- China

- /

- Electronic Equipment and Components

- /

- SZSE:002414

Asian Growth Leaders With Insider Ownership November 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating consumer sentiment and economic uncertainties, Asian equities have shown resilience, with Chinese indices reaching multi-year highs amid easing trade tensions. In this context, growth companies in Asia with high insider ownership can offer unique insights into potential market leadership, as insider confidence often reflects strong alignment with shareholder interests and belief in the company's long-term strategy.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| M31 Technology (TPEX:6643) | 26.3% | 117.3% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 56.2% |

We'll examine a selection from our screener results.

Farsoon Technologies (SHSE:688433)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Farsoon Technologies manufactures and supplies industrial polymer and metal laser powder bed fusion systems across China, North America, and Europe, with a market cap of CN¥24.36 billion.

Operations: The company's revenue segment primarily comprises Machinery & Industrial Equipment, generating CN¥545.20 million.

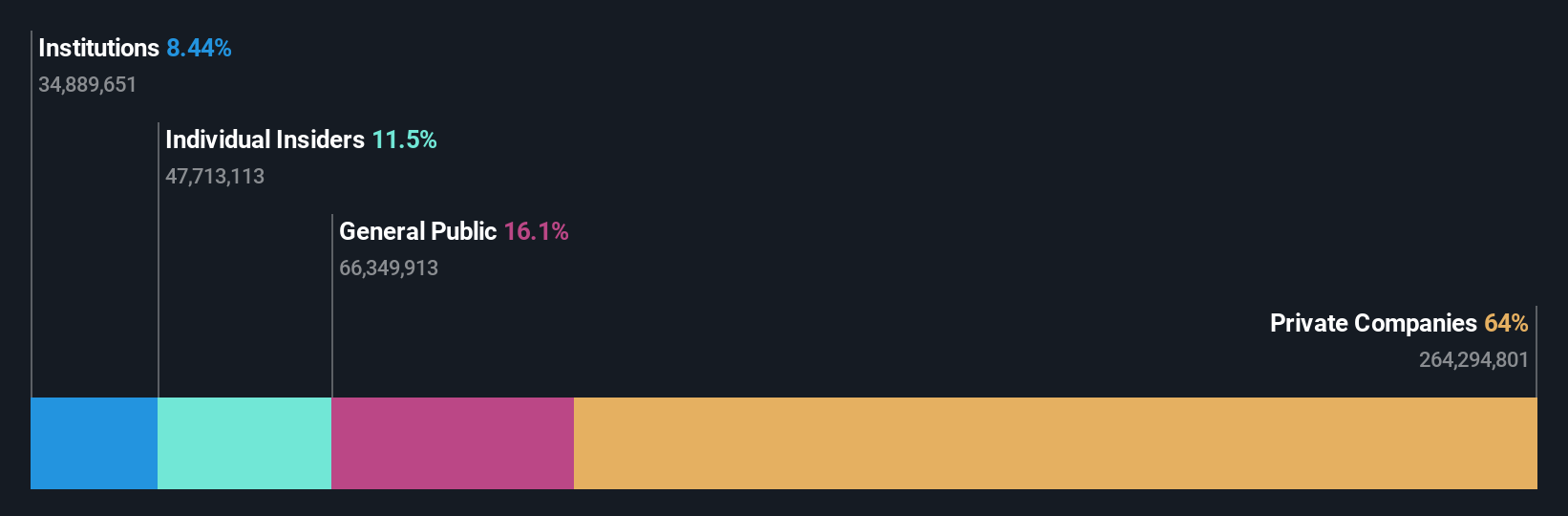

Insider Ownership: 11.5%

Earnings Growth Forecast: 27.2% p.a.

Farsoon Technologies, with significant insider ownership, is positioned for robust growth in Asia. The company forecasts substantial revenue growth at 37.6% annually, outpacing the market average. Despite a volatile share price and declining profit margins from 17.6% to 7%, earnings are expected to grow significantly over the next three years. Recent financial reports show increased sales but decreased net income, highlighting challenges in maintaining profitability amidst rapid expansion efforts.

- Dive into the specifics of Farsoon Technologies here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Farsoon Technologies shares in the market.

Suning.com (SZSE:002024)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Suning.com Co., Ltd. operates as a retail business in China with a market cap of CN¥16.48 billion.

Operations: Suning.com Co., Ltd. generates its revenue primarily through its retail operations in China.

Insider Ownership: 20.1%

Earnings Growth Forecast: 63% p.a.

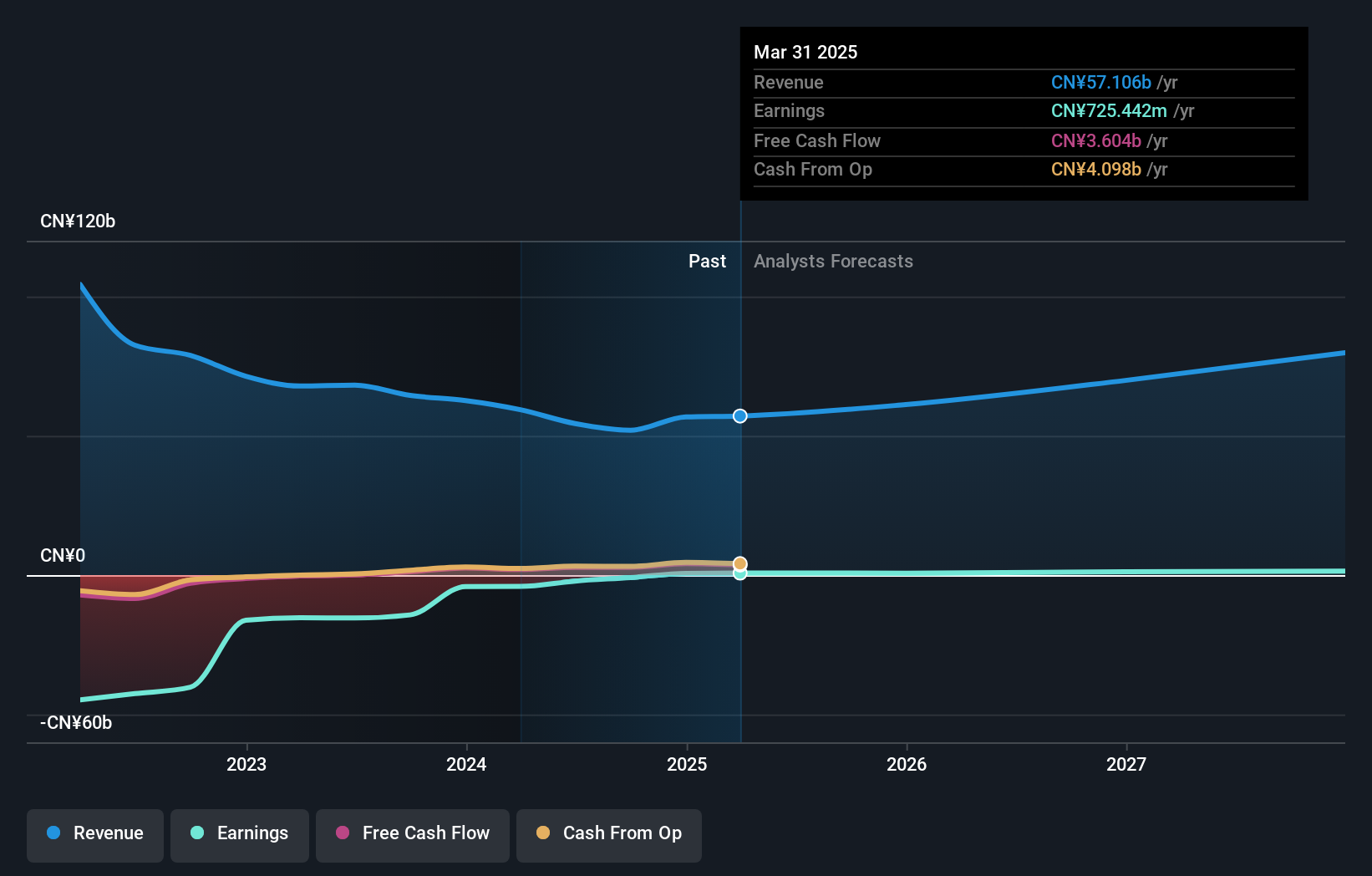

Suning.com shows significant growth potential with high insider ownership. Earnings are expected to grow 63.05% annually, surpassing the CN market's average growth rate. Although trading at a good value compared to peers, its return on equity is forecasted to be low in three years. Recent reports revealed stable sales but a sharp decline in net income from CNY 599.22 million to CNY 73.33 million, indicating challenges in profitability despite becoming profitable this year.

- Unlock comprehensive insights into our analysis of Suning.com stock in this growth report.

- Upon reviewing our latest valuation report, Suning.com's share price might be too pessimistic.

Wuhan Guide Infrared (SZSE:002414)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Guide Infrared Co., Ltd. specializes in the research, development, production, and sale of infrared thermal imaging technology in Asia with a market cap of CN¥56.97 billion.

Operations: Wuhan Guide Infrared Co., Ltd. generates revenue through its expertise in infrared thermal imaging technology across Asia.

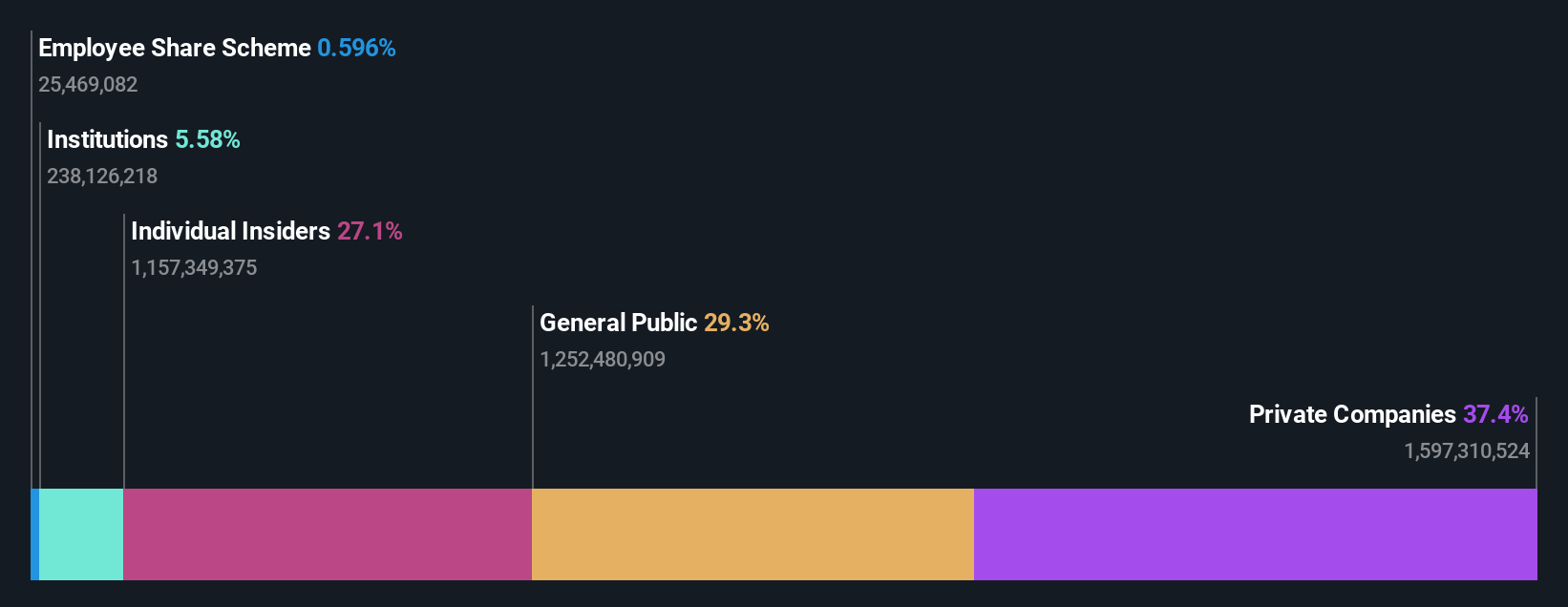

Insider Ownership: 27.1%

Earnings Growth Forecast: 61.3% p.a.

Wuhan Guide Infrared demonstrates strong growth potential with significant insider ownership. Recent earnings showed a substantial increase in net income from CNY 50.21 million to CNY 581.94 million, highlighting its profitability surge. Revenue is forecasted to grow at 27.4% annually, outpacing the CN market's average of 14.3%. Despite trading at a value below its estimated fair value, the company's return on equity is expected to remain low at 12.3% in three years, posing a potential concern for investors seeking high returns on equity investments.

- Click here and access our complete growth analysis report to understand the dynamics of Wuhan Guide Infrared.

- Upon reviewing our latest valuation report, Wuhan Guide Infrared's share price might be too optimistic.

Summing It All Up

- Click this link to deep-dive into the 627 companies within our Fast Growing Asian Companies With High Insider Ownership screener.

- Ready To Venture Into Other Investment Styles? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Guide Infrared might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002414

Wuhan Guide Infrared

Engages in the research and development, production, and sale of infrared thermal imaging technology in Asia.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives