Stock Analysis

- China

- /

- Construction

- /

- SHSE:603183

3 Promising Penny Stocks With Market Caps Over US$100M

Reviewed by Simply Wall St

Global markets have experienced a turbulent week, with major indexes mostly finishing lower amid busy earnings reports and mixed economic signals. In such a fluctuating market, investors may find opportunities in less conventional areas like penny stocks. Although the term "penny stocks" might seem outdated, these smaller or newer companies can offer unique growth potential when backed by strong financials. This article highlights three promising penny stocks that combine solid fundamentals with the potential for significant upside.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR337.78M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.565 | MYR2.81B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.79 | MYR136.84M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.84 | HK$533.22M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$138.53M | ★★★★☆☆ |

| Seafco (SET:SEAFCO) | THB2.28 | THB1.85B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.60 | A$69.75M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.52 | MYR756.88M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.255 | £849.6M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.78 | £207.57M | ★★★★★★ |

Click here to see the full list of 5,788 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Meilleure Health International Industry Group (SEHK:2327)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Meilleure Health International Industry Group Limited is an investment holding company involved in the trading of construction and photovoltaic components and materials across Hong Kong, China, Europe, and other international markets with a market cap of approximately HK$1 billion.

Operations: The company's revenue is primarily derived from its Trading Business, which accounts for HK$29.57 million, and its Property Related Business, contributing HK$15.05 million.

Market Cap: HK$1B

Meilleure Health International Industry Group has experienced a significant decline in sales, reporting HK$30.03 million for the half year ended June 2024 compared to HK$74.84 million a year ago, with net income also falling to HK$8.47 million from HK$18.16 million. Despite this, the company maintains strong short-term asset coverage over both long-term and short-term liabilities and has seen its debt-to-equity ratio improve over five years from 31.3% to 23.8%. However, earnings have been impacted by large one-off gains of HK$26.8 million, which may not reflect ongoing operational performance accurately.

- Click here and access our complete financial health analysis report to understand the dynamics of Meilleure Health International Industry Group.

- Explore historical data to track Meilleure Health International Industry Group's performance over time in our past results report.

Suzhou Institute of Building Science GroupLtd (SHSE:603183)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Suzhou Institute of Building Science Group Co., Ltd operates in the construction industry in China and has a market cap of CN¥1.95 billion.

Operations: The company's revenue is primarily derived from its operations within China, totaling CN¥929.16 million.

Market Cap: CN¥1.95B

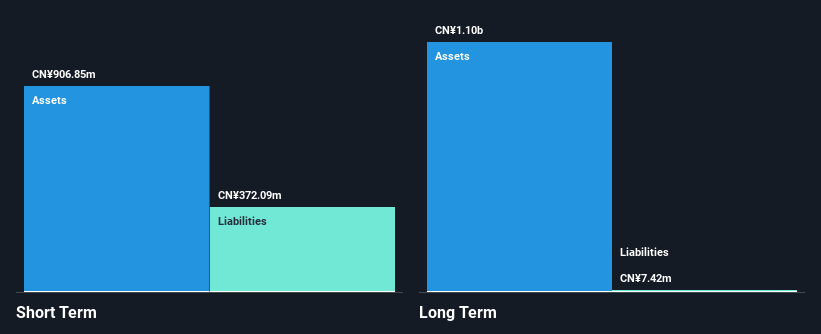

Suzhou Institute of Building Science Group Co., Ltd has shown resilience in a challenging market, with sales reaching CN¥576.01 million for the first nine months of 2024, up from CN¥539.09 million the previous year. However, net income fell to CN¥24.67 million from CN¥30.88 million due to lower profit margins and negative earnings growth over the past year. The company's financial stability is supported by short-term assets exceeding liabilities and a debt level well-covered by operating cash flow. Additionally, it completed a share buyback program worth CN¥12.5 million, indicating confidence in its valuation despite recent challenges.

- Get an in-depth perspective on Suzhou Institute of Building Science GroupLtd's performance by reading our balance sheet health report here.

- Examine Suzhou Institute of Building Science GroupLtd's earnings growth report to understand how analysts expect it to perform.

Tianjin Saixiang TechnologyLtd (SZSE:002337)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tianjin Saixiang Technology Co., Ltd specializes in the design, development, manufacture, and sale of radial tire equipment in China with a market cap of CN¥2.76 billion.

Operations: Tianjin Saixiang Technology Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥2.76B

Tianjin Saixiang Technology Co., Ltd has demonstrated growth in sales, reporting CN¥607.3 million for the first nine months of 2024, up from CN¥452.28 million the previous year. Despite this increase, net income decreased to CN¥46.17 million from CN¥59.78 million, reflecting a decline in profit margins from 12.8% to 6%. The company maintains financial stability with short-term assets exceeding both short- and long-term liabilities significantly and more cash than total debt, although its operating cash flow remains negative. The management team is experienced with an average tenure of over six years, supporting strategic continuity amidst fluctuating earnings performance.

- Click to explore a detailed breakdown of our findings in Tianjin Saixiang TechnologyLtd's financial health report.

- Gain insights into Tianjin Saixiang TechnologyLtd's historical outcomes by reviewing our past performance report.

Key Takeaways

- Click this link to deep-dive into the 5,788 companies within our Penny Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603183

Suzhou Institute of Building Science GroupLtd

Operates in the construction industry in China.