As we approach December 2025, the Asian markets are capturing global attention with their dynamic shifts, particularly in the technology and artificial intelligence sectors. With small-cap stocks showing strong performance and investor enthusiasm driving advances in key indices like China's CSI 300 Index, now is an opportune time to explore potential investment opportunities that may have been overlooked. In this context, a good stock often presents a blend of solid fundamentals and growth potential that aligns well with prevailing market trends and economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| CYMECHS | NA | -4.49% | -14.34% | ★★★★★★ |

| Jinghua Pharmaceutical Group | NA | 2.42% | 18.34% | ★★★★★★ |

| Suzhou Chunqiu Electronic Technology | 42.72% | 0.34% | -11.76% | ★★★★★★ |

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| Kanro | 5.65% | 7.36% | 35.28% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 11.18% | 1.78% | ★★★★★★ |

| Changchun FAWAY Group Automobile Components | 4.23% | -1.01% | -7.40% | ★★★★★☆ |

| Shanghai SK Automation TechnologyLtd | 26.22% | 27.36% | 28.69% | ★★★★★☆ |

| Suzhou Xingye Materials TechnologyLtd | 0.14% | -3.11% | -19.10% | ★★★★★☆ |

| Qingdao Daneng Environmental Protection Equipment | 57.57% | 29.08% | 28.94% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Streamax Technology (SZSE:002970)

Simply Wall St Value Rating: ★★★★★☆

Overview: Streamax Technology Co., Ltd. focuses on the research, development, manufacturing, and sale of AI-powered mobile safety and industrial management solutions for commercial vehicles both in China and internationally, with a market cap of CN¥8.82 billion.

Operations: Streamax Technology generates revenue primarily from the sale of AI-powered solutions for commercial vehicles. The company's cost structure includes expenses related to research, development, and manufacturing. It has a market cap of CN¥8.82 billion.

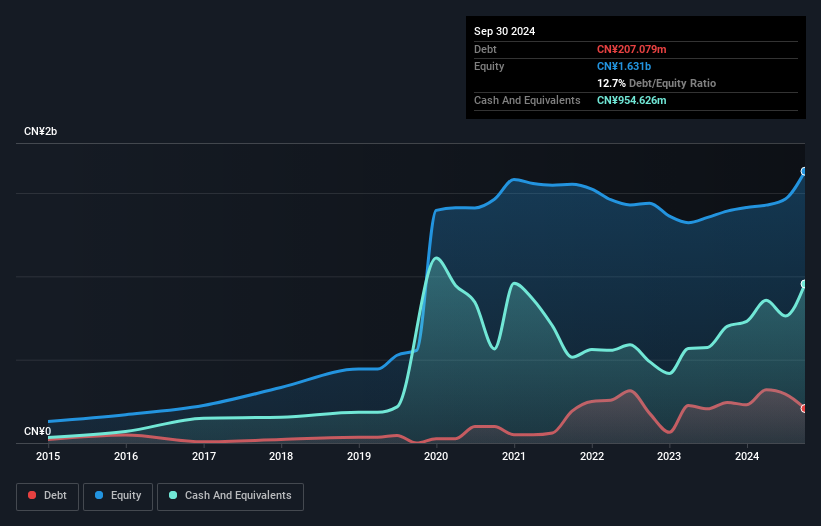

Streamax Technology, a smaller player in the market, shows promising signs with its earnings growing 42.7% over the past year, outpacing the Auto Components industry growth of 7.8%. The company reported a net income of CNY 274.04 million for the first nine months of 2025, up from CNY 220.3 million in the previous year, reflecting strong operational performance despite sales slipping to CNY 1.69 billion from CNY 1.92 billion. With a price-to-earnings ratio at an attractive level of 25.7x compared to the CN market's average of 43.6x and more cash than total debt, Streamax appears well-positioned financially and competitively within its industry context.

Shandong Kaisheng New MaterialsLtd (SZSE:301069)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shandong Kaisheng New Materials Co., Ltd. is involved in the research, development, production, and sale of fine chemical products and new polymer materials across Mainland China and various international markets, with a market cap of CN¥11.25 billion.

Operations: The company generates revenue primarily from its new chemical materials segment, which reported CN¥1.01 billion.

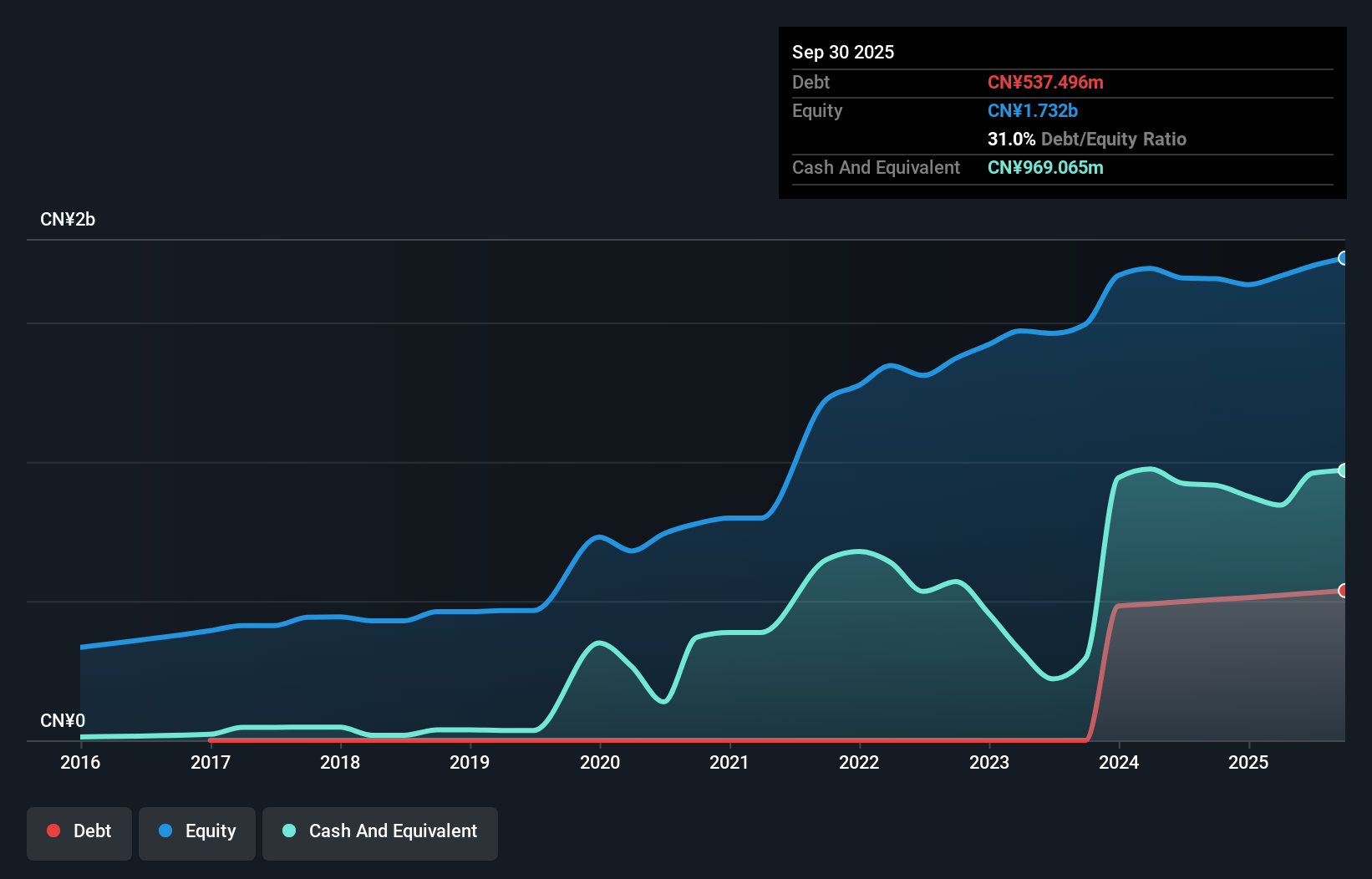

Shandong Kaisheng New Materials, a nimble player in the chemicals sector, posted impressive earnings growth of 56% over the past year, outpacing the industry's 6.8%. The company reported a net income of CNY 115.76 million for the first nine months of 2025, up from CNY 52.24 million last year. Despite its volatile share price recently, it boasts a healthy financial position with more cash than total debt and EBIT covering interest payments by 5.7 times. A notable one-off gain of CN¥52.1M impacted recent results, yet free cash flow remains positive and promising for future endeavors.

Machvision (TWSE:3563)

Simply Wall St Value Rating: ★★★★★★

Overview: Machvision Inc. specializes in developing and selling machine vision systems for the semiconductor and printed circuit board (PCB) industries in Taiwan, with a market capitalization of approximately NT$33 billion.

Operations: Machvision generates revenue primarily from its optical inspection machinery equipment and related products, amounting to NT$3.13 billion.

Machvision, a notable player in the semiconductor industry, has demonstrated remarkable financial performance recently. The company reported a significant rise in earnings for the third quarter of 2025, with sales reaching TWD 767.21 million compared to TWD 346.71 million the previous year. Net income soared to TWD 224.57 million from TWD 34.55 million, showcasing strong profitability and high-quality earnings. Earnings per share jumped to TWD 3.5 from TWD 0.54 last year, reflecting robust operational efficiency and growth potential within its sector despite past challenges of declining annual earnings by an average of 7%.

- Click here to discover the nuances of Machvision with our detailed analytical health report.

Understand Machvision's track record by examining our Past report.

Seize The Opportunity

- Delve into our full catalog of 2505 Asian Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301069

Shandong Kaisheng New MaterialsLtd

Engages in the research and development, production, and sale of fine chemical products and new polymer materials in Mainland China, Japan, South Korea, the United States, and internationally.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026