Sensirion (SWX:SENS): Evaluating Valuation After Major Capacity Expansion and New Facility Investments in Stafa

Reviewed by Simply Wall St

Sensirion Holding (SWX:SENS) just broke ground on a major new production facility in Stafa, Switzerland. The company also acquired land for an additional office building in the area. This move highlights the company’s ongoing focus on capacity expansion and long-term growth.

See our latest analysis for Sensirion Holding.

This new investment comes at a pivotal time for Sensirion Holding. Despite steady revenue and earnings growth, recent market sentiment has been muted, with the stock’s share price dipping 6% over the last month and slipping nearly 26% across the past quarter. Over twelve months, the total shareholder return stands at -5.9%, and the longer-term three-year figure trails at -47.7%. Short-term momentum has faded. However, the latest expansion move suggests management is positioning for a turnaround and renewed growth in the future.

If this kind of long-term growth initiative caught your attention, now is a great moment to see what else is possible and discover fast growing stocks with high insider ownership

With shares down significantly from their highs and annual revenue and profit both on the rise, is Sensirion now trading at an attractive discount or is the market already accounting for these growth ambitions in the price?

Most Popular Narrative: 35.7% Undervalued

With Sensirion closing at CHF55.9 and the most popular narrative estimating a fair value at CHF87, analysts are signaling considerable upside ahead based on projected earnings growth and margin expansion.

Strategic acquisition of Kuva Systems and continued R&D investment point toward Sensirion's intent to move up the value chain with data-driven solutions and environmental sensing for industrial and energy applications. This could create potential for higher-margin, recurring revenue streams.

Want to understand which bold growth bets back up this much higher price target? The narrative is anchored by aggressive profit margin gains and a future earnings power typically reserved for industry disruptors. Want a peek inside the financial forecasts that drive this bullish valuation? Only in the full narrative will you discover the exact numbers and market dynamics that explain this valuation gap.

Result: Fair Value of $87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent currency headwinds and potential stagnation in Sensirion’s key industrial and automotive segments could quickly dampen the bullish outlook.

Find out about the key risks to this Sensirion Holding narrative.

Another View: Multiples Suggest a Premium Price

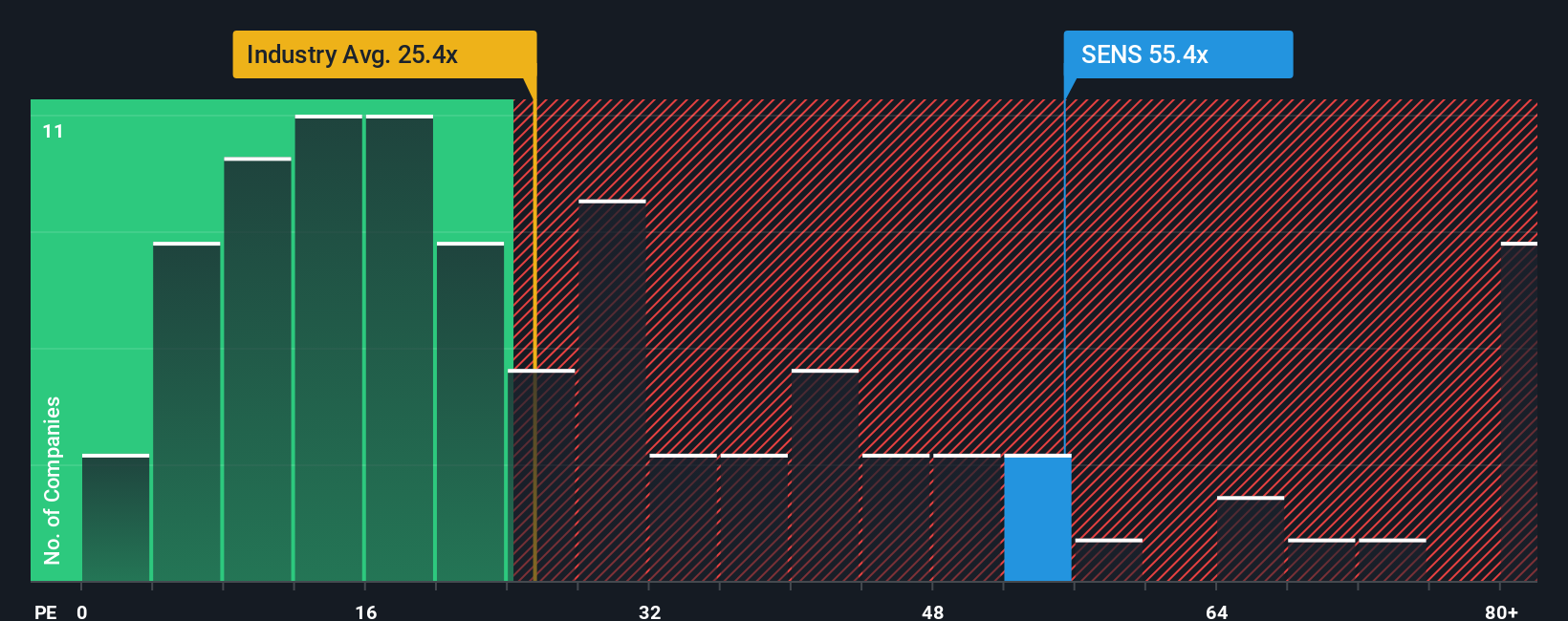

Taking a step back from the fair value estimate, Sensirion shares currently trade at a price-to-earnings ratio of 49.6x. This figure is well above the peer group average of 39.5x and the European Electronic industry’s 24.7x. The “fair ratio” for Sensirion is considered to be 39.2x, hinting that investors are paying up for future growth. At the same time, there is greater downside risk if expectations are missed. Is the market’s optimism justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sensirion Holding Narrative

If you see things differently or want to dig into the numbers on your own terms, you can craft your own Sensirion story in just a few minutes and Do it your way

A great starting point for your Sensirion Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Turn your next insight into action by tapping into the hottest market opportunities across sectors. Don’t watch from the sidelines while others build smarter portfolios.

- Maximize your income potential and secure regular payouts as you scan these 15 dividend stocks with yields > 3%, targeting high-yield opportunities with reliable financial strength.

- Be future-ready by analyzing these 28 AI penny stocks, which are powering the next wave of tech innovation with real-world applications in automation and intelligent data.

- Capitalize on rapid technological shifts by targeting these 31 healthcare AI stocks, which is transforming medical diagnostics, wearables, and patient care at the frontier of health tech.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SENS

Sensirion Holding

Engages in the development, production, sale, and servicing of sensor systems, modules, and components in the Asia Pacific, Europe, the Middle East, Africa, and the Americas.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives