- Switzerland

- /

- Medical Equipment

- /

- SWX:VBSN

European Dividend Stocks To Consider In September 2025

Reviewed by Simply Wall St

As European markets navigate a landscape of mixed economic signals and monetary policy decisions, the pan-European STOXX Europe 600 Index recently ended the week slightly lower. In this environment, dividend stocks may offer investors a potential source of steady income, especially as central banks maintain cautious stances on interest rates.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.39% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.40% | ★★★★★☆ |

| Swiss Re (SWX:SREN) | 4.19% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.51% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.49% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.85% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.73% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 4.41% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.72% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 6.01% | ★★★★★☆ |

Click here to see the full list of 222 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

BioGaia (OM:BIOG B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BioGaia AB is a healthcare company that develops, manufactures, markets, and sells probiotic products for gut, oral, and immune health across multiple regions including Europe, the Middle East, Africa, the United States, Asia-Pacific, Australia, and New Zealand with a market cap of SEK10.98 billion.

Operations: BioGaia AB generates revenue primarily from its Pediatrics segment, amounting to SEK1.08 billion, and its Adult Health segment, which contributes SEK352.62 million.

Dividend Yield: 6.4%

BioGaia's dividend yield of 6.36% ranks in the top 25% of Swedish dividend payers, yet its high cash payout ratio (225.1%) suggests dividends are not well covered by free cash flow, raising sustainability concerns. Recent strategic expansions into Germany and Austria could enhance revenue streams but may not immediately improve dividend coverage. Despite volatile past payments, the company's earnings growth prospects and innovative product developments in probiotics and microbiome health offer potential long-term support for dividends.

- Delve into the full analysis dividend report here for a deeper understanding of BioGaia.

- Our comprehensive valuation report raises the possibility that BioGaia is priced lower than what may be justified by its financials.

IVF Hartmann Holding (SWX:VBSN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IVF Hartmann Holding AG operates in the medical consumer goods sector, serving both Switzerland and international markets, with a market cap of CHF338.15 million.

Operations: IVF Hartmann Holding AG's revenue is primarily derived from its segments in Infection Management (CHF58.87 million), Wound Care (CHF44.04 million), and Incontinence Management (CHF33.92 million).

Dividend Yield: 4.4%

IVF Hartmann Holding's dividend yield of 4.37% places it among the top 25% in Switzerland, with dividends covered by earnings (payout ratio: 37.8%) and cash flows (cash payout ratio: 82.9%). Despite a history of volatility, dividend payments have grown over the past decade. However, outdated financial reports and an unstable track record may concern investors seeking reliability. The company's price-to-earnings ratio of 16.7x is attractive compared to the Swiss market average of 19.2x.

- Click here to discover the nuances of IVF Hartmann Holding with our detailed analytical dividend report.

- The valuation report we've compiled suggests that IVF Hartmann Holding's current price could be inflated.

Decora (WSE:DCR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Decora S.A. is involved in the production, distribution, sale, and export of flooring products and accessories in Poland, with a market cap of PLN818.45 million.

Operations: Decora S.A.'s revenue segments include PLN143.21 million from Wall products and PLN467.93 million from Flooring products.

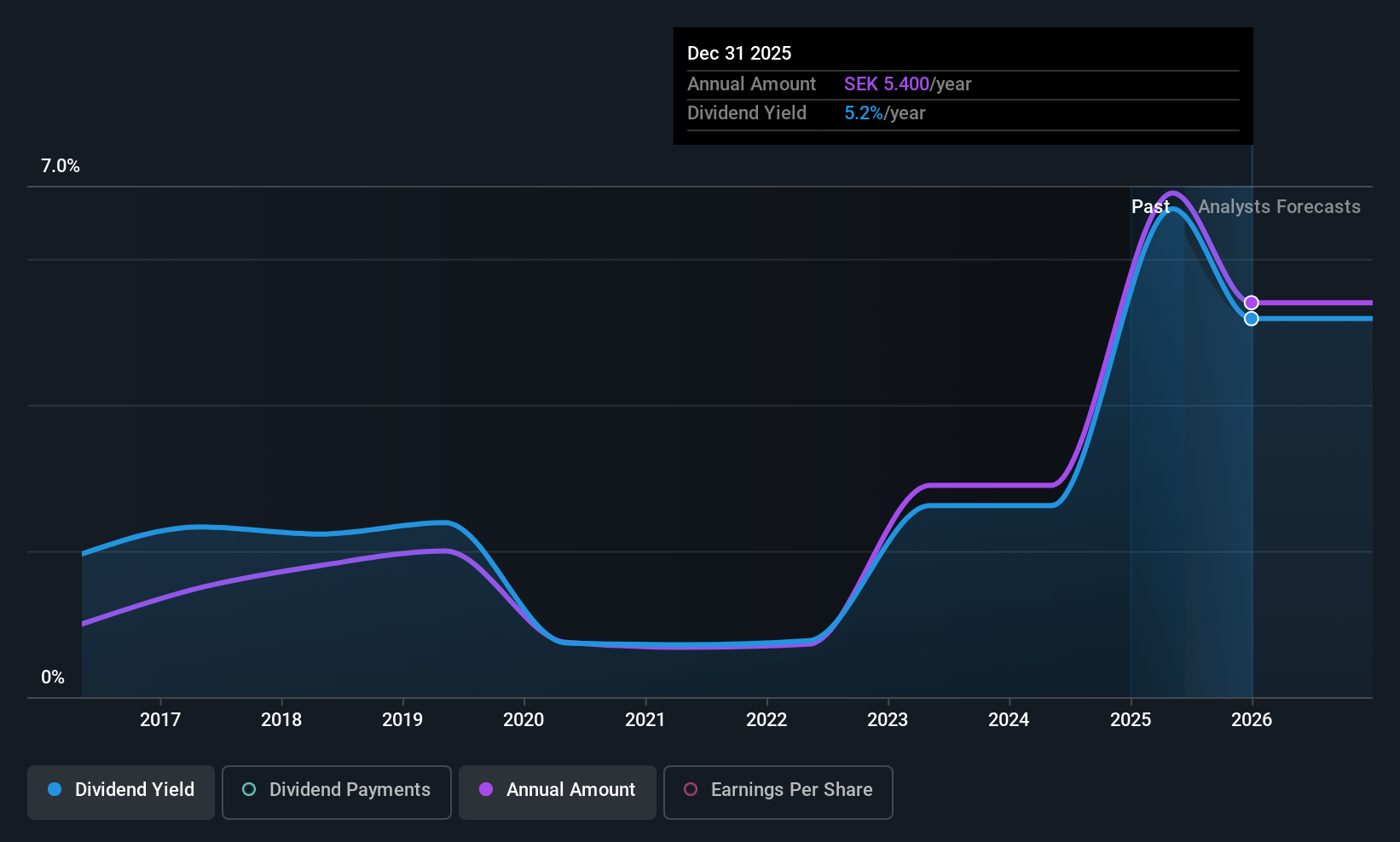

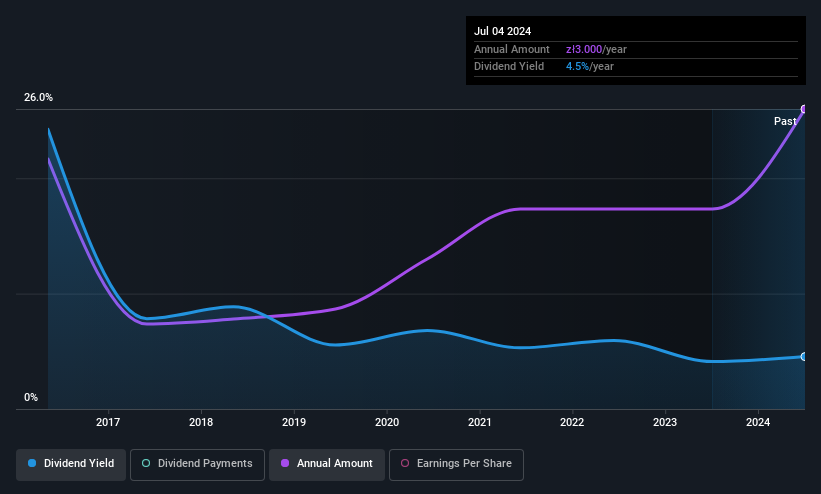

Dividend Yield: 5.2%

Decora's dividend payments have grown over the past decade, supported by a reasonable payout ratio of 56.2% and a cash payout ratio of 69.9%, indicating coverage by both earnings and cash flows. However, its dividend yield of 5.15% is below the top tier in Poland, and its track record has been unstable with volatility in payments. Recent earnings showed increased revenue at PLN 325.53 million but decreased net income to PLN 38.71 million year-over-year.

- Click to explore a detailed breakdown of our findings in Decora's dividend report.

- The analysis detailed in our Decora valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Explore the 222 names from our Top European Dividend Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:VBSN

IVF Hartmann Holding

Provides medical consumer goods in Switzerland and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives