Spotlighting Undiscovered Gems with Strong Potential In November 2024

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes nearing record highs and smaller-cap stocks outperforming their larger counterparts, investors are keenly observing the economic indicators that suggest a favorable climate for small-cap companies. In this context of broad-based gains and positive sentiment driven by strong labor data and home sales, identifying stocks with robust fundamentals and growth potential becomes crucial for those seeking opportunities in less-trodden paths.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Jiangsu Yunyi ElectricLtd (SZSE:300304)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Yunyi Electric Co., Ltd. engages in the research, development, manufacturing, marketing, and sale of automotive electronic parts both in China and internationally, with a market cap of CN¥7.28 billion.

Operations: Yunyi Electric generates revenue primarily from the sale of automotive electronic parts. The company has a market cap of CN¥7.28 billion.

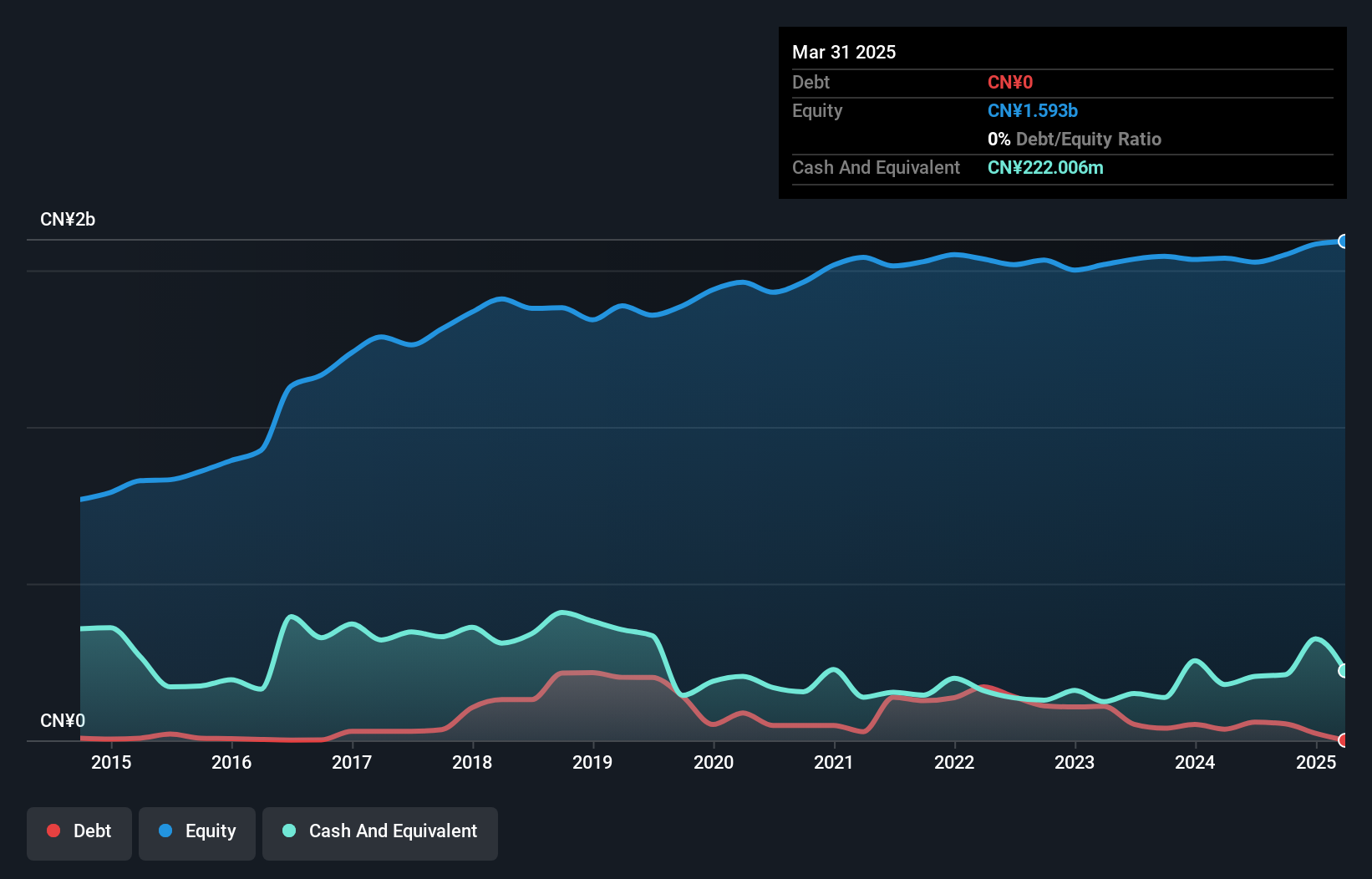

Jiangsu Yunyi Electric, a dynamic player in the auto components sector, has shown impressive financial resilience. Over the past five years, its debt to equity ratio plummeted from 13.8% to just 0.3%, demonstrating solid fiscal management. With earnings surging by 40.9% last year and outpacing the industry average of 10.5%, it seems poised for continued growth with forecasts suggesting a further annual increase of 21%. The company trades at a significant discount of nearly 56% below its estimated fair value, offering potential upside for investors seeking undervalued opportunities in this space.

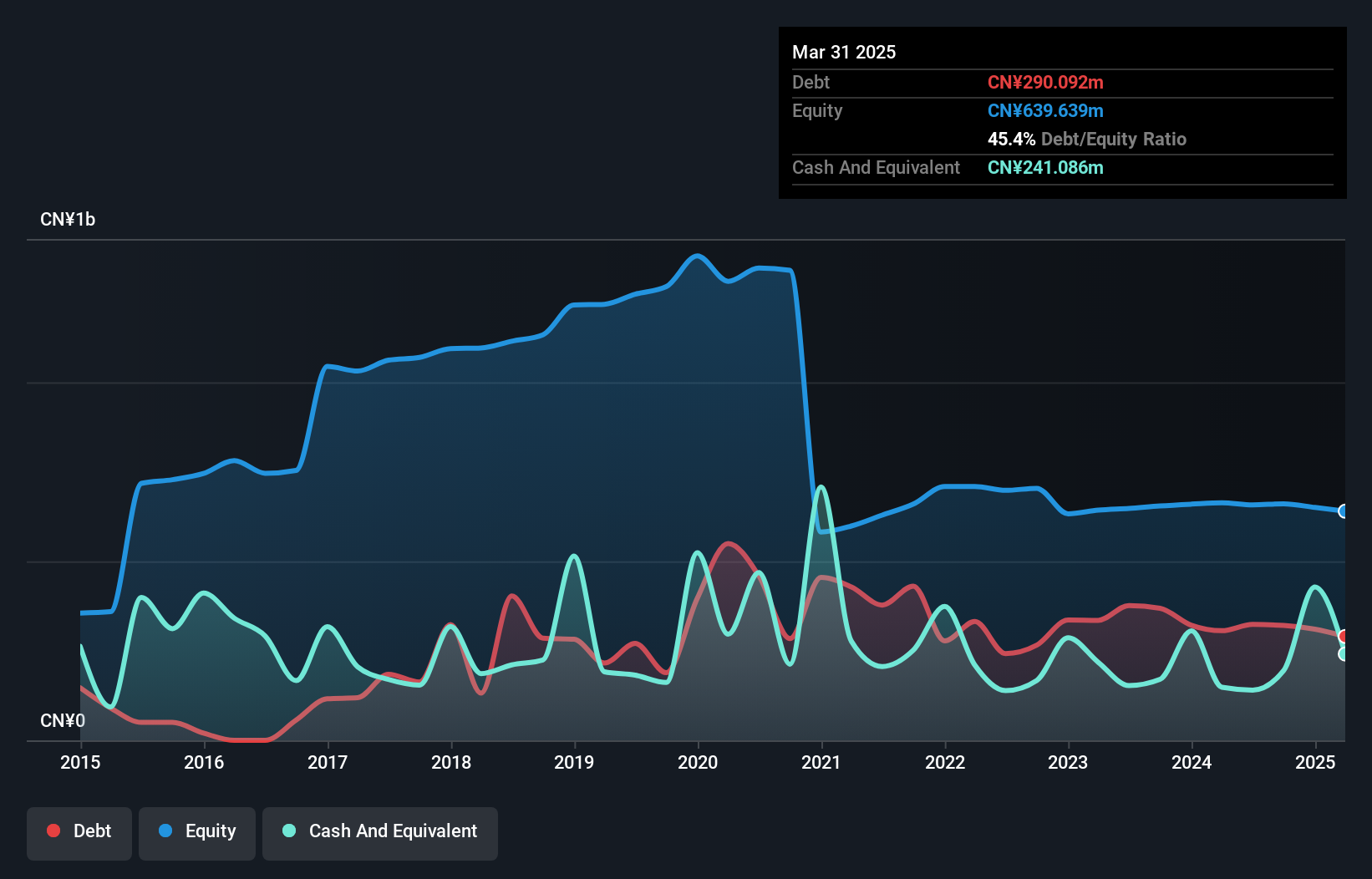

Changshu Tianyin ElectromechanicalLtd (SZSE:300342)

Simply Wall St Value Rating: ★★★★★★

Overview: Changshu Tianyin Electromechanical Co., Ltd focuses on the research and development, production, and sale of refrigerator compressor parts in China, with a market cap of CN¥7.99 billion.

Operations: The company generates revenue primarily from the sale of refrigerator compressor parts. It has a market capitalization of CN¥7.99 billion, reflecting its financial scale in the industry.

Changshu Tianyin Electromechanical, a nimble player in the electrical sector, has seen its earnings soar by 339% over the past year, outpacing industry growth of 1%. The company's financial health appears robust with cash exceeding total debt and a debt-to-equity ratio dropping from 10.1 to 3.4 over five years. Despite a large one-off loss of CN¥22M impacting recent results, free cash flow remains positive at CN¥96M for the latest quarter. Earnings per share rose to CNY 0.13 from CNY 0.10 year-on-year, reflecting solid operational performance amidst market volatility.

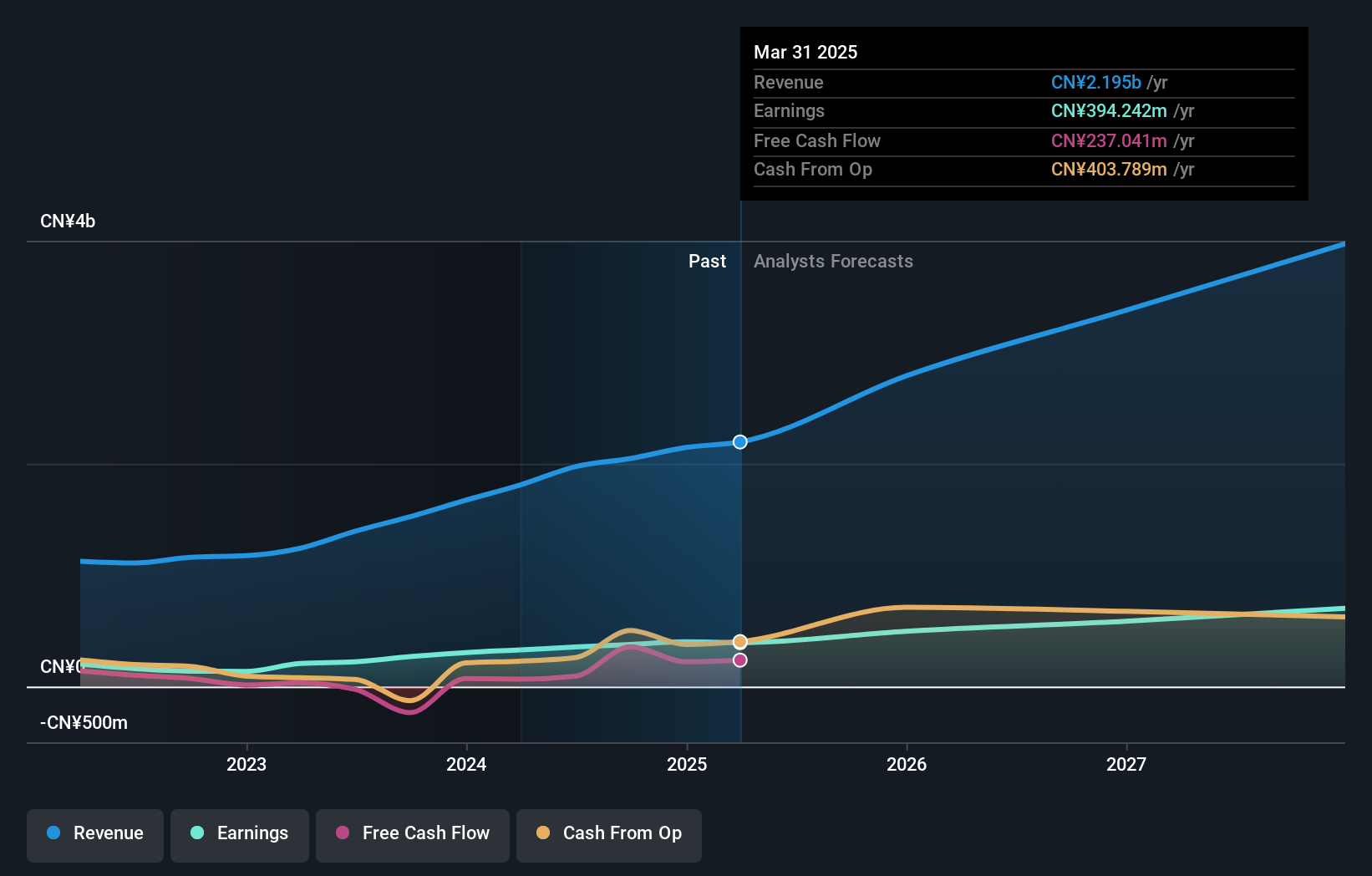

Global Infotech (SZSE:300465)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Global Infotech Co., Ltd. specializes in offering financial information software products and integrated services within China, with a market capitalization of CN¥6.61 billion.

Operations: Global Infotech's revenue streams are derived from its financial information software products and integrated services. The company's market capitalization is CN¥6.61 billion.

Global Infotech, a relatively smaller player in the tech sector, has shown resilience despite challenges. The company reported sales of CNY 762.9 million for the first nine months of 2024, down from CNY 885.44 million in the previous year, yet net income rose to CNY 24.04 million from CNY 21.22 million. Its basic earnings per share increased to CNY 0.0538 from CNY 0.0475 last year, indicating improved profitability amid revenue pressures. Recently completing a buyback of over three million shares for approximately CNY 30 million suggests confidence in its market valuation and strategic capital management efforts moving forward.

- Dive into the specifics of Global Infotech here with our thorough health report.

Understand Global Infotech's track record by examining our Past report.

Taking Advantage

- Navigate through the entire inventory of 4622 Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300465

Global Infotech

Provides financial information software products and integrated services in China.

Adequate balance sheet with acceptable track record.