- Switzerland

- /

- Machinery

- /

- SWX:SRAIL

3 Global Growth Companies With Insider Ownership As High As 29%

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets, where geopolitical tensions and consumer spending concerns weigh heavily on investor sentiment, identifying companies with strong growth potential is more crucial than ever. In this context, insider ownership can serve as a significant indicator of company confidence and alignment with shareholder interests, making it an important factor to consider when evaluating growth stocks.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| TF Bank (OM:TFBANK) | 15.6% | 20% |

| Laopu Gold (SEHK:6181) | 36.4% | 43.2% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 121.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.2% | 60% |

Let's take a closer look at a couple of our picks from the screened companies.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★★

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of approximately SEK28.81 billion.

Operations: The company's revenue primarily comes from its communications software segment, which generated SEK1.88 billion.

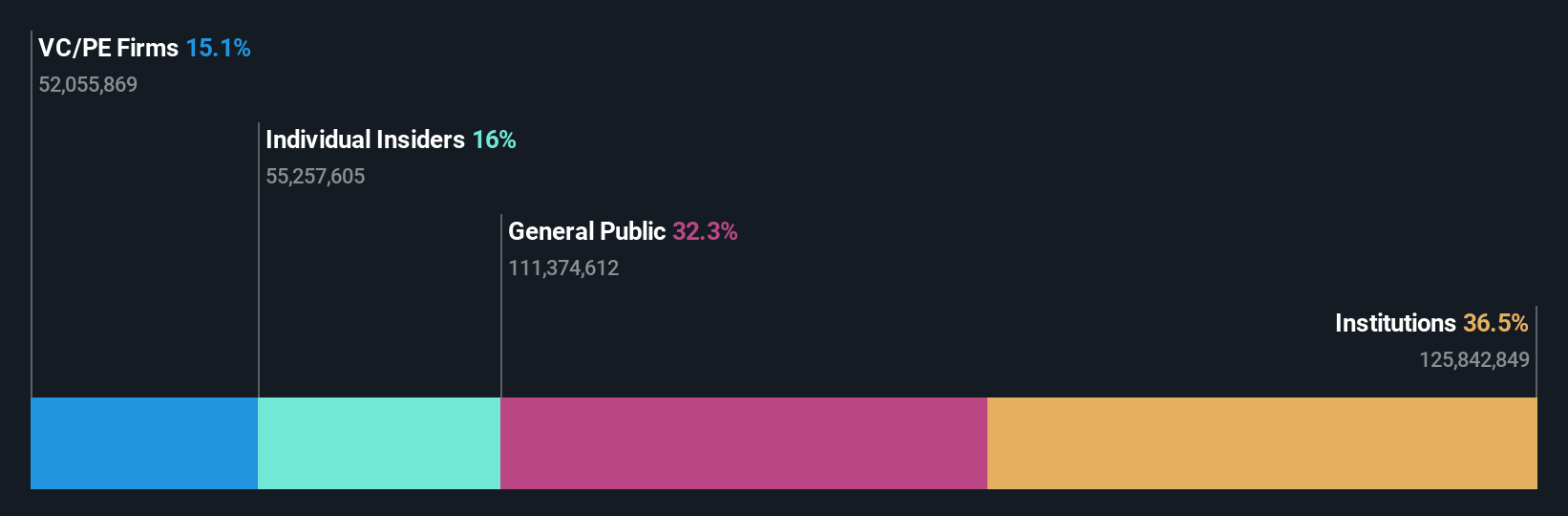

Insider Ownership: 29.7%

Truecaller demonstrates potential as a growth company with high insider ownership. Recent earnings show increased sales and net income, while the launch of advanced iOS features could boost subscription revenue. The company's forecasted annual profit and revenue growth rates are expected to significantly outpace the Swedish market. Strategic partnerships, like with Nawy, enhance its business communication solutions, potentially increasing customer trust and reducing fraud risks. Truecaller's return on equity is also projected to be very high in three years.

- Click here to discover the nuances of Truecaller with our detailed analytical future growth report.

- Our valuation report here indicates Truecaller may be overvalued.

Ningbo Sanxing Medical ElectricLtd (SHSE:601567)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ningbo Sanxing Medical Electric Co., Ltd. is engaged in the manufacturing and selling of power distribution and utilization systems both in China and internationally, with a market cap of CN¥37.10 billion.

Operations: Ningbo Sanxing Medical Electric Co., Ltd. generates its revenue through the manufacturing and sale of power distribution and utilization systems in both domestic and international markets.

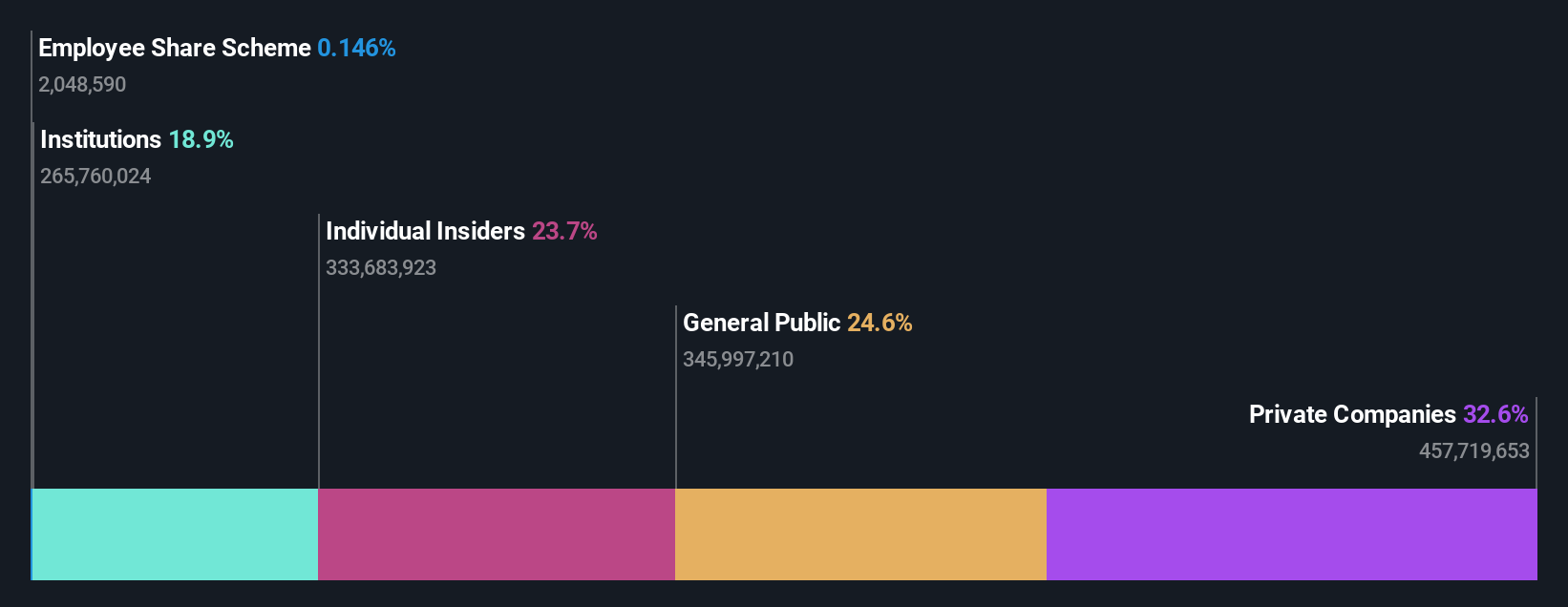

Insider Ownership: 23.8%

Ningbo Sanxing Medical Electric Ltd. is trading well below its estimated fair value, suggesting potential for price appreciation. Analysts expect revenue to grow at 21.9% annually, outpacing the Chinese market's average growth rate. However, its earnings growth forecast of 21.6% per year lags behind the broader market's expected growth of 25.5%. While insider trading activity is not substantial recently, high return on equity projections highlight operational efficiency prospects in the coming years.

- Delve into the full analysis future growth report here for a deeper understanding of Ningbo Sanxing Medical ElectricLtd.

- Upon reviewing our latest valuation report, Ningbo Sanxing Medical ElectricLtd's share price might be too pessimistic.

Stadler Rail (SWX:SRAIL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stadler Rail AG, with a market cap of CHF2.11 billion, manufactures and sells trains across Switzerland, Germany, Austria, Europe, the Americas, CIS countries and other international markets through its subsidiaries.

Operations: Stadler Rail's revenue is primarily derived from its Rolling Stock segment at CHF3.10 billion, followed by Service & Components at CHF789.41 million and Signalling at CHF135.68 million.

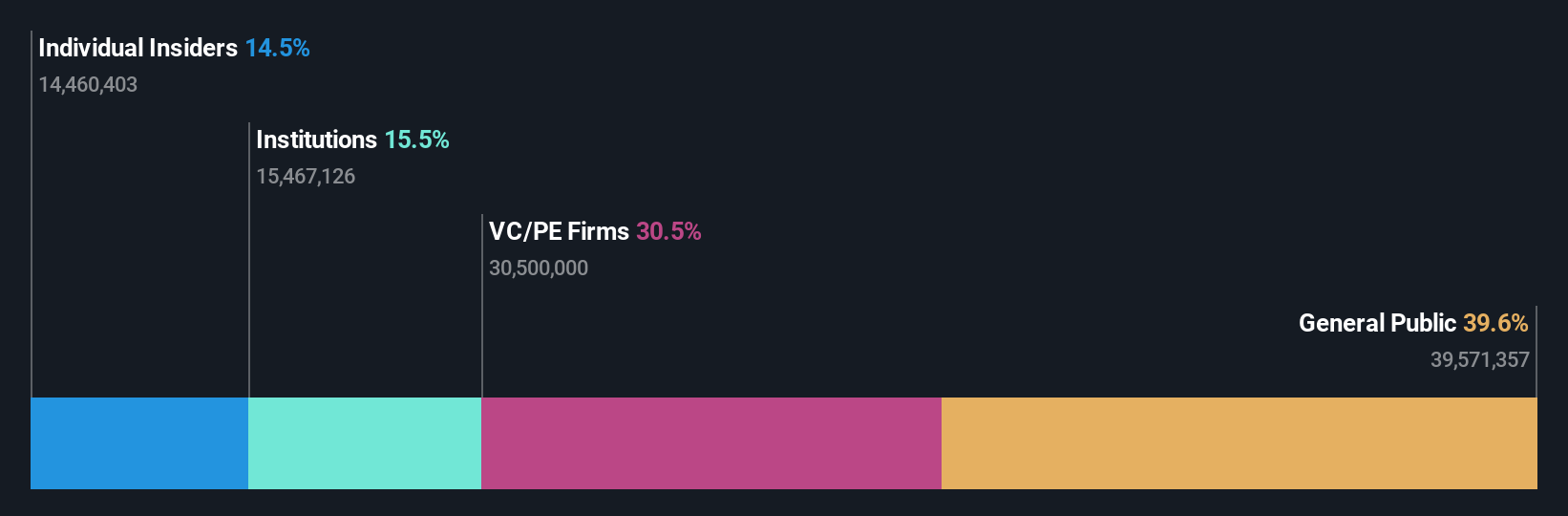

Insider Ownership: 14.5%

Stadler Rail is trading significantly below its estimated fair value, indicating potential undervaluation. Despite a modest revenue growth forecast of 5.2% annually, earnings are expected to rise substantially at 22.9%, surpassing the Swiss market average. However, its dividend yield of 4.27% isn't well-covered by free cash flows, and return on equity is projected to be relatively low at 18.7%. No significant insider trading activity has been reported recently.

- Unlock comprehensive insights into our analysis of Stadler Rail stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Stadler Rail shares in the market.

Make It Happen

- Take a closer look at our Fast Growing Global Companies With High Insider Ownership list of 868 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SRAIL

Stadler Rail

Through its subsidiaries, engages in the manufacture and sale of trains in Switzerland, Germany, Austria, Western and Eastern Europe, the Americas, the CIS countries, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives