- Switzerland

- /

- Medical Equipment

- /

- SWX:STMN

3 Top Growth Stocks With High Insider Ownership On SIX Swiss Exchange

Reviewed by Simply Wall St

The market in Switzerland has climbed by 3.1% over the past week, with every sector up, and is up 9.2% over the last 12 months. In this favorable environment, growth companies with high insider ownership can be particularly attractive as they often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 21.1% |

| VAT Group (SWX:VACN) | 10.2% | 22.5% |

| Straumann Holding (SWX:STMN) | 32.7% | 21.8% |

| LEM Holding (SWX:LEHN) | 29.9% | 18.4% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 12.9% |

| Temenos (SWX:TEMN) | 17.4% | 14.3% |

| Partners Group Holding (SWX:PGHN) | 17.1% | 13.5% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

| Sensirion Holding (SWX:SENS) | 20.7% | 80% |

| Arbonia (SWX:ARBN) | 28.8% | 100.1% |

Here we highlight a subset of our preferred stocks from the screener.

Partners Group Holding (SWX:PGHN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Partners Group Holding AG is a private equity firm that specializes in direct, secondary, and primary investments across private equity, real estate, infrastructure, and debt with a market cap of CHF31.49 billion.

Operations: The company's revenue segments include CHF1.17 billion from Private Equity, CHF379.20 million from Infrastructure, CHF211.30 million from Private Credit, and CHF186.90 million from Real Estate.

Insider Ownership: 17.1%

Return On Equity Forecast: 52% (2026 estimate)

Partners Group Holding, a Swiss private equity firm, is attracting attention due to its substantial insider ownership and solid growth prospects. The company's earnings are forecast to grow at 13.5% per year, outpacing the Swiss market average of 12%. Recent M&A discussions involving a potential buyout of Lighthouse Learnings highlight Partners Group's active role in lucrative deals. Despite high debt levels and a dividend not well-covered by earnings, its revenue growth remains robust at 14.1% annually.

- Click here and access our complete growth analysis report to understand the dynamics of Partners Group Holding.

- Our valuation report unveils the possibility Partners Group Holding's shares may be trading at a premium.

Straumann Holding (SWX:STMN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Straumann Holding AG, with a market cap of CHF20.25 billion, offers global tooth replacement and orthodontic solutions.

Operations: Straumann Holding AG's revenue segments include Sales NAM at CHF800.14 million, Operations at CHF1.26 billion, Sales APAC at CHF540.74 million, Sales EMEA at CHF1.20 billion, and Sales LATAM at CHF282.34 million.

Insider Ownership: 32.7%

Return On Equity Forecast: 23% (2027 estimate)

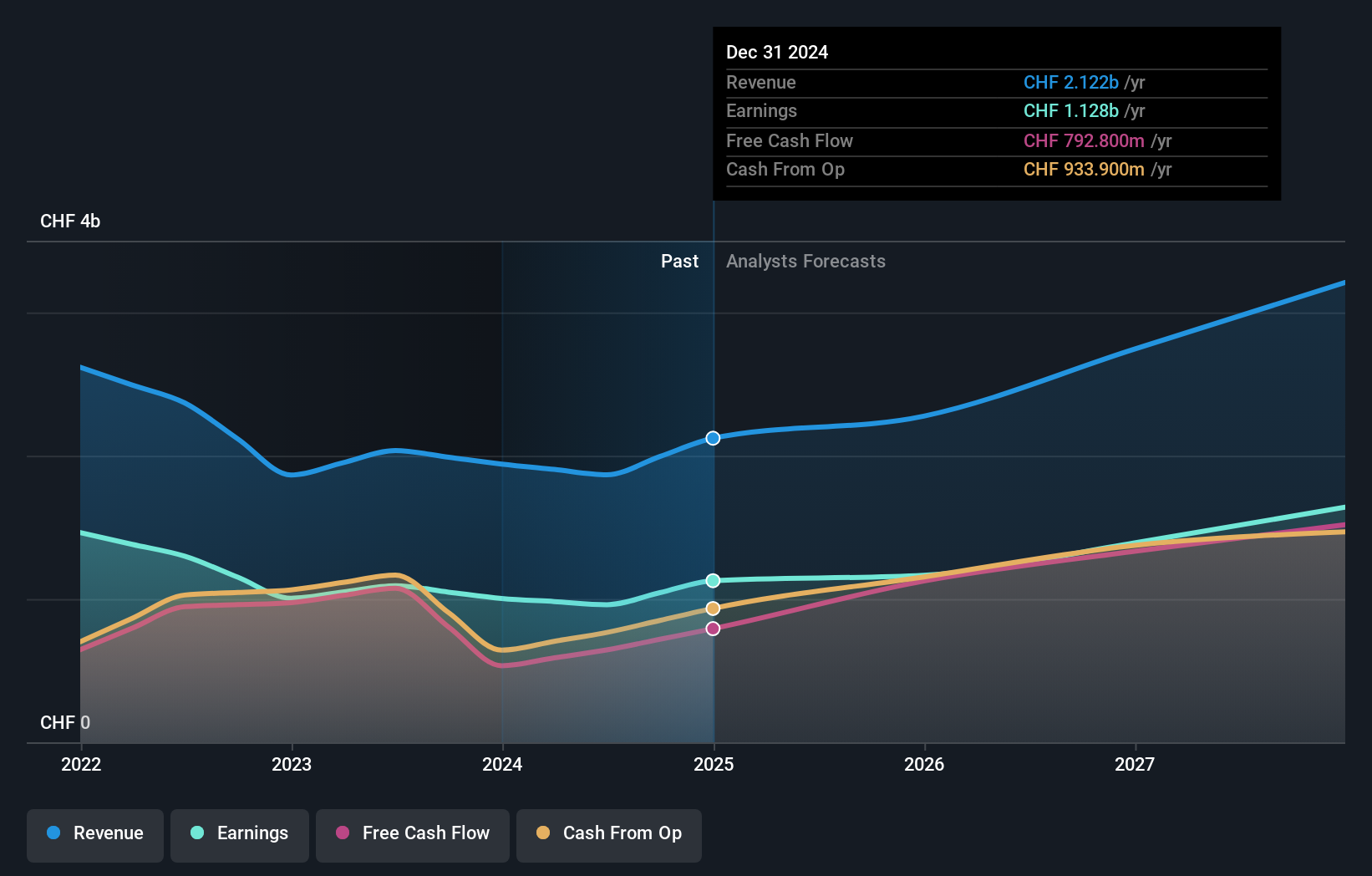

Straumann Holding, a growth company with high insider ownership in Switzerland, recently updated its 2024 outlook to low double-digit organic revenue growth and expects profitability between 27% and 28%. The company reported H1 2024 sales of CHF 1.27 billion, up from CHF 1.14 billion a year ago, with net income rising to CHF 230.37 million. Earnings are forecasted to grow significantly over the next three years at an annual rate of 21.78%, outpacing the Swiss market average of 12%.

- Get an in-depth perspective on Straumann Holding's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Straumann Holding's current price could be inflated.

VAT Group (SWX:VACN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: VAT Group AG, with a market cap of CHF13.02 billion, develops, manufactures, and supplies vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows across Switzerland and internationally.

Operations: The company's revenue segments are comprised of CHF783.51 million from Valves and CHF163.83 million from Global Service.

Insider Ownership: 10.2%

Return On Equity Forecast: 41% (2027 estimate)

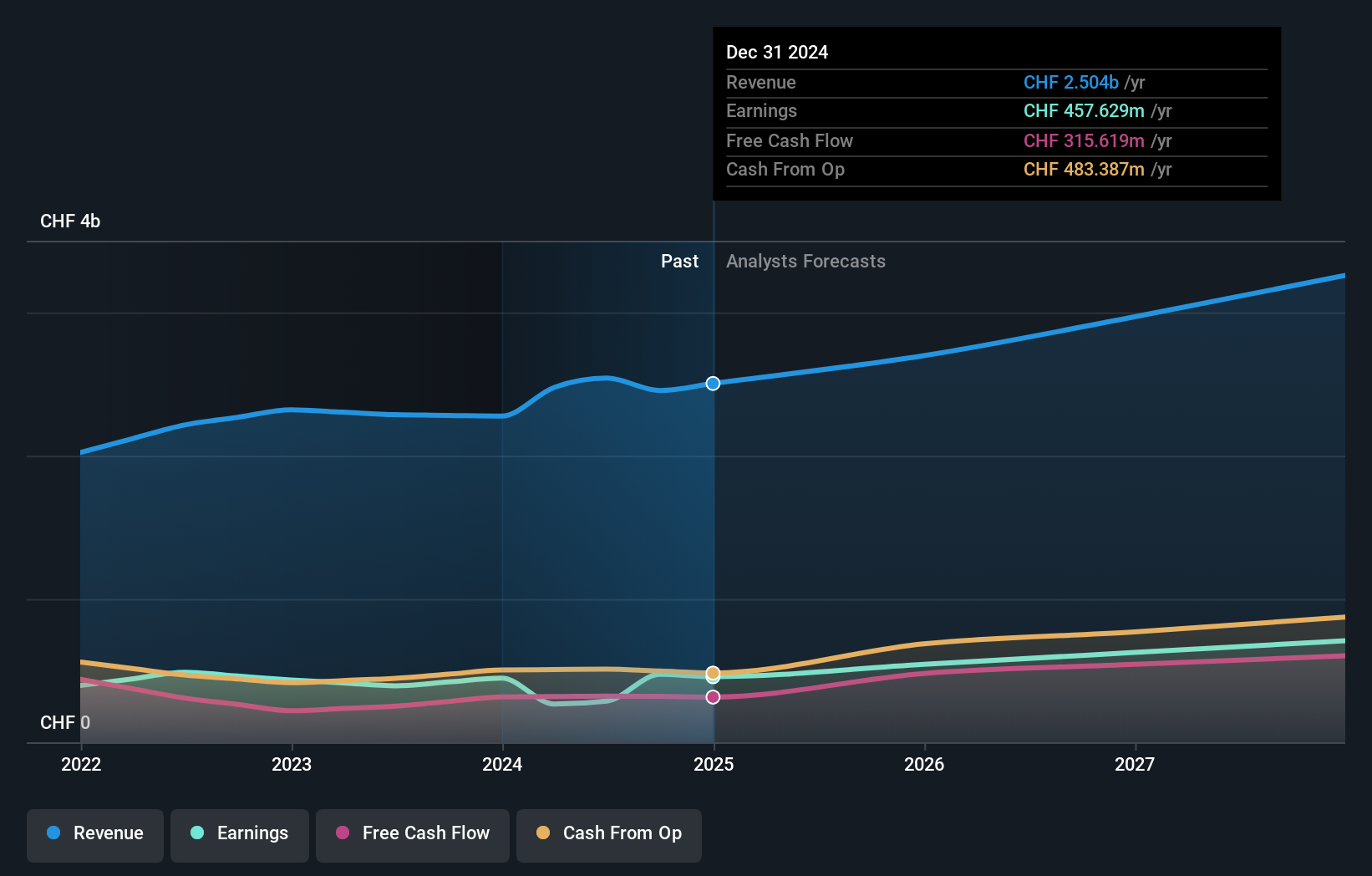

VAT Group, with substantial insider ownership, reported H1 2024 sales of CHF 449.61 million and net income of CHF 94 million, reflecting improved profitability despite a slight dip in sales compared to the previous year. The company’s earnings per share rose to CHF 3.14 from CHF 2.81. Forecasts indicate VAT Group's earnings will grow at an annual rate of 22.48%, significantly outpacing the Swiss market average of 12%, while revenue growth is expected at a robust but moderate pace of 18.3% annually.

- Dive into the specifics of VAT Group here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that VAT Group is trading beyond its estimated value.

Key Takeaways

- Gain an insight into the universe of 13 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:STMN

Straumann Holding

Provides tooth replacement and orthodontic solutions worldwide.

Flawless balance sheet with high growth potential.