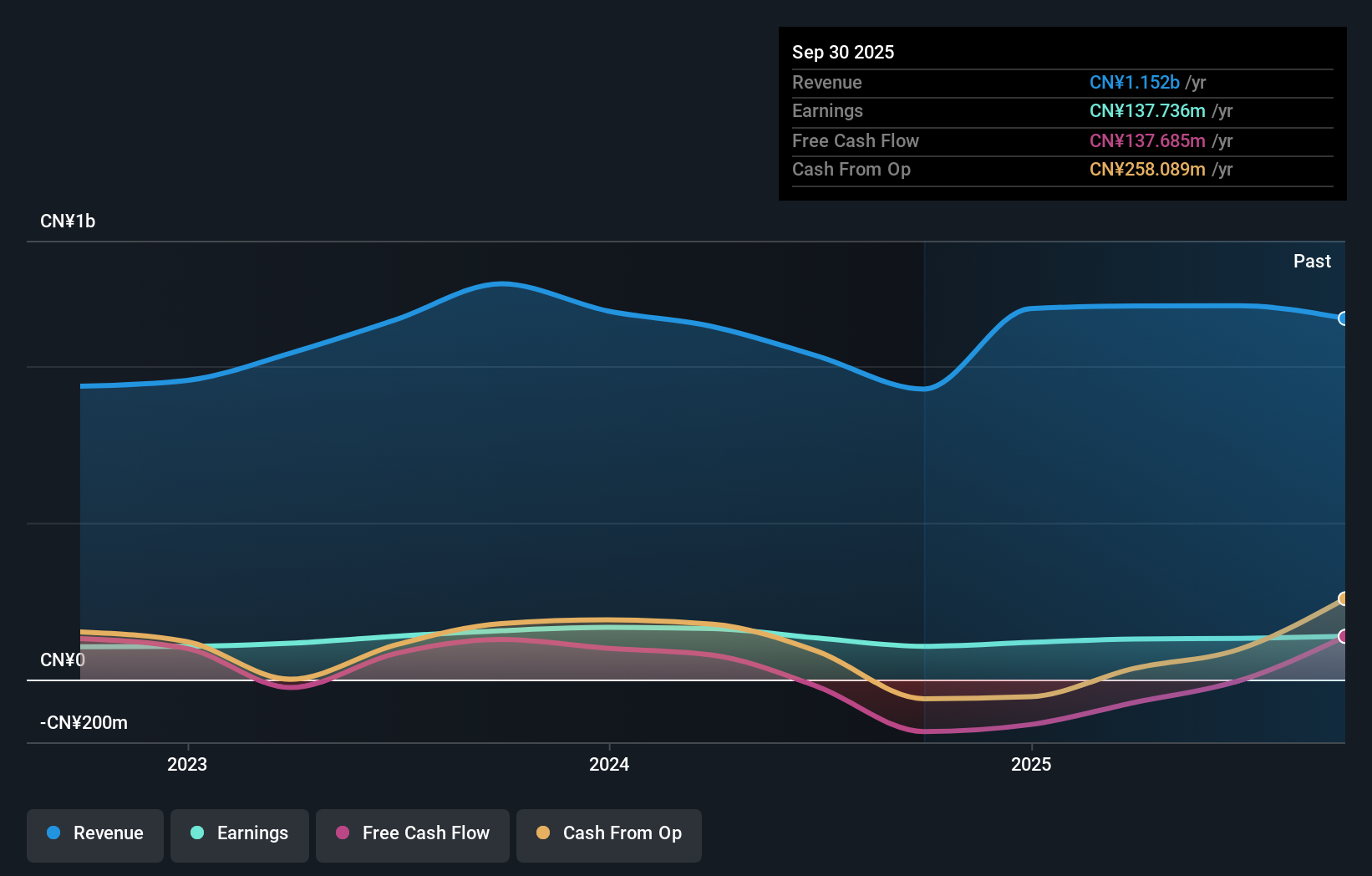

Jones Tech (SZSE:300684)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jones Tech PLC specializes in providing materials solutions for intelligent electronic equipment in China, with a market capitalization of CN¥12.77 billion.

Operations: Jones Tech PLC generates revenue primarily through its materials solutions tailored for intelligent electronic equipment. The company has a market capitalization of CN¥12.77 billion, indicating its significant presence in the industry.

Jones Tech, a rising player in the electronics sector, has demonstrated impressive earnings growth of 111.9% over the past year, outpacing the industry average of 9%. The company is trading at a favorable price-to-earnings ratio of 40.3x compared to the broader CN market's 43.9x, indicating good relative value. Despite a volatile share price recently, Jones Tech maintains high-quality earnings and has more cash than its total debt. Recent financials show net income climbing to CNY 251.7 million from CNY 132.06 million last year, with basic EPS increasing to CNY 0.8446 from CNY 0.4432 previously.

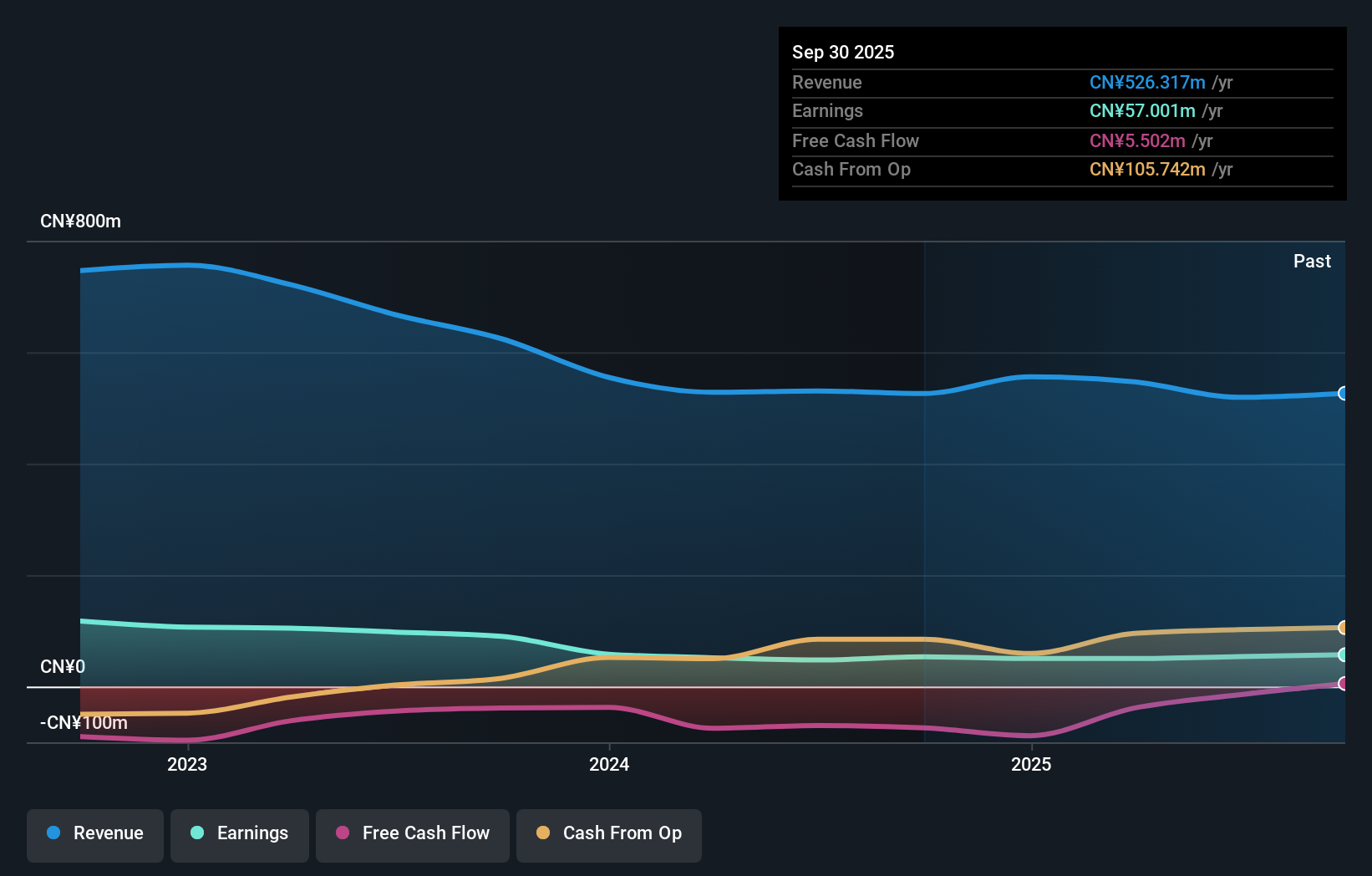

Xiamen Jiarong TechnologyLtd (SZSE:301148)

Simply Wall St Value Rating: ★★★★★★

Overview: Xiamen Jiarong Technology Corp., Ltd. specializes in the manufacturing and sale of environmental protection equipment, with a market capitalization of CN¥4.61 billion.

Operations: Xiamen Jiarong Technology generates revenue primarily through the sale of environmental protection equipment. The company's financial performance includes a notable net profit margin trend, which has shown fluctuations over recent reporting periods.

Xiamen Jiarong Technology, with a market presence that belies its size, recently reported earnings for the first nine months of 2025. The company saw sales of ¥362.46 million, down from ¥391.98 million the previous year, while net income rose to ¥59.3 million from ¥52.5 million, indicating improved profitability despite lower revenue. Earnings per share increased to ¥0.51 from ¥0.45 a year ago, reflecting solid operational performance amidst industry challenges. The company's debt-to-equity ratio has decreased over five years from 11.8% to 8.5%, suggesting prudent financial management and an encouraging outlook on its fiscal health and growth potential in the machinery sector.

- Dive into the specifics of Xiamen Jiarong TechnologyLtd here with our thorough health report.

Understand Xiamen Jiarong TechnologyLtd's track record by examining our Past report.

Summing It All Up

- Unlock more gems! Our Global Undiscovered Gems With Strong Fundamentals screener has unearthed 3005 more companies for you to explore.Click here to unveil our expertly curated list of 3008 Global Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300684

Jones Tech

Provides materials solutions for intelligent electronic equipment in China.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026