- Sweden

- /

- Life Sciences

- /

- OM:BIOT

European Stocks That May Be Trading Below Their Estimated Intrinsic Value

Reviewed by Simply Wall St

In recent weeks, the European stock market has exhibited cautious optimism, with the pan-European STOXX Europe 600 Index experiencing a modest rise amid ongoing geopolitical developments and economic challenges. As investors navigate these uncertain waters, identifying stocks that may be trading below their estimated intrinsic value can offer potential opportunities for those looking to capitalize on undervaluation in the market.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vimi Fasteners (BIT:VIM) | €0.995 | €1.95 | 48.9% |

| Wienerberger (WBAG:WIE) | €33.62 | €67.13 | 49.9% |

| CD Projekt (WSE:CDR) | PLN222.90 | PLN441.95 | 49.6% |

| Vestas Wind Systems (CPSE:VWS) | DKK104.05 | DKK205.07 | 49.3% |

| Nyab (OM:NYAB) | SEK5.27 | SEK10.42 | 49.4% |

| Cint Group (OM:CINT) | SEK6.67 | SEK13.22 | 49.5% |

| Surgical Science Sweden (OM:SUS) | SEK159.00 | SEK310.42 | 48.8% |

| Groupe Airwell Société anonyme (ENXTPA:ALAIR) | €1.24 | €2.42 | 48.7% |

| Bactiguard Holding (OM:BACTI B) | SEK34.80 | SEK68.97 | 49.5% |

| Facephi Biometria (BME:FACE) | €2.07 | €4.04 | 48.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Biotage (OM:BIOT)

Overview: Biotage AB (publ) offers solutions and products for drug discovery and development, analytical testing, and water and environmental testing, with a market cap of approximately SEK9.29 billion.

Operations: The company generates revenue from its Healthcare Software segment, amounting to SEK2.06 billion.

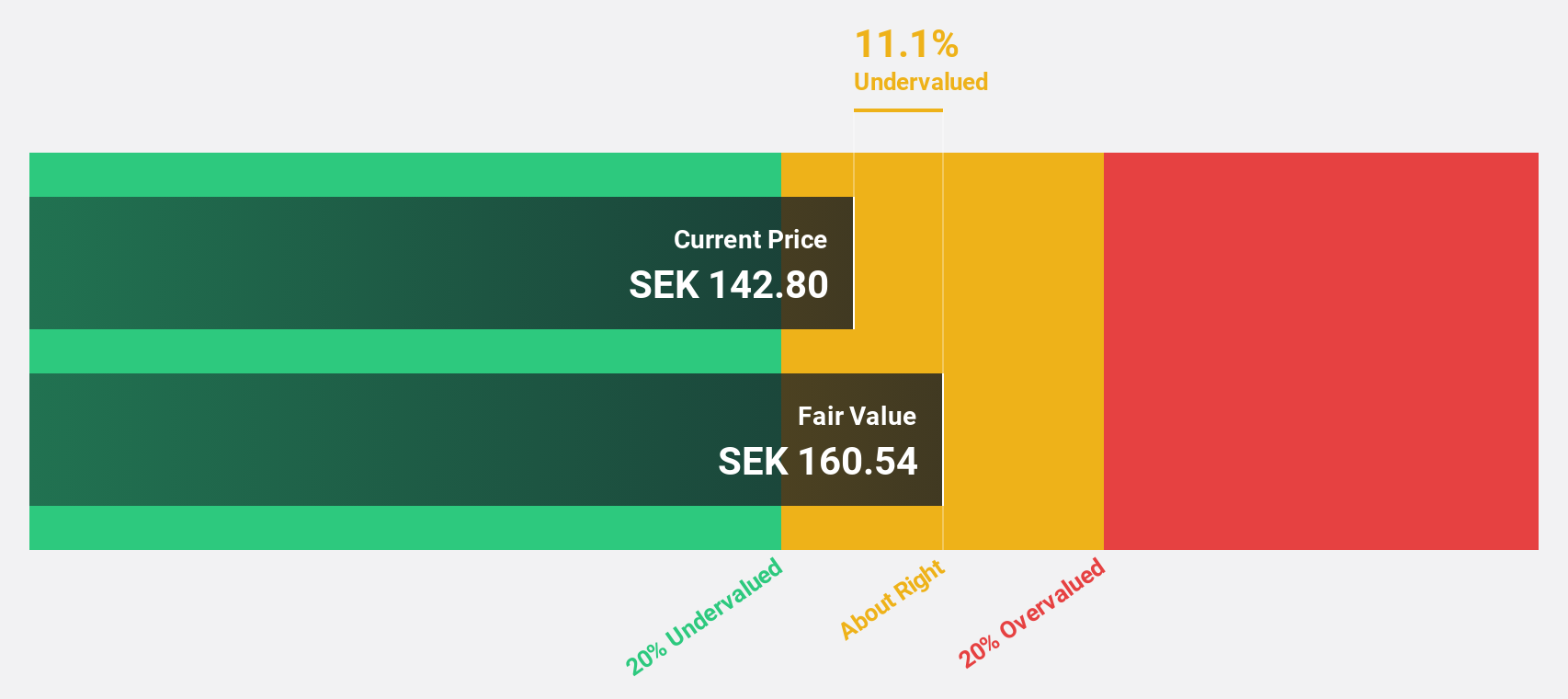

Estimated Discount To Fair Value: 39.9%

Biotage, trading at SEK116, is significantly undervalued compared to its estimated fair value of SEK192.89, offering a potential opportunity for investors focused on cash flow valuation. Despite slower revenue growth forecasts (9.7% annually) than the ideal 20%, it surpasses the Swedish market's 0.9% growth rate and boasts impressive expected earnings growth of over 20% annually. Recent financials show net income increased to SEK284 million in 2024 from SEK246 million in 2023, alongside a proposed dividend increase to SEK1.65 per share for 2024.

- The analysis detailed in our Biotage growth report hints at robust future financial performance.

- Click here to discover the nuances of Biotage with our detailed financial health report.

Comet Holding (SWX:COTN)

Overview: Comet Holding AG, along with its subsidiaries, offers X-ray and radio frequency power technology solutions across Europe, North America, Asia, and other international markets, with a market cap of CHF2.15 billion.

Operations: The company's revenue segments include X-Ray Systems at CHF115.34 million, Industrial X-Ray Modules at CHF95.90 million, and Plasma Control Technologies at CHF180.62 million.

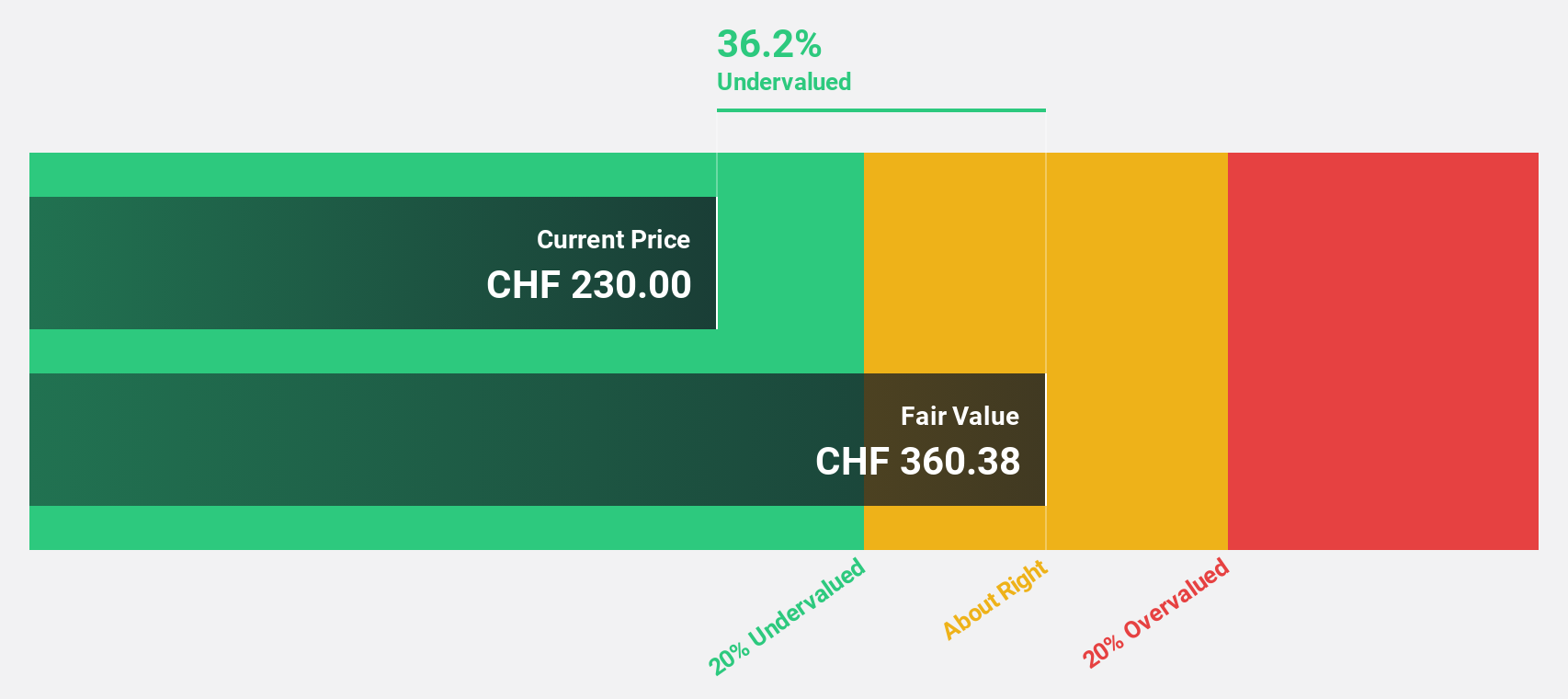

Estimated Discount To Fair Value: 36.5%

Comet Holding, trading at CHF276, is significantly undervalued with a fair value estimate of CHF434.38, presenting a potential opportunity for cash flow-focused investors. Despite recent profit margin declines to 4.6% from 10.8%, earnings are projected to grow substantially at 48.54% annually over the next three years—outpacing the Swiss market's growth rate of 11.4%. However, its share price has been highly volatile recently, adding an element of risk.

- The growth report we've compiled suggests that Comet Holding's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Comet Holding stock in this financial health report.

Stadler Rail (SWX:SRAIL)

Overview: Stadler Rail AG, with a market cap of CHF2.11 billion, manufactures and sells trains across Switzerland, Germany, Austria, various parts of Europe, the Americas, and the CIS countries.

Operations: The company's revenue segments include CHF135.68 million from Signalling, CHF3.10 billion from Rolling Stock, and CHF789.41 million from Service & Components.

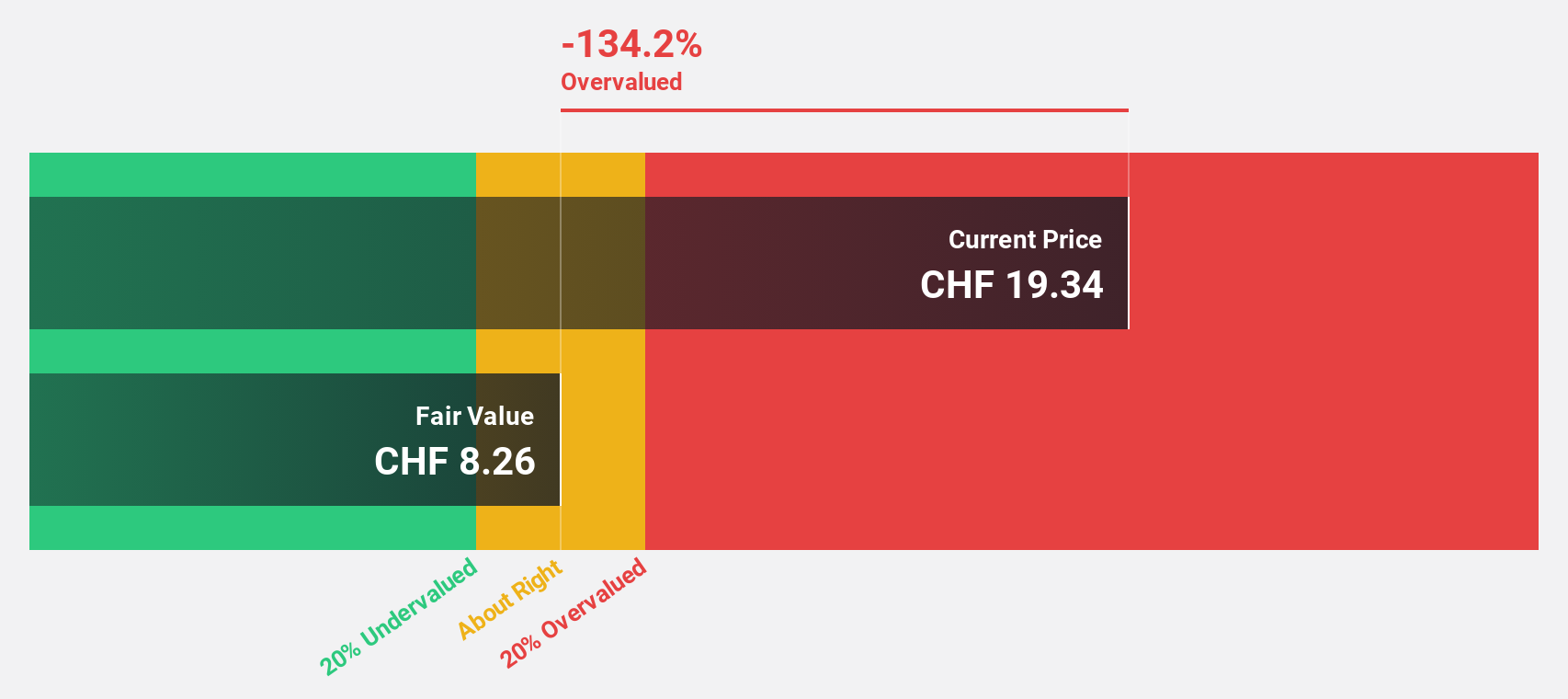

Estimated Discount To Fair Value: 40.9%

Stadler Rail, currently trading at CHF21.1, is undervalued with a fair value estimate of CHF35.68, offering potential for cash flow-focused investors. While its Return on Equity is forecast to be low at 18.7% in three years, earnings are expected to grow significantly by 22.94% annually, outpacing the Swiss market's growth rate of 11.4%. Despite this growth potential, its dividend yield of 4.27% isn't well covered by free cash flows.

- In light of our recent growth report, it seems possible that Stadler Rail's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Stadler Rail.

Seize The Opportunity

- Click through to start exploring the rest of the 198 Undervalued European Stocks Based On Cash Flows now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biotage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIOT

Biotage

Provides solutions and products in the areas of drug discovery and development, analytical testing, and water and environmental testing.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives