- Switzerland

- /

- Pharma

- /

- SWX:GALD

3 European Stocks Estimated To Be Trading Below Intrinsic Value By Up To 47.6%

Reviewed by Simply Wall St

As European markets experience a positive uptick, with the pan-European STOXX Europe 600 Index closing 2.35% higher and major single-country indexes also rising, investors are keenly observing opportunities that may arise from these movements. In this environment, identifying stocks trading below their intrinsic value can be particularly appealing as they offer potential for growth when market conditions stabilize or improve further.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimot (WSE:UNT) | PLN128.00 | PLN254.72 | 49.7% |

| PVA TePla (XTRA:TPE) | €22.44 | €44.40 | 49.5% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.48 | €4.88 | 49.1% |

| Jæren Sparebank (OB:JAREN) | NOK382.60 | NOK752.15 | 49.1% |

| Hensoldt (XTRA:HAG) | €66.20 | €130.09 | 49.1% |

| Gentili Mosconi (BIT:GM) | €3.33 | €6.53 | 49% |

| Esautomotion (BIT:ESAU) | €3.08 | €6.09 | 49.4% |

| EcoUp Oyj (HLSE:ECOUP) | €1.35 | €2.64 | 48.9% |

| B&S Group (ENXTAM:BSGR) | €5.94 | €11.85 | 49.9% |

| Allegro.eu (WSE:ALE) | PLN32.33 | PLN64.21 | 49.7% |

Let's dive into some prime choices out of the screener.

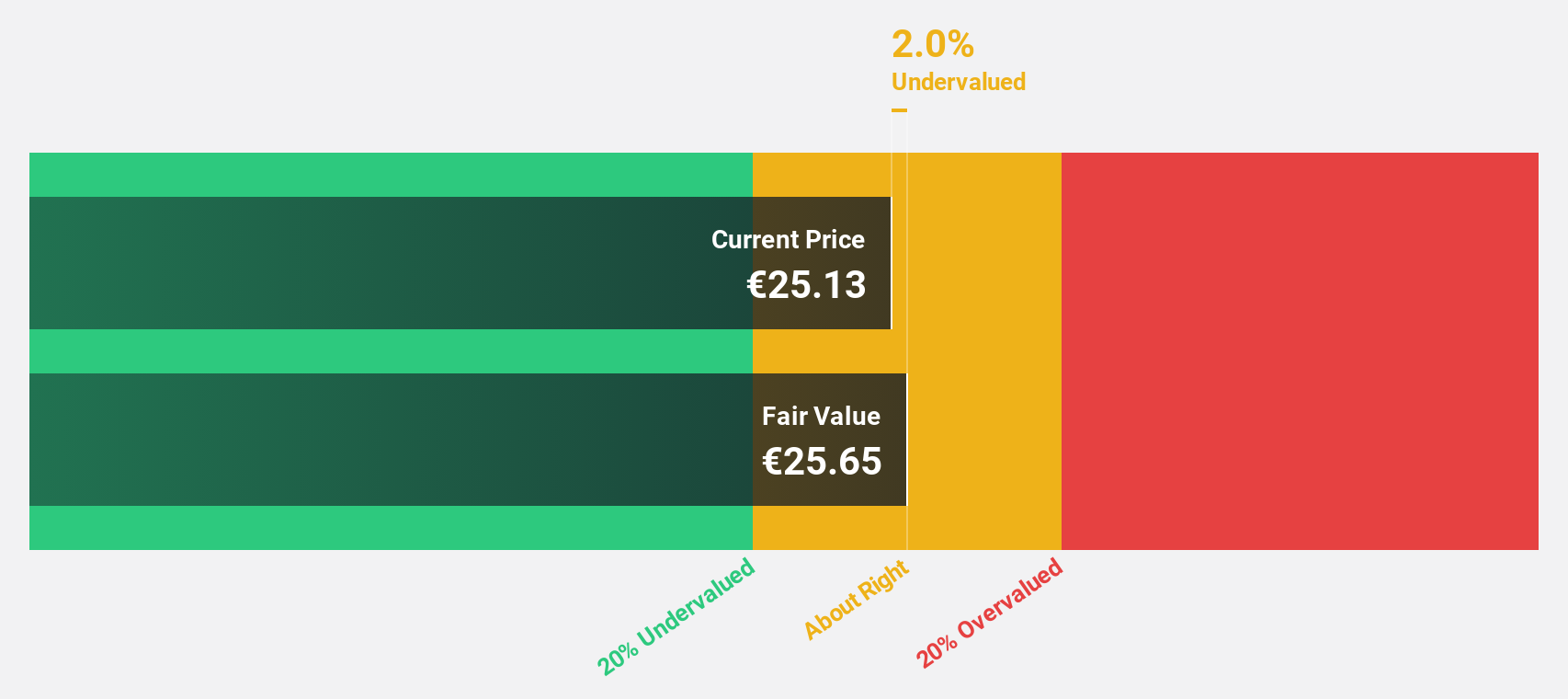

Soitec (ENXTPA:SOI)

Overview: Soitec SA develops and manufactures semiconductor materials across Asia, Europe, and the United States with a market cap of €937.25 million.

Operations: The company's revenue is primarily derived from its Electronics segment, which generated €783.86 million.

Estimated Discount To Fair Value: 10.2%

Soitec's recent financial results showed a net loss of €66.7 million for the first half of fiscal year 2026, contrasting with a profit from the previous year. Despite this, Soitec is trading approximately 10% below its estimated fair value and is expected to experience significant earnings growth over the next three years. The company’s strategic advancements in FD-SOI technology enhance its position in automotive cybersecurity, potentially bolstering future cash flows despite current volatility and low profit margins.

- According our earnings growth report, there's an indication that Soitec might be ready to expand.

- Click to explore a detailed breakdown of our findings in Soitec's balance sheet health report.

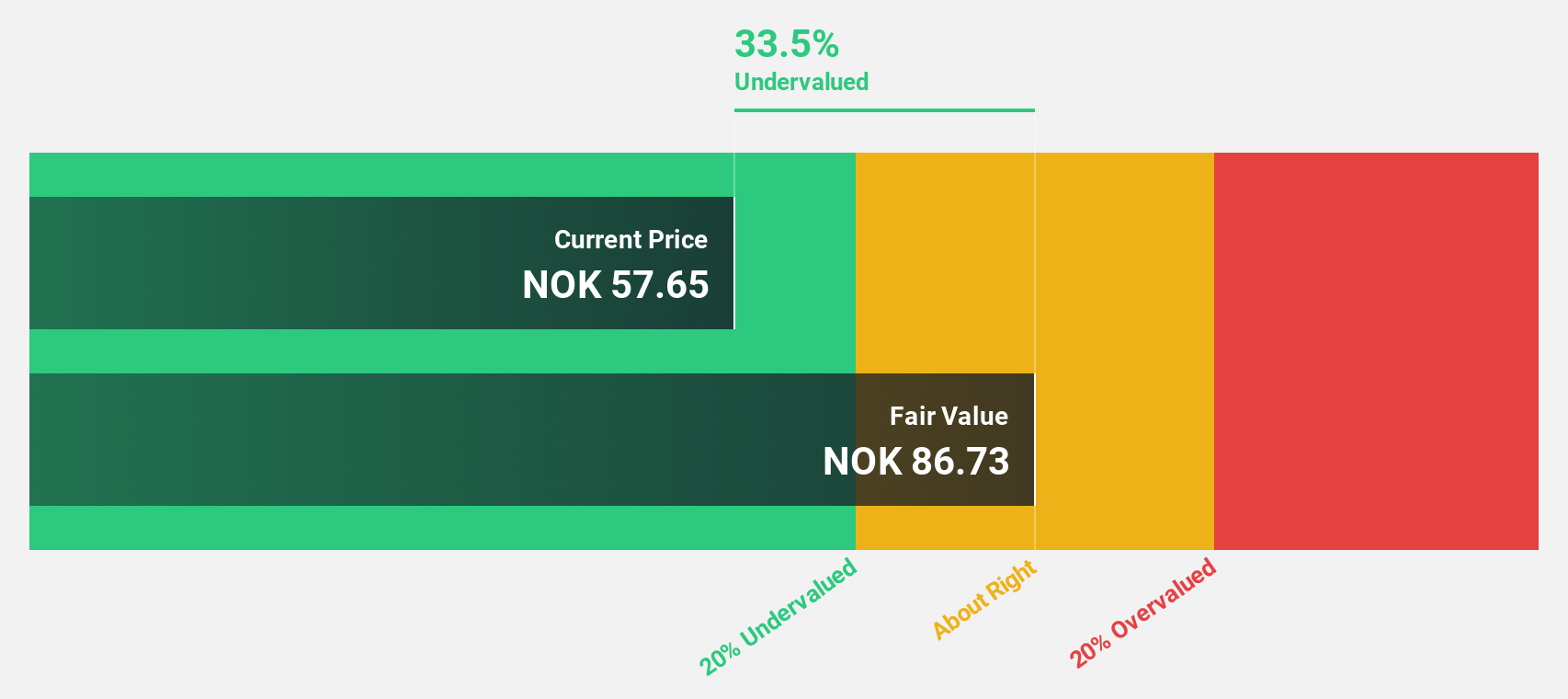

Kitron (OB:KIT)

Overview: Kitron ASA is an electronics manufacturing services provider operating in multiple countries including Norway, Sweden, and the United States, with a market cap of NOK12.81 billion.

Operations: The company's revenue segment is Electronics Manufacturing Services (EMS), generating €665.20 million.

Estimated Discount To Fair Value: 47.6%

Kitron's recent financial activities, including a NOK 973.25 million equity offering and strategic acquisitions, position it for robust cash flow growth. The company is trading significantly below its estimated fair value of NOK 112.96, with forecasts indicating substantial annual earnings growth of over 20%. Recent revenue guidance revisions highlight strong demand in the Defence/Aerospace sector, supporting Kitron's potential as an undervalued stock based on cash flows amidst ongoing market expansion efforts.

- In light of our recent growth report, it seems possible that Kitron's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Kitron.

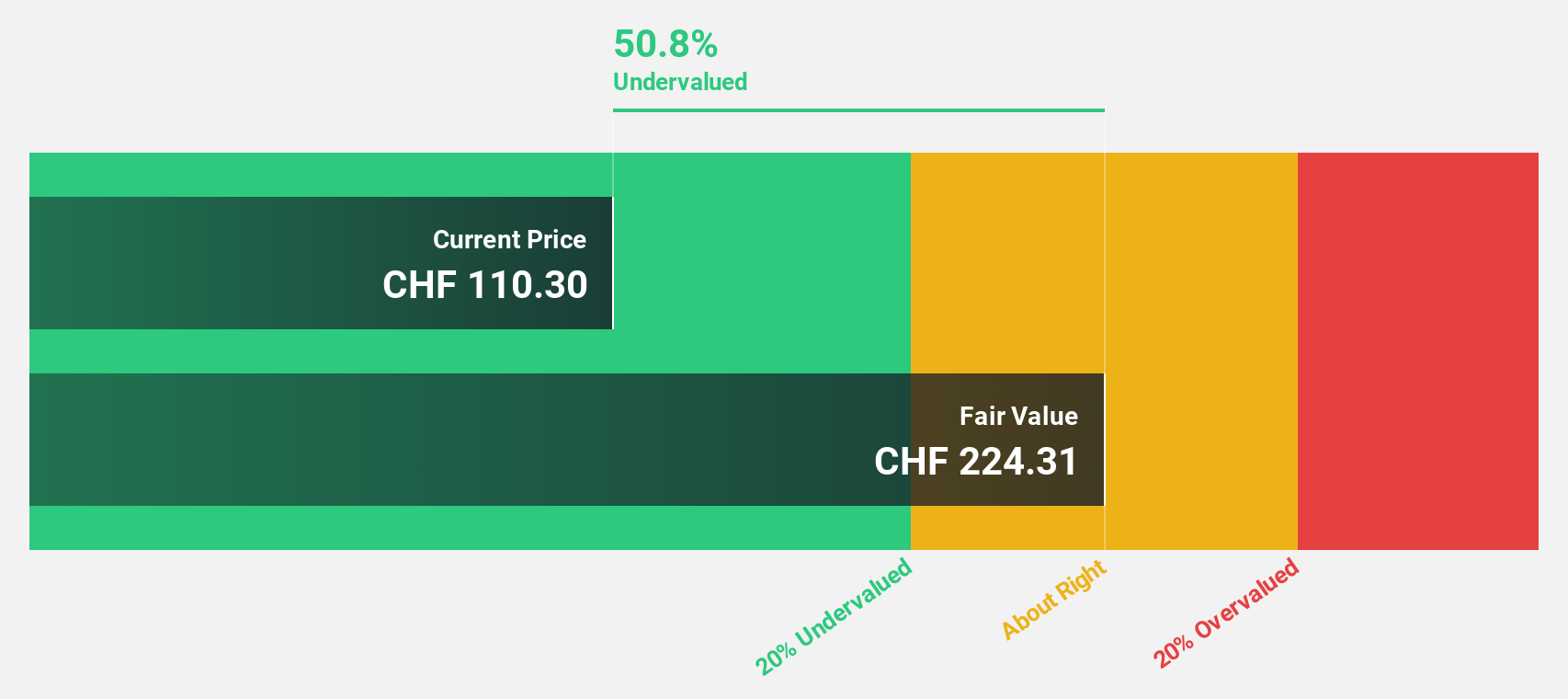

Galderma Group (SWX:GALD)

Overview: Galderma Group AG is a global dermatology company with a market cap of CHF37.53 billion.

Operations: The company's revenue is primarily derived from its dermatology segment, amounting to $4.69 billion.

Estimated Discount To Fair Value: 28.1%

Galderma Group is trading at CHF158.1, notably below its estimated fair value of CHF219.75, highlighting its potential as an undervalued stock based on cash flows. The company's earnings are projected to grow significantly at 31% annually, outpacing the Swiss market's growth rate of 10.4%. Recent FDA approval for Restylane Lyft and strong performance in Injectable Aesthetics further bolster Galderma's financial outlook amidst a favorable revenue trajectory and strategic product expansions.

- The analysis detailed in our Galderma Group growth report hints at robust future financial performance.

- Click here to discover the nuances of Galderma Group with our detailed financial health report.

Make It Happen

- Delve into our full catalog of 202 Undervalued European Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:GALD

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026