In a week marked by intense earnings reports and economic data releases, small-cap stocks demonstrated resilience amid broader market volatility, even as major indices like the S&P 500 and Nasdaq Composite saw declines. With manufacturing activity continuing to slump and mixed signals from labor markets, investors are increasingly turning their attention to stocks with strong fundamentals that can withstand such uncertain conditions. In this context, identifying undiscovered gems with solid financial health becomes crucial for navigating the current economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al Wathba National Insurance Company PJSC | 14.56% | 13.48% | 31.31% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Jiangsu Zijin Rural Commercial BankLtd (SHSE:601860)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Zijin Rural Commercial Bank Co., Ltd offers a range of banking products and services to individual and business clients, with a market capitalization of CN¥10.62 billion.

Operations: The bank generates its revenue primarily through interest income and fee-based services. It has reported a net profit margin of 16.5% in the latest financial period, reflecting its efficiency in managing costs relative to its income.

Jiangsu Zijin Rural Commercial Bank, with assets totaling CN¥271 billion and equity of CN¥19.6 billion, operates on a foundation of primarily low-risk funding sources, as 87% of its liabilities are customer deposits. The bank's total deposits stand at CN¥218.8 billion against loans amounting to CN¥180.6 billion, supported by a sufficient allowance for bad loans at 1.3%. Despite reporting negative earnings growth of -3.2% over the past year compared to the industry average growth of 2.7%, it trades at a significant discount to its estimated fair value and maintains high-quality earnings performance amidst these challenges.

Nanjing Kangni Mechanical & ElectricalLtd (SHSE:603111)

Simply Wall St Value Rating: ★★★★★★

Overview: Nanjing Kangni Mechanical & Electrical Co., Ltd specializes in the research, development, manufacture, sale, and maintenance of railway vehicle door systems and has a market capitalization of CN¥5.51 billion.

Operations: Kangni Mechanical & Electrical generates revenue primarily from the sale of railway vehicle door systems. The company's net profit margin has shown a notable trend, indicating its efficiency in converting revenue into actual profit.

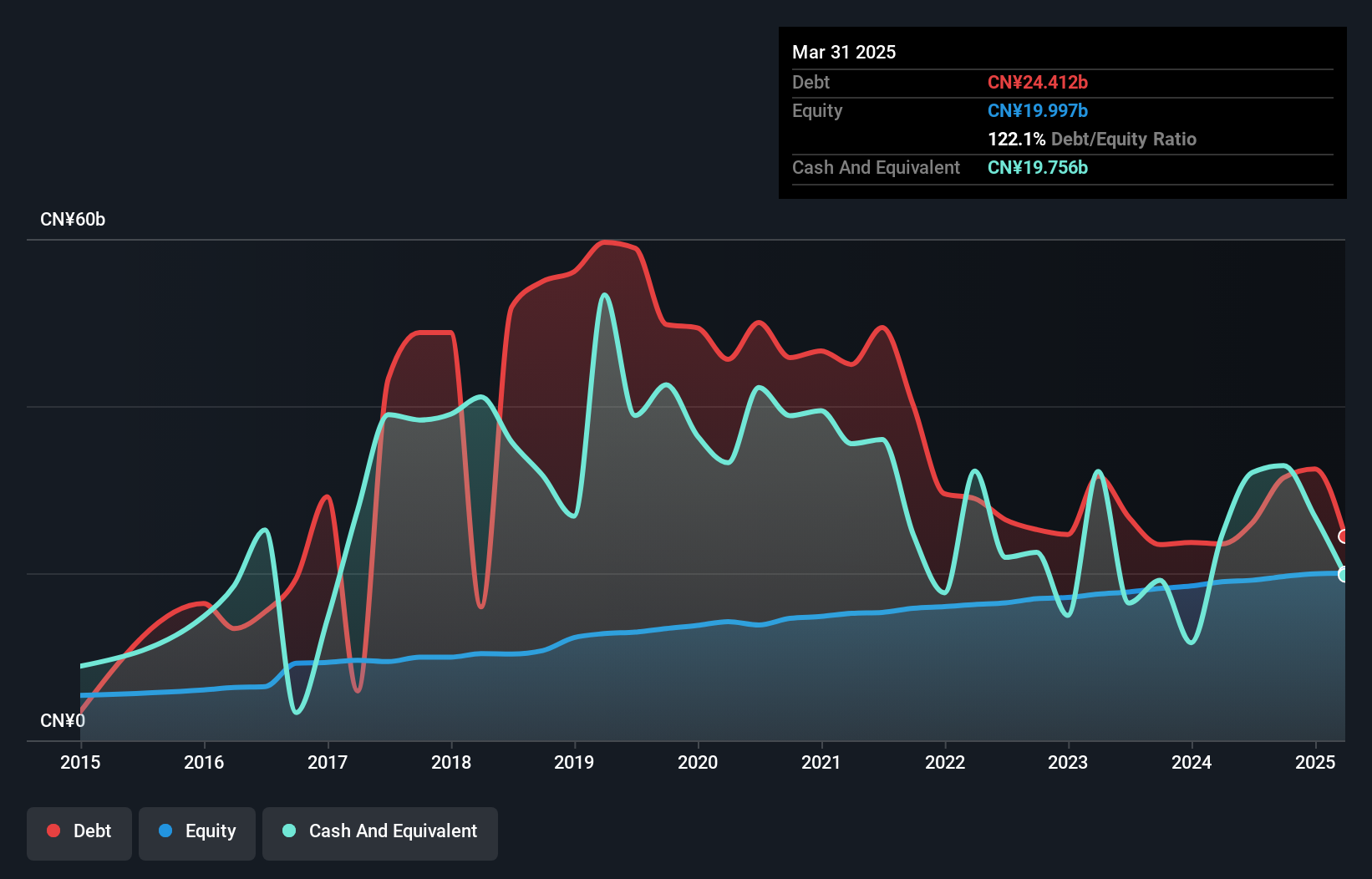

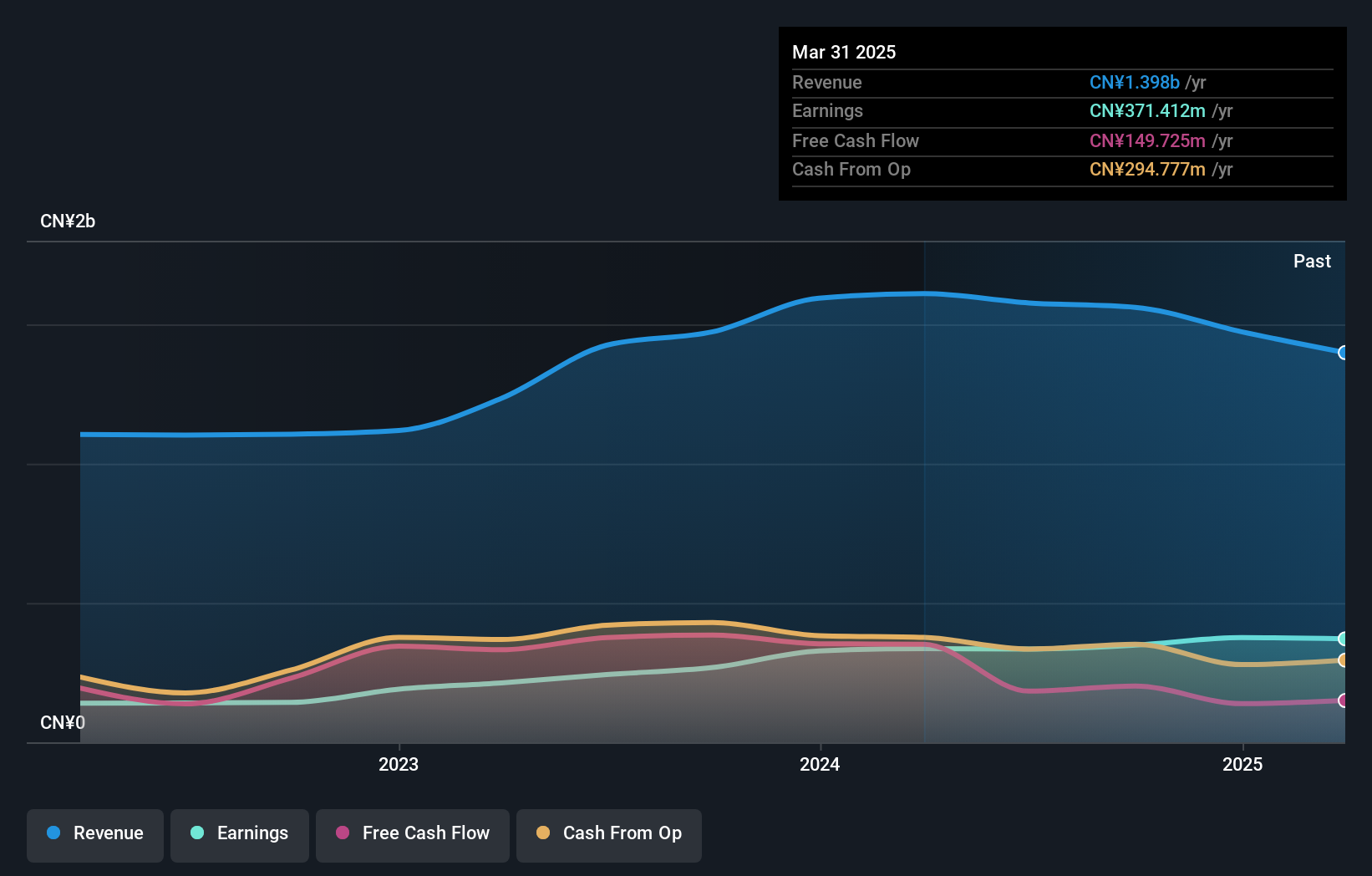

Nanjing Kangni Mechanical & Electrical, a relatively small player in its field, has shown notable financial strength. Over the past year, earnings surged by 41.7%, vastly outpacing the Machinery industry's -0.4% performance. The company boasts a favorable price-to-earnings ratio of 13.5x compared to the broader CN market's 34.4x, suggesting potential undervaluation. Additionally, it has successfully reduced its debt-to-equity ratio from 21.1% to just 4.1% over five years and holds more cash than total debt—a sign of financial stability and prudent management practices that could attract investor interest in future growth prospects.

Shanghai Kaibao PharmaceuticalLtd (SZSE:300039)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Kaibao Pharmaceutical CO.,Ltd focuses on the research, development, production, and sale of modern Chinese medicines primarily in China, with a market capitalization of CN¥7.23 billion.

Operations: Kaibao Pharmaceutical generates revenue of CN¥1.56 billion from its industry segment. The company's financial performance is influenced by its net profit margin trends, which have shown notable fluctuations over recent periods.

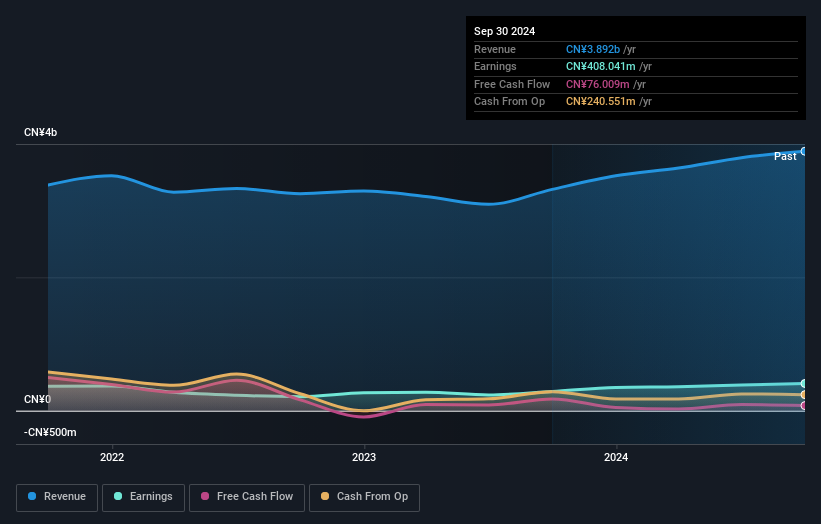

Shanghai Kaibao Pharmaceutical, a nimble player in the pharmaceutical sector, has shown a robust earnings growth of 30% over the past year, outpacing its industry peers. The company's price-to-earnings ratio stands at 20.7x, offering better value compared to the broader CN market's 34.4x. Despite a slight dip in sales from CNY 1,154 million to CNY 1,121 million for nine months ending September 2024, net income rose to CNY 217 million from CNY 196 million previously. With high-quality earnings and more cash than debt on hand, this firm seems well-positioned financially amidst industry challenges.

Where To Now?

- Discover the full array of 4731 Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Kangni Mechanical & ElectricalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603111

Nanjing Kangni Mechanical & ElectricalLtd

Engages in the research and development, manufacture, sale, and maintenance of railway vehicle door systems.

Flawless balance sheet with solid track record and pays a dividend.