- Italy

- /

- Gas Utilities

- /

- BIT:ASC

Discovering Europe's Undiscovered Gems This November 2025

Reviewed by Simply Wall St

As European markets experience a pullback, with the pan-European STOXX Europe 600 Index down 1.24% amid concerns over AI-related stock valuations, investors are keenly observing opportunities in lesser-known sectors. In this environment, identifying stocks that demonstrate resilience and potential for growth despite broader market sentiment can be key to uncovering undiscovered gems in Europe's dynamic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Intellego Technologies | 6.00% | 71.62% | 80.06% | ★★★★★★ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Ascopiave (BIT:ASC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ascopiave S.p.A. is involved in the distribution of natural gas in Italy, with a market capitalization of €719.66 million.

Operations: Ascopiave S.p.A. generates revenue primarily from the distribution of natural gas in Italy. The company's financial performance is influenced by its ability to manage costs associated with its operations, impacting its profitability metrics such as net profit margin.

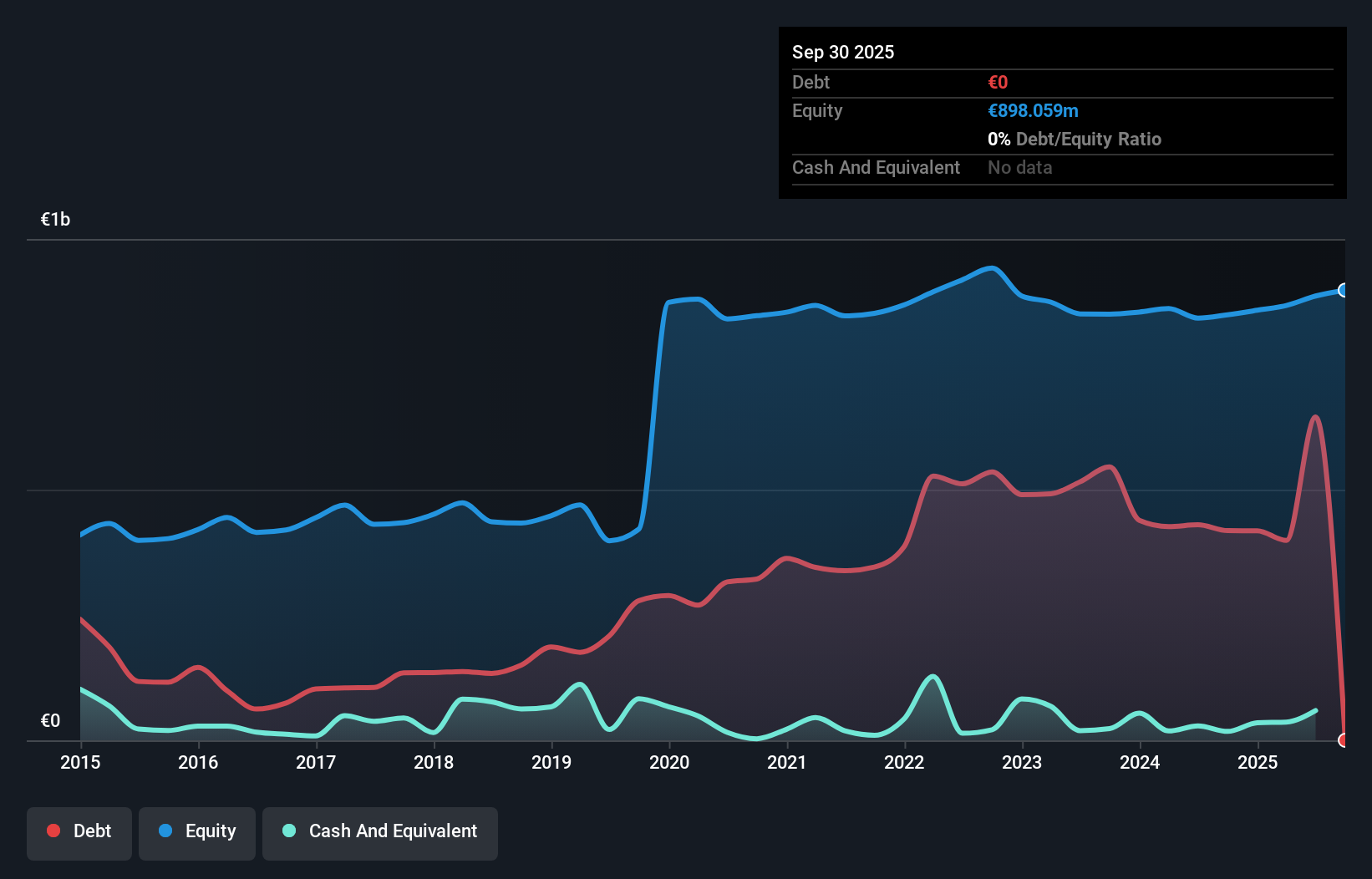

Ascopiave, a nimble player in the energy sector, has no debt and boasts high-quality earnings. Over the past year, its earnings surged by 76%, outpacing the Gas Utilities industry. Recent financials show sales at €183.87 million for nine months ending September 2025, up from €146.29 million previously, with net income leaping to €75.91 million from €25.71 million a year ago. Despite these gains, future earnings are forecasted to decline by 30% annually over three years as profit margins might shrink significantly due to strategic restructuring and market conditions impacting its valuation trajectory.

Schweizerische Nationalbank (SWX:SNBN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Schweizerische Nationalbank, an independent central bank offering banking services to the Swiss Confederation, has a market cap of CHF360 million.

Operations: The primary revenue stream for Schweizerische Nationalbank comes from its banking services provided to the Swiss Confederation. The company's financial performance is reflected in its market capitalization, which stands at CHF360 million.

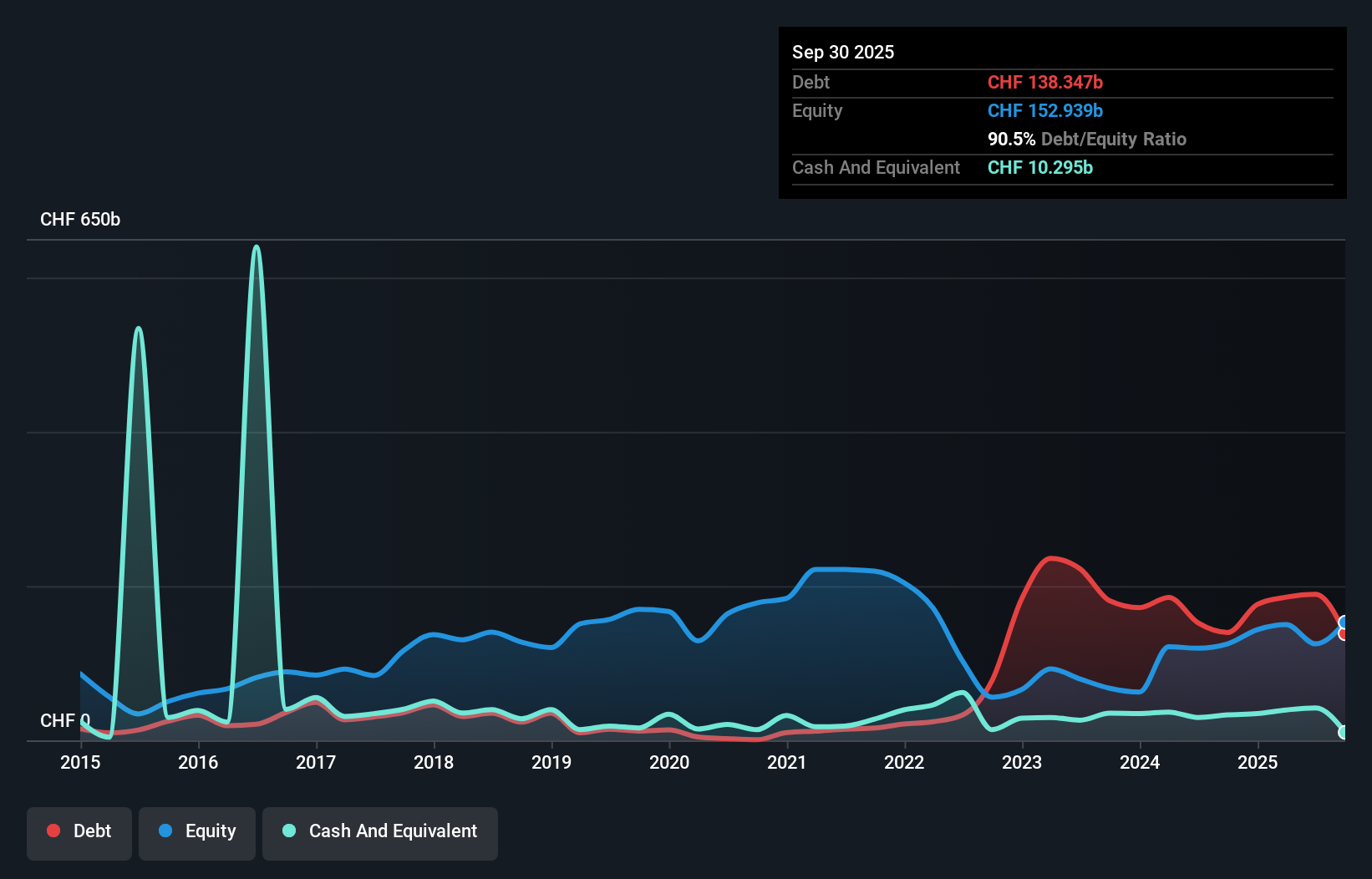

Schweizerische Nationalbank, with total assets of CHF886.6 billion and equity at CHF152.9 billion, showcases a robust financial foundation despite challenges. Total deposits stand at CHF452.6 billion against loans of just CHF2.6 billion, indicating a conservative lending approach supported by primarily low-risk funding sources like customer deposits (62% of liabilities). While recent earnings for the third quarter surged to CHF27,930 million from last year's CHF5,674 million, nine-month figures show net income slipping to CHF12,628 million from the previous year's impressive CHF62,477 million. This suggests volatility in earnings performance amidst broader industry trends and economic conditions.

Grenevia (WSE:GEA)

Simply Wall St Value Rating: ★★★★★★

Overview: Grenevia S.A. is a global manufacturer and seller of machinery and equipment for the mining, transport, and power industries with a market capitalization of PLN1.82 billion.

Operations: Grenevia generates its revenue through the sale of machinery and equipment across the mining, transport, and power sectors. The company's cost structure is primarily influenced by production and operational expenses. Notably, Grenevia's net profit margin has shown a trend worth noting at 12% in recent periods.

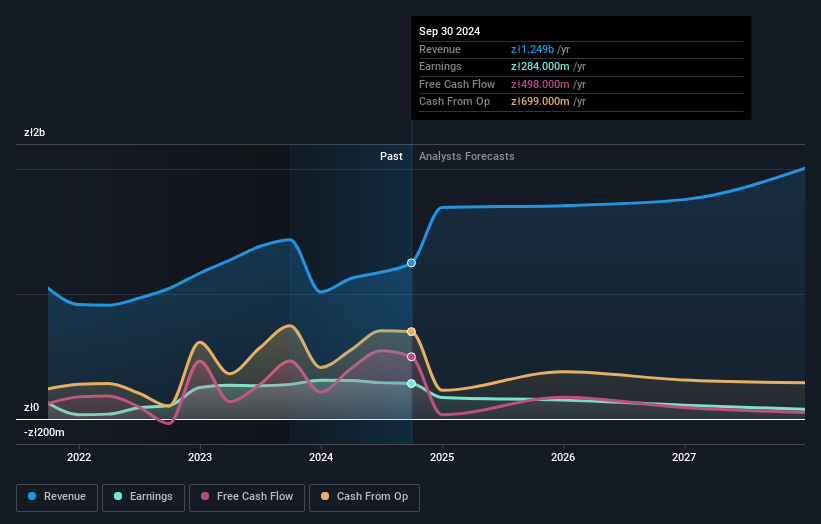

Grenevia, a nimble player in the machinery sector, has seen its earnings soar by 35.2% over the past year, outpacing an industry decline of 20.3%. With no debt on its books now compared to a 26.7% debt-to-equity ratio five years ago, financial stability is evident. Recent quarterly results show sales climbing to PLN 567 million from PLN 437 million last year and net income rising to PLN 74 million from PLN 63 million. Despite trading at about 12.8% below estimated fair value and having positive free cash flow, future earnings are expected to dip significantly by around an average of 40.9% annually over the next three years due to large one-off gains like a notable PLN86 million impact on recent financials.

- Click to explore a detailed breakdown of our findings in Grenevia's health report.

Review our historical performance report to gain insights into Grenevia's's past performance.

Seize The Opportunity

- Investigate our full lineup of 326 European Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ASC

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives