- Switzerland

- /

- Capital Markets

- /

- SWX:VONN

Exploring Swiss Dividend Stocks In June 2024

Reviewed by Simply Wall St

Amidst political tensions in Europe and ongoing uncertainty about interest rates, the Switzerland market experienced a downturn, closing weaker on Friday. As investors navigate these challenging conditions, dividend stocks in Switzerland may offer a degree of stability and potential for steady returns.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Vontobel Holding (SWX:VONN) | 5.64% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 5.30% | ★★★★★★ |

| Compagnie Financière Tradition (SWX:CFT) | 4.41% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.55% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.37% | ★★★★★★ |

| Novartis (SWX:NOVN) | 3.36% | ★★★★★☆ |

| Roche Holding (SWX:ROG) | 3.88% | ★★★★★☆ |

| EFG International (SWX:EFGN) | 4.47% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 5.14% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.71% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Banque Cantonale Vaudoise (SWX:BCVN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Banque Cantonale Vaudoise operates as a financial services provider in Vaud Canton, throughout Switzerland, the European Union, North America, and globally, with a market capitalization of CHF 8.13 billion.

Operations: Banque Cantonale Vaudoise generates revenue through various segments, including CHF 58 million from Trading, CHF 231.50 million from Retail Banking, CHF 158.80 million from Corporate Center, CHF 273.30 million from Corporate Banking, and CHF 438.40 million from Wealth Management.

Dividend Yield: 4.5%

Banque Cantonale Vaudoise offers a solid dividend yield at 4.55%, ranking in the top 25% of Swiss dividend payers. Its payout ratio stands at 78.7%, with dividends expected to be comfortably covered by earnings (85.4%) in three years, indicating sustainability. The bank's Price-to-Earnings ratio of 17.3x is below the Swiss market average, enhancing its appeal as a value investment. Additionally, BCVN has demonstrated a stable and reliable dividend history over the past decade, coupled with consistent earnings growth, including a notable 20.8% increase last year.

- Delve into the full analysis dividend report here for a deeper understanding of Banque Cantonale Vaudoise.

- In light of our recent valuation report, it seems possible that Banque Cantonale Vaudoise is trading beyond its estimated value.

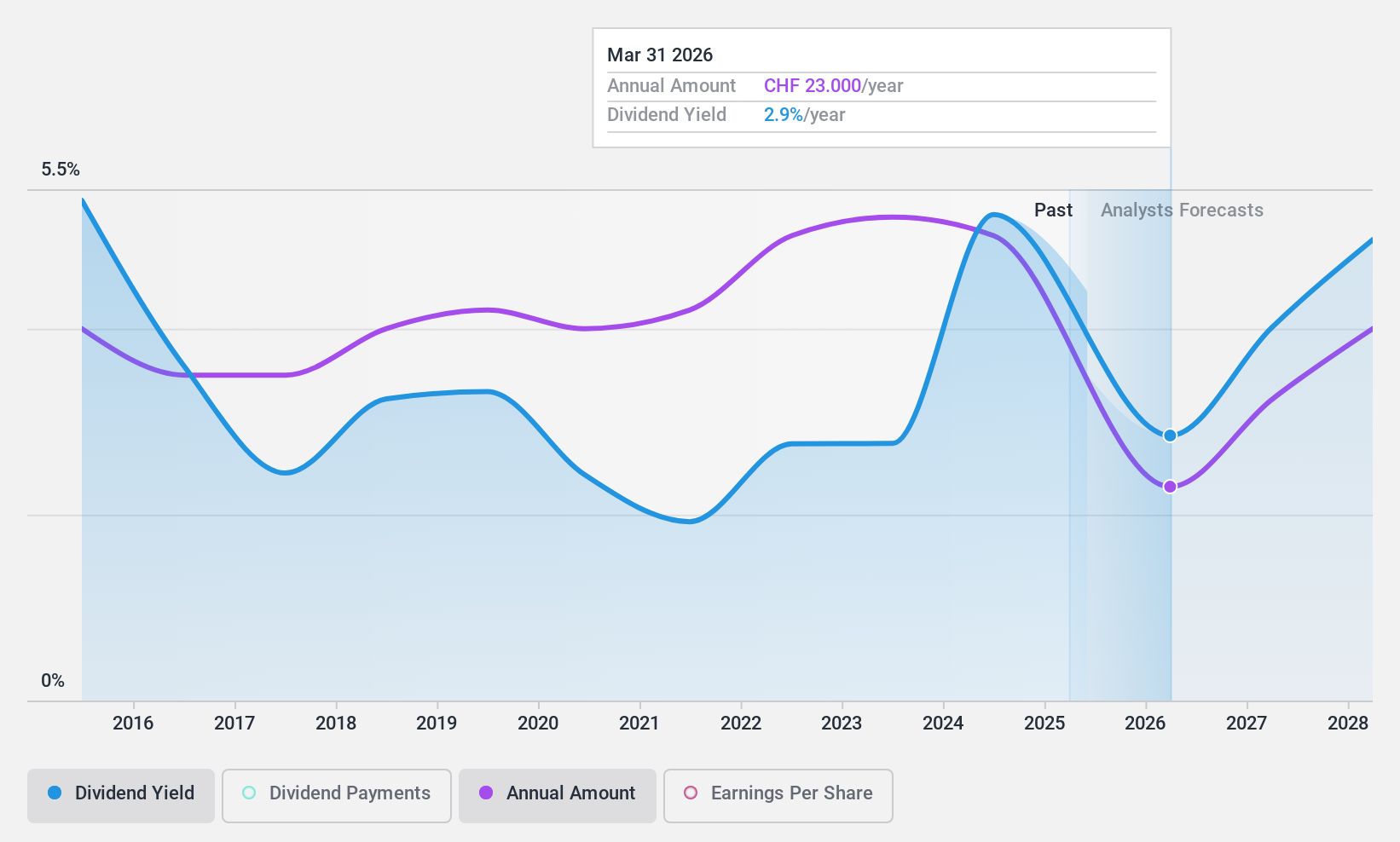

LEM Holding (SWX:LEHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LEM Holding SA operates globally, offering solutions for measuring electrical parameters across various regions including Asia, Europe, and the Americas, with a market capitalization of approximately CHF 1.69 billion.

Operations: LEM Holding SA generates revenue primarily through its operations in Asia and Europe/Americas, with segment revenues reported at CHF 201.98 million and CHF 203.80 million respectively.

Dividend Yield: 3.4%

LEM Holding SA's dividend yield of 3.37% is below the Swiss market's top quartile, and its high cash payout ratio of 125.8% suggests dividends are not well-supported by cash flows. Despite trading at an 8.9% discount to fair value, analysts anticipate a potential price increase of 31.5%. While dividends have shown stability and reliability over the past decade, recent financials reveal a decline in net income from CHF 75.34 million to CHF 65.33 million year-over-year, raising concerns about sustained growth and coverage.

- Click to explore a detailed breakdown of our findings in LEM Holding's dividend report.

- Our valuation report unveils the possibility LEM Holding's shares may be trading at a discount.

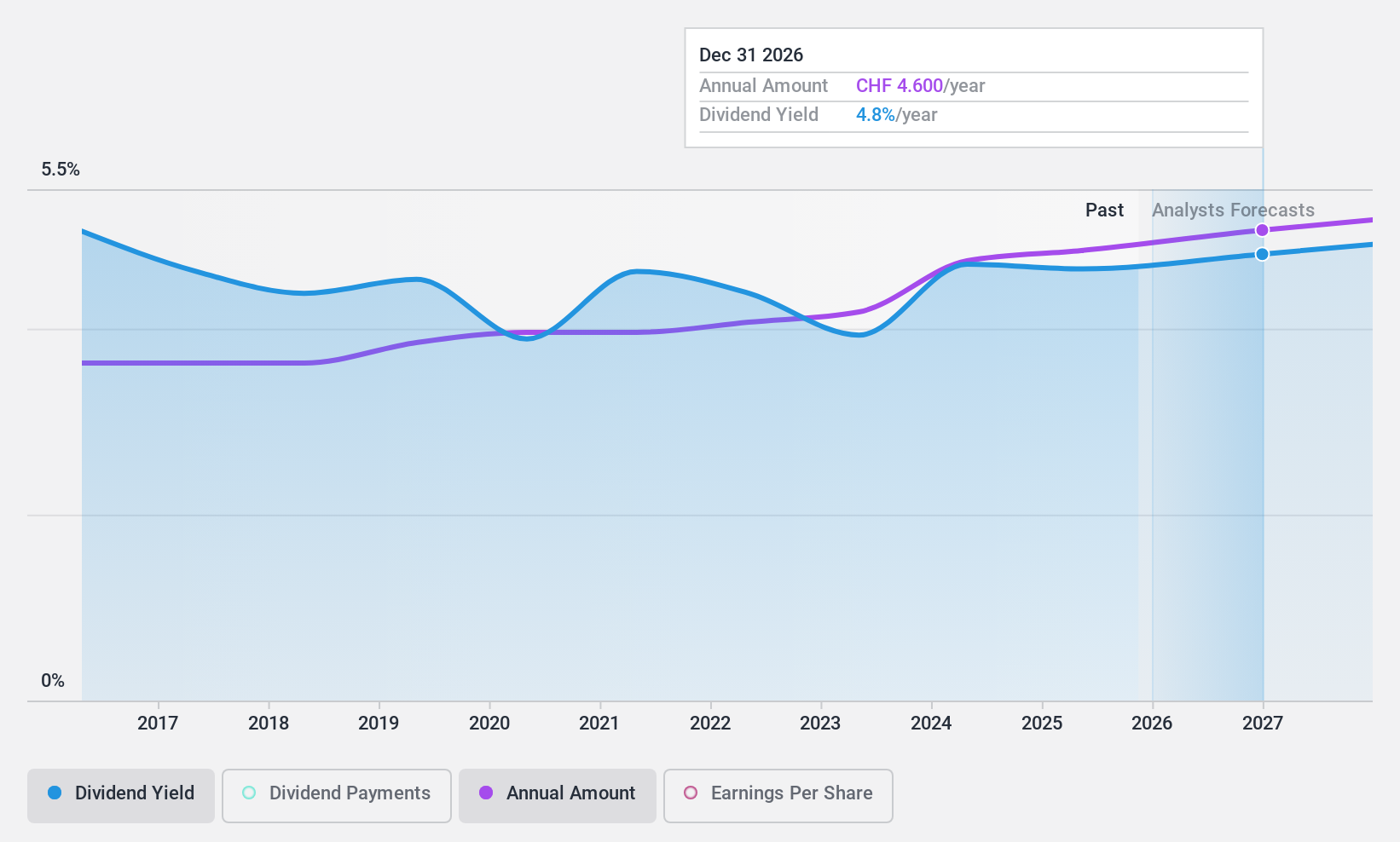

Vontobel Holding (SWX:VONN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Vontobel Holding AG is a financial services provider operating in multiple countries including Switzerland, Germany, the UK, Italy, North America, and Asia, with a market capitalization of CHF 2.94 billion.

Operations: Vontobel Holding AG generates revenue through three primary segments: Asset Management, which contributes CHF 384.10 million; Digital Investing, with CHF 154.30 million; and Wealth Management, accounting for CHF 746.90 million.

Dividend Yield: 5.6%

Vontobel Holding offers a strong dividend yield of 5.64%, outperforming the Swiss market average. The company's dividends have shown consistent growth and stability over the past decade, with a current payout ratio of 77.7% comfortably covered by earnings. Despite trading at a significant 44.9% below its estimated fair value, concerns arise from its funding structure, where 63% is sourced from higher-risk liabilities and an allowance for bad loans at only 76%.

- Take a closer look at Vontobel Holding's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Vontobel Holding shares in the market.

Next Steps

- Dive into all 28 of the Top Dividend Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:VONN

Vontobel Holding

Provides various financial services to private and institutional clients in Switzerland, Germany, the United Kingdom, Italy, North America, Liechtenstein, Singapore, Hong Kong, Australia, and Japan.

6 star dividend payer and undervalued.