- China

- /

- Electrical

- /

- SHSE:688717

Three High-Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

In a week marked by mixed performances across major indices and light pre-holiday trading, investors have been keeping a close eye on inflation data and consumer spending trends. Despite the volatility, certain growth companies with high insider ownership continue to attract attention due to their potential for strong alignment between management interests and shareholder value. When evaluating stocks in the current market environment, it's crucial to consider firms where insiders hold significant stakes. This often signals confidence in the company's future prospects and can be an indicator of robust internal governance.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 20.3% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Kirloskar Pneumatic (BSE:505283) | 30.4% | 30.1% |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.6% | 52.1% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| Calliditas Therapeutics (OM:CALTX) | 12.7% | 51.9% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 60.9% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 78.8% |

We'll examine a selection from our screener results.

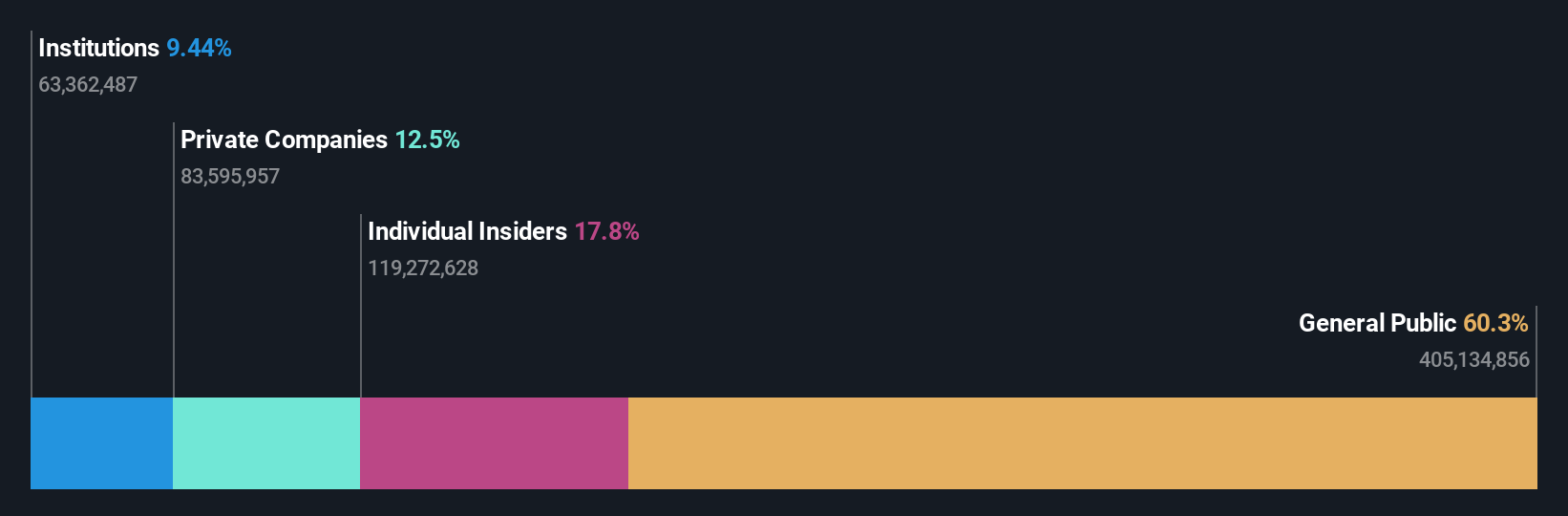

Hangzhou Lion ElectronicsLtd (SHSE:605358)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hangzhou Lion Electronics Co., Ltd. (SHSE:605358) specializes in the R&D, production, and sale of semiconductor silicon wafers, power devices, and compound semiconductor radio frequency chips in China, with a market cap of CN¥13.02 billion.

Operations: The company's revenue segments are comprised of CN¥1.62 billion from semiconductor wafers, CN¥939.92 million from semiconductor power devices, and CN¥227.27 million from compound semiconductor radio frequency chips.

Insider Ownership: 18.8%

Earnings Growth Forecast: 66.3% p.a.

Hangzhou Lion Electronics Ltd. exhibits significant growth potential with forecasted annual revenue growth of 26.4%, surpassing the Chinese market average. Despite a recent net loss of CNY 66.86 million for H1 2024, the company is expected to become profitable within three years, with earnings projected to grow at 66.29% annually. However, its return on equity is forecasted to remain low at 3.8%, and debt coverage by operating cash flow is inadequate, posing financial stability concerns.

- Click to explore a detailed breakdown of our findings in Hangzhou Lion ElectronicsLtd's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Hangzhou Lion ElectronicsLtd shares in the market.

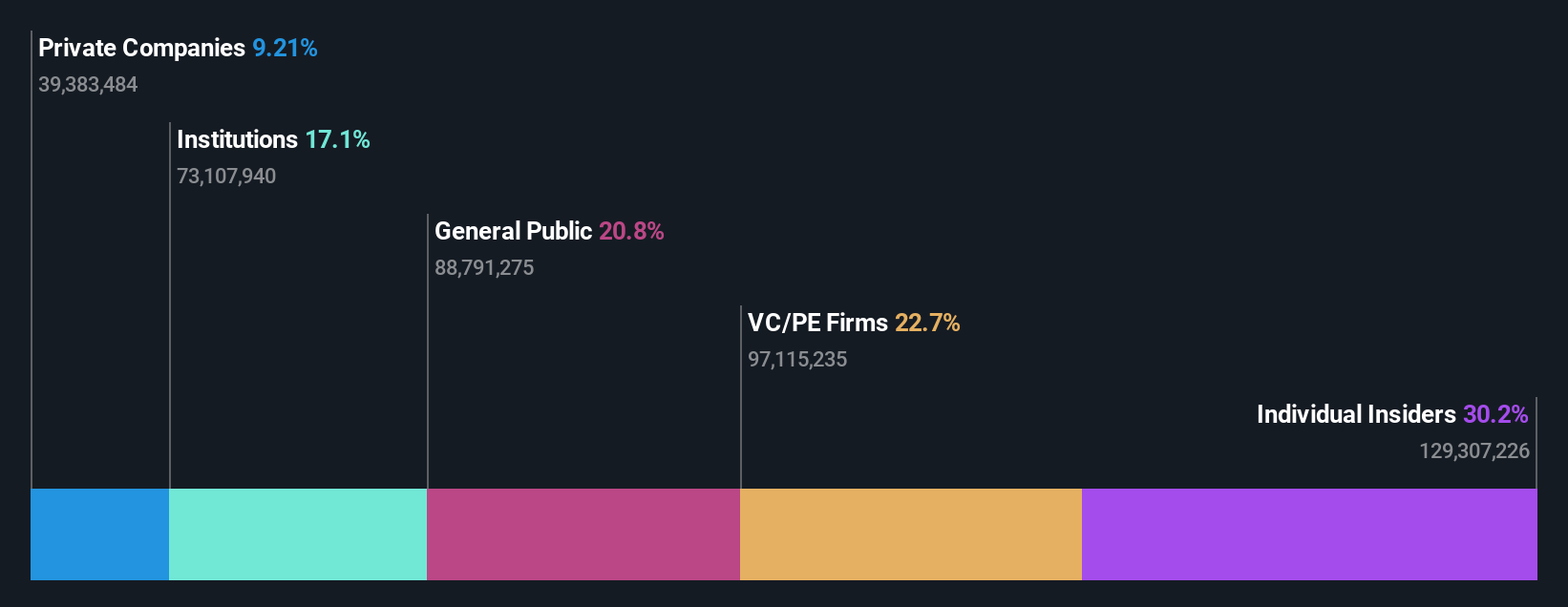

SICC (SHSE:688234)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SICC Co., Ltd. specializes in the research, development, production, and sale of silicon carbide semiconductor materials both in China and internationally, with a market cap of approximately CN¥21.08 billion.

Operations: SICC Co., Ltd. generates revenue through the development, manufacturing, and distribution of silicon carbide semiconductor materials across domestic and international markets.

Insider Ownership: 31.1%

Earnings Growth Forecast: 37.9% p.a.

SICC Co., Ltd. has shown impressive growth, with H1 2024 sales reaching CNY 912.23 million and net income at CNY 101.89 million, reversing a previous net loss. The company is forecasted to achieve significant annual earnings growth of 37.9% and revenue growth of 24.6%, both outpacing the Chinese market averages. Despite a low return on equity forecast of 12.4%, SICC's recent profitability and high insider ownership highlight its potential as a growth company.

- Dive into the specifics of SICC here with our thorough growth forecast report.

- Our valuation report unveils the possibility SICC's shares may be trading at a premium.

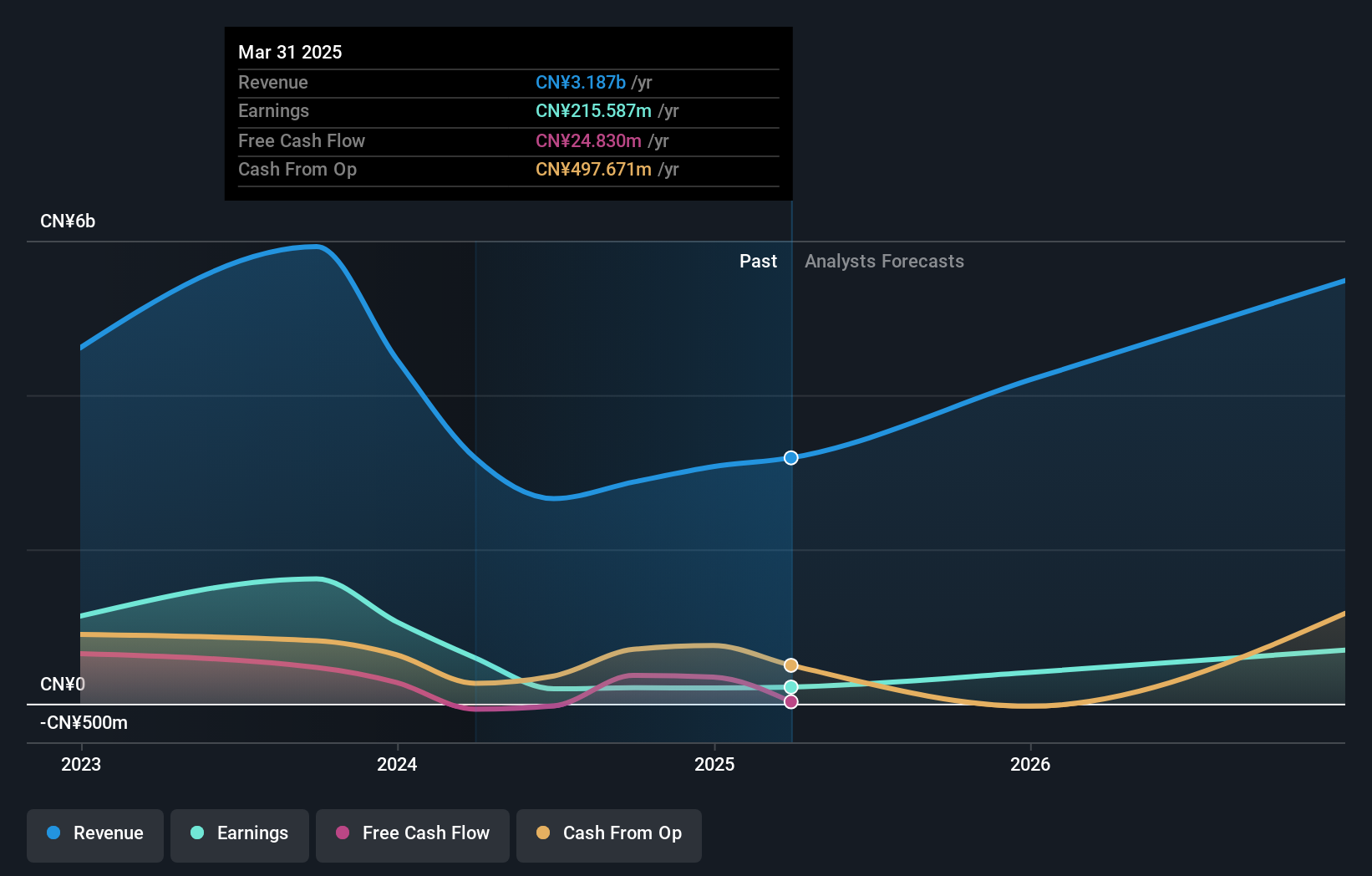

SolaX Power Network Technology (Zhejiang) (SHSE:688717)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SolaX Power Network Technology (Zhejiang) Co., Ltd. (SHSE:688717) focuses on the development and production of solar inverters and energy storage solutions, with a market cap of CN¥9.69 billion.

Operations: SolaX Power Network Technology (Zhejiang) Co., Ltd. generates revenue primarily from the development and production of solar inverters and energy storage solutions.

Insider Ownership: 35.1%

Earnings Growth Forecast: 49.4% p.a.

SolaX Power Network Technology (Zhejiang) Co., Ltd. reported a sharp decline in H1 2024 results, with sales at CNY 1.58 billion and net income at CNY 103.01 million, down from the previous year. Despite this, the company is expected to achieve significant annual earnings growth of 49.42% and revenue growth of 31.1%, both surpassing market averages. However, profit margins have decreased to 7.2% from last year's 26.5%, and return on equity is forecasted to be low at 14.4%.

- Delve into the full analysis future growth report here for a deeper understanding of SolaX Power Network Technology (Zhejiang).

- According our valuation report, there's an indication that SolaX Power Network Technology (Zhejiang)'s share price might be on the expensive side.

Key Takeaways

- Reveal the 1508 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688717

SolaX Power Network Technology (Zhejiang)

SolaX Power Network Technology (Zhejiang) Co., Ltd.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives