- Switzerland

- /

- Capital Markets

- /

- SWX:CFT

Top Dividend Stocks On SIX Swiss Exchange In September 2024

Reviewed by Simply Wall St

The Swiss market has been experiencing volatility, with uncertainty surrounding U.S. interest rate cuts and concerns over global economic growth impacting investor sentiment. Despite these challenges, dividend stocks on the SIX Swiss Exchange remain attractive for their potential to provide steady income and resilience in turbulent times.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.16% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.85% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.67% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.91% | ★★★★★★ |

| EFG International (SWX:EFGN) | 4.87% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 5.60% | ★★★★★☆ |

| TX Group (SWX:TXGN) | 4.63% | ★★★★★☆ |

| Luzerner Kantonalbank (SWX:LUKN) | 4.08% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.68% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.42% | ★★★★★☆ |

Let's dive into some prime choices out of the screener.

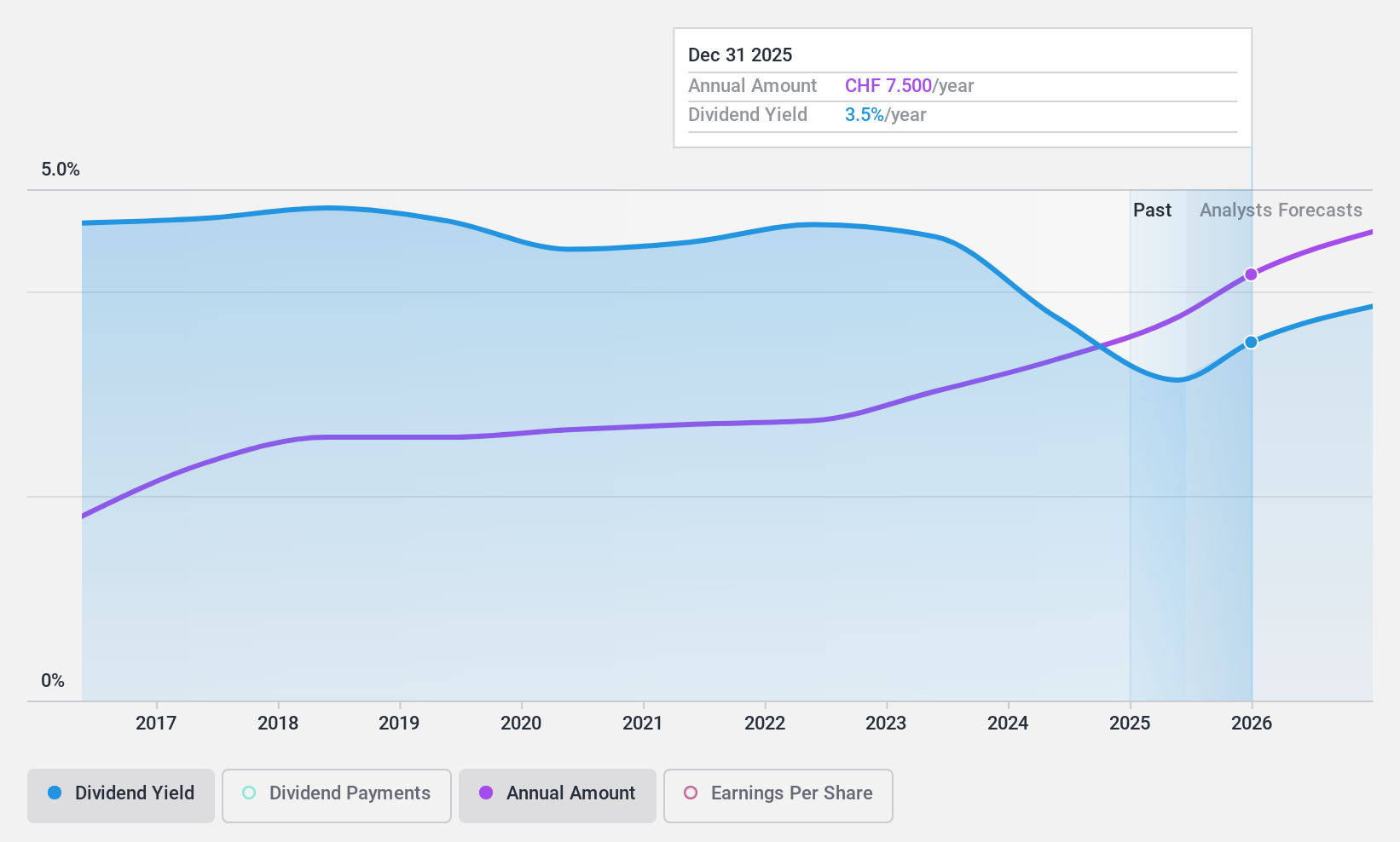

Compagnie Financière Tradition (SWX:CFT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Compagnie Financière Tradition SA operates as a global interdealer broker of financial and non-financial products, with a market cap of CHF1.16 billion.

Operations: Compagnie Financière Tradition SA generates revenue from its key regions as follows: CHF352.67 million in the Americas, CHF273.16 million in Asia-Pacific, and CHF452.85 million in Europe, Middle East, and Africa.

Dividend Yield: 4%

Compagnie Financière Tradition SA, trading at 34.6% below our fair value estimate, reported half-year revenue of CHF 538.34 million and net income of CHF 59.99 million as of June 30, 2024. The company has a stable dividend history over the past decade, with current payments covered by earnings (payout ratio: 43.3%) and cash flows (cash payout ratio: 60.7%). Despite a reliable yield of 4.01%, it is slightly below the top quartile in the Swiss market (4.39%).

- Take a closer look at Compagnie Financière Tradition's potential here in our dividend report.

- Our valuation report here indicates Compagnie Financière Tradition may be undervalued.

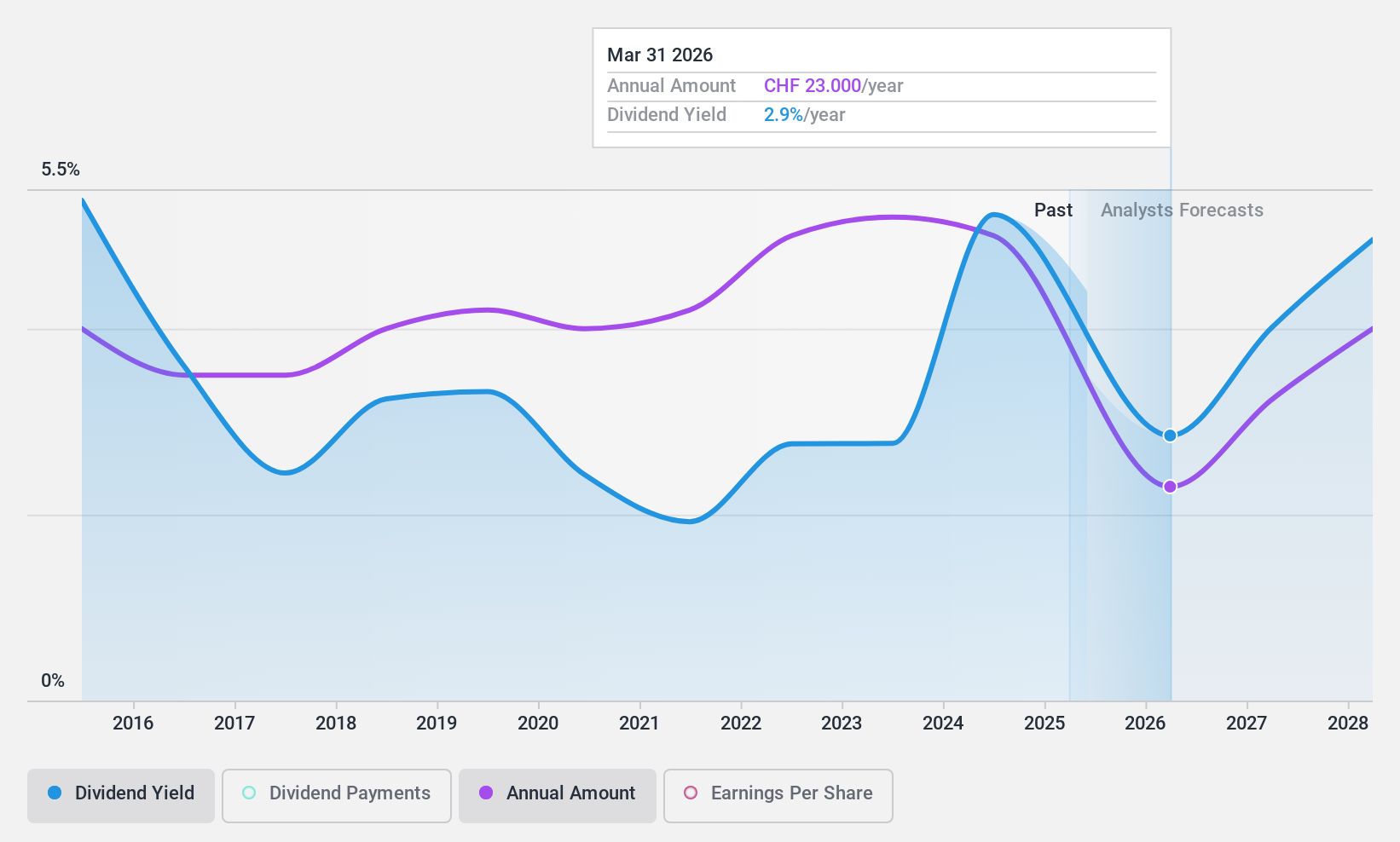

LEM Holding (SWX:LEHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LEM Holding SA, with a market cap of CHF1.42 billion, provides solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America.

Operations: LEM Holding SA generates revenue by providing solutions for measuring electrical parameters across multiple regions, including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America.

Dividend Yield: 4%

LEM Holding SA reported Q1 2024 earnings with sales of CHF 80.96 million and net income of CHF 4.78 million, down from CHF 112.34 million and CHF 20.54 million, respectively, a year ago. Despite dividend growth over the past decade, its current yield (4.01%) is below the top Swiss market quartile (4.39%). The dividend is not well covered by free cash flows (cash payout ratio: 125.8%), raising sustainability concerns amidst high debt levels and recent volatility in share price.

- Click here and access our complete dividend analysis report to understand the dynamics of LEM Holding.

- The analysis detailed in our LEM Holding valuation report hints at an deflated share price compared to its estimated value.

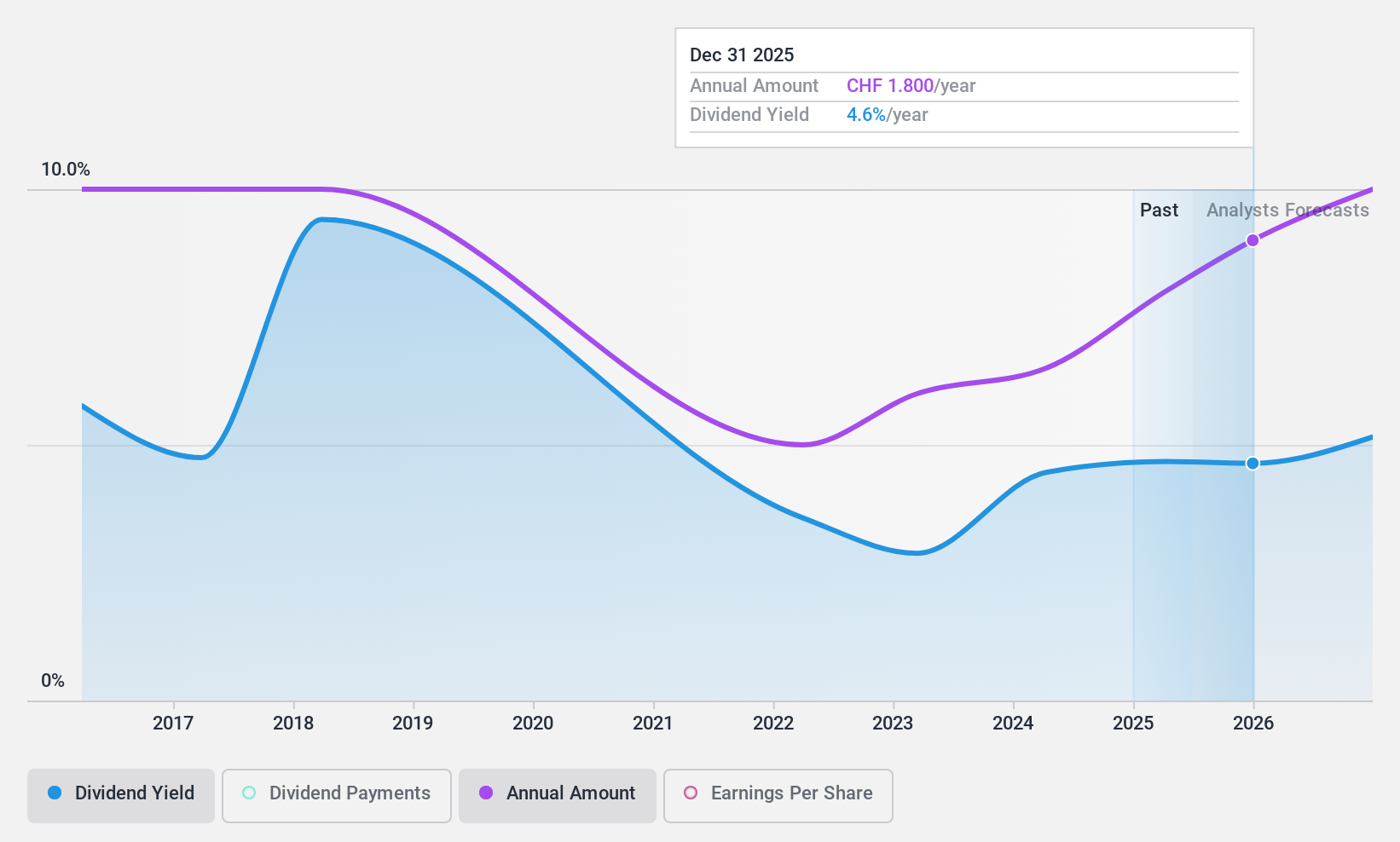

Meier Tobler Group (SWX:MTG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Meier Tobler Group AG operates as a trading and services company specializing in heat generation and air conditioning systems, with a market cap of CHF 274.87 million.

Operations: Meier Tobler Group AG generates revenue primarily through its Service segment, which accounts for CHF 104.01 million, and its Distribution segment, contributing CHF 404.27 million.

Dividend Yield: 5.3%

Meier Tobler Group's dividend yield (5.34%) ranks in the top 25% of Swiss market payers but faces sustainability issues, as it is not well covered by free cash flows (cash payout ratio: 179.3%). Despite a decade of increasing dividends, payments have been volatile and unreliable. Recent earnings for H1 2024 show declining sales (CHF 238.75 million) and net income (CHF 8 million), further challenging dividend stability amidst lower profit margins and high payout ratios.

- Click to explore a detailed breakdown of our findings in Meier Tobler Group's dividend report.

- Upon reviewing our latest valuation report, Meier Tobler Group's share price might be too pessimistic.

Make It Happen

- Access the full spectrum of 25 Top SIX Swiss Exchange Dividend Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CFT

Compagnie Financière Tradition

Operates as an interdealer broker of financial and non-financial products worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.