Global markets have recently experienced mixed results, with U.S. small-cap stocks outperforming larger indexes, while European and Japanese markets faced challenges amid political and economic uncertainties. Amid these broader market movements, investors often seek opportunities in less conventional areas such as penny stocks, which despite their name's vintage connotation, continue to offer intriguing potential for growth. In this article, we explore three global penny stocks that stand out for their financial strength and resilience in today's market landscape.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Cloudpoint Technology Berhad (KLSE:CLOUDPT) | MYR0.705 | MYR374.78M | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.55 | HK$915.41M | ✅ 4 ⚠️ 1 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.63 | MYR320.34M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.53 | HK$2.06B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.765 | SGD310.05M | ✅ 4 ⚠️ 2 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.48 | MYR594.3M | ✅ 5 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.06 | SGD12.04B | ✅ 5 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.095 | €289.57M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.946 | €31.9M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,728 stocks from our Global Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Jiangsu JIXIN Wind Energy Technology (SHSE:601218)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jiangsu JIXIN Wind Energy Technology Co., Ltd. (ticker: SHSE:601218) operates in the wind energy sector and has a market cap of CN¥4.12 billion.

Operations: Jiangsu JIXIN Wind Energy Technology Co., Ltd. does not report distinct revenue segments.

Market Cap: CN¥4.12B

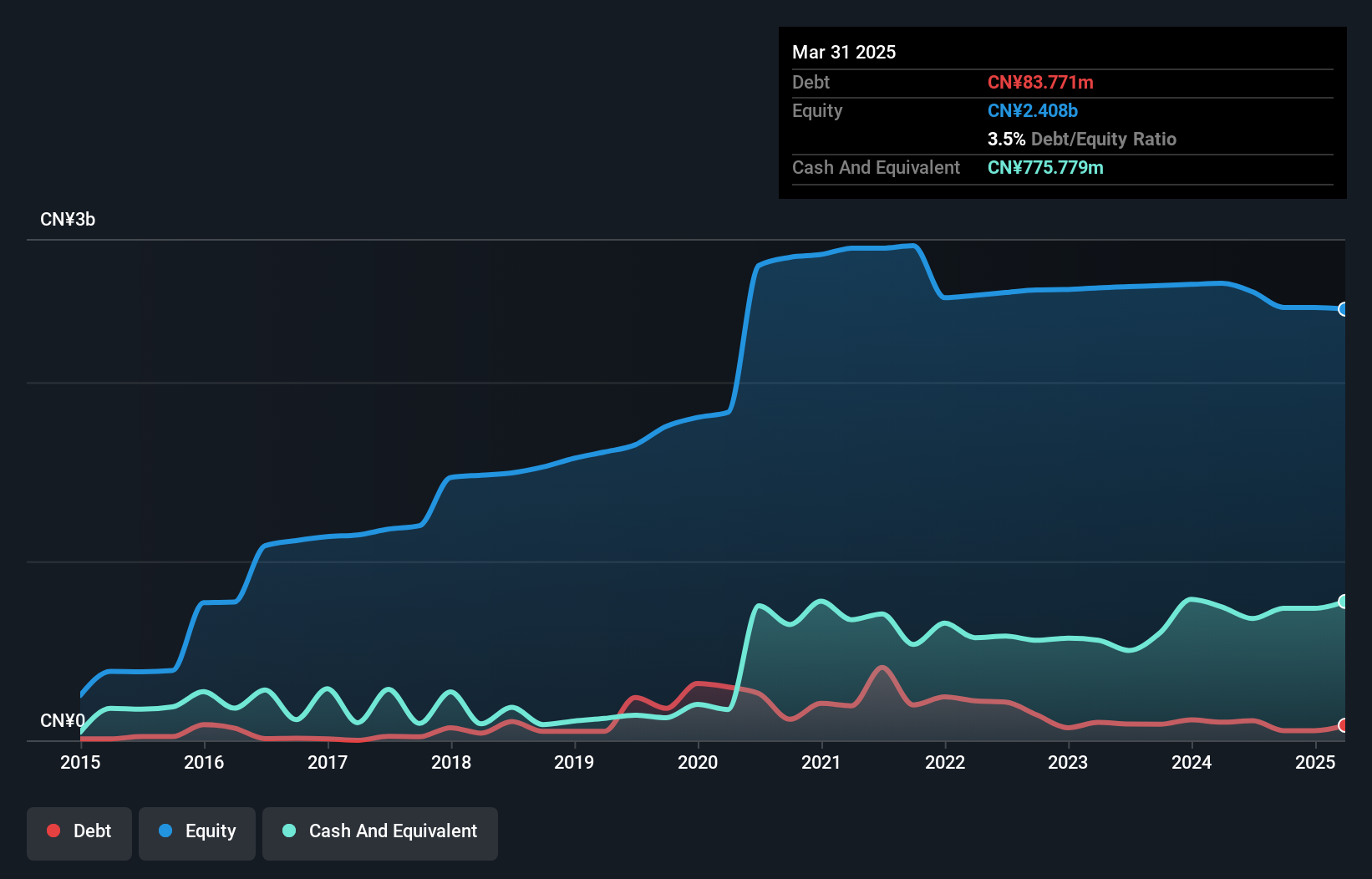

Jiangsu JIXIN Wind Energy Technology, with a market cap of CN¥4.12 billion, faces challenges including high share price volatility and declining earnings, which have dropped by 15.8% annually over the past five years. Despite this, the company maintains strong financial health with short-term assets exceeding liabilities and more cash than debt. The board is experienced but the management team is relatively new. While profit margins have decreased from 9.6% to 4.6%, debt levels are low with a reduced debt-to-equity ratio from 32.1% to 4.5%. The stock has not experienced significant shareholder dilution recently.

- Click to explore a detailed breakdown of our findings in Jiangsu JIXIN Wind Energy Technology's financial health report.

- Explore historical data to track Jiangsu JIXIN Wind Energy Technology's performance over time in our past results report.

HuBei NengTer TechnologyLtd (SZSE:002102)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: HuBei NengTer Technology Ltd operates an ecommerce platform focused on the supply chain of plastic raw materials in China, with a market cap of CN¥10.30 billion.

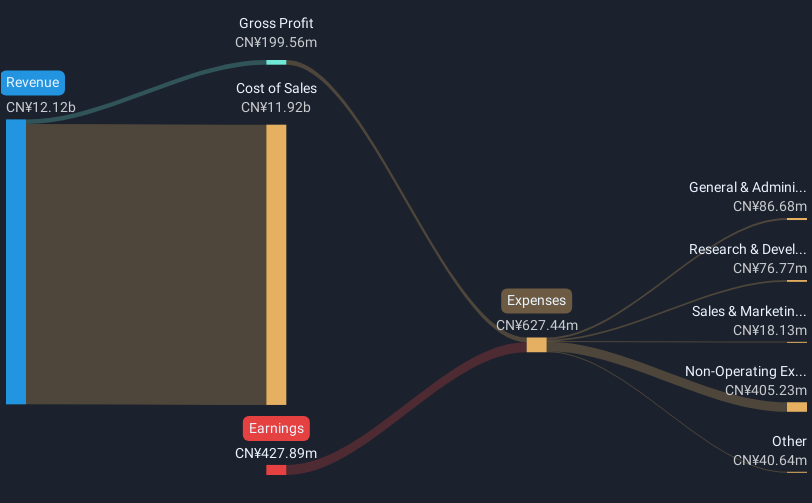

Operations: The company's revenue is primarily derived from China, accounting for CN¥11.09 billion, with an additional CN¥191.08 million generated from overseas markets.

Market Cap: CN¥10.3B

HuBei NengTer Technology Ltd, with a market cap of CN¥10.30 billion, operates an ecommerce platform for plastic raw materials in China. Despite being unprofitable, the company reported a significant increase in net income to CN¥339.22 million for the first half of 2025 compared to last year. It maintains a satisfactory net debt-to-equity ratio of 9.1% and has sufficient cash runway for over three years even as free cash flow shrinks annually by 11.2%. Recent activities include share repurchases worth CN¥50 million, reflecting strategic capital allocation efforts amid stable weekly volatility and experienced board oversight.

- Get an in-depth perspective on HuBei NengTer TechnologyLtd's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into HuBei NengTer TechnologyLtd's future.

Jiangsu Wuyang Automation Control Technology (SZSE:300420)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jiangsu Wuyang Automation Control Technology Co., Ltd. (SZSE:300420) operates in the automation control industry with a market cap of CN¥4.51 billion.

Operations: Jiangsu Wuyang Automation Control Technology Co., Ltd. does not have any reported revenue segments available for analysis.

Market Cap: CN¥4.51B

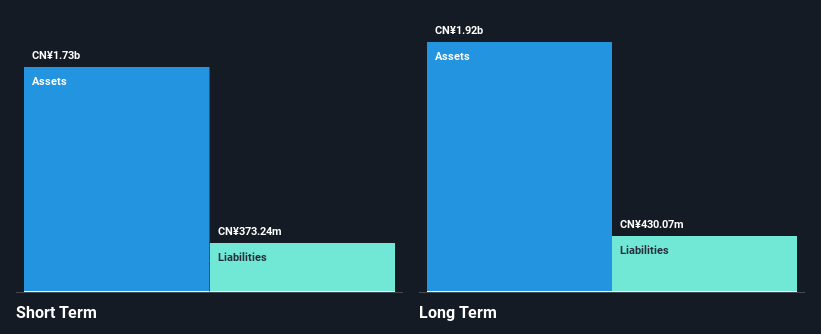

Jiangsu Wuyang Automation Control Technology Co., Ltd., with a market cap of CN¥4.51 billion, reported a modest revenue increase to CN¥458.94 million for the first half of 2025, reversing last year's net loss to achieve a net income of CN¥23.1 million. The company demonstrates financial prudence with short-term assets exceeding both its short and long-term liabilities, and cash reserves surpassing total debt levels. Despite its unprofitability, the company's stock trades significantly below estimated fair value, while stable weekly volatility suggests limited price fluctuations. Upcoming amendments to the company's articles will be discussed at an Extraordinary General Meeting in September 2025.

- Take a closer look at Jiangsu Wuyang Automation Control Technology's potential here in our financial health report.

- Examine Jiangsu Wuyang Automation Control Technology's past performance report to understand how it has performed in prior years.

Seize The Opportunity

- Discover the full array of 3,728 Global Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300420

Jiangsu Wuyang Automation Control Technology

Jiangsu Wuyang Automation Control Technology Co., Ltd.

Flawless balance sheet and fair value.

Market Insights

Community Narratives