As global markets experience broad-based gains with U.S. indexes approaching record highs and economic indicators like initial jobless claims reaching new lows, investors are closely monitoring the Federal Reserve's upcoming decisions on interest rates. In this dynamic environment, dividend stocks stand out as a compelling option for enhancing portfolios, offering potential income stability amid market fluctuations and geopolitical uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.60% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.73% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.45% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

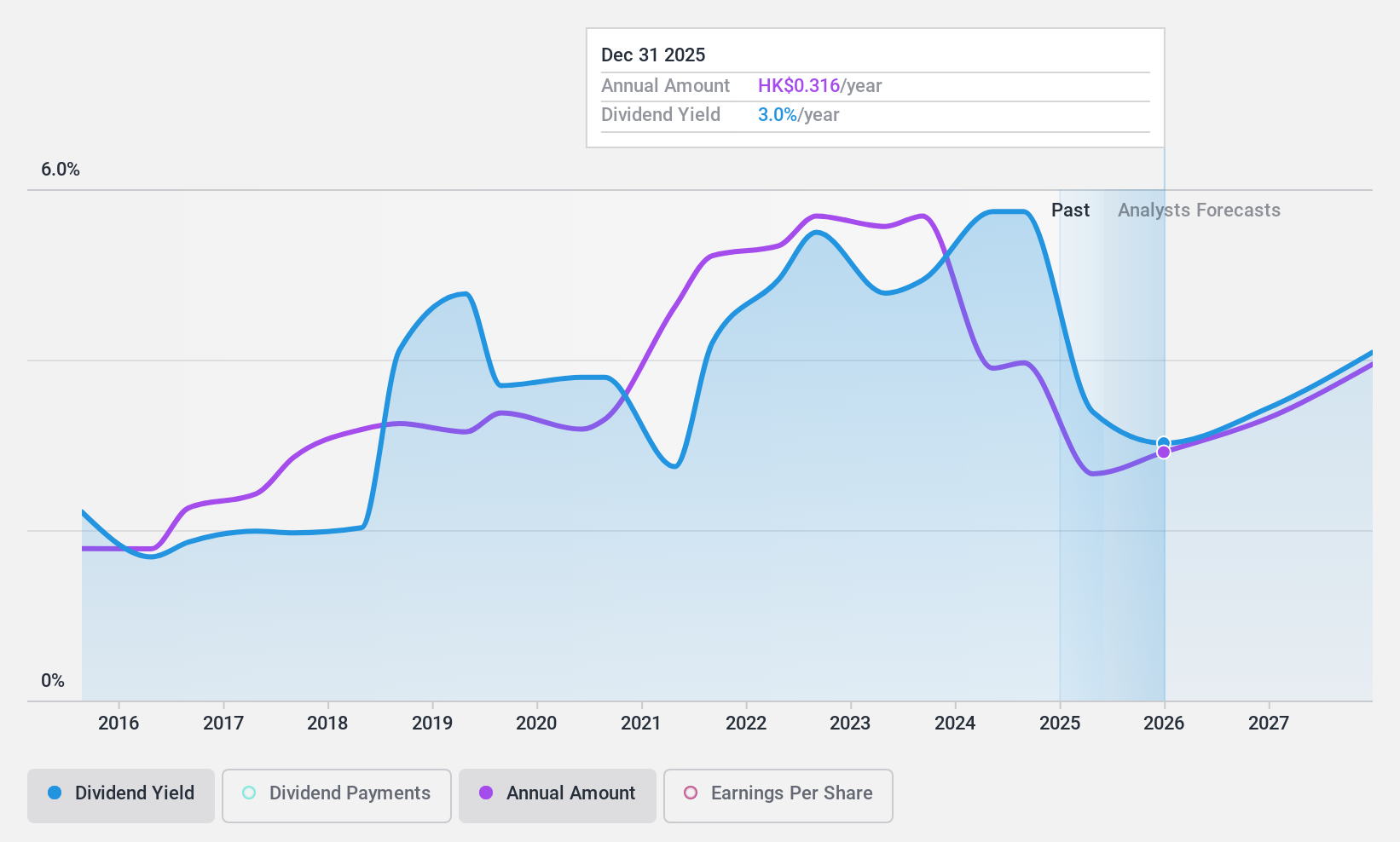

China Medical System Holdings (SEHK:867)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Medical System Holdings Limited is an investment holding company that manufactures, sells, markets, and promotes pharmaceutical products in the People’s Republic of China with a market cap of HK$18.66 billion.

Operations: The company's revenue segment primarily comprises CN¥7.01 billion from the marketing, promotion, sales, and manufacturing of pharmaceutical products in China.

Dividend Yield: 5.4%

China Medical System Holdings offers a dividend yield of 5.38%, which is modest compared to top-tier Hong Kong dividend payers. The company's payout ratio is 40.3%, suggesting dividends are covered by earnings, though cash flow coverage is tighter at 76.6%. Despite past volatility and unreliability in dividends, recent product approvals could enhance future stability and growth potential, especially with the NMPA's approval of CMS-D005 for clinical trials in China.

- Click here to discover the nuances of China Medical System Holdings with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that China Medical System Holdings is priced lower than what may be justified by its financials.

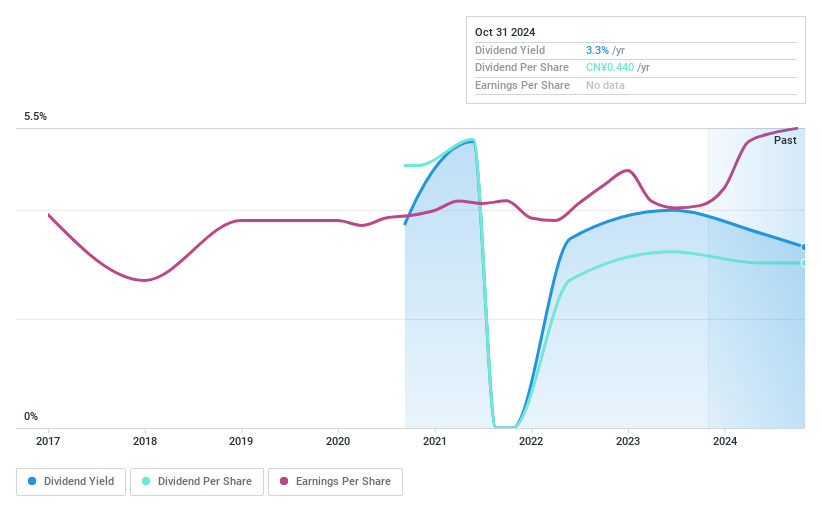

Runner (Xiamen) (SHSE:603408)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Runner (Xiamen) Corp. is involved in the R&D, design, production, and sale of kitchen and bathroom products as well as water purification products both in China and internationally, with a market cap of CN¥5.76 billion.

Operations: The company's revenue segments include kitchen and bathroom products (CN¥4.32 billion) and water purification products (CN¥2.15 billion).

Dividend Yield: 3.3%

Runner (Xiamen) has a dividend yield of 3.31%, placing it in the top 25% of CN market payers. Despite a low payout ratio of 36.7%, its dividends have been volatile and unreliable over four years, with payments decreasing. Earnings grew by CNY 106.4 million year-on-year to CNY 396.6 million, supporting dividend coverage alongside a cash payout ratio of 44%. The stock trades at a favorable P/E ratio of 11.1x compared to the CN market average.

- Click to explore a detailed breakdown of our findings in Runner (Xiamen)'s dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Runner (Xiamen) shares in the market.

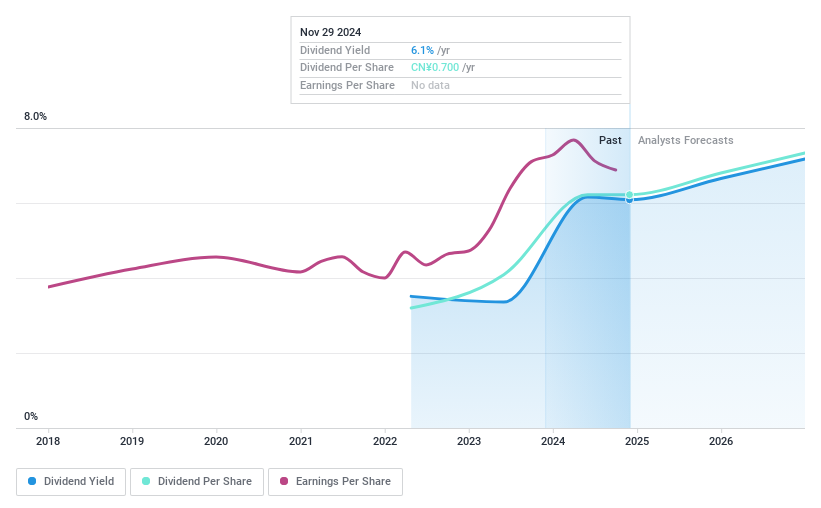

Beijing Caishikou Department StoreLtd (SHSE:605599)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beijing Caishikou Department Store Co., Ltd. operates as a retail company focusing on department store services, with a market cap of CN¥8.74 billion.

Operations: The company generates its revenue primarily from the sale of gold and jewellery, amounting to CN¥19.53 billion.

Dividend Yield: 6.1%

Beijing Caishikou Department Store Ltd. offers a dividend yield of 6.09%, ranking it among the top 25% in the CN market. Despite only three years of dividend history, payments have been stable and growing with coverage ensured by an 81.4% earnings payout ratio and a 61.6% cash flow payout ratio. The stock is attractively valued with a P/E ratio of 13.4x, well below the CN market average, indicating good relative value for investors seeking dividends amidst consistent revenue growth to CNY 15.35 billion for nine months ending September 2024 despite slight net income decline to CNY 554 million from CNY 591 million year-on-year.

- Take a closer look at Beijing Caishikou Department StoreLtd's potential here in our dividend report.

- Upon reviewing our latest valuation report, Beijing Caishikou Department StoreLtd's share price might be too pessimistic.

Next Steps

- Dive into all 1964 of the Top Dividend Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603408

Runner (Xiamen)

Engages in the research and development, design, production, and sale of kitchen and bathroom products, water purification products, and other products in China and internationally.

Flawless balance sheet with solid track record and pays a dividend.