- China

- /

- Construction

- /

- SZSE:002062

3 Penny Stocks With Market Caps Over US$300M

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes approaching record highs and smaller-cap stocks outperforming, investors are exploring diverse opportunities within the equity landscape. Penny stocks, often misunderstood due to their historical connotations, remain a compelling area of interest for those seeking potential growth in smaller or newer companies. By focusing on financial strength and market potential, these stocks continue to offer value beyond their price point, presenting intriguing possibilities for discerning investors.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| ME Group International (LSE:MEGP) | £2.22 | £836.42M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$66.23M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.20 | £417.71M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.92 | £74.76M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.20 | £102.41M | ★★★★★★ |

| United U-LI Corporation Berhad (KLSE:ULICORP) | MYR1.55 | MYR337.59M | ★★★★★★ |

Click here to see the full list of 5,752 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Zhejiang Yankon Group (SHSE:600261)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Yankon Group Co., Ltd. focuses on the research, development, production, and sales of lighting appliances in China with a market cap of CN¥4.43 billion.

Operations: The company generates revenue primarily from its Lighting and Electrical Industry segment, which amounts to CN¥3.22 billion.

Market Cap: CN¥4.43B

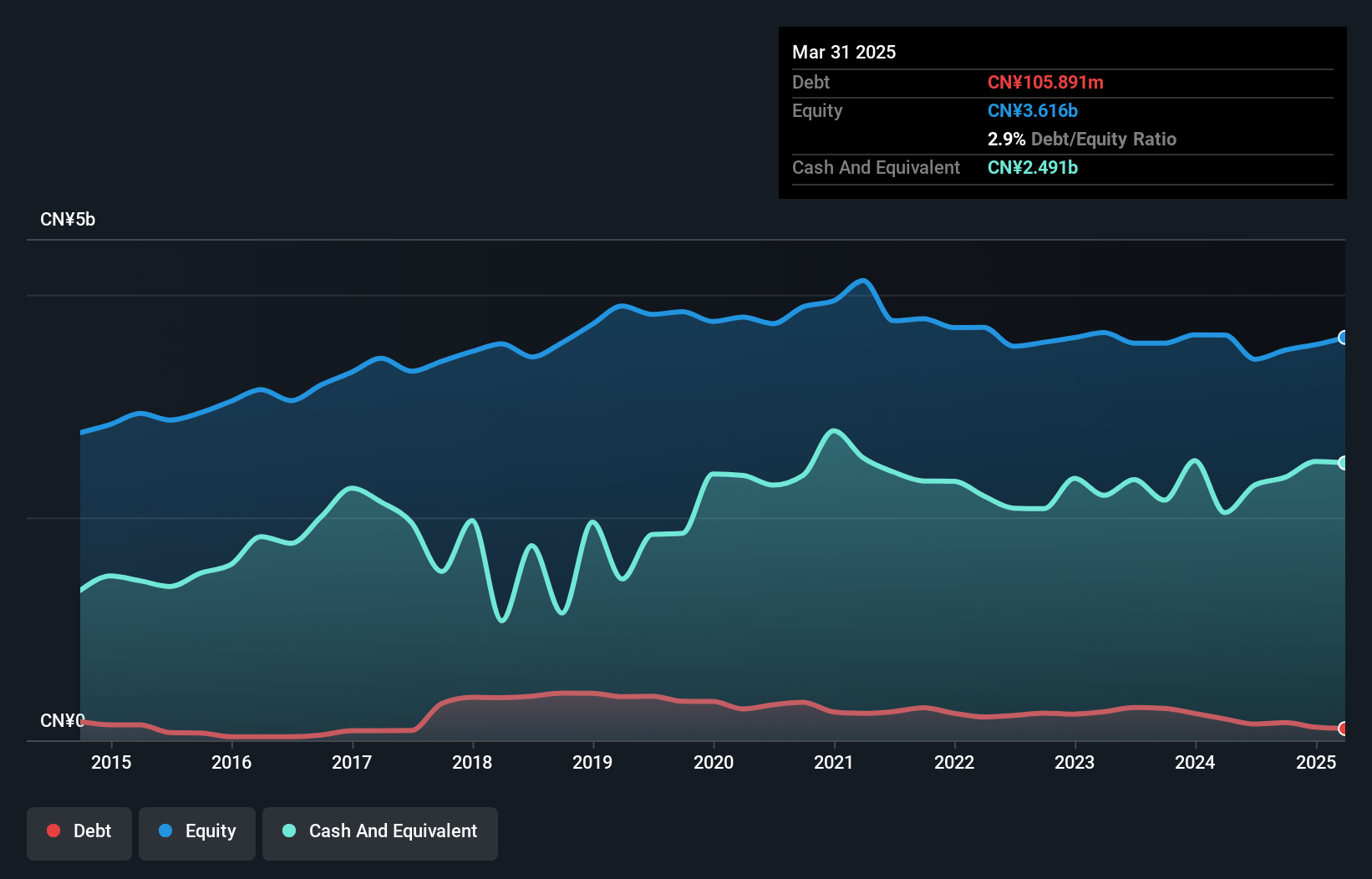

Zhejiang Yankon Group Co., Ltd. has shown resilience in the penny stock arena, with its short-term assets (CN¥3.8 billion) comfortably covering both short and long-term liabilities, indicating strong liquidity. Despite a past decline in earnings by 25.6% annually over five years, recent performance shows a rebound with a 13.3% growth last year, outpacing industry averages. The company has reduced its debt-to-equity ratio significantly over five years and holds more cash than total debt, highlighting financial prudence. However, concerns include an inexperienced board and an unstable dividend track record influenced by large one-off items impacting earnings quality.

- Get an in-depth perspective on Zhejiang Yankon Group's performance by reading our balance sheet health report here.

- Gain insights into Zhejiang Yankon Group's past trends and performance with our report on the company's historical track record.

Liuzhou Chemical Industry (SHSE:600423)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Liuzhou Chemical Industry Co., Ltd. is engaged in the production and sale of chemical fertilizers in China, with a market capitalization of approximately CN¥2.44 billion.

Operations: The company generates revenue of CN¥178.44 million from its chemical industry segment.

Market Cap: CN¥2.44B

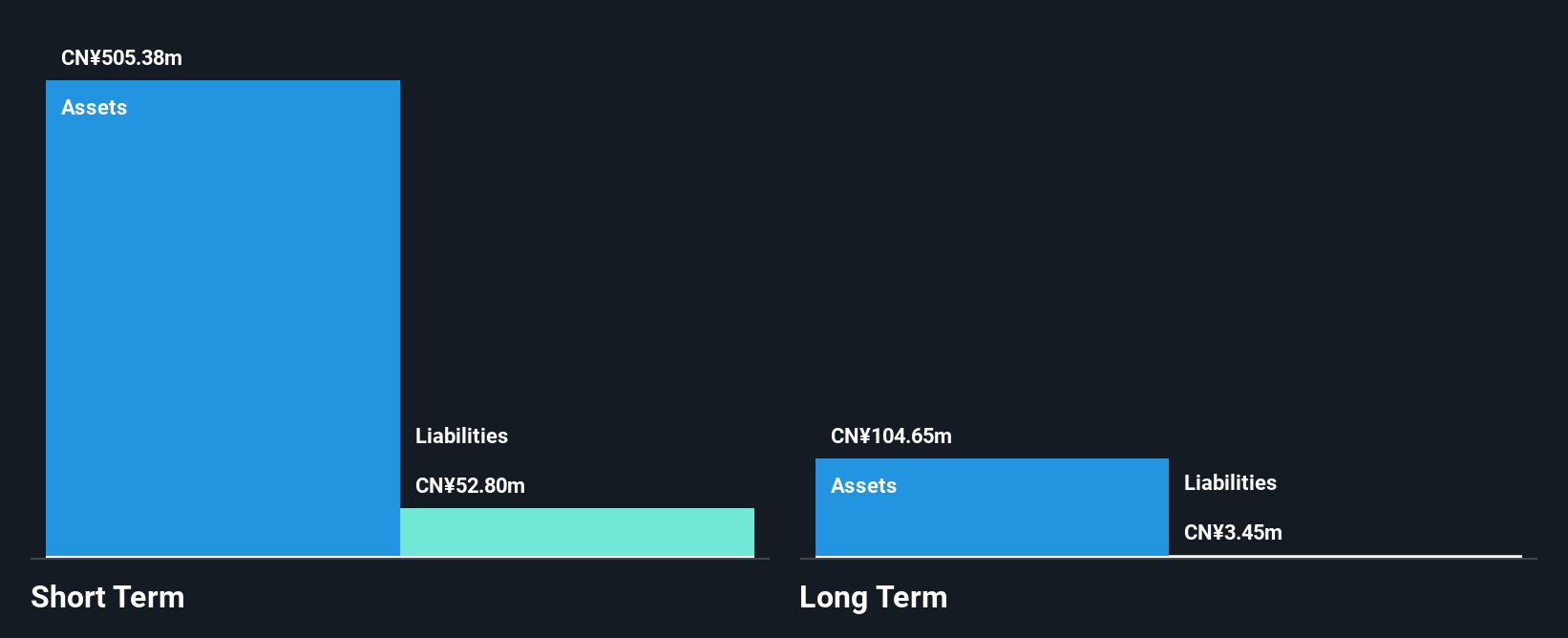

Liuzhou Chemical Industry Co., Ltd. demonstrates solid financial health with no debt and short-term assets of CN¥484.1 million exceeding both short and long-term liabilities, ensuring robust liquidity. The company's earnings growth is impressive, with a 381.3% increase over the past year, surpassing the chemicals industry's decline of 5.3%. Its Price-To-Earnings ratio of 26.2x suggests it is valued below the market average in China (35.4x), potentially indicating good value for investors mindful of volatility risks inherent in penny stocks. Despite a low Return on Equity at 16.9%, profit margins have significantly improved from last year’s figures.

- Dive into the specifics of Liuzhou Chemical Industry here with our thorough balance sheet health report.

- Explore historical data to track Liuzhou Chemical Industry's performance over time in our past results report.

Hongrun Construction Group (SZSE:002062)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hongrun Construction Group Co., Ltd. operates in the construction industry primarily within China and has a market capitalization of CN¥4.99 billion.

Operations: Hongrun Construction Group Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥4.99B

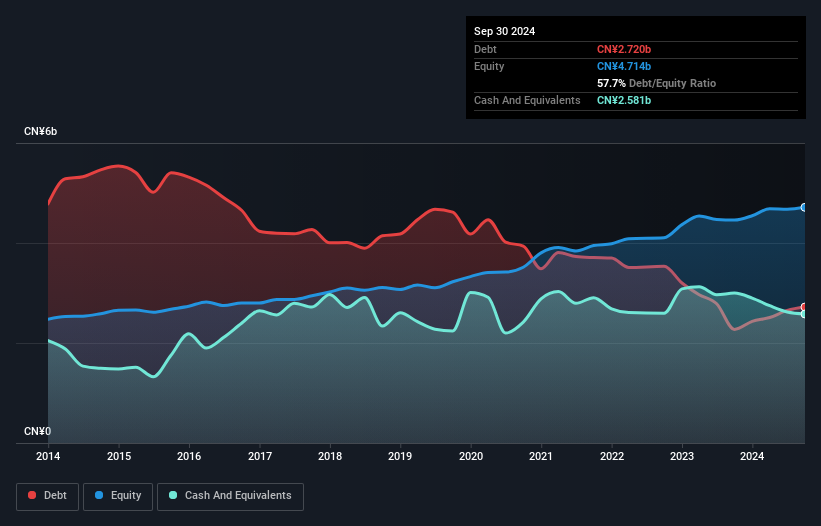

Hongrun Construction Group Co., Ltd. maintains a stable financial position with short-term assets of CN¥10.9 billion exceeding both short and long-term liabilities, indicating strong liquidity. The company has successfully reduced its debt to equity ratio from 143.2% to 57.7% over five years, reflecting improved financial management, though operating cash flow coverage of debt remains insufficient at 5.9%. Despite experiencing negative earnings growth recently, Hongrun's Price-To-Earnings ratio of 15.6x is below the Chinese market average, suggesting potential value for investors cautious about volatility in penny stocks despite low Return on Equity at 8.8%.

- Jump into the full analysis health report here for a deeper understanding of Hongrun Construction Group.

- Evaluate Hongrun Construction Group's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Take a closer look at our Penny Stocks list of 5,752 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hongrun Construction Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002062

Hongrun Construction Group

Engages in construction business primarily in China.

Excellent balance sheet average dividend payer.