- Switzerland

- /

- Insurance

- /

- SWX:ZURN

Exploring Zurich Insurance Group (SWX:ZURN) Valuation Following Strong Solvency and Record Premium Growth

Reviewed by Simply Wall St

Zurich Insurance Group (SWX:ZURN) just reported a Swiss Solvency Test ratio of 257% as of September 30, which highlights a solid capital position. The company’s Property & Casualty and Life divisions saw record gross written premiums, with each rising year-over-year.

See our latest analysis for Zurich Insurance Group.

Zurich Insurance Group’s solid solvency update comes on the back of record-setting premium growth, and investors have responded accordingly. The shares have climbed 3.96% year-to-date, while the total shareholder return over the last twelve months stands at an impressive 15.4%. This reflects building momentum for long-term holders.

If Zurich’s steady performance has you interested in fresh discovery, consider expanding your search and uncovering fast growing stocks with high insider ownership

With growth accelerating and Swiss Solvency Test ratios near record highs, are investors still underestimating Zurich Insurance Group? Or is the recent run-up proof that the market already sees the company’s future potential fully priced in?

Most Popular Narrative: 3.5% Overvalued

With Zurich Insurance Group's current share price sitting slightly above the consensus fair value estimate, the market appears to have factored in robust growth expectations. The price is now higher than analyst valuation models suggest. Observers will want to know what is driving this closely watched outlook and why opinions have started to diverge.

Zurich is strategically pivoting its P&C business toward specialties and mid-market segments while reducing exposure to large corporate and liability lines. The company is capitalizing on increased demand for complex risk management solutions and better pricing discipline, supporting both sustained revenue growth and improved net margins.

Wondering what makes the market so optimistic despite valuation risks? Behind this number is a bold set of profit margin and earnings growth projections. The narrative’s key figure hinges on a surprisingly ambitious multiple that could reshape expectations for this major insurer. Are you curious what future trends and competitive pivots could shift the fair value? All will be revealed in the deeper dive.

Result: Fair Value of $547.32 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if rising expenses persist or market conditions soften further, Zurich’s ambitious growth story could face significant headwinds in the coming quarters.

Find out about the key risks to this Zurich Insurance Group narrative.

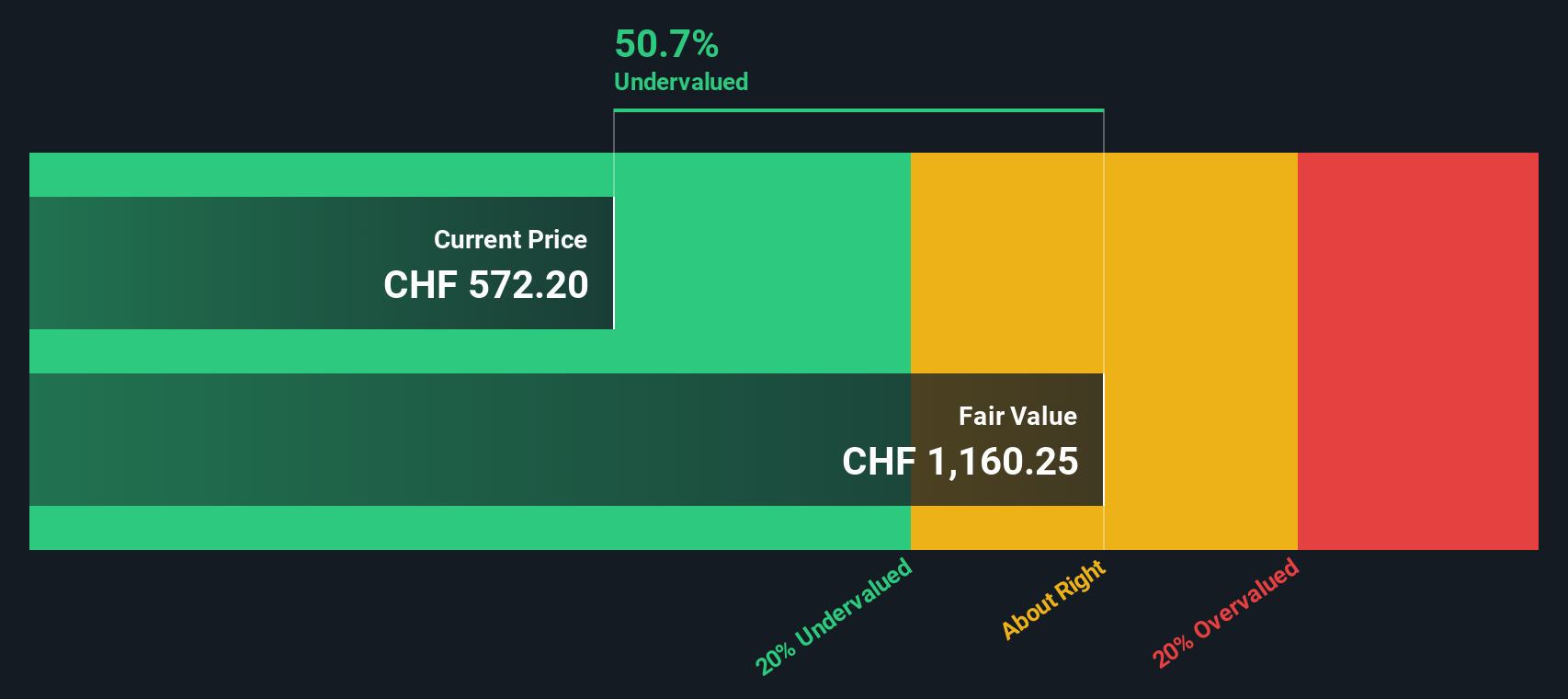

Another View: A Look Through the SWS DCF Model

While the prevailing market view suggests Zurich Insurance Group is slightly overvalued based on analyst price targets, the SWS DCF model tells a different story. According to this long-term cash flow forecast, Zurich shares may actually be undervalued, which could present an overlooked opportunity. Could this be a sign that the market is missing something beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Zurich Insurance Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Zurich Insurance Group Narrative

If you see the numbers differently or prefer to chart your own course, you can craft your own Zurich Insurance Group story in just a few minutes: Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Zurich Insurance Group.

Looking for More Smart Investment Opportunities?

Take advantage of top trends before everyone else by checking out handpicked stock ideas you might have missed. Don’t let the next great opportunity pass you by.

- Unlock income potential and grow your wealth further by targeting the most reliable high-yield picks using these 16 dividend stocks with yields > 3%.

- Tap into future leaders positioned at the forefront of artificial intelligence with these 24 AI penny stocks. These companies are riding today's biggest tech wave.

- Position your portfolio ahead of the curve with these 876 undervalued stocks based on cash flows, which are poised for strong upside based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zurich Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ZURN

Zurich Insurance Group

Provides insurance products and related services in Europe, the Middle East, Africa, North America, Latin America, and the Asia Pacific.

Outstanding track record 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives