High Growth Tech Stocks To Watch In Switzerland September 2024

Reviewed by Simply Wall St

The Switzerland market ended on a firm note on Tuesday, in line with other European markets, as a slew of stimulus measures announced by the Chinese central bank to revive the world's second-largest economy helped underpin sentiment. The benchmark SMI closed with a gain of 83.50 points or 0.7% at 12,048.85 after moving between 11,985.39 and 12,076.42. In light of these supportive global economic conditions and positive market sentiment, identifying high-growth tech stocks in Switzerland could present promising opportunities for investors looking to capitalize on innovation and expansion within this sector.

Top 10 High Growth Tech Companies In Switzerland

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| LEM Holding | 8.69% | 18.43% | ★★★★☆☆ |

| Santhera Pharmaceuticals Holding | 26.80% | 35.40% | ★★★★★★ |

| ALSO Holding | 11.99% | 23.95% | ★★★★☆☆ |

| Comet Holding | 21.22% | 47.97% | ★★★★★★ |

| Temenos | 7.60% | 14.32% | ★★★★☆☆ |

| SoftwareONE Holding | 8.60% | 52.57% | ★★★★★☆ |

| Cicor Technologies | 7.10% | 27.73% | ★★★★☆☆ |

| Basilea Pharmaceutica | 9.24% | 34.42% | ★★★★★☆ |

| Sensirion Holding | 13.96% | 104.68% | ★★★★☆☆ |

| Kudelski | 13.22% | 121.68% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

ALSO Holding (SWX:ALSN)

Simply Wall St Growth Rating: ★★★★☆☆

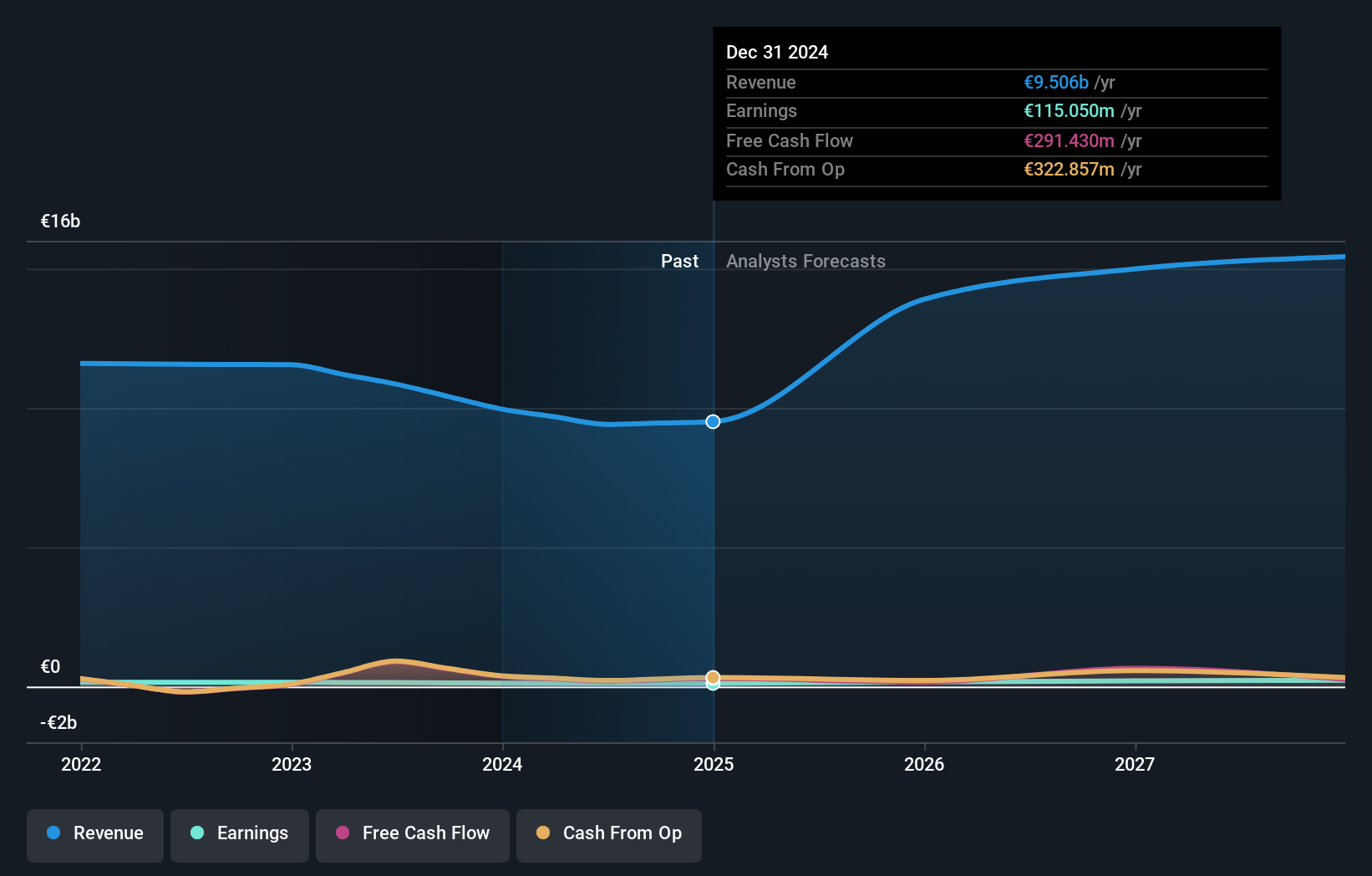

Overview: ALSO Holding AG operates as a technology services provider for the ICT industry in Switzerland, Germany, the Netherlands, Poland, and internationally with a market cap of CHF3.28 billion.

Operations: ALSO Holding AG generates revenue primarily from its operations in Central Europe (€4.62 billion) and Northern/Eastern Europe (€5.24 billion). The company experienced a negative reconciliation amounting to -€449.34 million.

ALSO Holding, navigating through a challenging economic landscape, reported a downturn in sales to €4.28 billion from €4.83 billion year-on-year, with net income also retracting to €41.66 million from €52.53 million. Despite these figures, the company's future looks promising with an anticipated earnings growth of 24% annually, outpacing the broader Swiss market's forecast of 11.7%. This growth is supported by ALSO's strategic focus on expanding its tech and software solutions, aligning well with industry shifts towards more integrated and service-based models. Moreover, R&D investments remain robust as ALSO continues to innovate within high-demand sectors of the tech industry, ensuring its competitive edge in a rapidly evolving market.

- Unlock comprehensive insights into our analysis of ALSO Holding stock in this health report.

Review our historical performance report to gain insights into ALSO Holding's's past performance.

Basilea Pharmaceutica (SWX:BSLN)

Simply Wall St Growth Rating: ★★★★★☆

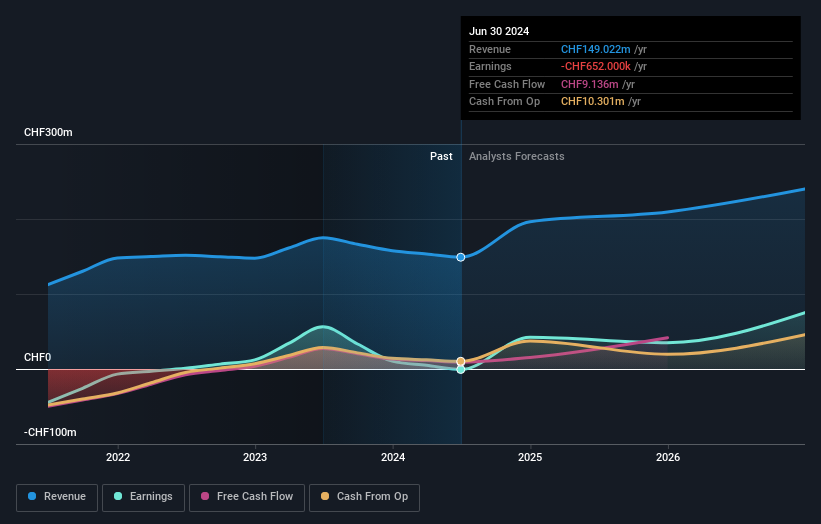

Overview: Basilea Pharmaceutica AG is a commercial-stage biopharmaceutical company specializing in developing products for oncology and anti-infectives, with a market cap of CHF559.39 million.

Operations: Basilea Pharmaceutica AG generates revenue primarily through the discovery, development, and commercialization of innovative pharmaceutical products, amounting to CHF149.02 million. The company focuses on addressing medical needs in oncology and anti-infectives.

Amid a dynamic tech landscape, Basilea Pharmaceutica AG stands out with its recent strategic achievements and robust R&D focus. The company's updated financial guidance for 2024 forecasts revenues of CHF 203 million and a net profit of CHF 60 million, reflecting an upward revision from earlier projections. This positive adjustment is supported by the European Commission's approval to extend Cresemba® indications to pediatric patients, enhancing its market exclusivity until October 2027—a move that not only broadens the potential patient base but also secures an additional revenue stream through a CHF 10 million milestone payment from Pfizer. Furthermore, Basilea's commitment to innovation is evident in its R&D spending trends which have consistently fueled advancements in pharmaceutical development, positioning it well within the high-stakes biotech sector despite current unprofitability. With earnings expected to grow by an impressive 34.42% annually, Basilea’s trajectory suggests a promising horizon as it moves towards profitability and beyond industry growth rates.

- Click here and access our complete health analysis report to understand the dynamics of Basilea Pharmaceutica.

Gain insights into Basilea Pharmaceutica's past trends and performance with our Past report.

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sensirion Holding AG, with a market cap of CHF992.77 million, develops, produces, sells, and services sensor systems, modules, and components globally.

Operations: Sensirion Holding AG generates revenue primarily from the sale of sensor systems, modules, and components, amounting to CHF237.91 million. The company operates on a global scale, focusing on the development and production of these high-precision products.

Sensirion Holding AG, navigating through a challenging tech landscape, has demonstrated resilience with a 14.0% annual revenue growth forecast, outpacing the Swiss market's 4.5%. Despite current unprofitability, the firm is poised for a turnaround with expected profitability in three years and an impressive projected earnings growth of 104.7% annually. The company’s commitment to innovation is underscored by its R&D expenditure trends; significantly investing in technology development to secure its competitive edge in sensor and interface technology sectors. This strategic focus not only aligns with industry demands but also positions Sensirion favorably for future market expansions and potential profitability.

Seize The Opportunity

- Click through to start exploring the rest of the 7 SIX Swiss Exchange High Growth Tech and AI Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SENS

Sensirion Holding

Engages in the development, production, sale, and servicing of sensor systems, modules, and components worldwide.

Flawless balance sheet with reasonable growth potential.