- Switzerland

- /

- Pharma

- /

- SWX:COPN

Cosmo Pharmaceuticals (SWX:COPN) Is Up 46.9% After Clascoterone Hair-Loss Win And EU Nod For Winlevi

Reviewed by Sasha Jovanovic

- Cosmo Pharmaceuticals has reported strong top-line Phase III results for clascoterone 5% topical solution in male androgenetic alopecia and, together with Glenmark Pharmaceuticals, secured European Commission marketing authorization for Winlevi (clascoterone 10 mg/g cream) to treat acne vulgaris in 17 countries.

- These developments highlight clascoterone’s potential as a versatile, first-in-class topical androgen receptor inhibitor across both hair loss and acne, expanding Cosmo’s dermatology footprint in the US and Europe.

- We’ll now examine how the positive Phase III clascoterone data for male hair loss may reshape Cosmo Pharmaceuticals’ broader investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Cosmo Pharmaceuticals Investment Narrative Recap

To own Cosmo Pharmaceuticals, you need to believe it can turn a focused GI and dermatology portfolio into growing, recurring, globally diversified revenue, despite pricing pressure and dependence on partners. The strong Phase III clascoterone data for male-pattern hair loss adds a fresh potential growth driver, but the key near term catalyst now shifts to successful US and EU regulatory submissions, while regulatory and development risk across the pipeline remains the most immediate threat.

The recent European Commission approval of Winlevi in 17 countries directly complements the positive hair loss readout, reinforcing clascoterone as a platform asset rather than a single product story. Together, these updates increase the stakes on Cosmo’s ability to manage complex global partnerships and pricing discussions, since execution by Glenmark and other distributors will influence how much of clascoterone’s clinical promise ultimately shows up in Cosmo’s recurring revenue line.

Yet while clascoterone’s progress is encouraging, investors should be aware that...

Read the full narrative on Cosmo Pharmaceuticals (it's free!)

Cosmo Pharmaceuticals’ narrative projects €272.7 million revenue and €116.1 million earnings by 2028.

Uncover how Cosmo Pharmaceuticals' forecasts yield a CHF98.59 fair value, a 8% upside to its current price.

Exploring Other Perspectives

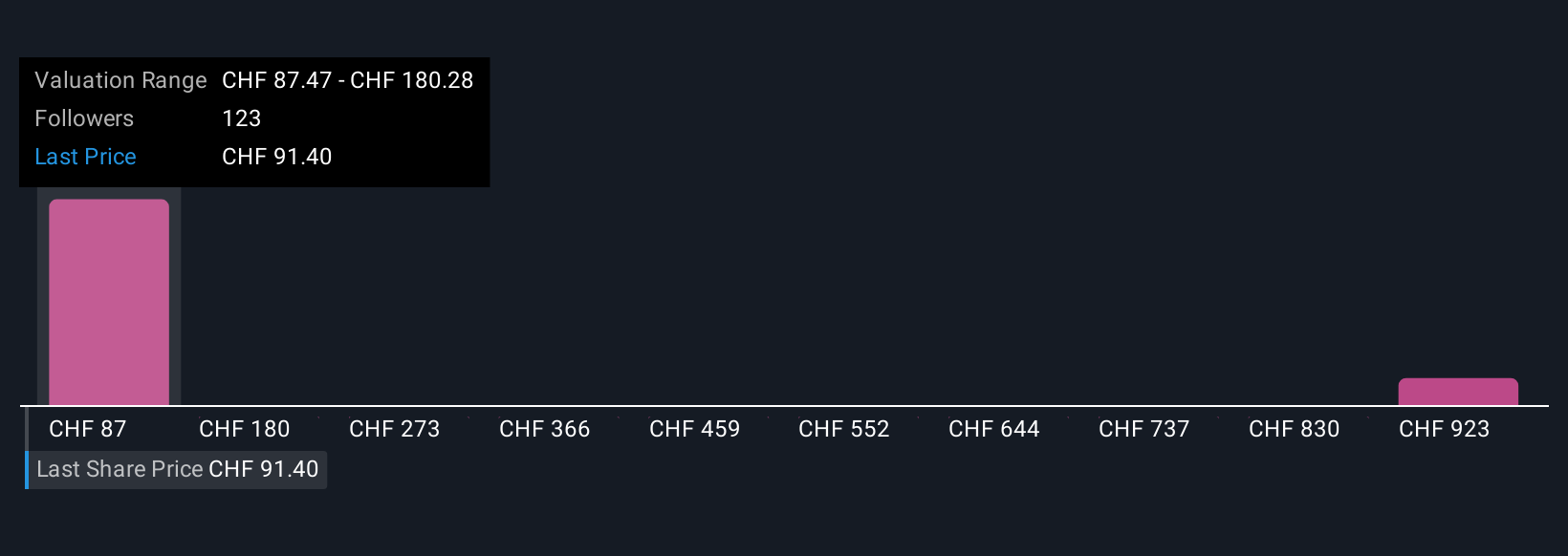

Seven Simply Wall St Community valuations for Cosmo range from CHF87.47 to CHF1,015.53, underscoring how far apart individual views can be. You should weigh those widely different opinions against the central risk that Cosmo still relies on a relatively narrow, late stage pipeline for its future earnings power.

Explore 7 other fair value estimates on Cosmo Pharmaceuticals - why the stock might be worth just CHF87.47!

Build Your Own Cosmo Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cosmo Pharmaceuticals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cosmo Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cosmo Pharmaceuticals' overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:COPN

Cosmo Pharmaceuticals

Focuses on the development and commercialization products for gastroenterology, dermatology, and healthtech worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026