- Switzerland

- /

- Pharma

- /

- SWX:NOVN

Novartis (SWX:NOVN): Evaluating Valuation Following a Period of Steady Share Performance

Reviewed by Simply Wall St

Novartis (SWX:NOVN) shares have recently seen relatively stable performance. Investors are keeping an eye on the company’s longer-term returns and current financial metrics. The recent stock action invites a closer look at its valuation and business outlook.

See our latest analysis for Novartis.

Novartis has posted a steady 17.55% year-to-date share price return, reflecting renewed optimism from investors following recent company announcements and broader sector momentum. Over the past year, long-term shareholders have enjoyed a total shareholder return of 16.07% as the market continues to reward consistent growth.

If you’re curious about what’s next in healthcare, this is the perfect moment to explore standout names with our See the full list for free.

With shares holding steady near analyst price targets and growth metrics remaining robust, the real question is whether Novartis offers untapped upside for new investors or if the market has already accounted for future progress.

Most Popular Narrative: Fairly Valued

Novartis closed at CHF104.64, nearly matching the most popular narrative's fair value assumption of CHF104.58. The consensus view sees current prices as largely reflecting the company's medium-term growth prospects, setting the stage for focused debate about what could drive the next move.

Operational efficiency gains from portfolio streamlining (for example, previous spin-offs and exiting non-core lines) and productivity improvements are driving core margin expansion and higher free cash flow, which can be reinvested in R&D and shareholder returns, supporting long-term earnings and net margin growth.

How do operational wins and future cash flow projections factor into Novartis’ current market price? The full narrative presents a bold model for margin and profit growth, underpinned by pivotal assumptions that just might surprise you. Discover what’s powering the fair value behind these high-stakes expectations.

Result: Fair Value of $104.58 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as global pricing pressures or the entry of generics for key drugs could quickly challenge these optimistic growth assumptions for Novartis.

Find out about the key risks to this Novartis narrative.

Another View: Value in the Multiples

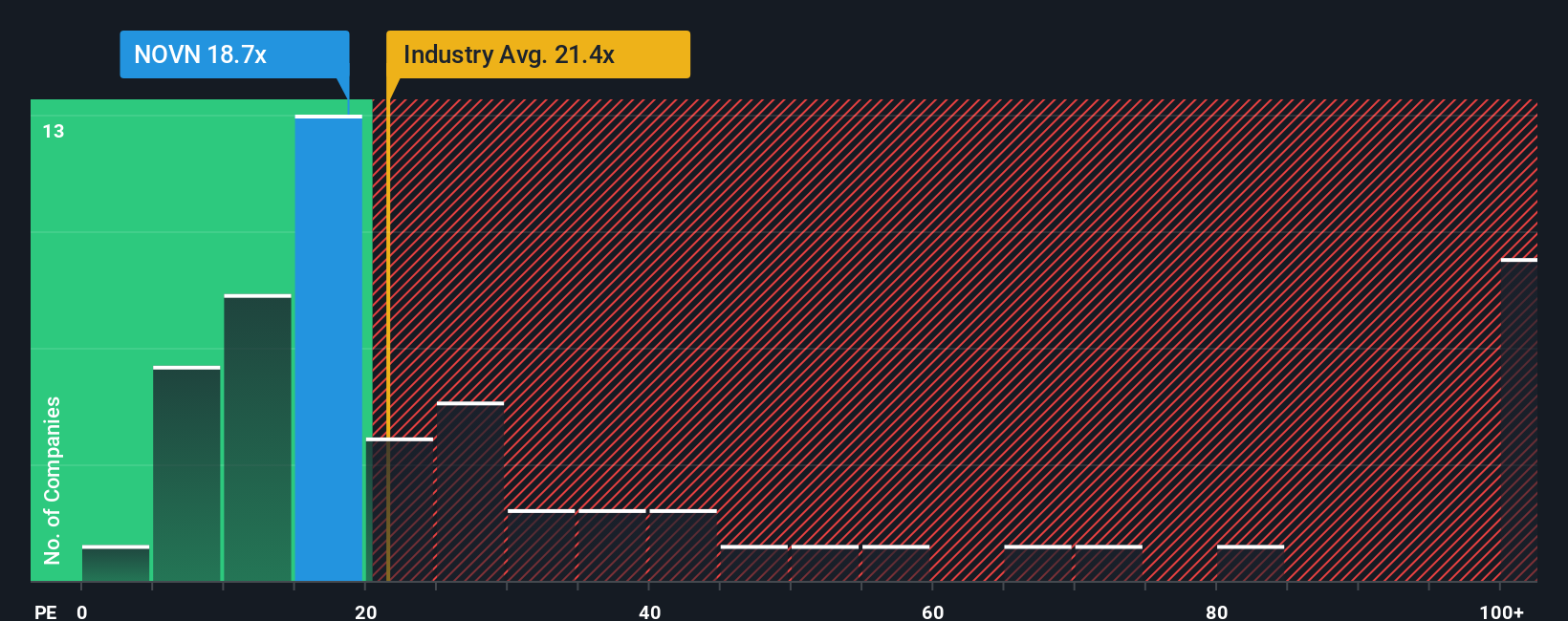

While fair value estimates suggest Novartis is priced about right, a look at the company’s price-to-earnings ratio paints a different picture. With a current P/E of 17.3x, which is well below the European industry average of 24.7x and a peer average of 81.8x, the gap hints at meaningful upside, especially if market perceptions shift closer to the fair ratio of 30.3x. Is the market underestimating Novartis, or is caution justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Novartis Narrative

If you want to take a hands-on approach or prefer looking deeper into the numbers yourself, you can assemble your own full narrative in just minutes. Do it your way.

A great starting point for your Novartis research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let market opportunities slip by when there are standout companies and trends just waiting to be uncovered. Let’s make your next pick the smartest yet.

- Capture generous yields and build stable income streams by scanning these 15 dividend stocks with yields > 3% with returns over 3%.

- Spot tomorrow’s breakthroughs by checking out these 25 AI penny stocks featuring high-potential advancements in artificial intelligence.

- Uncover value plays the market has overlooked by sorting through these 933 undervalued stocks based on cash flows based entirely on cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novartis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NOVN

Novartis

Researches, develops, manufactures, distributes, markets, and sells pharmaceutical medicines in Switzerland and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.