- Hong Kong

- /

- Infrastructure

- /

- SEHK:6198

3 Asian Dividend Stocks Offering Yields Up To 6%

Reviewed by Simply Wall St

As Asian markets navigate a landscape marked by deflationary pressures in China and political shifts in Japan, investors are increasingly looking for stability and income through dividend stocks. In this environment, selecting stocks that offer reliable dividend yields can be an effective strategy to mitigate volatility while providing steady returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.04% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.66% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.37% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.67% | ★★★★★★ |

| NCD (TSE:4783) | 4.27% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.01% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| Daicel (TSE:4202) | 4.29% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.37% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.45% | ★★★★★★ |

Click here to see the full list of 1009 stocks from our Top Asian Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

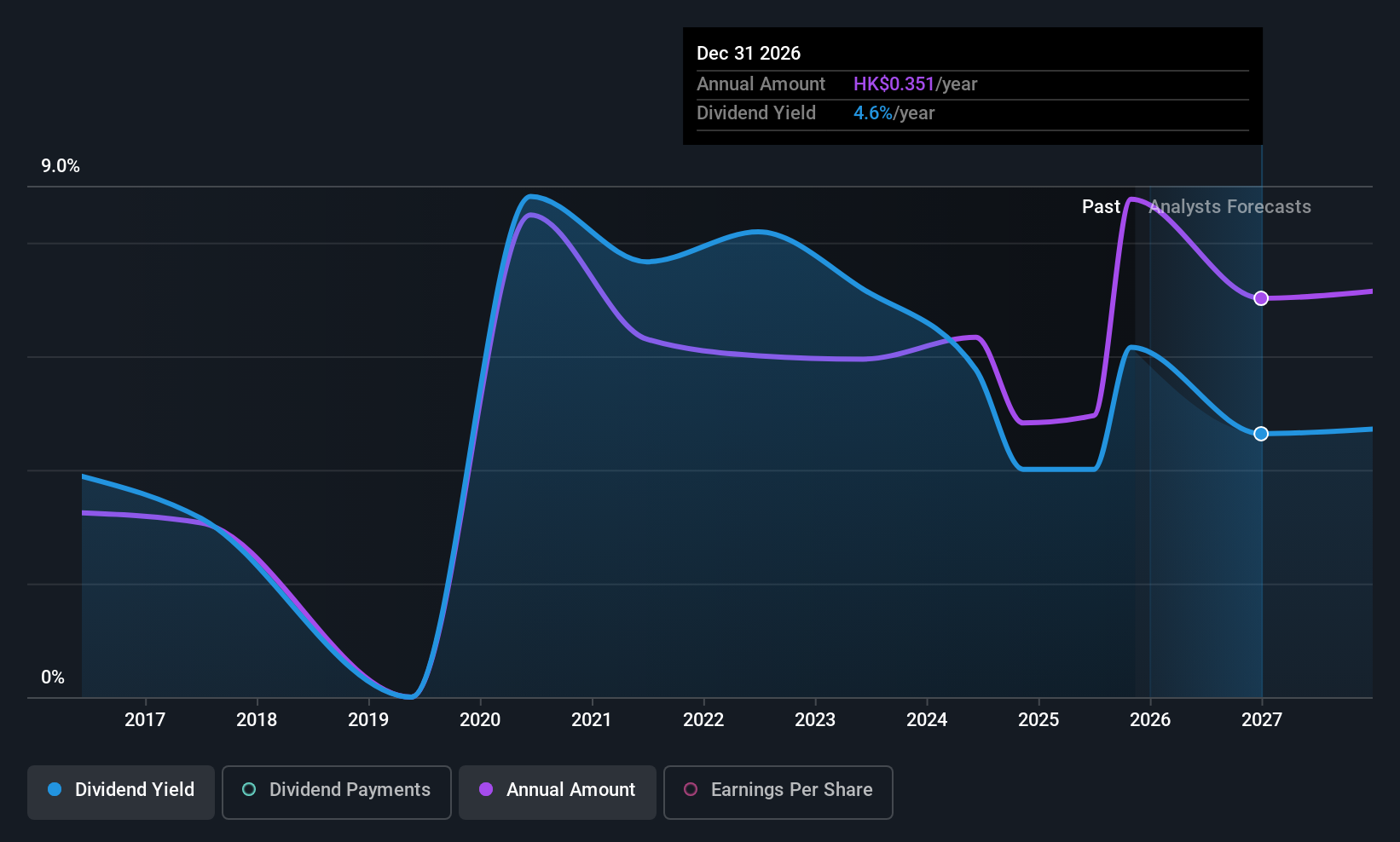

Qingdao Port International (SEHK:6198)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Qingdao Port International Co., Ltd. operates the Port of Qingdao and has a market capitalization of HK$58.99 billion.

Operations: Qingdao Port International Co., Ltd.'s revenue segments include CN¥7.59 billion from Logistics and Port Value-Added Services, CN¥4.85 billion from Cargo Handling and Supporting Services for Metal Ores, Coal, etc., CN¥3.36 billion from Liquid Bulk Handling and Ancillary Port Services, CN¥2.58 billion from Container Handling and Ancillary Services, and CN¥2.38 billion from Port Ancillary Services.

Dividend Yield: 6%

Qingdao Port International recently proposed an interim dividend of RMB 1.466 per 10 shares, indicating a commitment to shareholder returns despite a history of volatile dividends. The company's payout ratio is sustainable, with earnings and cash flows covering dividends at 41.3% and 59.5%, respectively. Although trading below estimated fair value, its dividend yield of 6.05% lags behind the top quartile in Hong Kong's market, suggesting room for improvement in dividend attractiveness relative to peers.

- Click here and access our complete dividend analysis report to understand the dynamics of Qingdao Port International.

- Our valuation report unveils the possibility Qingdao Port International's shares may be trading at a discount.

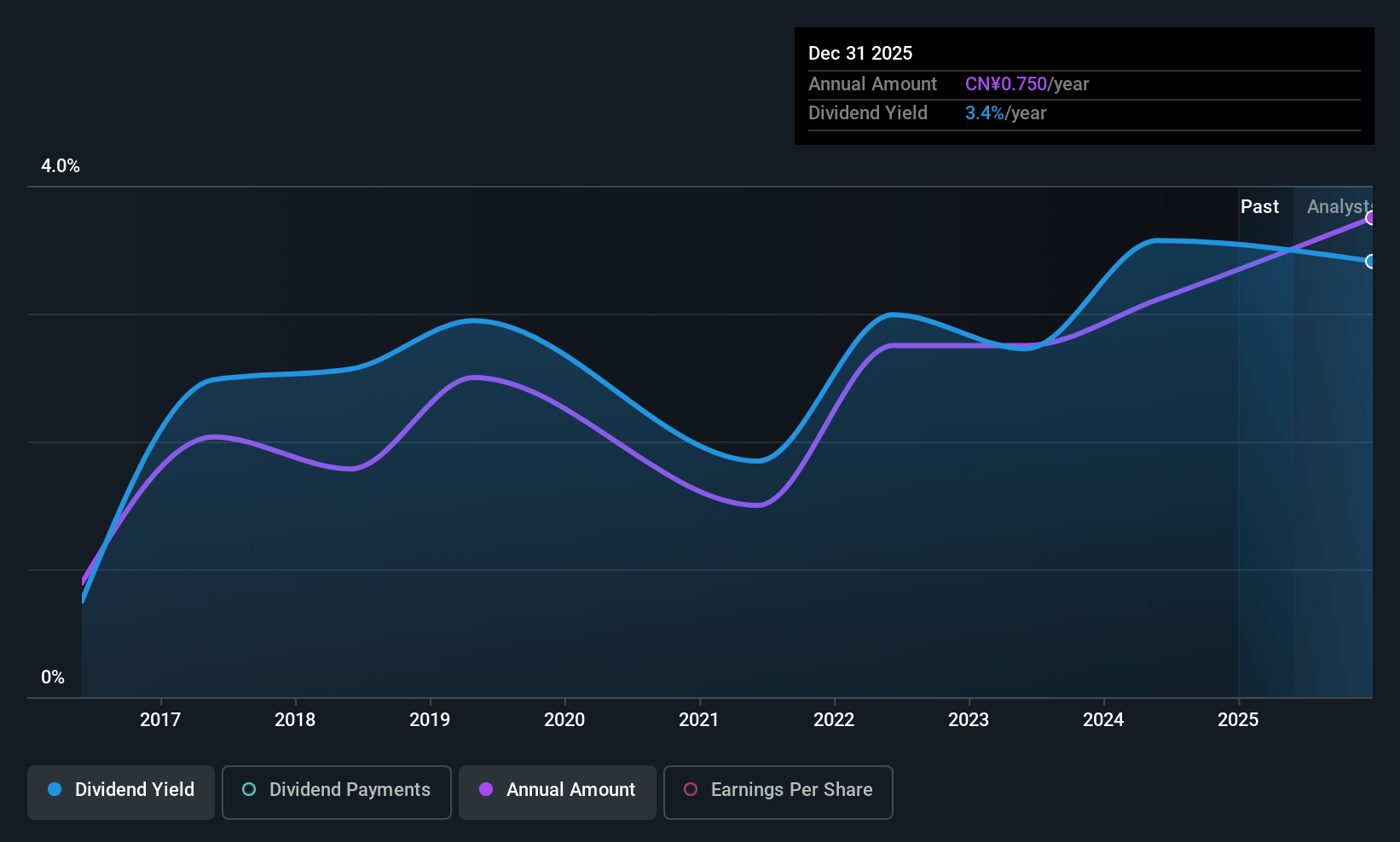

Noblelift Intelligent EquipmentLtd (SHSE:603611)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Noblelift Intelligent Equipment Co., Ltd. operates in the intelligent manufacturing equipment and smart logistics system sectors both in China and internationally, with a market cap of CN¥6.53 billion.

Operations: Noblelift Intelligent Equipment Co., Ltd. generates revenue through its operations in the intelligent manufacturing equipment and smart logistics system sectors, serving both domestic and international markets.

Dividend Yield: 3.5%

Noblelift Intelligent Equipment's dividend yield ranks in the top 25% of the Chinese market, supported by a low payout ratio of 49.6% and a cash payout ratio of 34.3%, indicating strong earnings and cash flow coverage. Despite past volatility in dividends, recent increases over ten years suggest potential growth. The company trades significantly below its estimated fair value, offering good relative value compared to peers, though dividend reliability remains a concern due to historical instability.

- Click to explore a detailed breakdown of our findings in Noblelift Intelligent EquipmentLtd's dividend report.

- The valuation report we've compiled suggests that Noblelift Intelligent EquipmentLtd's current price could be quite moderate.

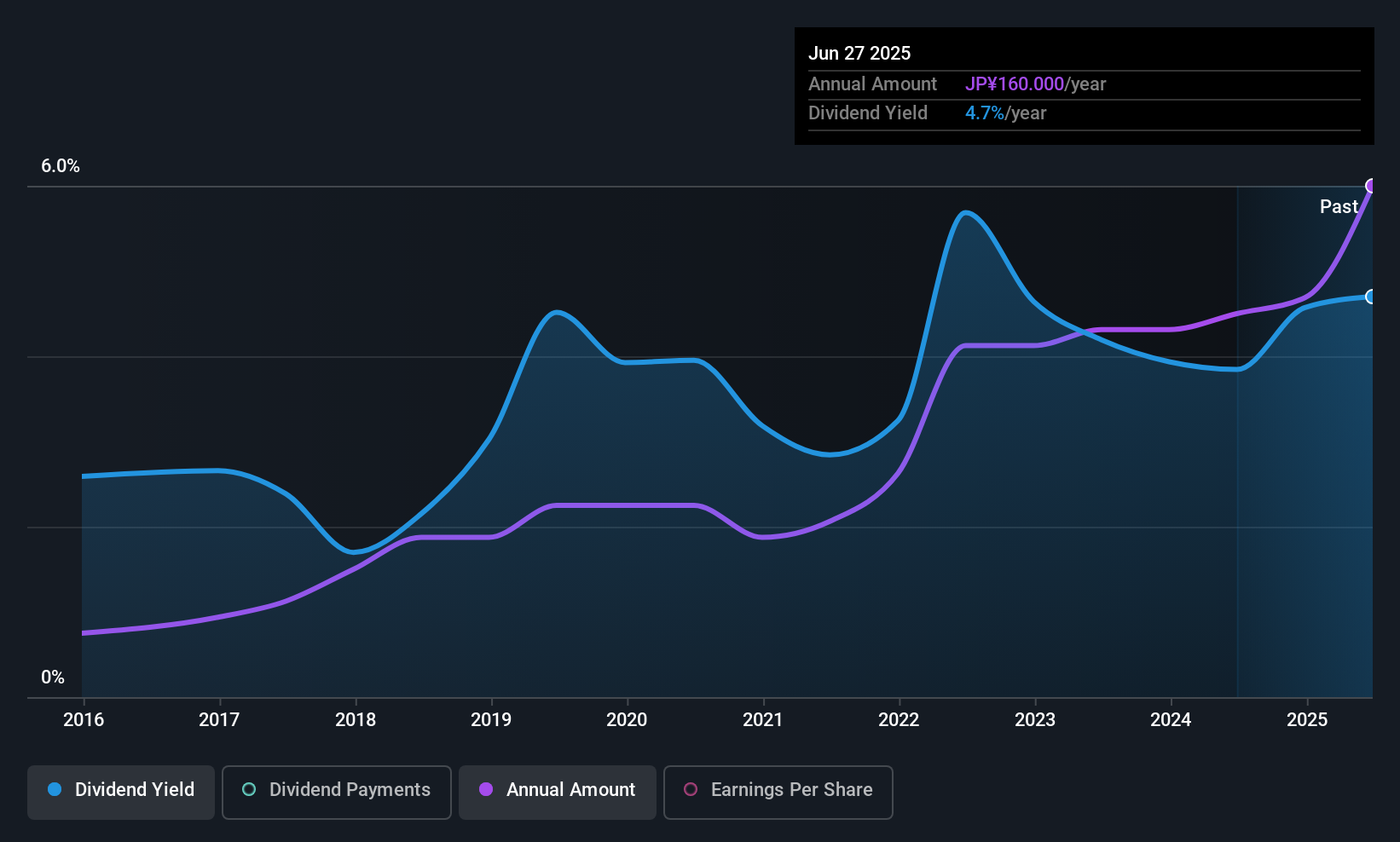

Daitron (TSE:7609)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Daitron Co., Ltd. is an electronic engineering trading company involved in the electronic equipment, components, and manufacturing equipment sectors both in Japan and internationally, with a market cap of ¥47.40 billion.

Operations: Daitron Co., Ltd. generates revenue through its Overseas segment with ¥28.28 billion, Domestic Sales Business with ¥68.36 billion, and Domestic Manufacturing Business with ¥12.14 billion.

Dividend Yield: 3.6%

Daitron trades at 75.3% below its estimated fair value, presenting a potential opportunity for value investors. Despite a low dividend yield of 3.56%, the company's dividends are well covered by earnings and cash flows, with payout ratios of 36.6% and 20.7% respectively. However, Daitron's dividend track record is unstable and has been volatile over the past decade, suggesting caution for those prioritizing reliable income streams in their investment strategy.

- Navigate through the intricacies of Daitron with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Daitron is priced lower than what may be justified by its financials.

Summing It All Up

- Get an in-depth perspective on all 1009 Top Asian Dividend Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qingdao Port International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6198

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives