- Switzerland

- /

- Media

- /

- SWX:TXGN

How Investors Are Reacting To TX Group (SWX:TXGN) Three-Year Share Buyback Launch

Reviewed by Simply Wall St

- On August 26, 2025, TX Group AG announced the launch of a new share repurchase program, valid for three years, in conjunction with the release of its H1 2025 earnings results.

- The buyback authorization highlights the company's intent to deploy capital efficiently and reflects ongoing efforts to return value to shareholders.

- We’ll explore how TX Group AG’s three-year buyback plan shapes its investment narrative centered on shareholder returns and capital efficiency.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is TX Group's Investment Narrative?

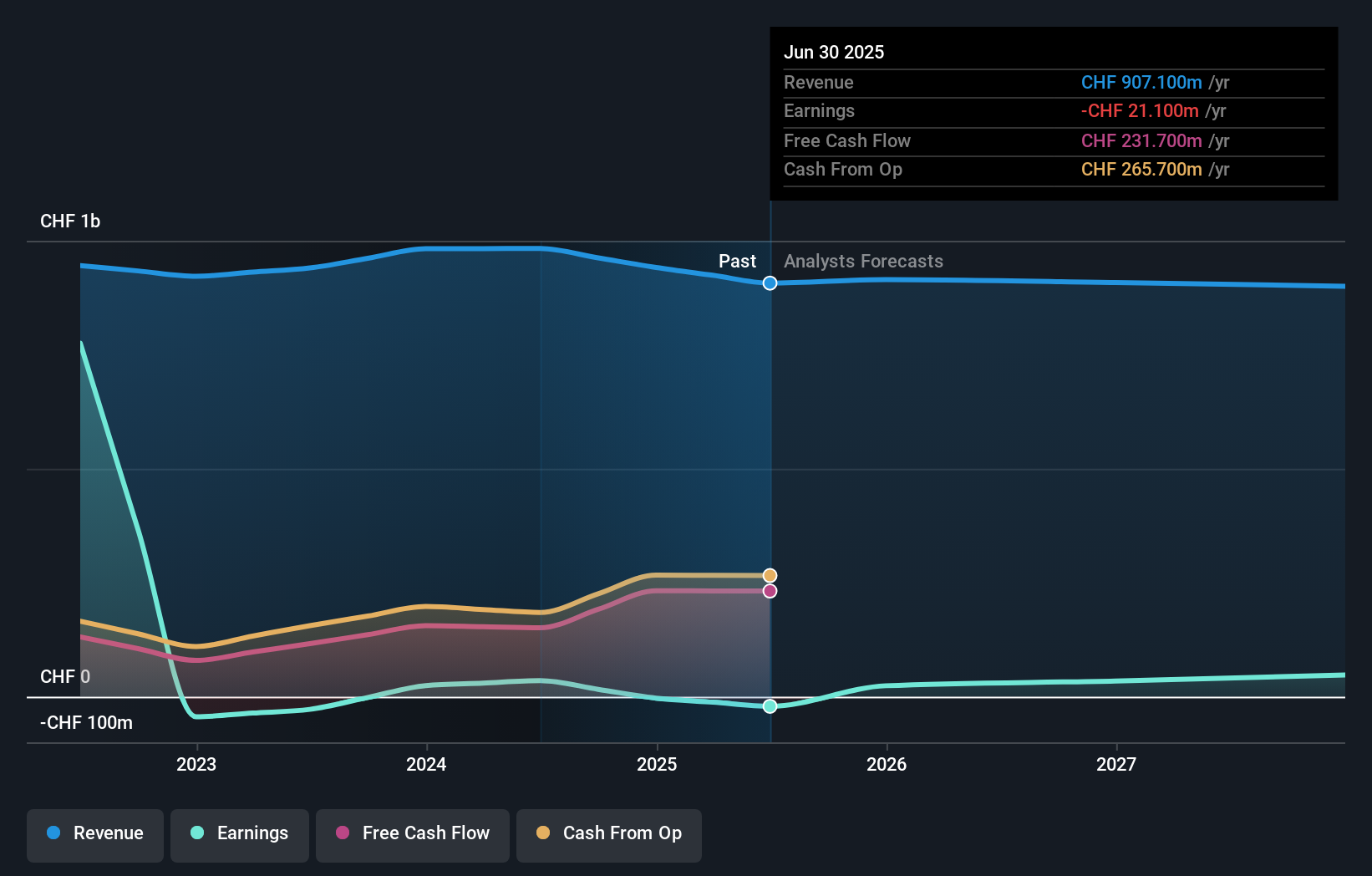

For anyone considering TX Group, the investment narrative has often centered on value, even as the company’s historical earnings have struggled to keep pace. The board’s recent decision to launch a three-year share repurchase program signals a more forceful commitment to capital efficiency and direct shareholder returns, especially meaningful given prior concerns over declining profitability and thin dividend coverage. This buyback initiative adds a potential short-term catalyst by supporting the share price and boosting investor confidence. However, it also comes at a delicate time, losses have increased by 3% per year over the past five years with negative return on equity and the dividend not well covered by earnings. While the buyback may bolster sentiment, the underlying earnings trajectory remains a core risk, and the material impact will likely hinge on whether operational improvements follow. Recent price moves suggest the effect may be limited for now.

But investor optimism around share repurchases may not offset persistent earnings headwinds. Despite retreating, TX Group's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 2 other fair value estimates on TX Group - why the stock might be worth as much as 27% more than the current price!

Build Your Own TX Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TX Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free TX Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TX Group's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TX Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:TXGN

TX Group

Operates a network of platforms and participations that provides users with information, orientation, entertainment, and other services in Switzerland.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026