- Switzerland

- /

- Pharma

- /

- SWX:SDZ

Sandoz Group (SWX:SDZ): How the New Biosimilar Deal Shapes Its Valuation Prospects

Reviewed by Simply Wall St

Sandoz Group (SWX:SDZ) just signed a global licensing agreement worth up to USD 152 million for commercial rights to a proposed biosimilar of pertuzumab, a leading oncology drug for HER2-positive breast cancer.

See our latest analysis for Sandoz Group.

Building on the momentum from the new biosimilar agreement, Sandoz Group’s shares have climbed steadily, posting a 12.8% share price return over the last month and an impressive 47.2% return year-to-date. These recent gains come as the company sharpens its focus on oncology and expands its pipeline. This signals growing optimism among investors about Sandoz's growth trajectory and role in the fast-evolving biosimilars market. In both the short and long term, performance has been strong and momentum appears firmly in the company’s favor.

If today’s biosimilar news piqued your interest, you might want to discover opportunities among other leading healthcare innovators using our free screener: See the full list for free.

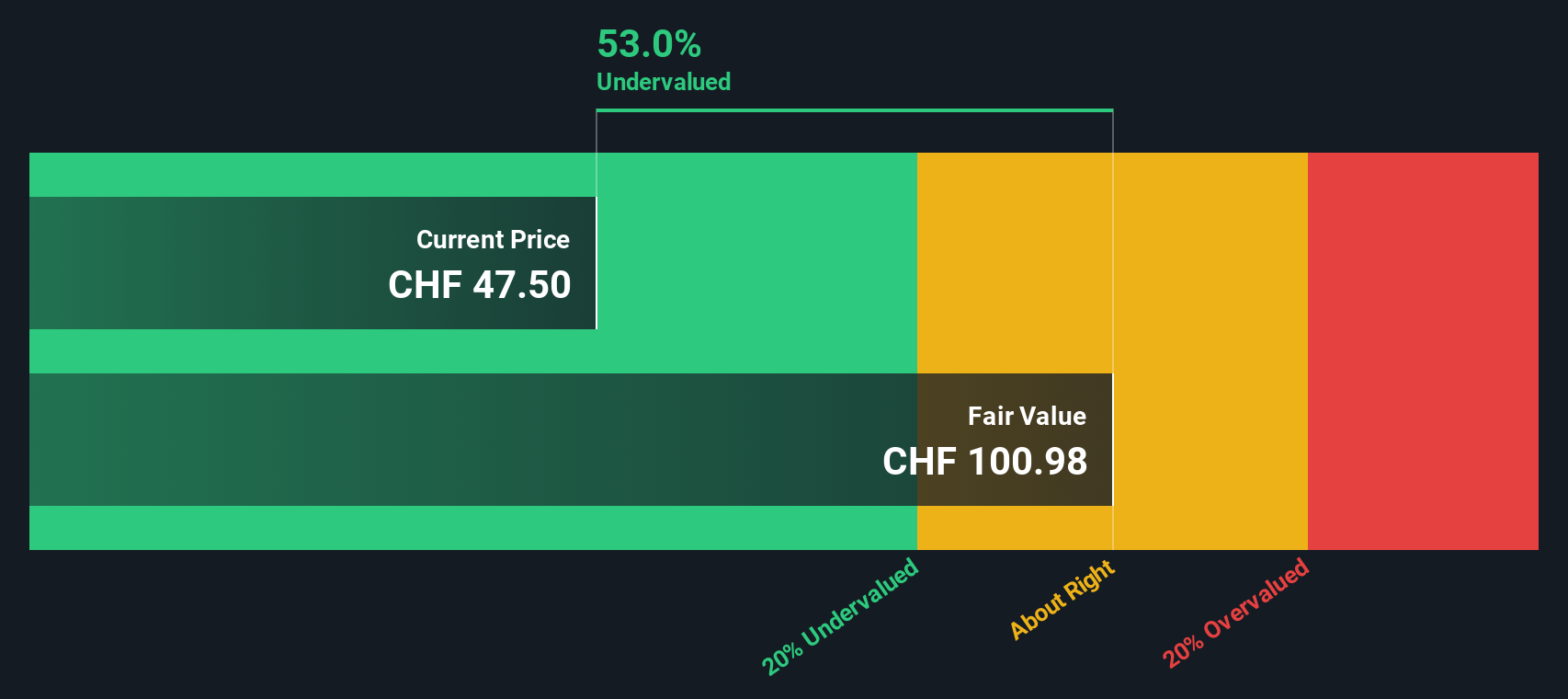

With Sandoz shares trading near recent highs, the key question is whether all the growth potential is already reflected in the price or if there is still meaningful value left for investors to capture.

Most Popular Narrative: 6% Overvalued

Sandoz Group’s last close price exceeded the narrative’s fair value estimate, suggesting heightened optimism in the current share price. Analysts appear to be baking in ambitious progress, but is the latest rally fully justified?

Regulatory streamlining and investments in advanced in-house manufacturing (notably Slovenia expansion and Just-Evotec acquisition) are expected to lower production costs and speed up time-to-market for new biosimilars. This may drive margin expansion and higher net earnings.

The real story behind this valuation centers on bold operational bets, significant manufacturing upgrades, and a financial transformation that could surprise investors. What is the linchpin assumption analysts are relying on for future profit leaps? Dig in and see how aggressive projections shape the narrative’s growth outlook and valuation risks.

Result: Fair Value of $52.05 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing pricing pressure in both biosimilars and generics, as well as sluggish US growth, could quickly dampen the current optimism around Sandoz’s outlook.

Find out about the key risks to this Sandoz Group narrative.

Another View: Discounted Cash Flow Upside

Taking a look through the lens of the SWS DCF model, the story shifts. In this view, Sandoz is estimated to be trading at a steep 36.9% discount to its calculated fair value. This method suggests there could be more upside potential for the shares. Could this alternative approach signal an overlooked opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sandoz Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sandoz Group Narrative

If you see the story differently, or prefer to draw your own conclusions from the numbers, you can build a personalized view in just minutes. Do it your way

A great starting point for your Sandoz Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investing means always having your eye on where the next opportunity could be. Don’t miss out on other standout stocks that could boost your portfolio.

- Tap into the massive yield potential of steady income with these 14 dividend stocks with yields > 3%, and secure stocks with attractive dividends exceeding 3%.

- Seize the edge by spotting breakthroughs in artificial intelligence through these 25 AI penny stocks. Discover the innovators driving tomorrow’s technology.

- Supercharge your search for bargains by targeting these 865 undervalued stocks based on cash flows, and find companies undervalued based on real cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SDZ

Sandoz Group

Develops, manufactures, and markets generic pharmaceuticals and biosimilars worldwide.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives