- Switzerland

- /

- Pharma

- /

- SWX:ROG

Does Roche Offer Value After Recent 19% Surge Fueled by Healthcare Innovation News?

Reviewed by Bailey Pemberton

- Wondering if Roche Holding is a hidden bargain or already fairly priced? You are not alone, as many investors are keeping a close eye on where the value really lies.

- The stock has had an impressive run, climbing 19.4% over the past month and up 24.6% over the last year, despite a slight 0.6% dip this week.

- Much of this momentum has been fueled by headlines surrounding Roche’s continued push into innovative therapies, as well as recent partnerships in healthcare technology. Growing market enthusiasm for these moves has helped drive the recent rally, while also reshaping perceptions of risk and opportunity.

- On our valuation checks, Roche scores a 4 out of 6, suggesting meaningful value in some key areas but room for debate in others. Let’s dive deeper into how analysts approach this valuation, and stick around to discover a smarter way to assess if Roche is really a buy right now.

Approach 1: Roche Holding Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and discounting them back to their present value. For Roche Holding, this approach relies on detailed forecasts of its Free Cash Flow (FCF), incorporating both analyst estimates and extended projections.

Currently, Roche Holding generates CHF 14.08 billion in Free Cash Flow. Over the next four years, analysts forecast steady increases, with FCF expected to climb to CHF 19.15 billion by 2029. Beyond these dates, Simply Wall St extrapolates future cash flows; however, the model highlights that most visibility is within the first five years. All calculations are presented in Swiss francs (CHF), Roche's reporting currency.

Applying the DCF model to these figures results in an estimated intrinsic value of CHF 709.39 per share. This figure suggests the stock trades at a substantial 56.4% discount to its fair value estimate, indicating Roche Holding is meaningfully undervalued by current market standards.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Roche Holding is undervalued by 56.4%. Track this in your watchlist or portfolio, or discover 923 more undervalued stocks based on cash flows.

Approach 2: Roche Holding Price vs Earnings

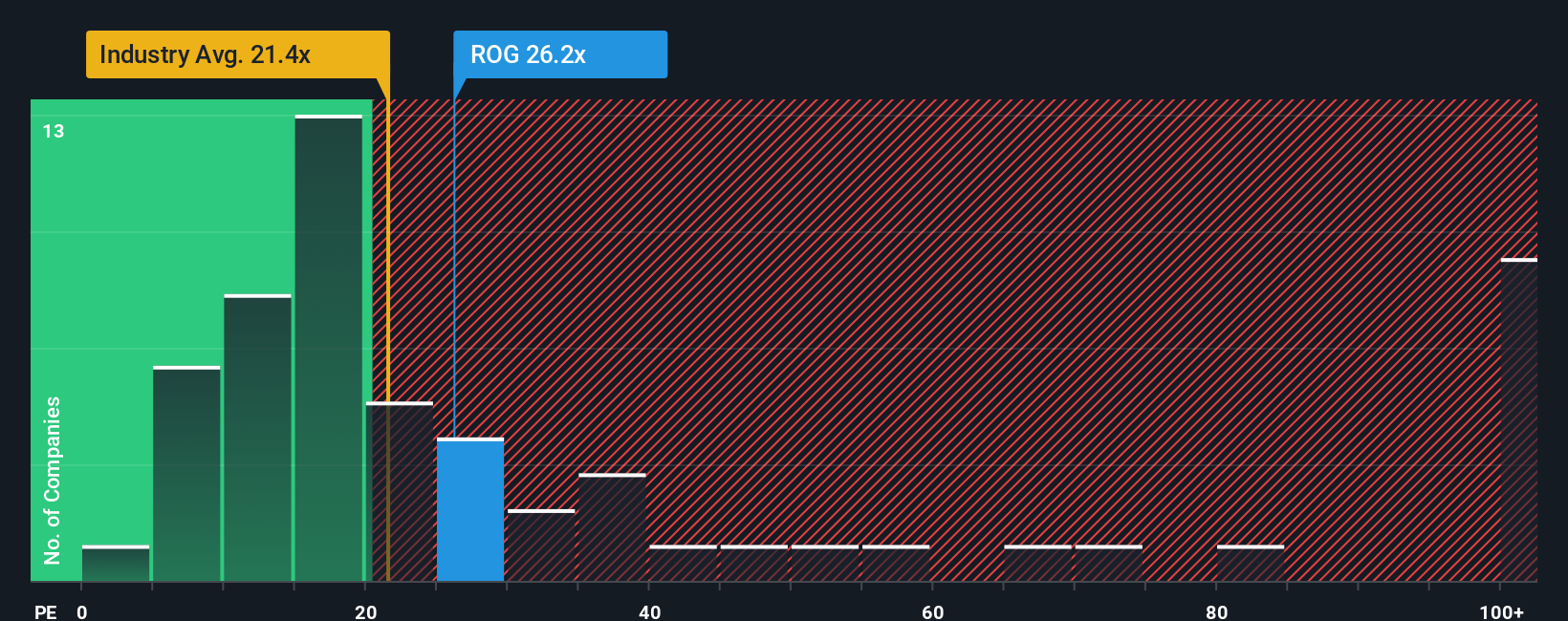

For profitable companies like Roche Holding, the Price-to-Earnings (PE) ratio is often considered the gold standard for valuation. This multiple measures how much investors are willing to pay for each unit of earnings, offering a direct snapshot of the market’s expectations for a business’s profitability.

Growth prospects and perceived risks play a central role in what a "normal" PE ratio should be. Higher expected growth and stable profits typically justify higher PE ratios, while riskier or slower-growing companies tend to trade at lower multiples.

Currently, Roche trades at a PE ratio of 27.87x. Compared to the Pharmaceuticals industry average of 22.77x and the average among peers at 78.94x, Roche’s valuation appears reasonable. It is above the industry norm but well below its peer group, which may contain several outliers.

Simply Wall St’s "Fair Ratio" adds essential context by estimating Roche’s appropriate PE ratio based on its unique characteristics, such as its earnings growth, profit margins, market capitalization, and the risks it faces. This makes it a more comprehensive benchmark than simply comparing Roche against industry or peers.

The Fair Ratio for Roche stands at 36.20x. When compared to its actual PE of 27.87x, this suggests Roche is trading at a meaningful discount to its fair value according to these customized inputs.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

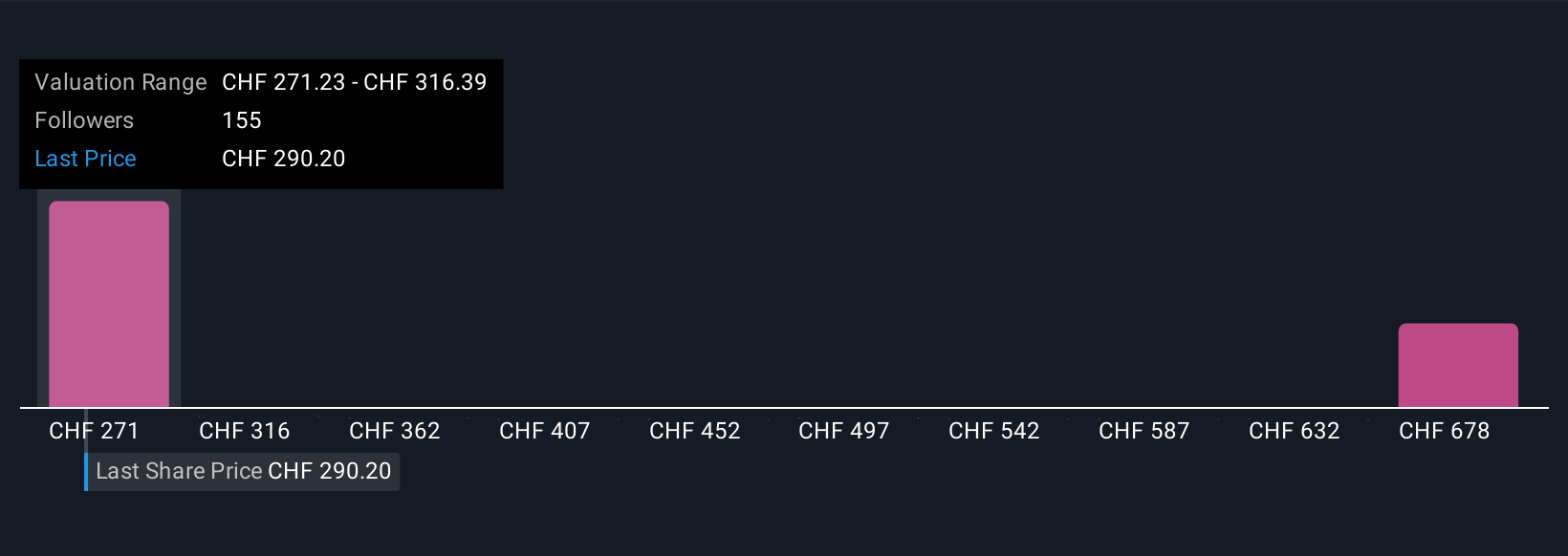

Upgrade Your Decision Making: Choose your Roche Holding Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a powerful but easy-to-use approach for investing. It lets you tell your story about a company’s future by connecting your own assumptions about revenue, profit, and margins to a fair value calculation, moving beyond just the numbers.

By linking a company’s story to a financial forecast and then to a fair value, Narratives allow you to see how your perspective translates into a clear estimate of what Roche Holding is really worth. On Simply Wall St’s Community page, Narratives are a central tool used by millions of investors. You can quickly compare your Fair Value to today’s share price and decide how it relates to your view. When news or results change, your narrative automatically updates to reflect the latest outlook.

For example, some investors believe Roche will navigate industry challenges and achieve a fair value as high as CHF 438, while others, more cautious, place fair value as low as CHF 230. The difference comes down to the story and forecasts each investor believes most likely.

Do you think there's more to the story for Roche Holding? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ROG

Roche Holding

Engages in the pharmaceuticals and diagnostics businesses in Europe, North America, Latin America, Asia, Africa, Australia, and New Zealand.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026