- China

- /

- Electrical

- /

- SZSE:300342

Undiscovered Gems In Asia Featuring KTK Group And 2 Promising Small Caps

Reviewed by Simply Wall St

As global markets navigate a landscape of cautious consumer sentiment and fluctuating manufacturing activity, small-cap stocks have shown resilience, with the Russell 2000 Index rising by 0.84% in early December. This uptick highlights the potential within smaller companies, particularly in Asia, where economic dynamics and growth opportunities can uncover promising investments like KTK Group and other emerging small-cap players. Identifying such gems often involves looking for companies that demonstrate strong fundamentals and adaptability amid shifting market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bonny Worldwide | 47.86% | 17.97% | 41.71% | ★★★★★★ |

| Asian Terminals | 25.82% | 12.05% | 17.00% | ★★★★★★ |

| Envipro Holdings | 45.78% | 5.54% | -10.67% | ★★★★★★ |

| Savior Lifetec | NA | -11.98% | 25.39% | ★★★★★★ |

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| House of Investments | 18.23% | 14.46% | 47.47% | ★★★★★☆ |

| AblePrint Technology | 7.13% | 15.97% | 15.61% | ★★★★★☆ |

| KNJ | 65.48% | 8.93% | 40.98% | ★★★★★☆ |

| TSTE | 37.68% | 4.91% | -5.78% | ★★★★★☆ |

| Praise Victor Industrial | 46.95% | 8.93% | 39.31% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

KTK Group (SHSE:603680)

Simply Wall St Value Rating: ★★★★★★

Overview: KTK Group Co., Ltd. specializes in researching, developing, producing, selling, and servicing interior systems, electrical controlling systems, and vehicle equipment for high-speed trains, metro systems, LRVs, and ordinary rail passenger cars both in China and internationally with a market cap of CN¥9.22 billion.

Operations: KTK Group generates revenue primarily from the sale of interior systems, electrical controlling systems, and vehicle equipment for various rail transport modes. The company's cost structure includes expenses related to production and development activities. Gross profit margin is a key financial metric for KTK Group, reflecting its efficiency in managing production costs relative to sales.

KTK Group, a nimble player in the machinery sector, has demonstrated notable financial health and growth. Over the past five years, its debt to equity ratio impressively decreased from 48.6% to 9.1%, indicating stronger financial stability. The company reported a substantial earnings increase of 41.9% over the past year, outpacing the industry's average growth of 6.1%. For the first nine months of 2025, KTK's sales reached CNY 3.52 billion compared to CNY 3.04 billion last year, with net income climbing to CNY 492.72 million from CNY 290.19 million previously—showcasing robust performance and potential for continued success in its market niche.

- Get an in-depth perspective on KTK Group's performance by reading our health report here.

Gain insights into KTK Group's historical performance by reviewing our past performance report.

Beijing XIAOCHENG Technology Stock (SZSE:300139)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing XIAOCHENG Technology Stock Co., Ltd, along with its subsidiaries, specializes in designing and developing integrated circuits both in China and internationally, with a market cap of CN¥7.87 billion.

Operations: The company generates revenue primarily from the design and development of integrated circuits. It operates with a market capitalization of CN¥7.87 billion.

Beijing XIAOCHENG Technology, a promising player in the tech sector, has shown robust growth with revenues reaching CNY 378.57 million for the first nine months of 2025, up from CNY 237.1 million last year. Net income rose to CNY 76.8 million compared to CNY 40.65 million previously, highlighting its profitability surge this year. The company trades at a significant discount of about 37% below its estimated fair value, presenting potential upside for investors seeking value opportunities in Asia's tech landscape. Despite recent volatility in share price, high-quality earnings and strong cash position underpin its financial health and future prospects.

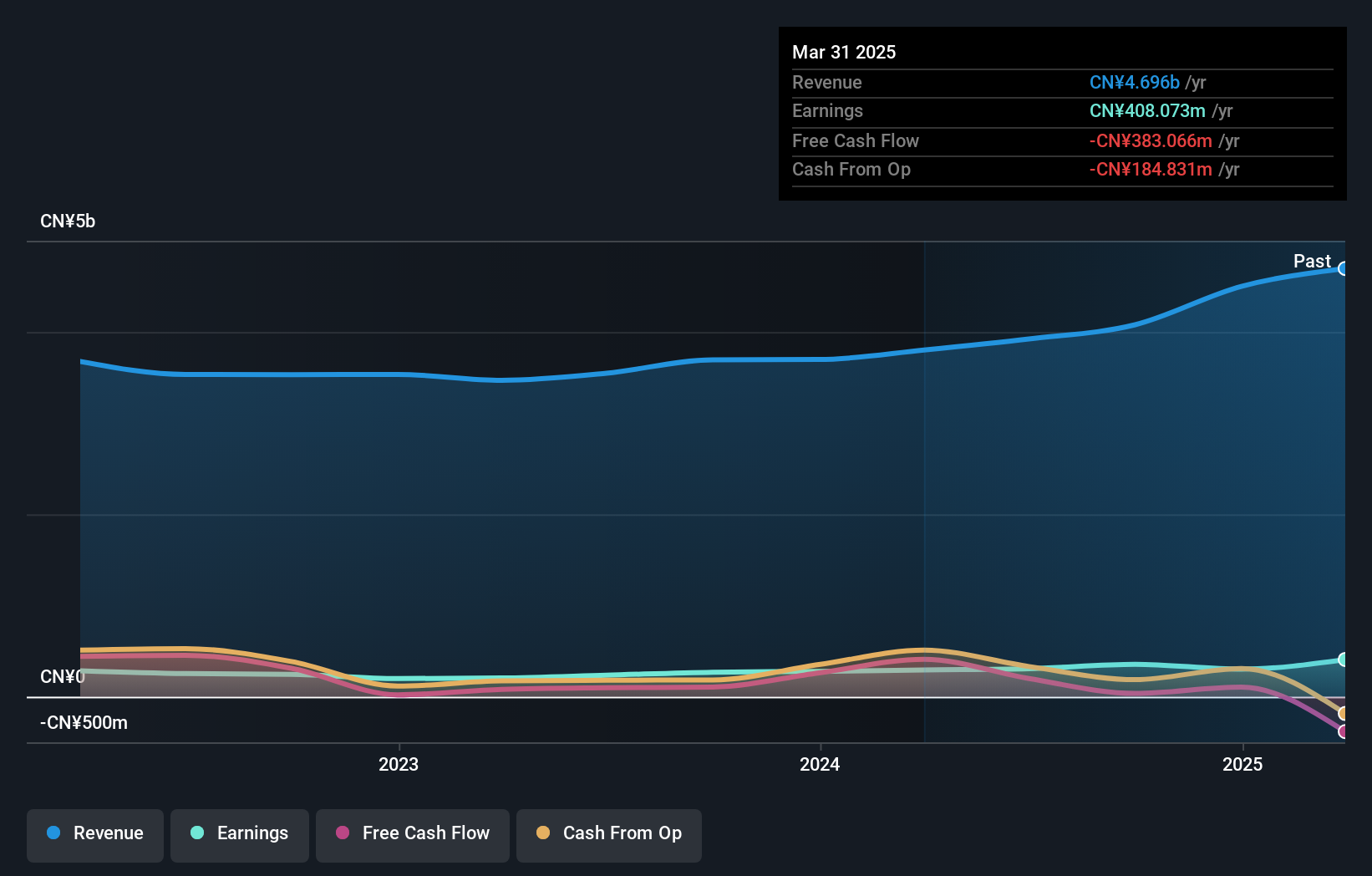

Changshu Tianyin ElectromechanicalLtd (SZSE:300342)

Simply Wall St Value Rating: ★★★★★★

Overview: Changshu Tianyin Electromechanical Co., Ltd focuses on the research, development, production, and sale of refrigerator compressor supporting parts in China, with a market capitalization of CN¥9.46 billion.

Operations: The company generates revenue primarily from the sale of refrigerator compressor supporting parts. Its financial performance is highlighted by a notable net profit margin trend, which has shown variability over recent periods.

Changshu Tianyin Electromechanical, a smaller player in the electrical industry, has shown resilience despite challenges. The company’s debt to equity ratio impressively decreased from 3.2% to 0.9% over five years, highlighting prudent financial management. Earnings surged by 31%, outpacing the sector's average growth of 3%. However, recent financials reveal a dip in revenue to CNY 580 million from CNY 751 million last year and net income dropped to CNY 24 million from CNY 55 million. With more cash than debt and positive free cash flow, Changshu Tianyin remains financially sound amid evolving market conditions.

Next Steps

- Dive into all 2497 of the Asian Undiscovered Gems With Strong Fundamentals we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300342

Changshu Tianyin ElectromechanicalLtd

Engages in the research and development, production, and sale of refrigerator compressor supporting parts in China.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026