- Switzerland

- /

- Transportation

- /

- SWX:JFN

Discovering Switzerland's Undiscovered Gems This September 2024

Reviewed by Simply Wall St

The Switzerland market closed higher on Friday, tracking positive cues from other European markets amid hopes the Federal Reserve will cut interest rates next week and possibly announce more reductions before the end of the year. The benchmark SMI ended with a modest gain of 54.94 points or 0.46% at 12,037.28. In this favorable economic climate, it's an opportune moment to explore lesser-known stocks that have strong fundamentals and growth potential within Switzerland's dynamic market landscape. Here are three undiscovered gems worth considering this September 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| IVF Hartmann Holding | NA | 1.26% | -4.29% | ★★★★★★ |

| TX Group | 0.93% | -1.67% | 7.21% | ★★★★★★ |

| naturenergie holding | NA | 17.32% | 34.71% | ★★★★★★ |

| APG|SGA | NA | 1.12% | -16.11% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Elma Electronic | 36.60% | 3.13% | 3.10% | ★★★★★★ |

| Compagnie Financière Tradition | 47.15% | 1.91% | 11.44% | ★★★★★☆ |

| Vaudoise Assurances Holding | NA | 1.52% | 1.85% | ★★★★★☆ |

| lastminute.com | 42.65% | 4.93% | 3.11% | ★★★★☆☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Jungfraubahn Holding (SWX:JFN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jungfraubahn Holding AG, along with its subsidiaries, operates cogwheel railways and winter sports facilities in the Jungfrau region of Switzerland, with a market cap of CHF997.88 million.

Operations: Jungfraubahn Holding AG generates revenue primarily from its Jungfraujoch - TOP of Europe segment (CHF190.99 million), Experience Mountains (CHF51.27 million), and Winter Sports (CHF40.47 million).

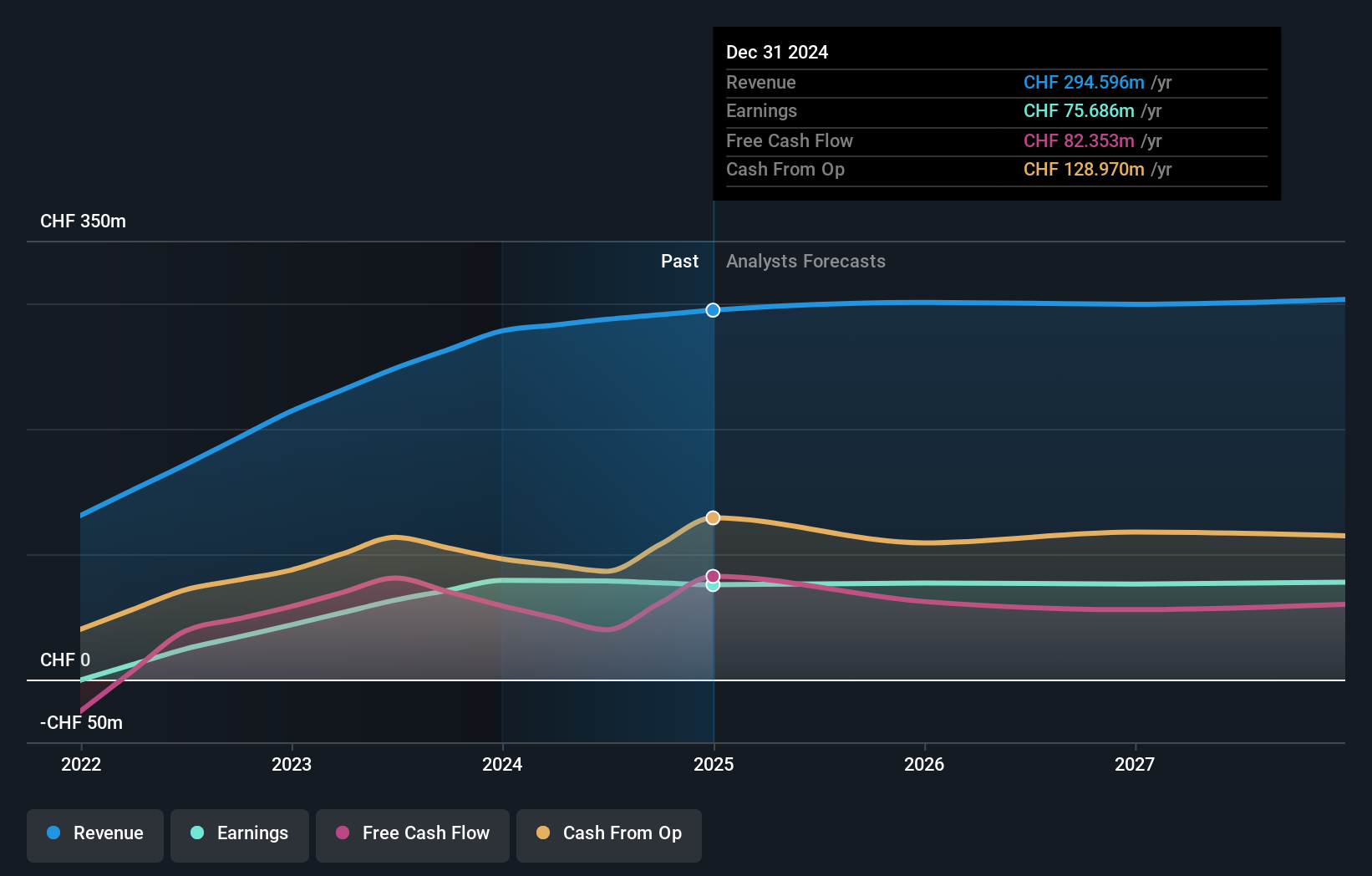

Jungfraubahn Holding, a notable player in the Swiss transportation sector, has recently reported half-year sales of CHF 15.65 million and revenue of CHF 141.77 million, showing solid growth from last year’s CHF 14.69 million and CHF 132.49 million respectively. The company’s net income stood at CHF 34.27 million with basic earnings per share at CHF 6.07, up from CHF 5.97 a year ago. With earnings growth outpacing the industry by a significant margin (24% vs -8.6%), Jungfraubahn is trading at about one-third below its estimated fair value and maintains a satisfactory net debt to equity ratio of 13%.

- Click to explore a detailed breakdown of our findings in Jungfraubahn Holding's health report.

Gain insights into Jungfraubahn Holding's past trends and performance with our Past report.

TX Group (SWX:TXGN)

Simply Wall St Value Rating: ★★★★★★

Overview: TX Group AG operates a network of platforms and participations offering information, orientation, entertainment, and support services in Switzerland with a market cap of CHF1.47 billion.

Operations: The primary revenue streams for TX Group AG are Tamedia (CHF427 million), Goldbach (CHF299.10 million), and Groups & Ventures (CHF159.40 million). The company also generates significant income from 20 Minutes (CHF115.60 million) and TX Markets (CHF126.40 million).

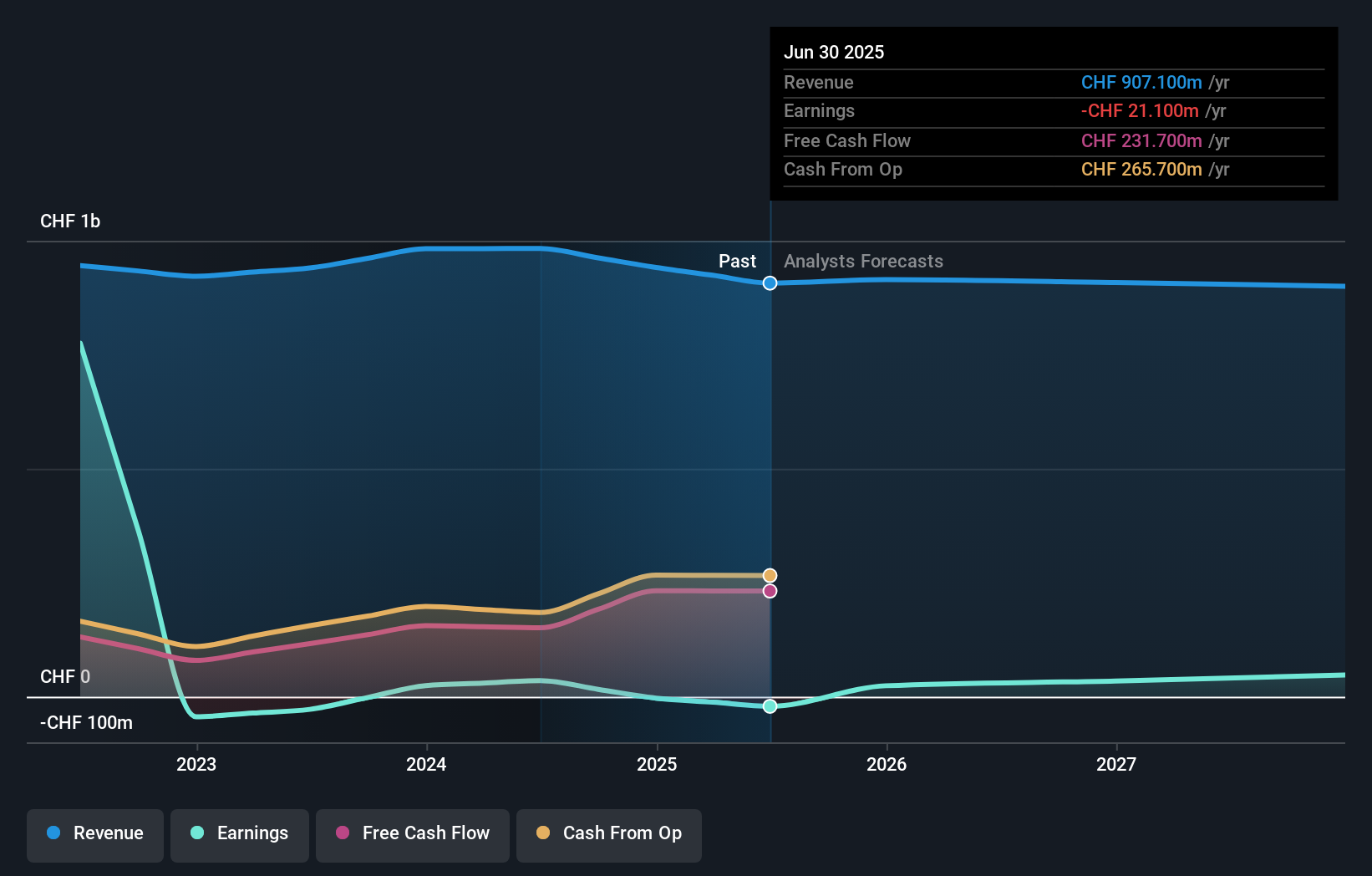

TX Group, trading at 66.4% below its estimated fair value, has seen its debt-to-equity ratio drop from 4.4 to 0.9 over five years and recently became profitable with net income of CHF 9.6 million for H1 2024 compared to a CHF 1.4 million loss the previous year. Despite high share price volatility in the past three months, TXGN's earnings are forecasted to grow by 32% annually, indicating strong future prospects in the media industry.

- Dive into the specifics of TX Group here with our thorough health report.

Gain insights into TX Group's historical performance by reviewing our past performance report.

Vaudoise Assurances Holding (SWX:VAHN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Vaudoise Assurances Holding SA offers insurance products and services mainly in Switzerland, with a market cap of CHF1.34 billion.

Operations: Vaudoise Assurances Holding SA generates revenue primarily from insurance premiums collected in Switzerland. Its market cap stands at CHF1.34 billion.

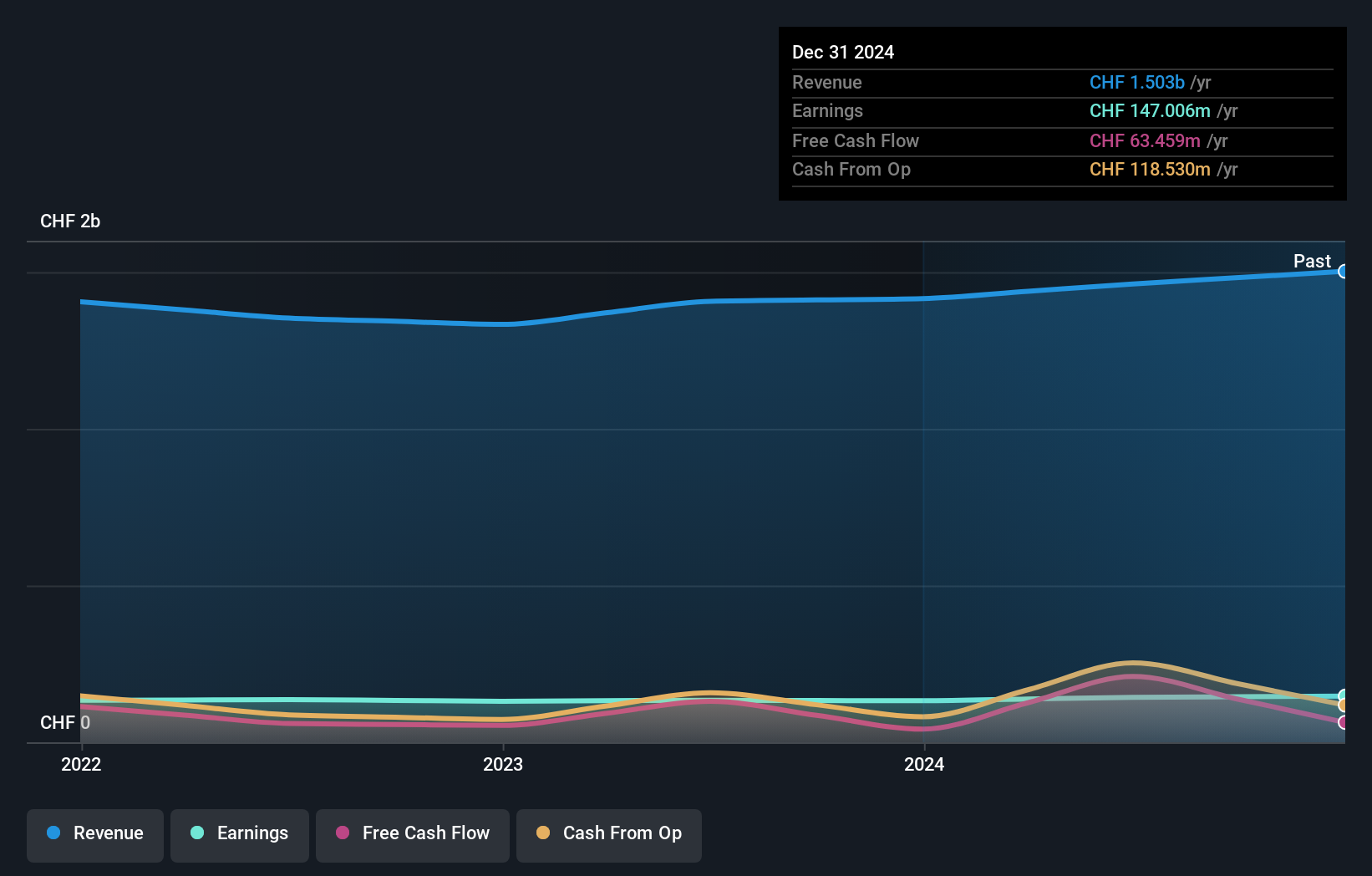

Vaudoise Assurances Holding, a lesser-known Swiss insurance firm, showcases strong financial health with zero debt and impressive earnings growth of 7.1% over the past year. Trading at 65.4% below its estimated fair value, it reported CHF 81.17 million net income for H1 2024, up from CHF 70.02 million last year. The company’s high-quality earnings and consistent profitability make it an attractive prospect in the insurance sector.

Make It Happen

- Gain an insight into the universe of 18 SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:JFN

Jungfraubahn Holding

Operates cogwheel railway and winter sports related facilities in Jungfrau region, Switzerland.

Good value with proven track record.