How Sensirion’s New High-Tech Facility and Product Launch Could Shape SWX:SENS Investor Sentiment

Reviewed by Sasha Jovanovic

- Sensirion recently held a groundbreaking ceremony for a new 11,000 m² high-tech production facility in Stafa, Switzerland, designed to address capacity constraints and support future advances in cleanroom manufacturing for the semiconductor industry.

- By also launching the versatile SGM5304 gas meter module and securing additional land for offices, the company is showcasing both long-term operational commitment and innovation in smart metering solutions to meet the evolving needs of global manufacturers.

- Next, we'll explore how Sensirion's investment in advanced production capacity could influence its growth prospects and broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Sensirion Holding Investment Narrative Recap

Investors interested in Sensirion need to believe in the company's ability to turn high-tech manufacturing investments into new growth streams, while managing exposure to sector-specific headwinds. The recent groundbreaking of the advanced Stafa facility demonstrates progress toward mitigating supply constraints, a key short-term catalyst, but does not materially impact Sensirion's biggest risk around currency fluctuations or its dependence on limited high-impact growth drivers.

The launch of the SGM5304 gas meter module ties directly to Sensirion’s strategy of innovation in smart metering and environmental sensing, a space that could contribute to future catalysts around product diversification and recurring revenue streams. This move underlines the company's commitment to evolving market requirements and potential incremental demand in next-generation energy solutions.

In contrast, investors should also be aware of the ongoing risk that Sensirion’s recent growth in the industrial segment could stall if...

Read the full narrative on Sensirion Holding (it's free!)

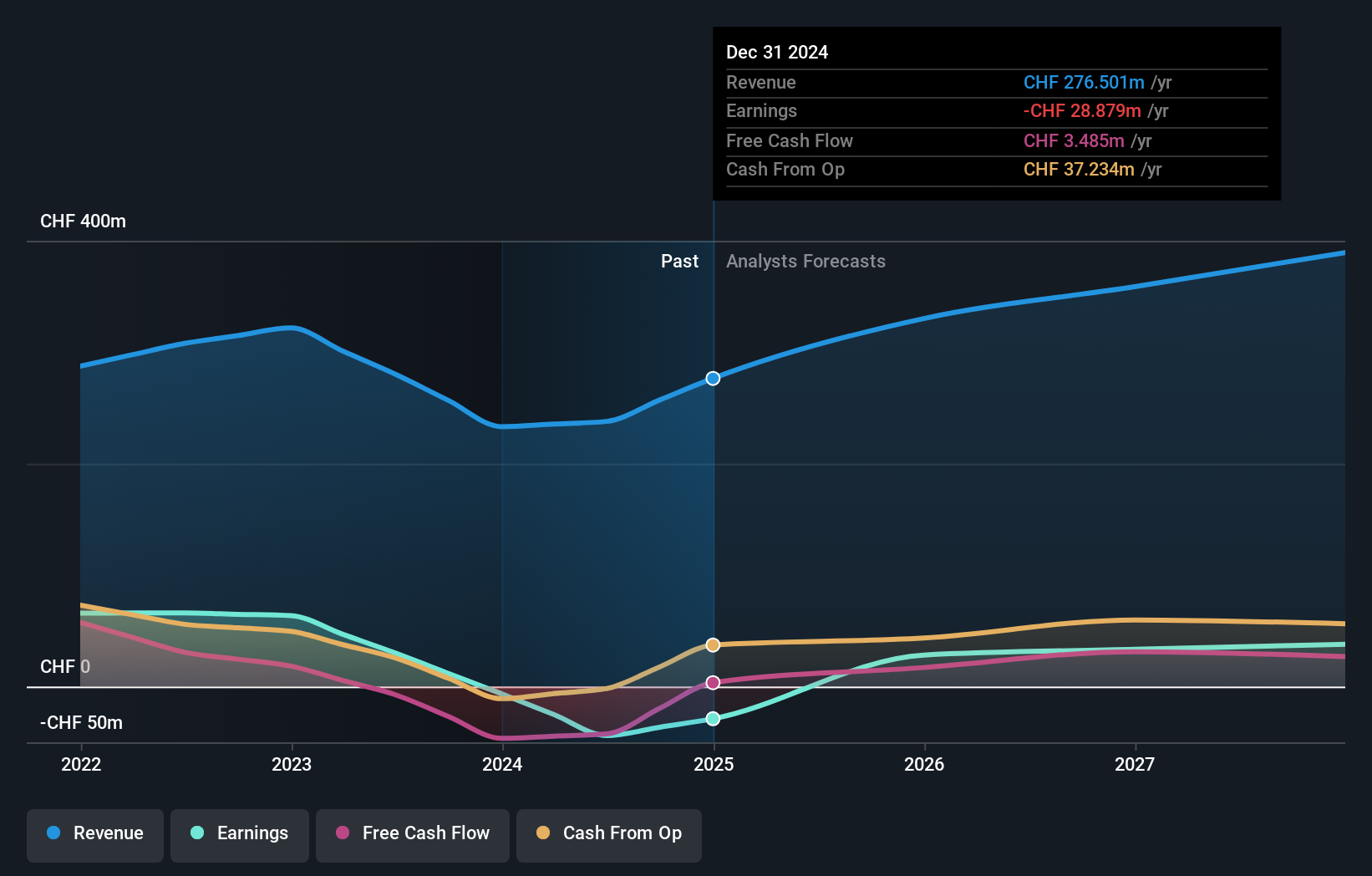

Sensirion Holding's narrative projects CHF403.7 million revenue and CHF44.2 million earnings by 2028. This requires 6.6% yearly revenue growth and a CHF26.6 million earnings increase from CHF17.6 million.

Uncover how Sensirion Holding's forecasts yield a CHF87.00 fair value, a 49% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community currently shares a single fair value estimate at CHF87, reflecting only one perspective. This stands beside analyst expectations that Sensirion’s product innovation may support growth amid pressing risks related to demand concentration, inviting you to consider a range of possible outcomes.

Explore another fair value estimate on Sensirion Holding - why the stock might be worth as much as 49% more than the current price!

Build Your Own Sensirion Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sensirion Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sensirion Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sensirion Holding's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SENS

Sensirion Holding

Engages in the development, production, sale, and servicing of sensor systems, modules, and components in the Asia Pacific, Europe, the Middle East, Africa, and the Americas.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives