As global markets navigate the complexities of new U.S. tariffs and mixed economic signals, small-cap stocks have shown resilience, with little distinction in performance between large-caps and small-caps. In this environment, identifying undiscovered gems requires a keen eye for companies that can capitalize on shifting trade dynamics and consumer trends while maintaining robust financial health.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Indofood Agri Resources | 30.05% | 2.36% | 41.87% | ★★★★★★ |

| Daphne International Holdings | NA | -40.78% | 85.98% | ★★★★★★ |

| Thai Steel Cable | NA | 3.84% | 18.67% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Taiyo KagakuLtd | 0.69% | 5.32% | -0.36% | ★★★★★☆ |

| Tai Sin Electric | 28.69% | 9.56% | 4.66% | ★★★★★☆ |

| Shanghai Pioneer Holding | 5.59% | 4.81% | 18.60% | ★★★★★☆ |

| Hong Leong Finance | 0.07% | 6.89% | 6.61% | ★★★★★☆ |

| Uju Holding | 33.18% | 8.01% | -15.93% | ★★★★★☆ |

| Sing Investments & Finance | 0.29% | 9.07% | 12.24% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

KTK Group (SHSE:603680)

Simply Wall St Value Rating: ★★★★★☆

Overview: KTK Group Co., Ltd. engages in the research, development, production, sale, and servicing of interior systems, electrical controlling systems, and vehicle equipment for high-speed trains and other rail vehicles globally; it has a market capitalization of CN¥10.12 billion.

Operations: KTK Group generates revenue primarily from the sale of interior systems, electrical controlling systems, and vehicle equipment for high-speed trains and other rail vehicles. The company's cost structure includes expenses related to research, development, production, and servicing of these products. It has a market capitalization of CN¥10.12 billion.

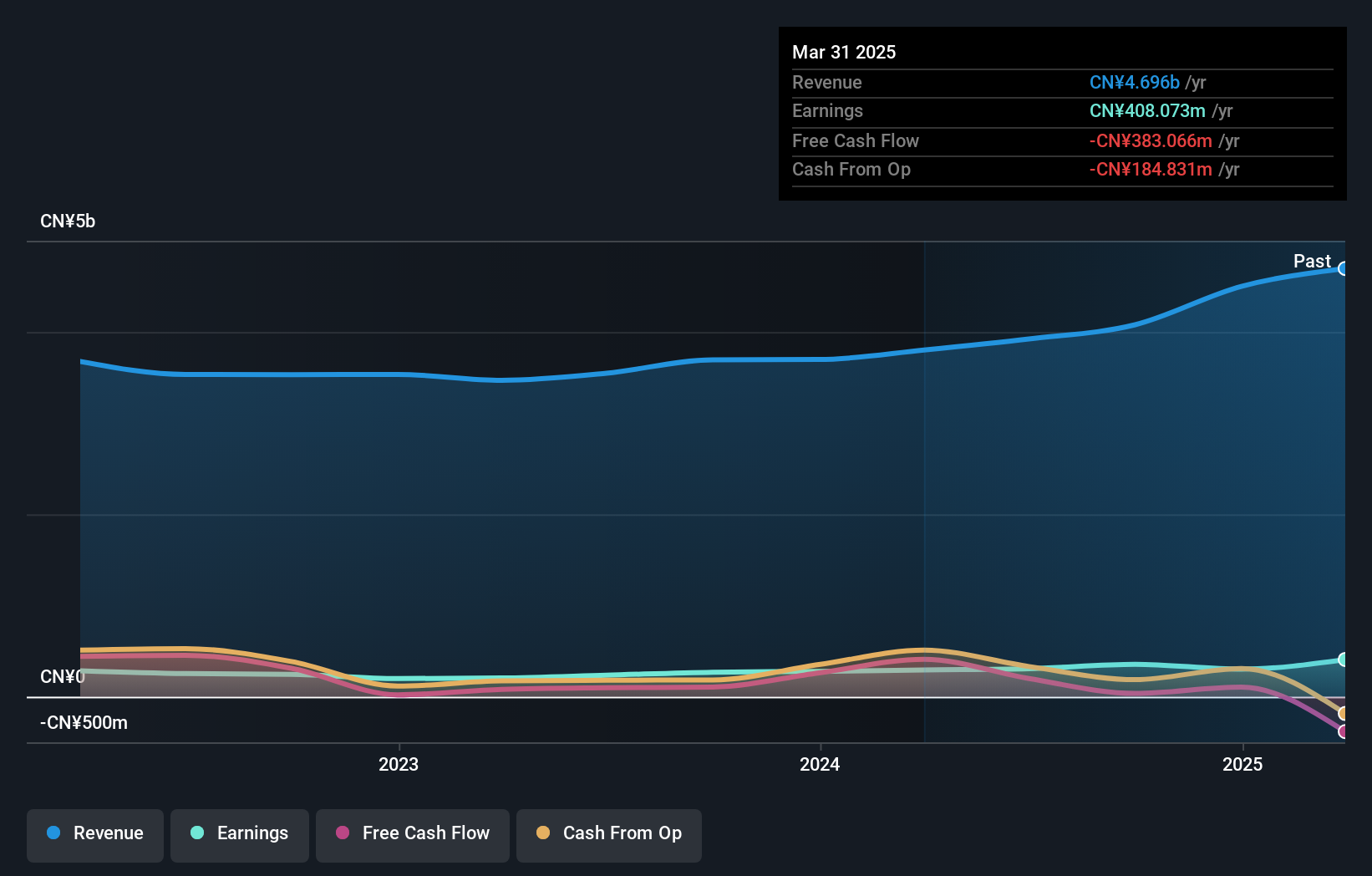

KTK Group, a small cap player in the machinery sector, has seen its earnings grow by 38.9% over the past year, outpacing the industry average of 1%. Despite a volatile share price recently, KTK's net income for Q1 2025 rose to CNY 149.4 million from CNY 43.39 million last year. The company has reduced its debt-to-equity ratio from 62.9% to a satisfactory 20.6% over five years, reflecting prudent financial management. While free cash flow remains negative, KTK's price-to-earnings ratio at 24.5x suggests it is valued attractively compared to the broader CN market average of 40.4x.

- Unlock comprehensive insights into our analysis of KTK Group stock in this health report.

Examine KTK Group's past performance report to understand how it has performed in the past.

Guangzhou Tech-Long Packaging MachineryLtd (SZSE:002209)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangzhou Tech-Long Packaging Machinery Co., Ltd. specializes in the production of liquid packing machines and automatic equipment, with a market cap of CN¥3.35 billion.

Operations: Tech-Long generates revenue primarily from its liquid packing machines and automatic equipment segment, amounting to CN¥1.68 billion. The company's financial performance is influenced by various factors, including its cost structure and market conditions.

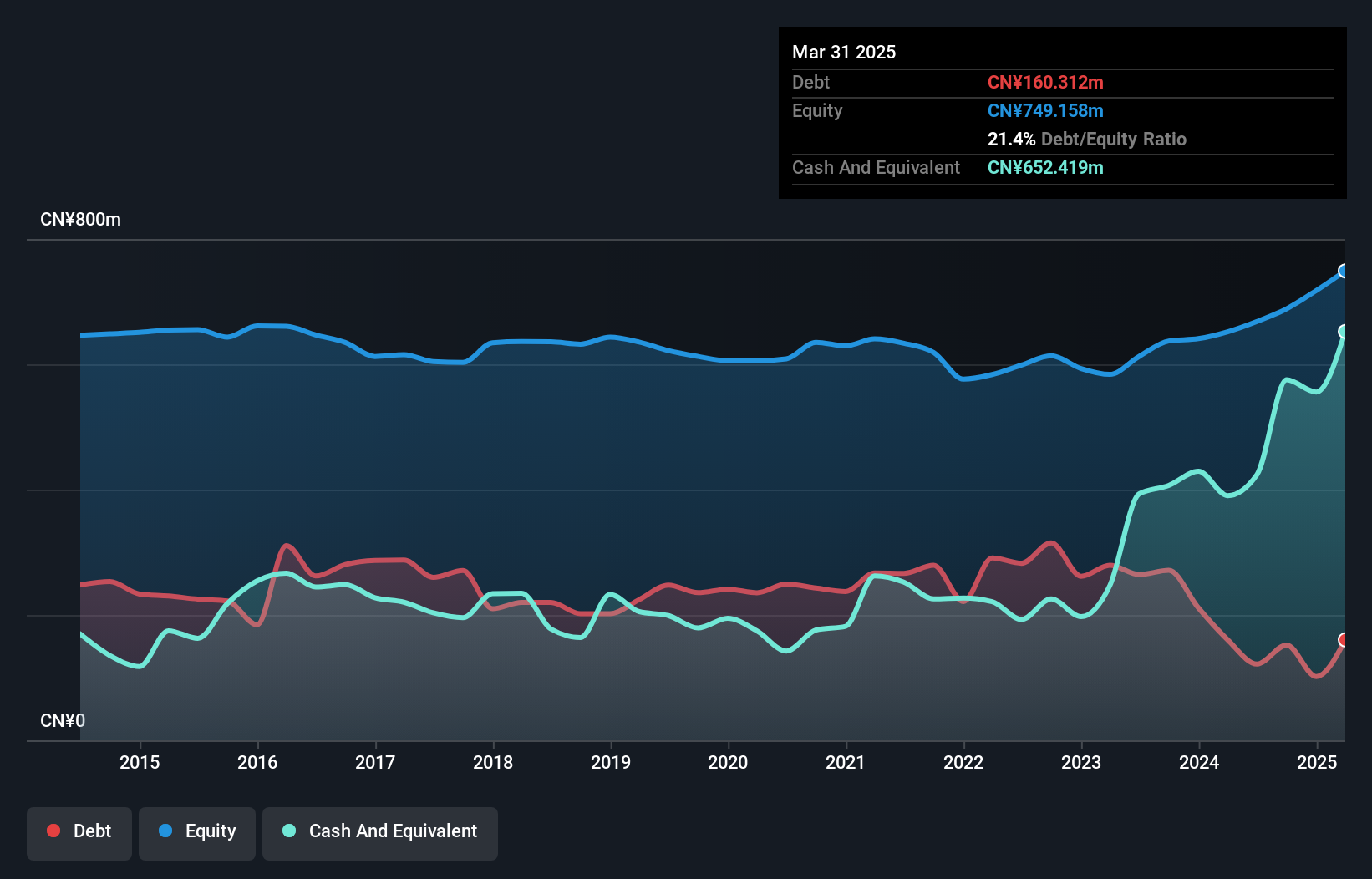

Guangzhou Tech-Long Packaging Machinery, a small company in the machinery sector, has been making waves with its impressive financial performance. The firm's earnings growth of 39.8% over the past year outpaced the industry average of 1%, showcasing its potential for investors seeking dynamic opportunities. Its price-to-earnings ratio stands at 40.7x, which is below the industry average of 44.1x, indicating potential value. Notably, their debt-to-equity ratio improved from 38.9% to 21.4% over five years, reflecting prudent financial management and a healthy balance sheet position with more cash than total debt—a promising sign for future stability and growth prospects.

- Delve into the full analysis health report here for a deeper understanding of Guangzhou Tech-Long Packaging MachineryLtd.

Learn about Guangzhou Tech-Long Packaging MachineryLtd's historical performance.

Jiangsu NanFang PrecisionLtd (SZSE:002553)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu NanFang Precision Co., Ltd. engages in the research, development, manufacturing, and sale of needle roller bearings, one-way clutches, one-way pulley assemblies, and mechanical parts both domestically in China and internationally with a market capitalization of CN¥8.42 billion.

Operations: The company generates revenue through the sale of needle roller bearings, one-way clutches, one-way pulley assemblies, and mechanical parts. Its market capitalization stands at CN¥8.42 billion.

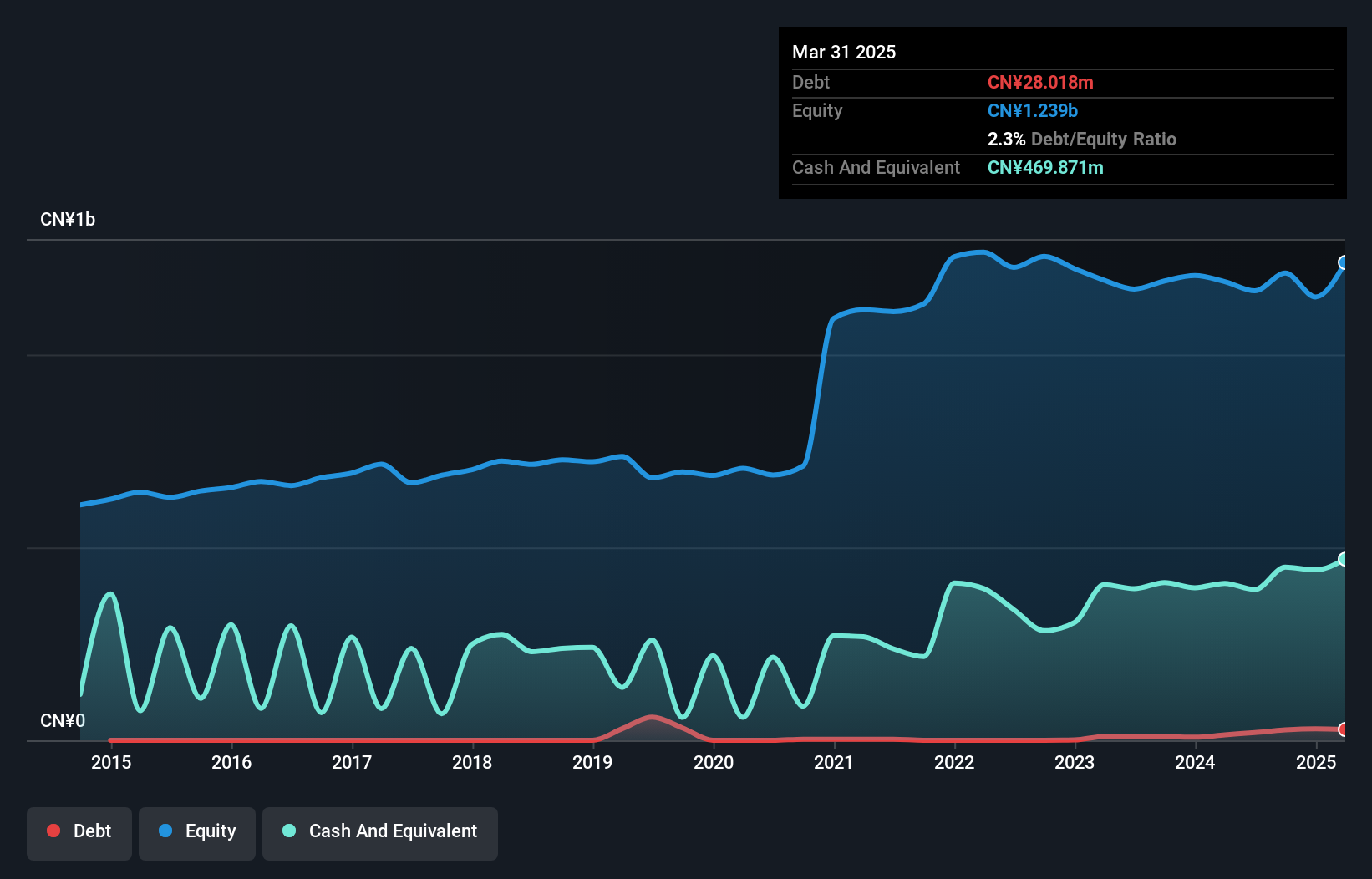

Jiangsu NanFang Precision, a nimble player in the machinery sector, has shown impressive earnings growth of 227.8% over the past year, outpacing the industry average of 1%. Despite a volatile share price recently, its financial health seems robust with more cash than total debt and positive free cash flow. Over five years, its debt to equity ratio rose from 0% to 2.3%, yet interest coverage remains solid as it earns more than it pays. Recent results highlight a significant turnaround with net income reaching CNY 91.51 million for Q1 2025 compared to a loss previously reported.

- Dive into the specifics of Jiangsu NanFang PrecisionLtd here with our thorough health report.

Gain insights into Jiangsu NanFang PrecisionLtd's past trends and performance with our Past report.

Taking Advantage

- Gain an insight into the universe of 3164 Global Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002553

Jiangsu NanFang PrecisionLtd

Research and development, manufacturing, and sale of needle roller bearings, one-way clutches, one-way pulley assemblies, and mechanical parts in China and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives